03 Jun IKIO Lighting IPO Details – GMP, Date, Price, Reviews & More

IKIO Lighting IPO: Issue details, GMP, Financials and key things to know before applying

IKIO Lighting, an Indian manufacturer of LED lighting solutions, is set to launch its initial public offering (IPO) from June 6 to June 8. The shares are expected to begin trading on June 16.

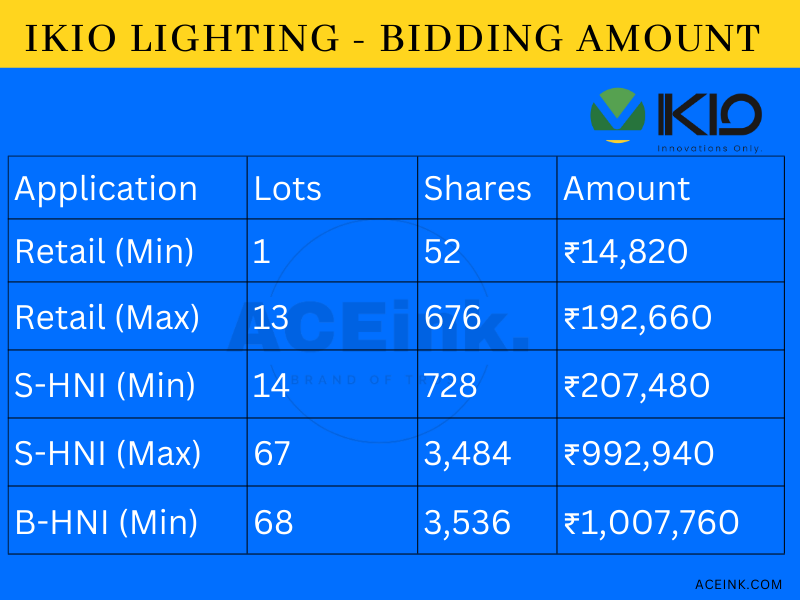

During the IPO, the company plans to list its shares at a price range of INR270 to INR285 per equity share.

The upper end of this range could raise INR607 crore for the company.

The IPO will consist of a fresh equity issue of up to INR350 crore and an offer for sale of up to 9 million shares. The funds raised through the IPO will be utilized for purposes such as repaying borrowings, investing in subsidiary IKIO Solutions, and supporting general corporate requirements.

Also Read:Why did South Indian Bank SIB Rally 11% ?

Company Overview:

Company Name: Ikio Lighting Limited

Year of Incorporation: March 21, 2016

Industry Experience: Over 6 years of industry presence

Promoters: Hardeep Singh and Surmeet Kaur

Product Focus: LED lighting solutions

Manufacturing Facilities: 4 manufacturing plants are located in NCR and Uttarakhand.

Annual Manufacturing Capacity: Over 18 million fixtures

Product Categories: LED lighting, refrigeration lights, ABS piping, and other related products

Industry Application: Products used in residential, industrial, and commercial lighting

Business Model: Original Design Manufacturer (ODM) that designs develops, manufactures, and supplies LED lighting products to customers.

Expertise: Specializes in LED lighting solutions

Customer Collaboration: Works closely with customers to develop, manufacture, and supply products as per their specifications

Industry Overview:

Global Electronics Manufacturing Services (EMS) Market:

- Comprised companies involved in manufacturing electronic products, focusing on PCB assembly and box builds for major brands.

- Plays a key role in the production and assembly of various electronic devices.

Evolution of the EMS Market in India:

Scope of EMS Services:

- Encompasses PCB assembly, product testing, supply chain management, and after-sales support.

- Supports the production of consumer electronics, industrial equipment, telecommunications devices, medical devices, and automotive electronics.

Market Growth Drivers:

- Increasing complexity and miniaturization of electronic devices.

- Growing demand for customized products.

- Need for cost-effective manufacturing solutions.

- EMS companies leverage their expertise in design, engineering, and manufacturing to provide comprehensive solutions for customers.

- Rising emphasis on eco-friendly manufacturing practices, recycling, and waste reduction.

- Compliance with stringent environmental regulations.

- Intense competition among EMS players striving for market share.

- Factors driving growth: favorable government policies, increasing domestic demand, rising exports, and a skilled workforce.

- Crucial role in the global electronics manufacturing ecosystem.

- Supports brands and OEMs in bringing innovative and high-quality electronic products to the market.

- March 2020: Rs. 144.83 crores

- December 2022: Rs. 335.50 crores

- Indicates a substantial increase in assets over the period.

- March 2020: Rs. 221.83 crores

- March 2022: Rs. 334.00 crores

- December 2022: Rs. 332.79 crores (for FY23)

- Demonstrates consistent revenue growth, with FY23 revenue nearing FY22 earnings.

- March 2020: Rs. 21.41 crores

- March 2022: Rs. 50.52 crores

- December 2022: Rs. 51.35 crores (for FY23)

- This signifies a significant increase in profits, surpassing the previous financial year’s net profit.

- March 2020: Rs. 46.86 crores

- December 2022: Rs. 136.33 crores

- Indicates an increase in borrowing over the period.

End-to-End Solutions:

Sustainability Focus:

Competitive Landscape in India:

Importance of the EMS Industry:

SOURCE – DRHP

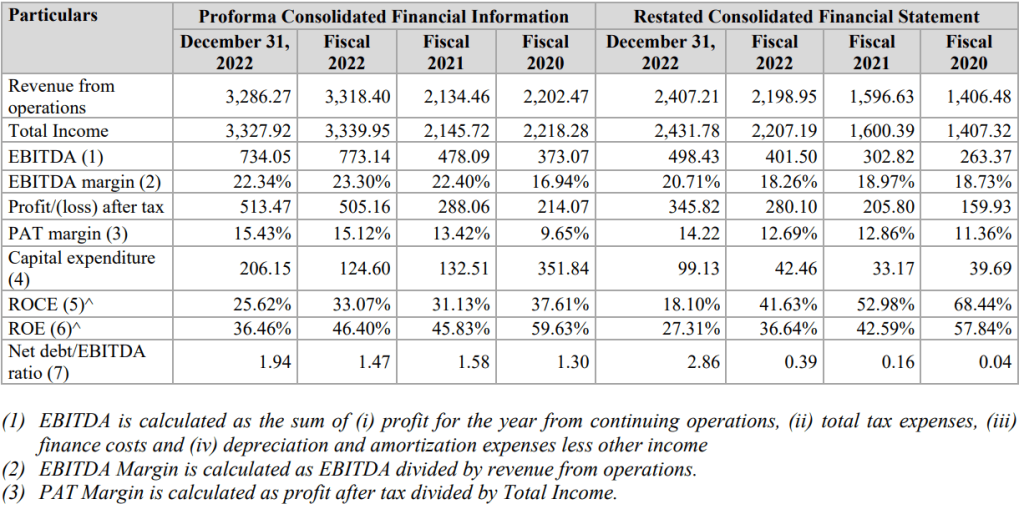

From March 2020 to December 2022, IKIO Lighting has shown significant growth in its financials. Here are the key highlights:

Asset Growth:

Revenue Growth:

Profit Growth:

Borrowings:

SOURCE – DRHP

Key Ratios

ROE 36

ROCE 26

Debt/Equity 1.03

EPS (Rs) 7.9

RoNW (%) 36.46

These financial indicators reflect IKIO Lighting’s growth and success, with notable increases in assets, revenue, and profits. However, it is important to consider the increase in borrowing as it may impact the company’s financial position and future operations

Strengths:

Market Growth Potential: IKIO Lighting is well-positioned to capture growth in the LED market, driven by factors such as smart city and infrastructure projects, as well as increasing demand for energy-efficient lighting.

Diverse Product Range: The company offers a wide range of products, including LED lighting and ABS piping, allowing them to cater to different industries and expand its market share.

Strong Customer Base: IKIO Lighting has supplied its products to nearly 900 customers, including 16 international customers. The company has relationships with renowned industry customers like Signify (Philips), Western Refrigeration Private Limited, Panasonic Life Solutions India Private Limited, and Novateur Electrical & Digital Systems Private Limited.

R&D Capabilities: The company’s R&D department independently generates ODM designs and evaluates OEM designs obtained from clients. This enables them to develop and enhance deliverable products through design enhancements, suitable raw material selection, and rigorous testing.

In-House Manufacturing: IKIO Lighting manufactures all mechanical components in-house with their own tool room, except for diodes and resistors used in LED lighting products. This allows for better quality control and cost management.

Weaknesses:

Dependency on Key Customers: A significant portion of the company’s revenue is generated from Signify Ltd, and 85% of revenue comes from the top 20 customers. Any reduction in demand, termination of relationships, or delays from these key customers can negatively impact the business.

Lack of Long-Term Agreements: The company does not have long-term agreements with its customers. Failure to renew contracts can disrupt operations and revenue flow.

Dependency on Third-Party Suppliers: IKIO Lighting relies on a variety of third-party suppliers for components, supplies, stock-in-trade, and customer support services. Any shortfall or issues with these suppliers can have a negative impact on the company’s operations.

Raw Material Supply and Cost: The company imports various raw materials required for its operations. Any disruption or increase in the cost of raw materials can disrupt operations and affect profitability.

Working Capital Requirements: IKIO Lighting requires a significant amount of working capital for its continued operation and growth. The inability to meet working capital requirements may have a negative impact on operating performance and financial position.

IKIO Lighting GMP :

As of June 3rd, 2023, the grey market premium (GMP) for the IKIO Lighting IPO was ₹75 per share. The GMP for the IKIO Lighting IPO increased from ₹50 on June 1 to ₹75 on June 2.

The shares of IKIO Lighting were trading at a premium of 27.04% in the grey market, with a trading price of Rs 345 per share. This indicates positive market sentiment and potential investor interest in the company’s initial public offering (IPO).

IKIO Lighting Review: “May Apply”

Experts have different opinions about the IKIO Lighting IPO and how much profit it could bring.

This means investors should take a closer look at the company and understand its strengths and weaknesses. By analyzing things like the company’s position in the market, how well it’s doing financially, and what it’s good at or lacking, investors can make smart decisions about whether or not to invest in the IPO.

It’s important to do thorough research to understand the risks and rewards before making any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

Pingback:Buy or Sell: Top 3 Trading Ideas for Next Week by Experts - aceink.com

Posted at 18:31h, 10 September[…] Also Read:IKIO Lighting IPO Details – GMP, Date, Price, Reviews & More […]