16 Jun 3 Small Cap Stock suggestions by Experts

Midcaps, small caps at record high: 3 stocks suggested by Research Analysts that can give healthy returns

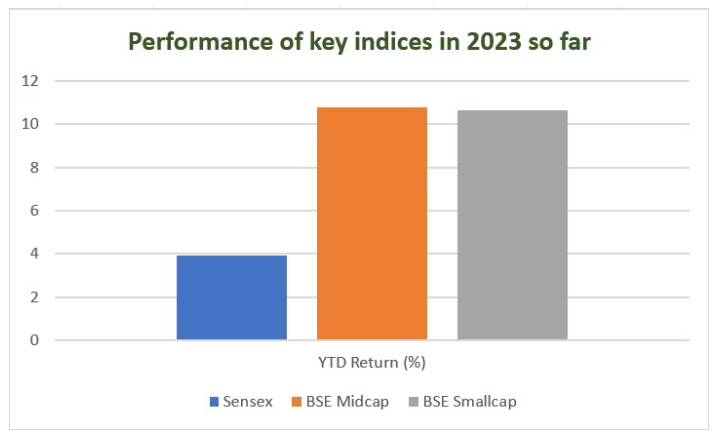

The BSE Midcap and Smallcap indices have recently reached record highs, indicating a strong bullish trend. Analysts anticipate further upward movement in the mid and small-cap space, driven by the healthy fundamentals of the domestic market.

Both indices have outperformed the benchmark Sensex, with gains of 11 percent each compared to a 4 percent increase in the Sensex. On Thursday (June 15), the BSE Midcap index hit a fresh all-time high of 28,215.13, while the Smallcap index reached its peak at 32,190.2 during morning trade.

More to Read:IEX share rebounds 10% from 52-week lows -UBS sees 58% upside in the stock

It is important to note that while analysts are optimistic about the mid and small-cap sectors, blind investments should be avoided. Careful consideration and analysis are essential in selecting stocks.

Here is a list of 3 stocks from small-cap space, which is collated in the Livemint article and shared by different Analysts and Experts, that show potential for delivering healthy returns within the next one to two-year timeframe.

Also Read:NPS withdrawal rule set to change Soon- All you need to know about NPS

Expert: Kaustubh Pawaskar, deputy VP of fundamental research at Sharekhan by BNP Paribas

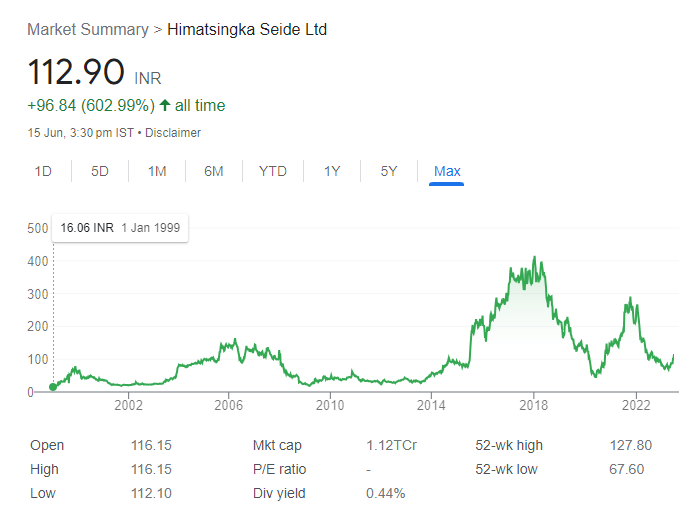

Himatsingka Seide

Target Price: Rs 140

Himatsingka Seide Ltd. is a vertically integrated home textile player based in India. With a rich heritage and global presence, the company has established itself as a leading provider of high-quality home textile products. Himatsingka Seide operates across the entire value chain of the home textile industry, from manufacturing to distribution, catering to both domestic and international markets.

Business and Products:

Home Textile Products: Himatsingka Seide specializes in the production and distribution of a wide range of home textile products, including bed linens, bath linens, window coverings, upholstery fabrics, and other decorative textiles.

The company offers a diverse collection of premium quality products that cater to various customer preferences and style trends.

Vertical Integration: Himatsingka Seide follows a vertically integrated business model, which allows it to have control over the entire production process. The company owns and operates manufacturing facilities that encompass the spinning, weaving, processing, and finishing of textiles.

This integration enables Himatsingka Seide to maintain quality standards, optimize the production efficiency, and provide a comprehensive range of products.

Market Presence: Himatsingka Seide has a strong presence in the Indian market, serving both retail and institutional customers. Additionally, the company has strategically expanded its operations globally, catering to international markets across the Americas, Europe, and Asia.

It leverages its global network to meet the evolving demands of customers worldwide.

