11 May What Should Investors Do After the Current Stock Market Rally?

“Sell in May and go away”- still valid?

The Outline

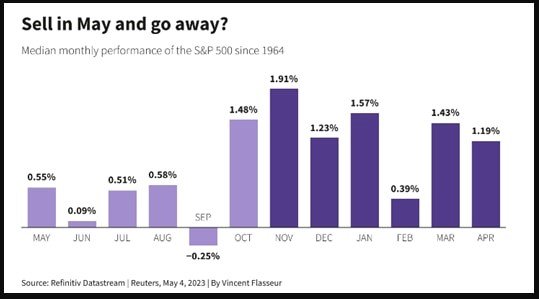

Many studies have found evidence to suggest that stock markets tend to perform better from November to April compared to the period from May to October. This has led to the popular saying “Sell in May and go away”.

The recent stock market rally has prompted investors to reassess their investment strategies and consider the best course of action moving forward.

Traditionally, there has been a popular saying, “Sell in May, go away,” which suggests that investors should liquidate their financial investments in May and return to the market in October.

This strategy was based on the observation that stock market returns during the November-April period tend to outperform those during the May-October period. To learn more about such strategies one can enroll for our Stock Market Learning Courses, here .

However, it is important to note that the effectiveness of this strategy has been called into question in recent years.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Is “Sell in May, go away,” still true?

While various research studies have supported the seasonality of stock market returns, indicating that November-April typically yields better results, the gap between the two periods has been narrowing over time.

For example,

over the last 50 years, the S&P 500 has gained an average of 4.8% between November and April, compared to just 1.2% between May and October. However, this pattern has been fading over shorter time frames.

Over the past 20 years, the outperformance of November-April over May-October has narrowed to 1%.

Similarly, over 10 years, November-April has actually underperformed May-October by 1 percentage point, and over the last 5 years, it has underperformed by 3 percentage points.

These findings suggest that blindly following the “sell in May” strategy may not be as effective as it once was.

Therefore, instead of relying solely on seasonal patterns, investors should consider a more comprehensive approach to their investment decisions. What factors have contributed to the recent stock market rally in India?

What factors have contributed to the recent stock market rally in India?

Strong Macro Data:

Positive macroeconomic indicators such as GDP growth, industrial production, and consumer spending have provided a favorable backdrop for the stock market rally. These indicators suggest a robust economic environment and increased investor confidence.

Better-Than-Expected Earnings:

The fourth-quarter earnings for the fiscal year 2023 exceeded market expectations. When companies report stronger earnings, it generally boosts investor sentiment and leads to a rise in stock prices.

Easing Bond Yields:

Bond yields have eased, indicating a decline in borrowing costs for companies. Lower yields make equities more attractive for investors, potentially driving up stock prices.

Pause in Tightening Cycle by RBI:

The Reserve Bank of India (RBI), the country’s central bank, has signaled a pause in its tightening cycle. This decision provides relief to investors and indicates a supportive monetary policy environment, which can boost stock market performance.

Improved Inflation Within RBI’s Tolerance Range:

Inflation, a key concern for investors and policymakers, has remained within the RBI’s tolerance range. Stable inflation rates reduce uncertainty and provide a conducive environment for the stock market to rally.

Better Current Account Deficit (CAD):

The improvement in the current account deficit, which measures the balance of trade and income flows between a country and its trading partners, indicates a healthier external position for India. A lower CAD reduces the risk of economic imbalances and supports investor confidence.

Record-High GST Collections:

The Goods and Services Tax (GST) collections in India have reached all-time highs. Robust GST revenue indicates increased economic activity and consumption, which can drive corporate earnings and investor optimism.

Improving Lead Economic Indicators:

Positive trends in lead economic indicators such as freight haulage, auto sales, and power demand point to improving economic conditions. These indicators provide insights into economic growth and can bolster investor confidence in the stock market.

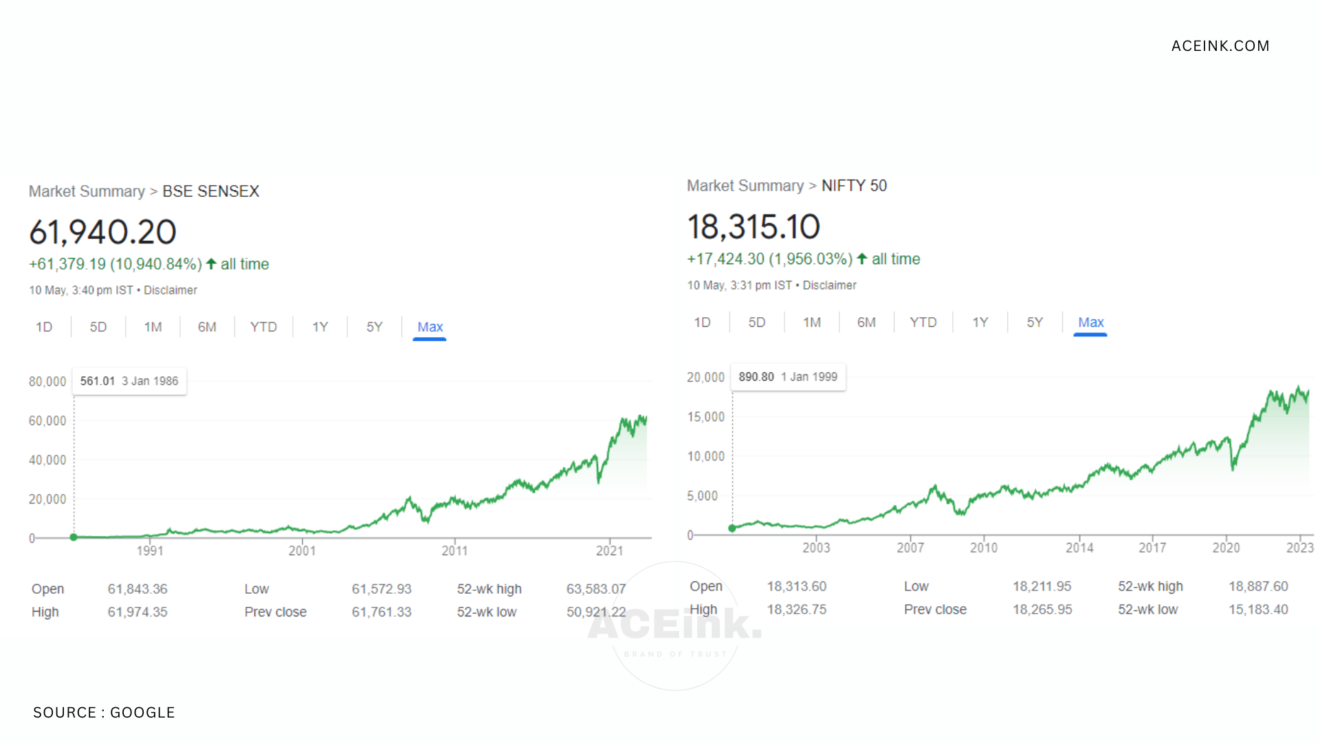

Overall, the combination of strong macro data, better-than-expected earnings, easing bond yields, a pause in the tightening cycle by the RBI, improved inflation, better CAD, record-high GST collections, and positive lead economic indicators have collectively contributed to the recent stock market rally in India.

Should investors and traders sell into the current rally or hold on to their positions?

According to the market experts, From a technical standpoint, the markets may be nearing the upper bound of the trading range, suggesting a negative risk-reward ratio for traders at current price levels.

However, from a macroeconomic and corporate fundamentals perspective, the markets appear to be entering a structural bull market that could last for the coming years.

It is crucial to evaluate the current market conditions, economic indicators, and individual investment goals before making any significant portfolio adjustments. Diversification, asset allocation, and risk management remain important factors in designing a successful investment strategy.

What Factors Should Be Monitored During the Market Rally?

-Stay updated on market trends,

-global economic developments,

-central bank policies,

-geopolitical factors, and

-company-specific news.

These factors provide insights and opportunities for making informed investment decisions.

One should conduct thorough research, consider personal financial situations, and consult with a qualified financial advisor before making investment decisions.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments