27 Jan Indian Markets: Anticipate 700M USD Inflow in Feb

“IREDA, PNB, cello may enter MSCI Index: Nuvama”

MSCI is about to reveal a new list of stocks that might join its global standard index and small-cap index. The date range for deciding on these stocks is from January 18 to January 31. The official announcement will come on February 13, and any necessary adjustments will happen on February 29.

Currently, India’s portion in the MSCI Emerging Markets Index (EM), which includes large and mid-cap representation across 24 emerging market countries, rose to 17.1%. Nuvama anticipates this share to further grow and reach 20% by mid-2024.

Also Read: PSU Stocks Rally: What’s Fueling the Surge?

MSCI, or Morgan Stanley Capital International, is a global provider of financial market indexes and portfolio analysis tools. It is widely recognized for creating a variety of equity indices that investors use to track the performance of different markets and investment strategies. MSCI indices are crucial benchmarks for measuring the performance of investment portfolios, and they cover a broad range of asset classes, including stocks from various regions and countries.

Investors often refer to MSCI indices to analyze and compare the returns of different investment opportunities in the global financial markets.

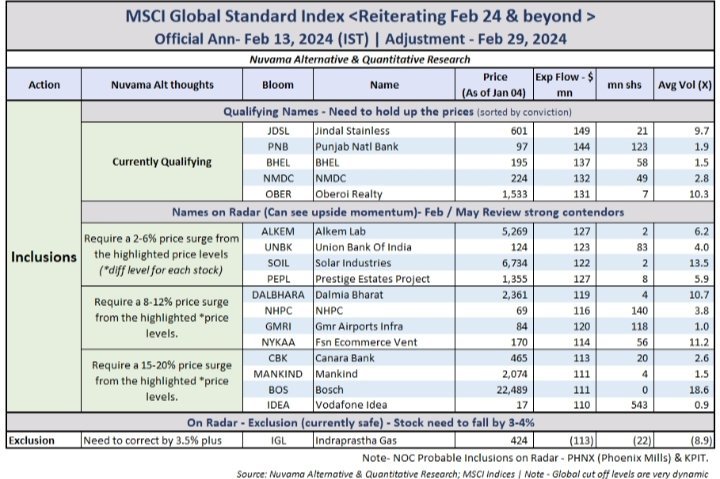

As we approach the MSCI index rebalance in February, Nuvama Institutional Equities has identified stocks with high conviction for inclusion in both the MSCI Global Standard Index and the MSCI Smallcap Index.

Nuvama Alternative and Quantitative Research predicts a passive inflow of over $700 million into the Indian markets in February.

Also Read: Interim Budget 2024: What to Expect ?

High Conviction Picks for MSCI Global Standard Index by Nuvama:

- Punjab National Bank (PNB), Bharat Heavy Electricals Ltd (BHEL), and Jindal Stainless Ltd stand out as top picks.

- Union Bank of India and Oberoi Realty hover on the borderline for potential inclusion.

Passive Inflows Projections:

- BHEL and Jindal Stainless are anticipated to attract substantial inflows, each expected to reach $146 million.

- PNB is poised to draw in passive inflows of $146 million.

- Union Bank might attract $133 million, while Oberoi Realty could see $129 million in passive inflows if included.

Also Read: What Factors Could Trigger a 20% Fall in the Indian Market?

MSCI Standard Index Contenders:

- Notable contenders include Jindal Stainless, PNB, BHEL, NMDC, and Oberoi Realty.

- Alkem Laboratories, Union Bank, Solar Industries, and Prestige Estate are closely monitored for potential inclusion.

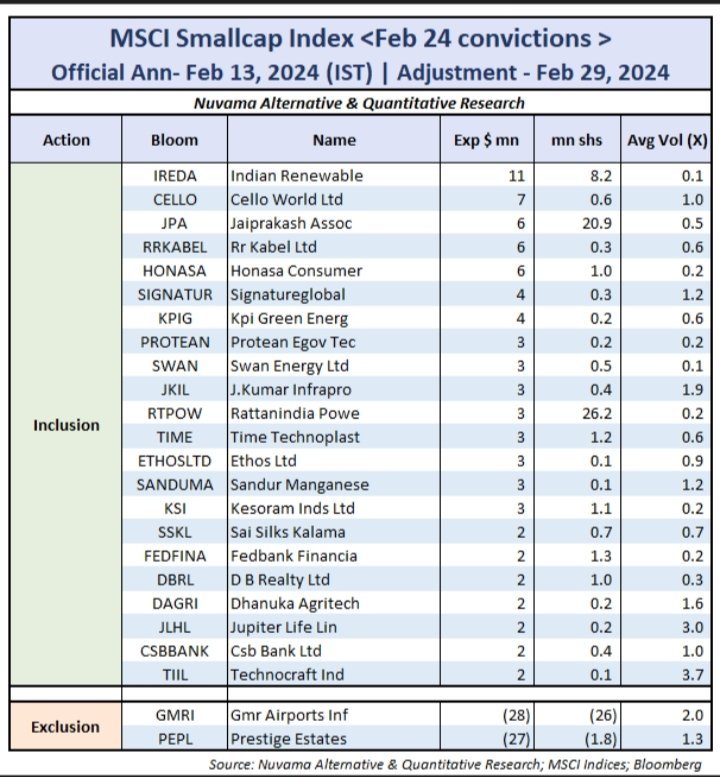

MSCI Smallcap Index Inclusion Predictions:

- IREDA, CELLO World, Jaiprakash Associates Ltd, RR Kabel Ltd, Honasa Consumer Ltd, Signatureglobal (India) Ltd, and KPI Green Energy are among high conviction inclusions.

- Additional potential inclusions encompass Swan Energy Ltd, Ethos Ltd, DB Realty Ltd, and RattanIndia Power.

- Honasa Consumer, J. Kumar Infraprojects, Fedbank Financial Services, and CSB Bank are among the 22 potential contenders.

GMR Infra and Prestige Estate could face exclusion, while Indraprastha Gas may be removed.

These insights from Nuvama provide a valuable guide for investors navigating the intricate landscape of the stock market. With the official announcement expected on February 13 and adjustments scheduled for February 29, investors should stay tuned for potential market shifts and capitalize on emerging opportunities.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

Pawan Laddha

Posted at 13:46h, 28 January499 wala plan Kiya hai,, but aapka service support number koi help hi nahi karta

9422819444

Pawan Laddha