Himatsingka Seide’s reputation as a leading home textile player, coupled with its vertically integrated operations and global market presence, positions it as a trusted choice for customers seeking premium home textile products. With a commitment to quality, innovation, and sustainability, the company is well-equipped to capitalize on the evolving trends in the home textile industry and maintain its competitive edge.

Investment Rationale By Analyst:

A beneficiary of the Growing US Home Textile Market:

Himatsingka Seide, a vertically integrated home textile player, is expected to be a key beneficiary of India’s increasing share in the US home textile market. Leveraging its experience in the US market and its vertically integrated business model, the company is focused on strengthening its presence in European and Middle Eastern markets as well.

This strategic expansion into new markets positions the company for growth opportunities and diversification.

Capacity Expansion and Revenue Generation:

The company has successfully completed its capital expenditure program, investing around Rs 2,500 crores to expand its capacity of bedsheets and spindles.

This expanded capacity is expected to generate revenues of Rs 750-800 crore per quarter from the second half of FY24.

This increased production capacity enhances the company’s ability to meet growing demand and capitalize on market opportunities.

Opportunities from Trade Agreements and Shifting Retail Base:

The likely signing of a Free Trade Agreement (FTA) in the UK and the shifting of large retailers’ base from China create additional opportunities for Himatsingka Seide. These developments open up new avenues for the company to expand its customer base and capture market share, particularly in the European market.

Improvement in Margins and Debt Reduction:

A correction in cotton prices and a decline in supply chain costs, combined with expected improvement in volumes, are anticipated to contribute to a recovery in Himatsingka Seide’s EBITDA margins. The company aims to achieve EBITDA margins of 18-21% in the coming years.

Furthermore, with no major capital expenditures planned, the company intends to utilize incremental cash to reduce its debt burden. This focus on debt reduction strengthens the company’s financial position and improves its return on capital employed (RoCE).

Attractive Valuations and Favorable Risk-Reward:

The stock is currently trading at discounted valuations of eight times and five times its FY24E and FY25E earnings, respectively. With strong earning visibility and a favorable risk-reward profile, Himatsingka Seide emerges as a preferred pick in the textile space.

Based on this analysis, the analyst recommends a ‘buy’ rating on the stock, with a price target of Rs 140 per share.

Expert: Abhishek Gaoshinde, deputy VP of research at Sharekhan by BNP Paribas

More to Read:Can ITC shares reach Rs 1000 Levels?

Gabriel India

Target Price: Rs 270

Company Overview:

Gabriel India Limited is a flagship company of the Anand Group and a leading manufacturer of suspension products for two-wheeler and four-wheeler players. With a legacy of over five decades, Gabriel India has established itself as a trusted provider of high-quality suspension solutions, catering to the automotive industry.

Business and Products:

Suspension Systems: Gabriel India specializes in the design, development, and manufacturing of suspension systems for a wide range of vehicles, including motorcycles, scooters, cars, SUVs, and commercial vehicles.

The company offers a comprehensive portfolio of suspension products that contribute to superior ride comfort, stability, and safety on the road.

Two-Wheeler Suspension: Gabriel India is a market leader in the two-wheeler suspension segment, serving major original equipment manufacturers (OEMs) in the motorcycle and scooter industry.

The company’s suspension systems are designed to enhance handling, reduce vibrations, and provide a smooth riding experience for two-wheeler enthusiasts.

Four-Wheeler Suspension: Gabriel India also manufactures suspension systems for four-wheelers, catering to passenger cars, SUVs, and commercial vehicles.

The company’s suspension solutions are known for their durability, reliability, and ability to withstand varying road conditions, ensuring optimal performance and passenger comfort.

Electric Vehicle (EV) Focus: In line with the industry’s shift towards electric mobility, Gabriel India has been actively focusing on providing suspension solutions for electric vehicles.

The company aims to leverage its expertise and technological capabilities to meet the unique requirements of EV suspensions, including optimized weight distribution, improved handling, and enhanced energy efficiency.

Research and Development: Gabriel India places a strong emphasis on research and development (R&D) to drive innovation and stay at the forefront of technological advancements in the suspension industry.

The company’s dedicated R&D centers work on developing new products, improving existing offerings, and collaborating with OEMs to provide customized suspension solutions.

Global Presence: Gabriel India has a global presence, serving customers across various international markets. The company’s products are exported to several countries, contributing to its reputation as a reliable and preferred supplier of suspension systems.

With its strong industry expertise, technological capabilities, and commitment to customer satisfaction, Gabriel India has established itself as a trusted partner for OEMs in the automotive sector.

The company’s focus on innovation, expanding its product portfolio, and addressing the evolving needs of the market positions it well for continued growth in the suspension systems segment.

Investment Rationale By Analyst:

Dominant Position and Market Share Growth:

Gabriel India, a flagship company of Anand Group, is a leading manufacturer of suspension products for two-wheeler and four-wheeler players. The company has maintained its dominant position in its existing business while successfully gaining significant market share in the electric two-wheeler segment.

Furthermore, Gabriel is actively exploring growth opportunities in the electric bicycle space in the export market, positioning itself for future growth and diversification.

EBITDA Margin Expansion:

The management of Gabriel India is focused on improving its revenue mix and aims to achieve an expansion in EBITDA margins in FY24. With a strong emphasis on profitability, the company is striving to achieve double-digit EBITDA margins in the medium term. This focus on margin expansion demonstrates the management’s commitment to enhancing operational efficiency and financial performance.

Diversification Strategy and Inorganic Growth:

Gabriel India has embarked on a diversification strategy by collaborating with Inalfa for manufacturing sunroof systems in India. This strategic move opens up new avenues for the company and provides opportunities for revenue diversification.

Additionally, the management remains open to suitable inorganic growth opportunities, indicating its proactive approach to expanding its market presence and capabilities.

Strong Brand Equity and Market Share Expansion:

The analyst highlights Gabriel India’s strong brand equity, which contributes to its market share expansions. The company’s ability to maintain its dominant position in the suspension products market, coupled with its success in the electric two-wheeler segment, showcases its competitiveness and ability to adapt to evolving market trends.

Favorable Valuation and Growth Prospects:

Considering the company’s strong brand equity, market share expansions, focus on profitability, and inorganic growth strategies, the analyst recommends a ‘buy’ rating on Gabriel India’s stock. With a target price of Rs 217, the analyst believes that the stock offers attractive growth prospects and a favorable valuation based on its potential for future earnings growth and market opportunities.

Expert: Yash Kukreja, Research Analyst, Mehta Equities

Dreamfolks Services

Target Price: Rs 735

Company Overview:

Dreamfolks Services is a prominent player in the domestic airport service aggregator platform and an incubator of the industry. The company operates with a unique, capital-efficient, and asset-light business model, positioning itself as a dominant player in the market. Dreamfolks focuses on providing a comprehensive range of services to enhance the travel experience for customers at airports.

Business and Products:

Airport Service Aggregator Platform: Dreamfolks Services operates an innovative platform that aggregates various airport services to create a seamless and convenient experience for travelers.

The company partners with all 60 lounges in India, offering services such as lounge access, food and beverage, spa services, meet and assist, and airport transfer services. This one-stop-shop approach enables customers to access multiple services through a single platform, enhancing their overall travel experience.

Railway Lounges Segment: In addition to its presence in the airport services segment, Dreamfolks has ventured into the railway lounges segment. By diversifying its service offerings, the company aims to tap into the growing demand for enhanced travel experiences in railway stations.

This expansion allows Dreamfolks to leverage its expertise and network to deliver similar quality services in railway lounges.

International Presence: Dreamfolks Services is focused on growing its international presence. By expanding its operations beyond India, the company aims to capture opportunities in global airport service markets.

This strategic approach enables Dreamfolks to broaden its customer base and extend its reach to international travelers seeking premium airport services.

Dreamfolks Services operates as a dominant player in the domestic airport service aggregator platform. With its capital-efficient and asset-light business model, the company provides a wide range of services to enhance the travel experience of customers. By diversifying into the railway lounges segment and expanding internationally, Dreamfolks aims to further strengthen its position in the market and capitalize on the growing demand for superior travel services.

Investment Rationale By Analyst:

Dominant Position and Unique Business Model:

According to Kukreja, Dreamfolks is a well-positioned dominant player in the domestic airport service aggregator platform and acts as an incubator of the industry. The company’s unique business model is characterized by being capital-efficient and asset-light, which allows it to operate in a cost-effective manner while maintaining a strong market position.

The analyst appreciates the company’s one-stop shop diversified service offerings, including lounge access, food and beverage, spa services, meet and assist, and airport transfer services, partnered with all 60 lounges in India.

Robust Industry Growth:

The analyst expects the airport services industry to experience robust growth, with the number of lounges projected to reach approximately 193 by 2040. The expansion of lounge facilities to tier-II airports is also anticipated to contribute to the growth of new lounges in the coming years.

Dreamfolks, with its market dominance and focus on enhancing the air travel experience, is well-positioned to benefit from this growth trend.

Asset and Human Resource Light Business Strategy:

Dreamfolks’ asset and human resource light business strategy is highlighted as a significant competitive advantage. The company’s ability to deliver services through an extensive lounge network with minimal capital investment and resource utilization allows for healthy growth prospects.

This efficient approach to operations enables Dreamfolks to scale its business and capture opportunities in the airport services market.

Diversification and International Expansion:

Dreamfolks Services has strategically focused on diversifying its service offerings by entering the railway lounges segment. This expansion into a new market segment serves as a growth trigger for the company.

Additionally, the analyst emphasizes the company’s efforts to grow its international presence, indicating a broader market reach and potential for further expansion.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments