20 Jul “Public Sector Banks: Share Prices are Still 80% Down from All-Time Highs Despite Recent Rally

The market capitalisation of most PSU Banks is at an all-time high but the share prices are not!

The story starts in January 2021, way before the current market rally.

Public sector banks got all fired up and started climbing like champs on the Nifty PSU Bank Index. Since then, they’ve soared over 154 percent, breaking records left and right!

But here’s the twist:

Even though the market capitalization of most state-owned banks reached an all-time high, also some banks have experienced gains of 50 to 90 percent, but the share prices didn’t reach their peak levels.

Take Bank of Baroda, for example. Its market capitalization has now reached an impressive Rs 1.03 lakh crore. However, its share price still falls short by about 9 percent compared to its peak value of Rs 228.90 back on January 23, 2015, when its market cap was only Rs 47,901 crore.

Since January 2021, the Nifty PSU Bank Index has surged over 154 percent. Despite this remarkable growth, none of the stocks in the index have managed to reach their all-time highs. However, amidst the rally, three public sector banks – Canara Bank, Indian Bank, and Bank of Baroda – achieved a 52-week high.

Related Read: Will the Nifty Reach 21,000?

So, why the discrepancy?

Well, The government injected a ton of cash into the banking sector by issuing fresh shares. That’s like pouring buckets of money into the banks, making them look super valuable in terms of market capitalization.

From 2010 to 2019, the government injected about Rs 3.12 lakh crore into the banking sector. An additional Rs 22,000 crore was infused since 2020, but there have been no further injections since 2022.

This influx of capital has boosted the overall market capitalization of these banks.

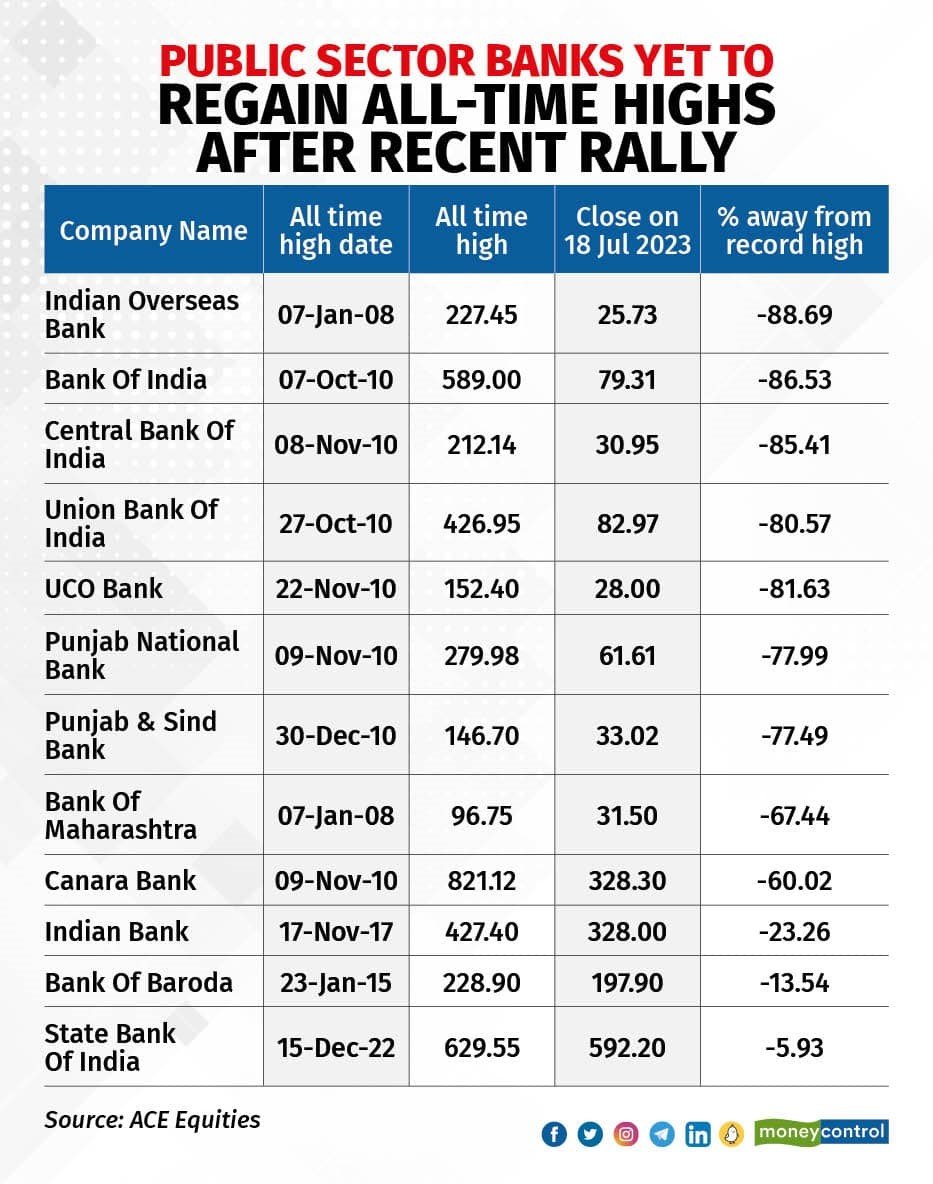

Despite this rally, several public sector banks are still significantly below their record levels, with some down over 80 percent from their peak valuations.

Indian Overseas Bank, Bank of India, Central Bank of India, and Union Bank of India have seen a decline of over 80 percent from their all-time highs. Likewise, Uco Bank, Punjab National Bank, Punjab & Sind Bank, Bank of Maharashtra, and Canara Bank are currently 60-78 percent away from their record highs.

Indian Bank is 28 percent away from its record high, while State Bank of India, the most valued state-owned lender in the country, is currently approximately 6 percent away from its all-time high.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

“According to Devarsh Vakil, deputy head of retail research at HDFC Securities, the decline in market capitalization for these banks was primarily caused by lower profitability, higher non-performing assets, and derating on the valuation front. To regain their past all-time highs and trade beyond those levels, these banks need to focus on consistent profitability, growth in their business, and managing the new credit cycle while minimizing non-performing assets.

In contrast, the current rally in the banking sector has surpassed the one witnessed during the 2007-2010 period of the US recession. This time, the entire banking sector is thriving, with public sector banks collectively recording a net profit of Rs 1.05 lakh crore in FY23. State Bank of India and other banks reported their highest-ever earnings, and all public sector banks saw a decline in both gross and net bad loans, as a percentage of loans and in absolute terms.”

Investors will be looking for these factors to improve before considering re-rating the banks to higher valuation multiples.

Since March 31, 2022, the market capitalization of PSBs has witnessed an impressive increase of 43.7 percent, reaching Rs 10.47 lakh crore. In comparison, the market capitalization of private banks rose by 21.7 percent, totaling Rs 26.55 lakh crore.

However, there are concerns surrounding state-owned banks.

The Reserve Bank of India has announced that Expected Credit Loss provisioning norms will be implemented for banks in the financial year 2024. This implies that banks will be required to set aside provisions based on expected credit losses on their loan portfolios. While the implementation will happen over five years, analysts believe that this move might impact public sector banks negatively, as they generally have lower levels of floating provisions. Floating provisions act as a buffer to absorb potential losses, and lower levels of these provisions might pose challenges for the banks in the future.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this stock has the growth Potential?” In today’s world, the need for sustainable energy solutions has never…..Read More

——————-

“Why this small-cap stock can perform exceptionally in the future? ” What comes to your mind when you hear……Read More

Down 20% in 1 year, but why analysts are bullish on this small cap?

No Comments