27 Apr “Railway Stock Rally: Boom or Bubble? Expert Predictions Inside”

“Railway Stocks: A Short-Term Trend or a Long-Term Investment? “

Have you noticed the recent surge in railway stocks?

It’s hard to ignore the impressive rally in the counter in the last few sessions. But as an investor, the burning question is:

Is this a short-term trend or a long-term investment opportunity?

In this blog, we’ll be diving into the world of railway stocks and exploring the potential future of these investments, along with the Expert’s insights.

So, let’s get started!”

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

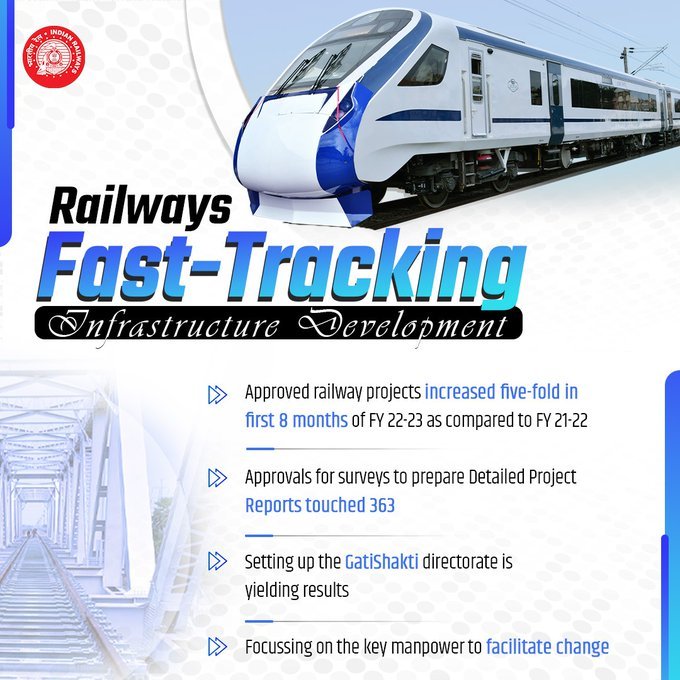

The Short-Term Reason behind the Rally

In the latest news, Indian Railways have announced their plans to manufacture 120 state-of-the-art Vande Bharat Express trains by August 2023, as reported by various media outlets. This development has had a positive impact on the market sentiment towards major railway stocks.

In addition, the increase in travel activity and the optimistic outlook for its continuation even after the COVID-19 pandemic has further contributed to the optimistic sentiment.

The Long-Term Prospectives

Potential Growth in Industrial Value Chain :

Analysts note that the ongoing mega push in rail capex will benefit the entire industrials value chain over this decade.

Cyclically strong industrial capex, along with new-age areas such as

EV ecosystem,

data centres,

metros,

wastewater management,

warehouse and logistics,

defence and

smart infra,

will continue to drive order inflows. Low and medium-voltage T&D products and relevant equipment suppliers are expected to see a positive trend through the next decade.

Now Let’s understand how these factors will affect the sector:

Cyclically strong industrial capex:

This refers to the cyclical nature of investments in industries, where there are periods of high investment followed by periods of low investment.

Currently, there is a strong wave of investment in industries such as

-manufacturing,

-infrastructure, and

-construction.

This investment is expected to benefit railway companies, as they are a key component of the infrastructure sector and often rely on industrial capex to support their growth and expansion.

EV ecosystem:

The shift towards electric vehicles (EVs) is expected to benefit railway companies, as they can provide an eco-friendly and efficient means of transportation for goods and people.

Railways can serve as a backbone for EV infrastructure by transporting raw materials and finished products related to EVs.

-For example, railway companies can transport batteries, components, and finished EVs, reducing the carbon footprint of the transportation sector.

Data centres:

Data centres are a critical component of the digital economy, providing storage and processing power for the vast amounts of data generated by businesses, governments, and individuals.

Railway companies can benefit from the growth of data centres by providing transportation services for the construction and operation of data centres, as well as transporting the data stored in these facilities.

Metros:

Metros are urban rapid transit systems that can help reduce traffic congestion and improve connectivity in densely populated areas.

Railway companies can benefit from the construction and operation of metros by providing engineering, construction, and transportation services for these projects.

Wastewater management:

Railway companies can play a role in wastewater management by transporting sewage and wastewater from urban areas to treatment plants.

This can help reduce pollution and improve the quality of water resources.

Warehouse and logistics:

Railway companies are an important component of the logistics industry, providing transportation services for goods and products.

The growth of e-commerce and online shopping has led to an increased demand for warehouse and logistics services, which can benefit railway companies by increasing the volume of goods transported.

Defence and smart infra:

Railway companies can benefit from the growth of defence and smart infrastructure by providing transportation services for the construction and operation of these projects.

For example, railway companies can transport military equipment and supplies, as well as provide transportation services for the construction of smart cities and other infrastructure projects.

Low and medium-voltage T&D (Transmission and Distribution) products and relevant equipment suppliers are critical components of the infrastructure sector.

-These products and suppliers facilitate the transfer of electricity from power generators to end-users. Railway companies are one of the major consumers of T&D products such as transformers, switchgear, and cables. As the railway industry continues to grow and expand, the demand for T&D products and equipment is also expected to increase.

In addition, with the government’s focus on the electrification of railways and the adoption of renewable energy, the demand for low and medium-voltage T&D products is expected to see a positive trend through the next decade. This would not only benefit T&D product manufacturers and suppliers but also railway companies by enabling them to provide efficient and reliable power supply to their trains and other railway infrastructure.

Railway Stocks to Perform Well

Given the allocation happening in railway and infrastructure, all railway stocks are expected to perform well in the near future, according to experts. However, investors must keep in mind the high volatility of these stocks and be prepared for potential downsides.

RVNL and IRCON – A PSU-led Pack in Railways

As per experts, RVNL and IRCON are among the companies that are likely to benefit from the increasing number of government contracts in the railway sector. The outsized order book in comparison with their annual revenues indicates substantial growth potential. However, these stocks are highly volatile, and investors must be ready to take a 25-30% downside.

Read More:“RVNL shares rally for Four straight sessions, hit 52-week high; Here’s why?”

There are a few risks associated with investing in PSU railway stocks:

-First of all, stocks can be quite volatile, which means that their prices can fluctuate rapidly and unpredictably. This volatility can make it difficult to predict how much you stand to gain or lose from an investment in the stock.

Additionally, the Indian railway sector has historically been plagued by issues such as

-slow decision-making,

-bureaucratic hurdles, and

-poor infrastructure.

These factors can impact the ability of companies in this sector to execute contracts and deliver projects on time, which can ultimately affect their profitability.

Another risk to consider is the potential for political interference in the operations of PSU railway companies. As these companies are owned by the government, their operations and decision-making can be subject to political pressures, which can impact their financial performance.

Finally, investors should also be aware of the overall economic and political climate in India, as this can have an impact on the railway sector and the profitability of railway stocks.

For example, changes in government policies or economic conditions can affect the demand for railway services and ultimately impact the financial performance of railway companies.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments