23 Apr “2 Stocks for Long-Term : High ROE and Net Margins”

“The Winning Combination: High ROE and Net Margins for Long-Term Investing”

Investors often look for stocks that can potentially generate good returns.

To make informed decisions, they rely on tools, which use quantitative analysis to generate scores based on five key components. The components considered include return on equity, net profit margin, institutional ownership, and upside potential.

For midcap stocks, it’s important to keep in mind the level of risk involved.

That’s why stocks with a minimum return on equity (ROE) of 20% and a net profit margin of at least 20% are considered. These measures provide a good indication of the company’s profitability.

It’s important to note that every business has its own capital requirements. While some require a constant dose of capital, others require a large amount of capital at one point in time. Ultimately, what matters is how efficiently the management uses the capital to maximize shareholder returns.

Institutional shareholders can also be a good indicator of a company’s potential. That’s why the selected midcap stocks must have at least 10% institutional ownership. This suggests that a certain level of due diligence has been performed by professionals who manage large amounts of money.

Based on these two selected midcap stocks CMS Info Systems and Emami Limited, can show an upside potential in the range of 33% to 44% as per experts.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

CMS Info Systems:

Introduction

-CMS Info Systems is a leading provider of cash management and payment solutions in India.

-The company was established in 1983 and has over 38 years of experience

-CMS Info Systems has a widespread presence in India with over 100,000 employees

-a network of more than 120 offices across the country.

– has expanded its operations globally and currently has a presence in 9 countries across Asia, Europe, and Africa.

Accolades and Awards

CMS Info Systems has won several accolades for its services and solutions, including the prestigious “Best Cash Management Company” award at the Economic Times Awards for Corporate Excellence.

The company’s commitment to excellence, innovation, and customer satisfaction has made it a trusted partner for leading organizations across various industries in India and beyond.

Products with differentiation

CMS Info Systems is a company that focuses on providing innovative and reliable cash management and payment solutions to its customers.

-Here are some examples of product leadership initiatives that CMS has implemented:

Cash Management Solutions: CMS offers a range of cash management solutions to help customers manage their cash more efficiently.

-This includes cash pickup and delivery services, cash processing, and ATM replenishment services.

Currency Processing Solutions: CMS has developed cutting-edge currency processing solutions to help banks and financial institutions process large volumes of cash quickly and accurately.

-These solutions use advanced technology and are designed to improve efficiency and reduce errors.

ATM Maintenance Services: CMS provides ATM maintenance services to ensure that customers’ ATMs are always up and running.

-The company has a team of trained professionals who can provide onsite maintenance and repair services to ensure maximum uptime and customer satisfaction.

Digital Payment Solutions:

Mobile payments,

QR code payments,

and other innovative payment options.

Self-Service Kiosks: CMS has developed self-service kiosks that allow customers to perform a range of banking and financial transactions quickly and easily.

-These kiosks are designed to improve the customer experience and reduce wait times at bank branches.

Customer Base:

CMS has a diversified customer base, which includes

banks,

financial institutions,

retailers, and other businesses.

The company has a strong reputation for delivering high-quality and reliable services to its customers, which has helped it build long-term relationships and maintain a loyal customer base.

Industry Position:

CMS is one of the largest players in the cash management and payment solutions industry in India.

The company has a strong market position and a well-established brand name, which gives it a competitive advantage over its peers.

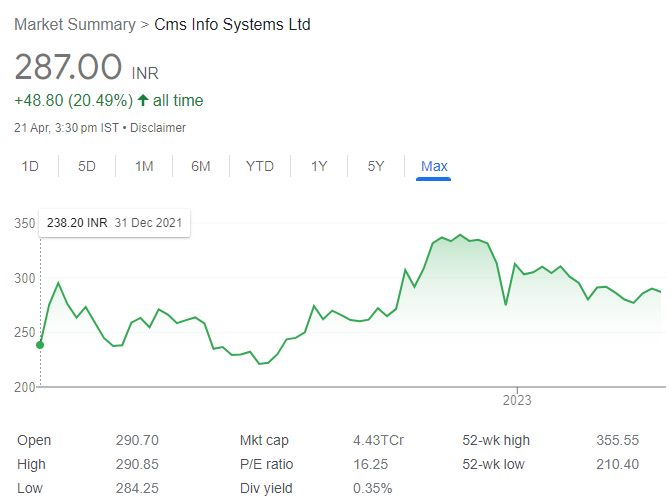

Fundamental :

- Market Cap ₹ 4,418 Cr.

- Current Price ₹ 286

- High / Low ₹ 356 / 210

- Stock P/E 17.4

- Industry PE 32

- Promoter holding 61%

- DII holding 12.6 %

- FII holding 13.1 %

- Public holding 14 %

Financial :

- ROCE 27.5 %

- ROE 19.6 %

- OPM 27.0 %

- Debt ₹ 210 Cr.

- Debt to equity 0.16

- Qtr Profit Var 0.74 %

- Qtr Sales Var 23.6 %

Growth Prospects:

-CMS has a strong growth outlook, driven by the increasing demand for cash management and payment solutions in India.

-The company is well-positioned to capitalize on the growing digital payments market in India, which is expected to continue to grow at a rapid pace.

Risks associated with CMS Info Systems:

Regulatory Risk:

The cash management and payment solutions industry in India is highly regulated, and any changes in regulations or non-compliance with regulatory requirements could have a negative impact on CMS’s business.

-The company needs to keep up-to-date with regulatory developments and adapt its business practices accordingly to manage regulatory risks.

Technology Risk:

CMS’s business model is heavily dependent on technology, and any disruptions or failures in its technology infrastructure could negatively impact its business operations.

-The company needs to invest in and maintain robust technology infrastructure and cybersecurity measures to manage technology risks.

Competition Risk:

The cash management and payment solutions industry in India is highly competitive, with several large players and a growing number of new entrants.

-CMS needs to continuously innovate and differentiate itself from its competitors to maintain its market position and market share.

Concentration Risk:

CMS derives a significant portion of its revenue from a few large customers, and any loss of these customers could have a significant impact on its financial performance.

-The company needs to diversify its customer base to manage concentration risks.

Economic Risk:

The cash management and payment solutions industry in India is influenced by the economic conditions of the country.

-Any downturn in the economy could lead to a reduction in consumer spending and a decline in the demand for cash management and payment solutions, which could negatively impact CMS’s business.

Overall, CMS Info Systems operates in a complex and dynamic business environment that involves several risks. While the company has demonstrated a strong track record of managing these risks, investors should be aware of the risks and monitor the company’s risk management practices.

Emami Limited

Emami Limited is an Indian multinational company that produces consumer goods, including personal care and healthcare products.

Founders:

-The company was founded in 1974 and is headquartered, in India.

-Emami was founded by two childhood friends, Mr. R.S. Agarwal, and Mr. R.S. Goenka.

-Both of whom have extensive experience in the FMCG industry.

Business Segments:

Emami operates in various business segments, including:

a. Personal Care: Emami’s personal care segment includes products such as skin care, hair care, and bath and body care products.

-Some of its popular brands in this segment include Navratna, Boroplus, and Fair and Handsome.

b. Healthcare: Emami’s healthcare segment includes products such as pain management ointments, digestive products, and women’s health products.

-Some of its popular brands in this segment include Zandu Balm, Zandu Chyawanprash, and Zandu Kesari Jivan.

c. Paper: Emami’s paper segment includes manufacturing and marketing of newsprint, writing and printing paper, and tissue paper products.

d. Cement: Emami’s cement segment includes manufacturing and marketing of cement under the brand name Emami Double Bull Cement.

Global Presence:

-Emami has a global presence and exports its products to over 60 countries.

-The company has subsidiaries and offices in countries such as the USA, UK, UAE, and Singapore.

Awards and Recognition:

-Emami has won several awards and recognitions for its products and business practices.

-Some of its notable awards include the India Business Leader Awards, the CII-ITC Sustainability Awards, and the World Branding Awards.

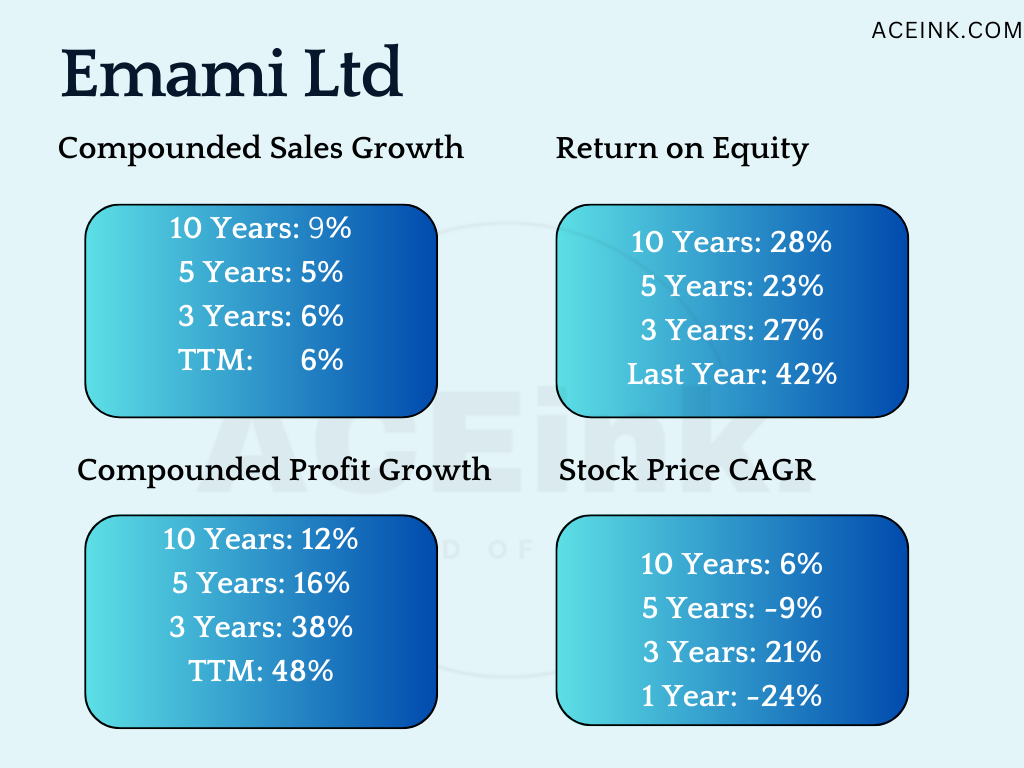

Fundamentals:

- Market Cap ₹ 16,012 Cr.

- Current Price ₹ 363

- High / Low ₹ 525 / 341

- Stock P/E 19

- Industry PE 32

- Dividend Yield 2.20 %

Fundamentals:

- ROCE 30.6 %

- ROE 41.6 %

- OPM 24.4 %

- Debt₹ 97.5 Cr.

- Debt to equity 0.04

- Qtr Profit Var 6.13 %

- Qtr Sales Var 1.20 %

Growth Strategy:

-Emami is focusing on D2C and e-commerce as important channels for future growth, with a goal of omnichannel distribution.

-The company has appointed a Chief Growth Officer to lead new brand development, innovation, strategic investments, and other growth opportunities.

-Emami plans to continue and expand its Project Khoj investments, which are expected to generate around INR 85 crores by year-end.

To accelerate its growth, the company has laid out several plans, including:

-Aggressive marketing strategies to drive awareness and sales

-Expansion of rural initiatives and distribution to tap into new markets

-Focus on e-commerce and modern trade to reach a wider customer base

-Introduction of new digital-first brands to cater to changing consumer preferences

Risk Factors:

-The FMCG industry is highly competitive, with a large number of players vying for market share. Emami faces intense competition from both domestic and international FMCG companies.

-Raw material prices, especially those of palm oil, which is a key input for the company, are subject to volatility. Any significant increase in raw material prices can impact the company’s profitability.

-Emami’s presence in international markets exposes it to risks associated with currency fluctuations and geopolitical risks.

-Any adverse regulatory changes, such as changes in labeling requirements or restrictions on advertising, can impact the company’s business.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments