12 Dec IREDA Crosses Rs.100 Mark- What Next?

Why IREDA is up 200% from IPO price?

IREDA, the Indian Renewable Energy Development Agency, is on fire!

The stocks surged over 210% from Rs 32, it crossed Rs 100 on the NSE, in the morning.

Big move, right? Trading volumes? A massive 9.9 crore shares!

Why the buzz?

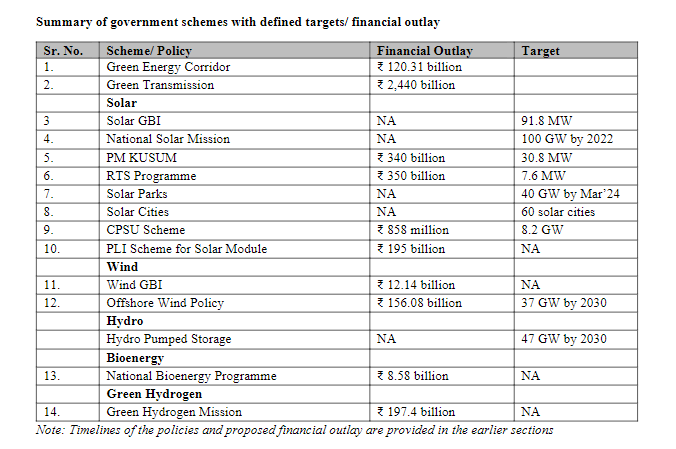

IREDA launched a retail division, focusing on projects like PM-KUSUM scheme and Rooftop Solar – for retailers (that’s B2C). Quick action Rs 58 crore loan sanctioned under the same KUSUM-B scheme.

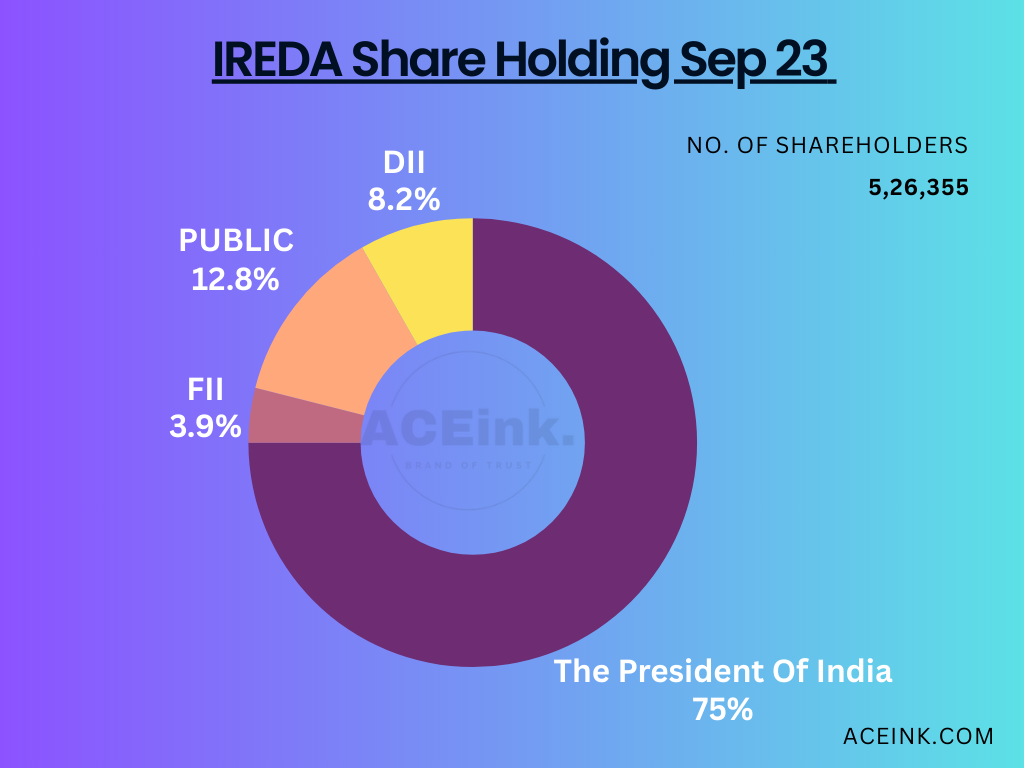

IREDA is the first public sector company listed in the market in over a year after LIC.

IREDA’s power play? Solar energy dominates at 30%, followed by wind power (20.9%), state utilities (19.2%), and hydropower (11.5%).

While some investors might think about cashing in on their gains, experts say IREDA is here for the long run. This company isn’t just about numbers; it’s about making green initiatives happen.

Stay tuned for more on IREDA’s journey.

Also Read: “From Crisis to Confidence: YES Bank’s Journey to Stability”

Company Overview: Incorporated in March 1987, Indian Renewable Energy Development Agency (IREDA) stands as a Mini Ratna (Category – I) government enterprise. Specializing in promoting, developing, and extending financial assistance for new and renewable energy (RE) projects, as well as energy efficiency and conservation (EEC) projects, IREDA has been a key player in shaping India’s sustainable energy landscape.

Business Profile: Providing a comprehensive range of financial products and services, IREDA supports the entire value chain of Renewable Energy (RE) projects. From project conceptualization to post-commissioning, the company facilitates activities such as equipment manufacturing and transmission.

Projects: IREDA has been instrumental in financing projects across diverse RE sectors, including:

- Solar Power

- Wind Power

- Hydropower

- Transmission

- Biomass, including bagasse and industrial co-generation

- Waste-to-Energy

- Ethanol

- Compressed Biogas

- Hybrid RE

- Energy Efficiency and Conservation (EEC)

- Green Mobility

Also Read: “Suzlon 2.0: What Lies Ahead -Post Turnaround?”

- Loan Book Data (as of September 2023):

- Diversified Loan Book: Rs. 47,514 crore

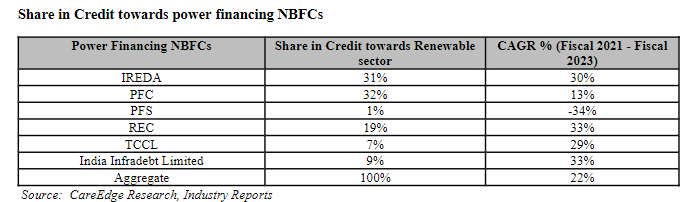

- Strong Growth: Demonstrated a robust 30% Compound Annual Growth Rate (CAGR) between FY21 and FY23.

- Loans Disbursed (FY2021 to FY2023):

- Loans Sanctioned:

- FY2021: Rs. 11,001 crore

- FY2023: Rs. 32,587 crore

- Loans Disbursed:

- FY2021: Rs. 8,828 crore

- FY2023: Rs. 21,639 crore

- Loans Sanctioned:

Also Read: The Remarkable Turnaround of JLR: From Tata’s “Biggest Mistake” to a “Biggest Victory”

Asset Quality Data:

- GNPA’s (Gross Non-Performing Assets):

- FY21: 8.77%

- FY22: 5.21%

- FY23: 3.21%

- NNPA’s (Net Non-Performing Assets):

- FY21: 5.61%

- FY22: 3.12%

- FY23: 1.66%

Geographical Presence (as of September 2023): IREDA maintains a geographically diversified portfolio, operating across 23 states and five union territories.

Credit Rating:

- Secured Assets: 93.41%

- Credit Rating: AAA (Stable) by India Ratings, ICRA, and Acuite.

Loan Concentration (as of September 2023):

- Largest Borrower: 3.9% of the loan book.

- Top 5 Borrowers: 16.2%

- Top 10 Borrowers: 25.9%

- Top 20 Borrowers: 39.7%

Loan Book Bifurcation – Sectorwise (FY2022 to FY2023):

- Private Sector: 73% (FY23) vs. 66% (FY22)

- Public Sector: 27% (FY23) vs. 34% (FY22)

IPO Details (Planned): IREDA aims to raise Rs. 2,150 crore through its IPO, with Rs. 1,290 crore allocated for augmenting the capital base to meet future requirements and lending. The IPO also promises listing benefits.

Also Read: “Ircon International: On Track with Big Plans?”

Fundamentals:

- Market Cap ₹ 26,622 Cr.

- Current Price ₹ 99.0

- High / Low ₹ 102 / 50.0

- Stock P/E 30.8

- Industry PE 14.2

- OPM 93.4 %

- ROCE 8.17 %

- ROE 15.4 %

- Sales growth 21.8 %

- Profit growth 36.5 %

- Profit Var 3Yrs 59.1 %

- Sales growth 3Years 13.7 %

Analysts’ Perspectives:

- Long-Term Play: Analysts believe IREDA is a long-term play and has the potential for further rallies despite the recent surge.

- Valuations: While valuations have become expensive compared to peers like PFC and REC, IREDA’s strong loan book growth prospects make it an attractive investment.

Expert Opinions:

- According to Nirmal Bang, IREDA’s diversification and expansion in emerging green technologies position it for longer-term sustainability and high growth in its loan book.

Particular Risks in Investing in IREDA:

- Market Volatility:

- IREDA’s stock has experienced a rapid surge, which may increase susceptibility to market volatility. Sudden fluctuations can impact short-term investors.

- Dependency on Renewable Energy Sector:

- IREDA’s asset book is heavily concentrated in the renewable energy sector. Any adverse developments or policy changes in this sector could significantly impact the company’s performance.

- Asset Composition Risk:

- The dominance of solar energy (30%) in IREDA’s asset composition exposes the company to risks associated with this specific sector. Adverse conditions in solar energy could affect overall portfolio performance.

- Dependency on Government Policies:

- As a state-owned enterprise, IREDA’s fortunes are closely tied to government policies and initiatives in the renewable energy domain. Regulatory changes or shifts in government priorities may impact the company’s operations.

- Valuation Concerns:

- The recent surge in IREDA’s stock has led to relatively high valuations. Investors should be cautious about potential corrections, especially if the stock becomes overvalued compared to industry peers.

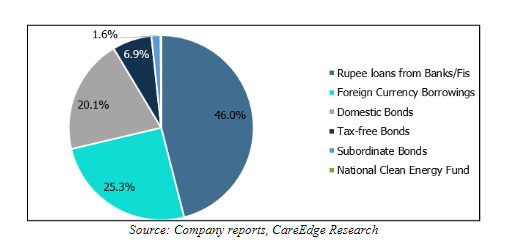

- Interest Rate Risks:

- IREDA’s business involves significant borrowing for financing projects. Fluctuations in interest rates could impact the cost of borrowing, potentially affecting profitability and financial performance.

- Loan Concentration Risk:

- The concentration of a significant portion of the loan book in specific states and sectors, such as solar and wind energy, may expose IREDA to regional or industry-specific economic challenges.

- Operational Risks:

- The successful implementation of renewable energy projects is subject to various operational risks, including delays, technical issues, and project execution challenges, which can impact financial outcomes.

- Limited Trading History:

- IREDA’s limited trading history since its listing on November 29, 2023, makes it challenging for investors to assess its long-term performance trends and potential risks accurately.

- Global Economic Factors:

- External factors such as global economic conditions, geopolitical events, or changes in international trade policies may indirectly impact IREDA’s operations and financial stability.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments