“5 PSBs to Lower Government Stake by August 2024”

In the financial realm, sticking to rules is crucial for stability and trust. One such rule, set by Sebi, says listed companies must keep at least 25% of their shares public. Recently, Public Sector Banks (PSBs) have been working hard to meet this rule.

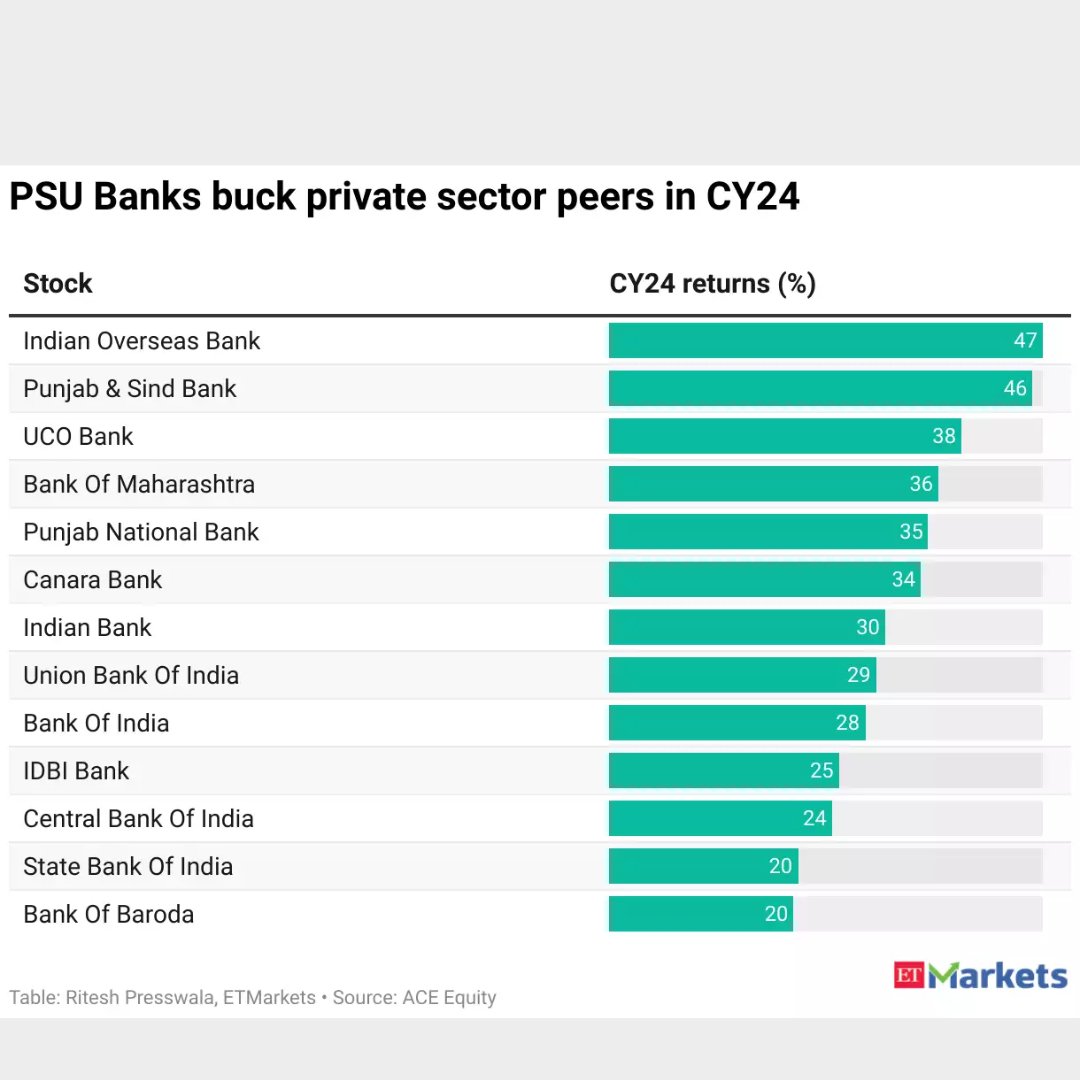

PSBs, like Bank of Maharashtra and UCO Bank, are aiming to reduce government ownership to less than 75%. This move helps PSBs follow Sebi’s rule and makes them more attractive to investors.

Despite challenges, many PSBs are making progress. By 2023, four PSBs met Sebi’s rule, and three more joined them this year

Also Read: ““Has Sebi Discovered the Harshad Mehta of Today’s Market?”

A Cartel Under Sebi Scanner”

5 PSU Banks to Reduce Government Shareholding: DFS Secretary

Five public sector banks, including Bank of Maharashtra, IOB, and UCO Bank, plan to reduce government stake to below 75% to meet Sebi’s MPS norms, says Financial Services Secretary Vivek Joshi.

Out of 12 PSBs, four complied with MPS norms by March 31, 2023. Three more PSBs met the 25% public float requirement in the current fiscal year.

The remaining five PSBs are strategizing to fulfil MPS requirements. Government holdings in some banks are significantly high.

Also Read: “How does the market trend move in a pre-election month?”

As of the latest quarter ending December 2023, here is the breakdown of the Government’s stake in listed PSU banks:

- State Bank of India (SBI): 57.5% stake held by the Union government.

- Bank of Baroda: The government owns 63.97% of the total paid-up equity.

- Canara Bank: The Central government holds 62.93% stake, down from 69.33% in June 2021 due to a QIP issue.

- Punjab National Bank (PNB): Currently, the government owns a 73.15% stake, which increased by 5.83% in November 2018.

- Indian Bank: The government reduced to 73.84% post-QIP (Dec 23) from 79.86%.

- Union Bank of India: The government holds 74.76% post a QIP on Feb 24.

- Bank of India: Government ownership stands at 73.38%, reduced on Dec 23 from 81.41%.

- Bank of Maharashtra: The Government of India holds an 86.46% stake.

- Central Bank of India: The government currently holds a 93.08% stake.

- UCO Bank: The government owns a 95.39% stake.

- Indian Overseas Bank: The government holds a 96.38% stake.

- Punjab and Sind Bank: The government’s stake is currently at 98.25%, the highest among all PSU banks.

There have been recommendations for the privatization of the Indian Overseas Bank and Central Bank of India by NITI Aayog in 2022, although no official announcement has been made regarding this.

Sebi mandates all listed companies to maintain a 25% MPS, giving state-owned banks until August 2024 to comply.

Financial Services Secretary Vivek Joshi highlighted that these banks have options like follow-on public offerings or Qualified Institutional Placements to reduce government stake. Each bank will decide on the best course of action based on market conditions and shareholder interests.

Efforts are underway to meet the MPS requirement, although no specific timeline was provided.

The government’s objective is to establish 4-5 major state-owned banks, comparable in size to the largest lender, the State Bank of India. Following the 2019 consolidation initiative, there are currently seven large PSU banks and five smaller ones in operation. This consolidation reduced the number of banks from 27 to 12 by merging 10 banks into four entities. The merger officially took effect in April 2020.

Additionally, the Finance Ministry has instructed state-owned banks to review their gold loan portfolios due to observed instances of non-compliance with regulatory norms.

Last month, a directive was issued advising banks to address anomalies in gold loan operations. Concerns included issues with fee collection, interest, closure of accounts, and disbursement of loans without proper collateral. The Department of Financial Services (DFS) urged banks to review gold loan activities from January 1, 2022, to January 31, 2024, to ensure compliance with regulations and internal policies.

The surge in gold prices, reaching record levels, has heightened scrutiny on gold loan operations. In the past month alone, the price of 10 grams of gold increased from Rs 63,365 to Rs 67,605. Instances of non-compliance prompted the DFS to issue the advisory.

State Bank of India (SBI) leads with a gold loan portfolio of Rs 30,881 crore as of December 2023.

Punjab National Bank’s exposure stands at Rs 5,315 crore, and Bank of Baroda’s at Rs 3,682 crore by the end of the third quarter.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

https://aceink.com/has-sebi-discovered-the-harshad-mehta-of-todays-market/