25 Aug Stock on Radar : Tata Power- Time to Buy?

After a 16% Rally in a month Will it hit a Fresh 52-week High?

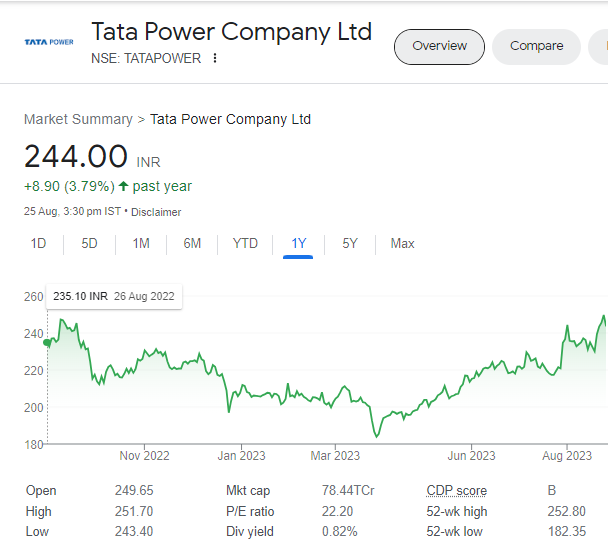

The remarkable surge of Tata Power’s stock from Rs 217 on July 24 to Rs 252 on August 24, reaching its 52-week high, signifies an impressive 16% surge within a single month. This swift price escalation prompts conversations regarding potential investment prospects.

Analyzing the technical aspects, Tata Power, in June, liberated itself from a downward-sloping trendline, indicating the potential for a shift in its movement. Moreover, the weekly charts reveal a breach of the Ascending Triangle pattern, indicating the possibility of further upward movement.

Technical indicators add to the analysis. The daily Relative Strength Index (RSI) is at 65.9, not entering the overbought territory above 70 but still displaying positive momentum.

In terms of price action, the stock maintains a favorable position above crucial short- and long-term moving averages, including 5, 10, 30, 50, 100, and 200-day moving averages.

This suggests a positive sentiment among market participants.

Related Read: “Technical Analysis: All You Need to Know for Smarter Investments”

Short-Term Strategies

Technical experts advise short-term traders to contemplate acquiring the stock presently or during slight retracements.

With a target price set at Rs 275 within a 5-7 week span, this projection is founded on the stock’s positioning within an ascending channel and its establishment of a higher bottom pattern. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Expert Insights

Over the past decade, Tata Power has grappled with significant losses from its Mundra Power plant due to elevated coal prices and shifts in Indonesian regulations.

While the company demonstrated proficiency in managing Delhi and Mumbai distribution ventures, its entry into Odisha discom occurred only in 2022.

Despite pioneering renewable energy, Tata Power’s capacity lags behind newer renewable companies backed by sovereign wealth funds (SWF) or private equity (PE). Volatility in module prices impacted its solar engineering (EPC) profitability.

Experts revised projections consider lower coal prices, anticipated Power Purchase Agreement (PPA) adjustments, and evolving module price estimates.

Also Read: “Top Picks for the Current Market”

Company Overview and Business Focus

Tata Power, a part of the Tata Group conglomerate, is a leading integrated power utility in India.

The company’s operations span the entire power supply chain, from generation and transmission to distribution and trading. With a commitment to sustainable energy solutions, Tata Power plays a vital role in the nation’s energy sector.

Diverse Range of Products

The company offers a diverse range of products and services in the energy domain.

These include conventional energy sources such as coal, gas, and oil, as well as renewable energy sources like solar and wind power.

Tata Power’s portfolio reflects its dedication to a balanced and sustainable energy mix.

Also Read: “Pharma Comeback: 5 Stocks to Watch”

Financial Performance Highlights and Strategic Focus: Tata Power’s Strong Quarter and Renewable Energy Thrust

Tata Power has reported robust financial performance in its recent quarter, showcasing its resilience and strategic focus. Here are the key takeaways from the company’s recent financial report:

Consistent Profit Growth

-Tata Power achieved a remarkable milestone by recording a growth in its Profit After Tax (PAT) for the 15th consecutive quarter.

-The reported PAT stood at Rs. 1,141 crores, a significant increase from the previous Rs. 884 crores.

-While the company’s revenue remained flat at Rs. 15,003 crores, its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) witnessed a notable upswing. EBITDA surged by 43%, reaching Rs. 3,005 crores.

Business Segment Performance

Tata Power’s various business segments demonstrated solid performance during the quarter. The existing generation business, the Mundra plant, and the renewable and Transmission and distribution (T&D) segments all contributed positively.

Stabilization of Transmission and Distribution Business

In the transmission and distribution domain, Tata Power’s business in Odisha has stabilized, with expectations of improved future performance. This stabilization is anticipated to enhance the overall financial outlook.

Also Read: ““Metals in the Spotlight: 7 metal stocks to deliver up to 40% returns”

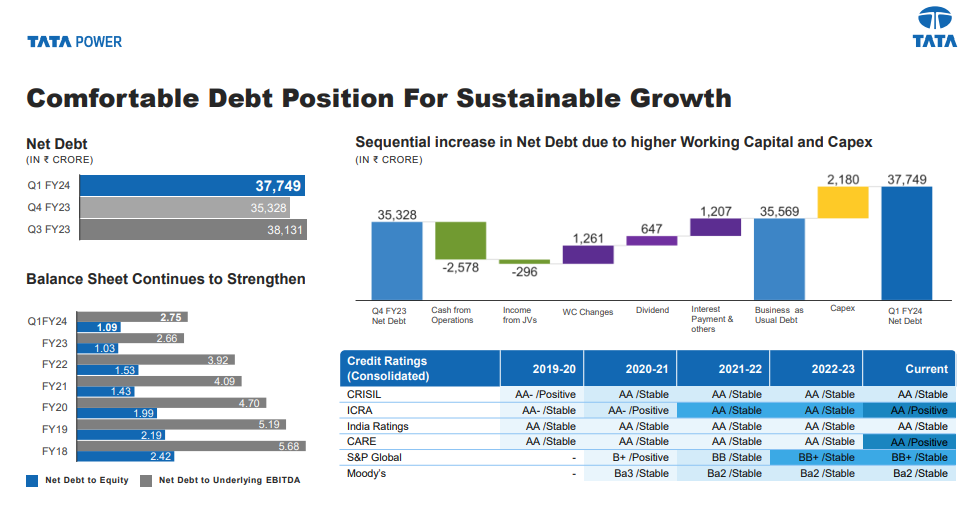

Tata Power maintains a healthy financial standing, reflected in its debt equity ratio of 1.1. Additionally, the company has seen an improvement in working capital, ensuring a balanced and sustainable financial structure.

Credit Rating Upgrades

The company’s efforts in financial management have been acknowledged with credit rating upgrades by ICRA and CARE. These upgrades underscore Tata Power’s commitment to prudent financial practices.

Also Read: “Contra Bets: 5 Software Stocks with 29% Upside Opportunity”

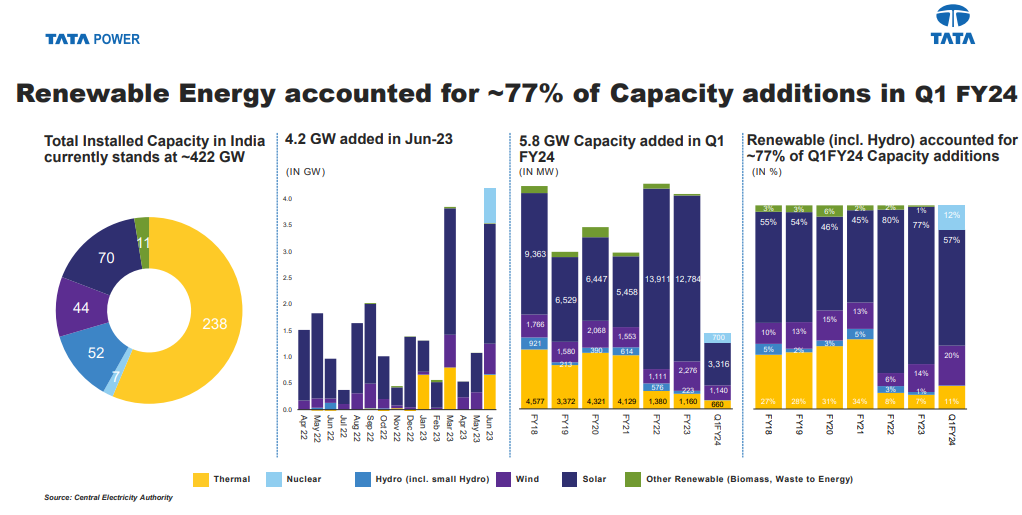

Renewable Energy Strategic Focus

Beyond its core energy business, Tata Power’s ventures such as the electric vehicle (EV) sector have flourished.

The company’s EV business has achieved consistency, establishing numerous public, home, and bus charging stations across the country.

Plans include the addition of 2 GW to 2.5 GW of renewable capacity annually, with emphasis on utility-scale and group captive projects.

Pumped Hydro Projects and Competitive Advantage

Tata Power is investing in pumped hydro projects, with the aim of supporting 6 GW to 7 GW of round-the-clock renewable power.

The company foresees a competitive edge in the solar cell and module market, driven by reduced prices and domestic production.

Positive Outlook and Commitment to Transparency

Tata Power’s performance outlook remains positive, with expectations of improved margins in group captive and rooftop projects. The company maintains an open channel of communication with analysts and stakeholders, ensuring regular updates on its progress.

Tata Power’s quarter demonstrates both its financial strength and its dedication to sustainable and innovative ventures in the energy sector, positioning the company for future success.

Considering the significant rally, technical patterns, and expert opinions, it’s evident that Tata Power has attracted substantial attention. Investing in Tata Power carries potential risks. Fluctuations in global coal prices could impact profitability, as the company relies on coal for a portion of its energy generation. Regulatory changes in the energy sector, like altered power purchase agreements, could affect revenue streams.

The renewable energy market’s rapid growth may lead to heightened competition and pricing pressures. Furthermore, delays or disruptions in new projects could impact expansion plans.

As with any investment, thorough research and risk assessment are essential.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments