16 May Paytm Stocks Rally 33% – Buy or not?

” Paytm- A Promising Present, A Challenging Tomorrow”

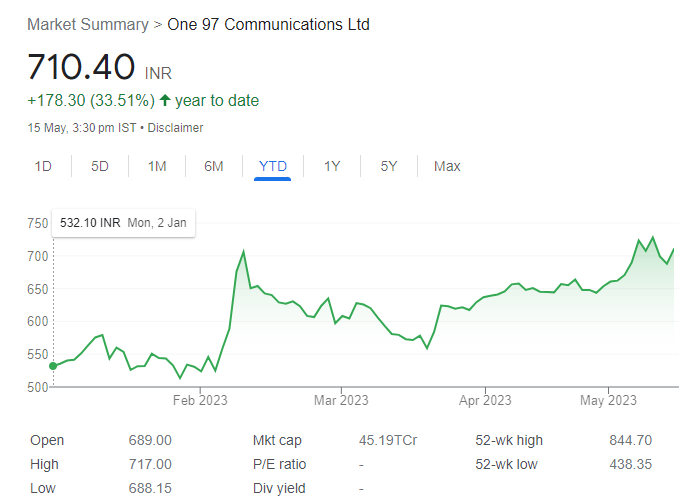

Paytm, the popular digital payment and financial services company, has been making waves in the market in 2023. Its stock price has surged by 33% this year, reaching INR710, which has caught the attention of investors and analysts.

However, despite the optimism, there is a sense of uncertainty about what lies ahead, leading many to hesitate when it comes to making long-term decisions regarding Paytm’s stock.

The reason for this hesitation is rooted in the history of major initial public offerings (IPOs) in India.

Large IPOs have often struggled to deliver sustained returns for investors.

Out of the top 10 biggest IPOs in India, only two have managed to provide positive long-term returns. These IPOs were launched during bullish market conditions when valuations were high, but they faced difficulties maintaining growth and profitability when market conditions became challenging.

This brings us to the current situation with Paytm. While the company has shown impressive revenue growth, with a 51% increase to INR2,334 crore in the last quarter, and its stock price has been rising, there are still doubts about its long-term potential.

In simple terms, people are wondering whether Paytm can break the pattern seen with other big IPOs and overcome the obstacles they faced. We need to consider factors such as the competitive market, changing regulations, and Paytm’s ability to adapt and grow in order to understand what lies ahead for the company.

Join us as we unravel the story behind Paytm’s stock performance, balancing hope and caution, and discover whether it can defy the odds and emerge as a true success story in the ever-evolving world of digital payments.

Introduction:

-Founded in August 2010 by Vijay Shekhar Sharma and is headquartered in Noida, Uttar Pradesh, India.

-Paytm initially started as a mobile recharge and bill payment platform but has since expanded its services to include various financial products.

Market Leader During Demonetization:

Paytm experienced its peak performance in 2016 when it emerged as the market leader in digital payments during the period of demonetization. It capitalized on the shift towards digital transactions when UPI had not gained significant traction.

Key Offerings:

Mobile Wallet: Paytm offers a digital wallet that allows users to store money and make payments using their smartphones.

QR Code Payments: Paytm facilitates quick and secure payments through QR codes, enabling merchants to accept payments easily.

Digital Banking: Paytm provides digital banking services such as savings accounts, fixed deposits, and digital debit cards.

Wealth Management: Paytm offers investment and wealth management services, including mutual funds, gold investment, and insurance.

E-commerce Marketplace: Paytm operates an online marketplace where users can buy products across multiple categories.

Paytm Bank:

-In 2017, Paytm received approval from the Reserve Bank of India to launch Paytm Payments Bank, a separate entity offering banking services.

-Paytm Payments Bank allows customers to open savings accounts, avail banking services, and earn interest on their deposits.

Expansion and Diversification:

-Paytm has expanded its services beyond India and has operations in various countries, including Canada and Japan.

-The company has diversified its offerings by venturing into sectors such as insurance, wealth management, and ticket booking.

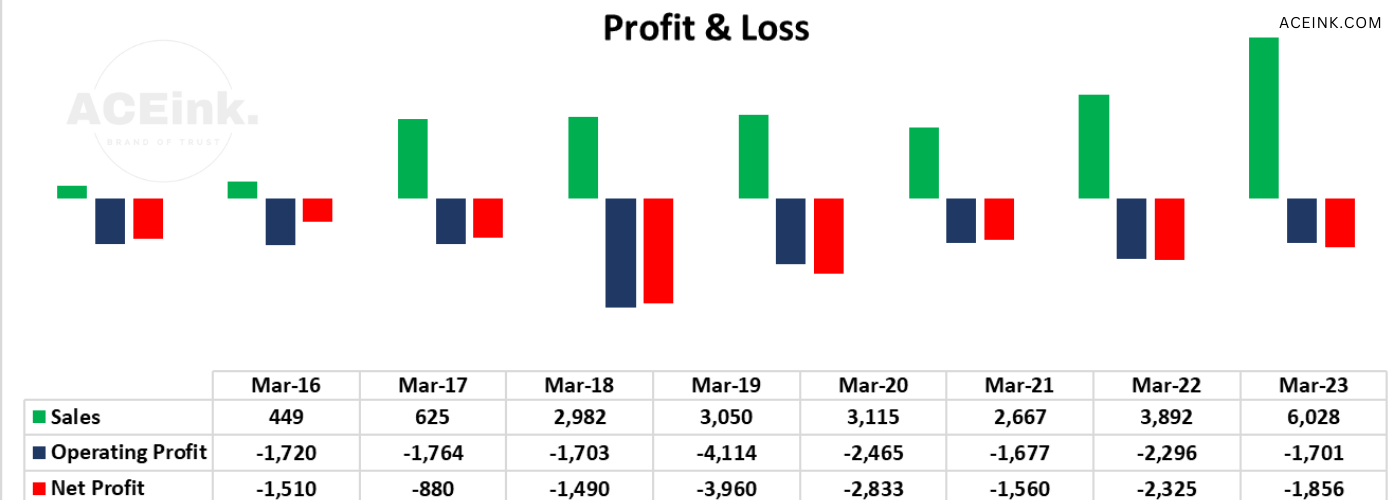

Financial Performance:

Positive Shift in Recent Quarters: Paytm has experienced a positive turnaround in its financial performance in the past two quarters, marking a significant change for the company.

Strong Year-on-Year Revenue Growth: In the quarter ending March, Paytm achieved a notable 61% year-on-year revenue growth, reaching INR2,334 crore. This growth was driven by an increase in gross merchandise value (GMV), higher merchant subscription revenues, and the growth of loans distributed through its platform.

Improved EBITDA and Reduction in Losses: Paytm’s EBITDA before ESOPs showed improvement, reporting INR101 crore in contrast to a loss of INR368 crore the previous year.

Payments Business:

Growth in Payments Business: The payments business of Paytm has witnessed substantial growth, reaching Rs. 4,930 crores, which is a 2.9x increase over the past two years.

Merchant Adoption: Merchants have embraced digital payment options, contributing to the growth of Paytm’s payment line item and strengthening merchant relationships.

Subscription Revenue and Extra Charges: Paytm’s payment business is fueled by revenue from subscriptions and additional charges for various payment instruments.

Monetization of UPI Payments: UPI payments are moving towards monetization through Merchant Discount Rates (MDRs), with different payment instruments incurring different charges for merchants.

Market Leadership:

Paytm holds a prominent position as a market leader in merchant-side payments, with credit being a key performance metric.

Commerce and Cloud Services Business:

-The commerce and cloud services business, including co-branded credit card distribution, is experiencing year-on-year growth.

– Paytm’s co-branded credit card business continues to scale well, contributing to its overall performance.

-The marketing cloud business saw a decline, although its contribution to the company’s total revenue remains below 3%.

Revenue Growth in Financial Services: Paytm’s financial services revenue increased to Rs. 475 crores, driven by growth in the lending business.

Partnerships with NBFCs and Banks: Paytm is investing in consumer growth and expanding its financial product distribution by collaborating with large Non-Banking Financial Companies (NBFCs) and banks.

New Technology Platform: Paytm has launched a new technology platform capable of handling 10 times more transactions than the current scale. The platform incorporates artificial intelligence (AI) for fraud protection.

UPI Lite and Wallet Interoperability: Paytm introduced UPI Lite for small payments without requiring a PIN, witnessing success with millions of customers and significant transaction volumes. Additionally, Paytm wallet interoperability allows acceptance on all UPI QR codes.

Co-branded RuPay Credit Card: Paytm is set to launch a co-branded RuPay credit card in the near future, expanding its offerings in the financial services domain.

Device Portfolio Refresh: Paytm has updated its device portfolio, including a dynamic QR device and a 4G-enabled Sound Box, catering to evolving customer needs.

Expenses:

Controlled Operating Expenses: Operating expenses, particularly indirect expenses, have remained stable for four consecutive quarters, aligning with revenue growth.

Management of Promotional Cash-back Incentives: Promotional cash-back incentives have slightly decreased due to seasonality and are being carefully managed.

Other Direct Expenses: Other direct expenses include costs related to high take rate events in the events business and collection costs associated with lending.

Company’s Outlook:

Cautionary Growth Approach:

Paytm exercises caution regarding growth in the first and second quarters, considering elevated interest rates. However, the company anticipates higher growth in the second half of the year if the portfolio performance remains favorable.

Focus on Profitability:

Paytm aims to realign growth in the loan distribution business towards profitability, emphasizing the importance of sustainable financial performance.

Cash Flow Profitability:

Paytm is on the verge of achieving cash flow profitability, which would mark a significant milestone for the company. Discussions with the board will take place to determine the best utilization of the cash on books, including potential options like buybacks and strategic investments.

- Market Cap ₹ 45,216 Cr.

- Current Price ₹ 713

- High / Low ₹ 845 / 438

- Book Value₹ 194

- Price to book value 3.68

- ROCE -13.4 %

- ROE -13.8 %

- OPM -28 %

- Qtr Profit Var 74 %

- Qtr Sales Var 68 %

- Free Cash Flow ₹ -586 Cr.

- Promoter holding 0.00 %

- FII holding 71.8 %

- Public holding 25.%

- DII holding 3.19 %

- Chg in FII Hold -0.97 %

- Chg in DII Hold 1.32 %

The Analysts’ View:

Caution from Anurag Singh, managing partner of Ansid Capital:

Holds a skeptical view of Paytm’s stock.

He cites the net losses of many New Age companies as a deterrent and believes that Paytm is a favorable investment only at a price below INR400.

Singh questions the rationale behind investing in companies that consistently incur losses. He emphasizes that the current investment landscape no longer offers free money, raising concerns about funding losses. According to Singh, Indian markets are in an overvaluation zone, prompting investors to seek new ideas and value in undervalued New Age stocks.

Macquarie’s Stance:

Macquarie was initially bearish on Paytm even before its listing on the stock exchange.

Revised its outlook and upgraded the company’s rating to ‘outperform’ in February.

This change in stance came after Paytm’s December quarter report showed promising results. In May, Macquarie maintained its rating on the firm, setting a target price of INR800.

Goldman Sachs’ Optimism:

Goldman Sachs, known for its optimism regarding Paytm, issued a ‘Buy’ rating for the company.

They have set a target price of INR1,150, indicating confidence in Paytm’s future growth prospects.

Goldman Sachs believes that Paytm’s strong Q4 results will address concerns about its business model traction and profitability. They see the resolution of regulatory issues as the next catalyst for the stock, potentially boosting its performance. Overall, Goldman Sachs remains optimistic about Paytm’s future prospects.

Citigroup’s Positive Outlook:

Citigroup also shares a positive outlook on Paytm, giving it a ‘Buy’ rating and setting a target price of INR1,144.

They believe that the current valuations of the company are attractive and have already factored in most of the downside risks.

Paytm holds a key edge in the market due to its first-mover advantage in the payments ecosystem. With 90 million monthly transacting users (MTUs) and 7 million merchant devices, Paytm has established a strong customer acquisition engine. This advantage positions Paytm well to expand into new services, including commerce, financial services, and payments.

SoftBank had offloaded a 2.07% stake in the company

On Thursday, Paytm’s stock experienced a decline of nearly 5% following the announcement that SoftBank had offloaded a 2.07% stake in the company. This stake reduction was carried out through open market transactions since February to comply with the takeover regulations set by the Securities and Exchange Board of India (Sebi).

As a result, SoftBank’s ownership in Paytm has decreased from 13.24% to 11.17%. This news of a stake sale by a significant investor may have influenced the drop in the stock price.

Impact of Valuation Markdowns on New Age Companies

Listing Pop and Subsequent Decline: New Age companies like Zomato, Delhivery, and Nykaa experienced a significant increase in stock prices during their IPOs, providing traders with short-term gains. However, these companies were unable to maintain their initial momentum, resulting in disappointing returns for long-term investors.

Valuation Markdowns for Unlisted Startups:

The markdown of valuations for unlisted startups is having an impact on listed companies as well. Investment firms like Vanguard Group and Invesco have reduced the valuations of prominent startups, signaling a cautious sentiment in the market.

On May 10, 2023, Vanguard Group decreased the valuation of ride-hailing startup Ola by 35%, lowering it from USD 7.4 billion to USD 4.8 billion. This markdown reflects the challenges faced by high-growth startups in sustaining their valuations in the market.

In a similar vein, Invesco reduced the valuation of food-tech company Swiggy for the second time in four months. The valuation was slashed from USD 10.7 billion to USD 5.5 billion, highlighting the volatility and uncertainties surrounding the valuation of New Age companies.

Cautious Investor Sentiment:

The markdowns in valuations indicate a cautious sentiment among investors. They serve as a reminder for investors to carefully evaluate the long-term potential and sustainability of these companies before making investment decisions.

Potential Risks Impacting Paytm’s Growth and Fintech Sector

Increased Competition in Loan Distribution:

Paytm’s first-mover advantage in the loan distribution business may face challenges due to aggressive competition from rivals like PhonePe and Google Pay. The intensifying competition could potentially hinder Paytm’s growth momentum in this segment.

Regulatory Overhang on the Fintech Sector:

The fintech sector, including Paytm, continues to be affected by regulatory uncertainties. The need for regulatory approval from the Reserve Bank of India (RBI) for licenses such as small finance bank (SFB) or non-banking financial company (NBFC) could impact Paytm’s ability to expand and build its own balance sheets. The regulatory environment adds an element of uncertainty for the entire fintech sector.

Cash Flow and Profitability Focus:

The high valuations of startups prior to listing have been challenged by the market’s emphasis on cash flows and profitability. This shift in investor focus has affected both Paytm and other listed entities, highlighting the importance of sustainable financial performance for long-term success.

Potential Impact on Valuations:

Independent analyst Ambareesh Baliga highlights that even though some companies, like Nykaa, experienced a strong listing performance, their stock prices have declined significantly since then. This serves as a reminder that high valuations during the listing phase do not guarantee sustained performance, and market dynamics can impact the rewards for investors.

While Paytm benefits from being a first-mover and a market leader, it faces challenges such as increased competition in the loan distribution business and regulatory uncertainties in the fintech sector. The focus on cash flows and profitability has become crucial for sustaining valuations. Investors should consider these risks when evaluating the growth potential of Paytm and the overall fintech sector.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments