06 Mar The Biggest Beneficiaries of Tata Sons IPO?

Why Tata Chemical Is Rising Continuously?

Tata Sons, classified as an upper-layer non-banking finance company (NBFC-UL), must list on the stock market by September 2025 as per RBI rules.

The potential market value of Tata Sons in its IPO could range from Rs7 lakh crore to Rs8 lakh crore, according to investment advisory Spark PWM Pvt Ltd.

“There are multiple levers of value available from the unlisted investments as the group is entering into new-age segments such as semiconductors (by Tata Electronics). Thus, we believe that the group could derive another Rs1 lakh crore to Rs1.5 lakh crore of value from unlisted investments and step-down subsidiaries such as Tata Technologies, Tata Metaliks, and Rallis,” Spark PWM says.

The current market capitalization of Tata Group companies suggests a valuation of around Rs16 lakh crore for Tata Sons’ listed investments.

Additionally, the book value of Tata Sons’ unlisted investments is estimated to be Rs60,000 crore.

Investors are showing significant interest in Tata Chemicals amidst the anticipation of Tata Sons’ potential listing.

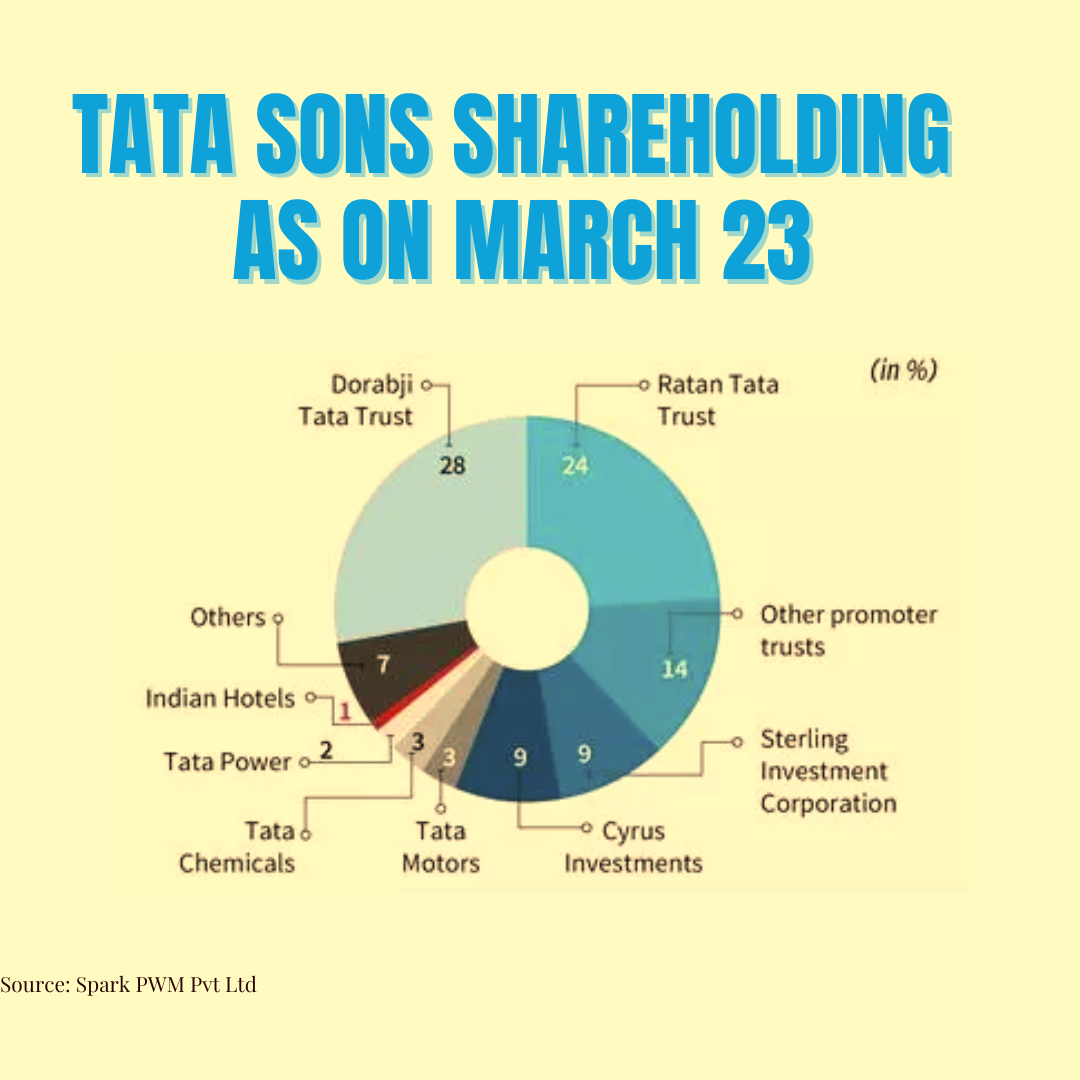

Ownership and Stakeholder Dynamics

Dorabji Tata Trust and Ratan Tata Trust own the majority of Tata Sons, with other Tata Group companies holding smaller stakes.

Tata Chemicals holds a 3% stake in Tata Sons, which could represent significant value for the company.

Also Read: Why IHCL is the Best Play for Industry Upcycle

Regulatory Mandate and Potential IPO Size

Tata Sons, classified as an upper-layer NBFC by RBI last year, is required to list itself on stock exchanges by September 2025.

Reports suggest that Tata Sons could be valued at Rs 11 lakh crore, indicating a substantial IPO size.

A 5% stake sale in Tata Sons could potentially result in an IPO size of approximately Rs 55,000 crore.

Factors Influencing Valuation

Tata Sons’ entry into new-age segments like semiconductors is expected to add further value, potentially ranging from Rs1 lakh crore to Rs1.5 lakh crore.

Unlisted investments in subsidiaries such as Tata Technologies, Tata Metaliks, and Rallis could contribute Rs1 lakh crore to Rs2 lakh crore.

Also Read: “How does the market trend move in a pre-election month?”

RBI Regulations and Timeline

RBI’s regulations require upper layer NBFCs to list within three years of classification. Tata Sons falls under this category and is thus expected to list by September 2025.

The regulatory changes also mandate disclosure requirements similar to those of listed companies.

Market Perception and Valuation

Investors may discount Tata Sons’ equity value by 30% to 60% due to its status as a holding company.

The valuation also considers the market’s perception of holding company discounts, similar to those of Godrej Industries and Bajaj Holdings.

A change in the holding company discount assumption can significantly impact Tata Sons’ equity value.

Tata Chemicals is expected to be the primary beneficiary of the mega IPO.

On Tuesday, Tata Chemicals’ shares surged by 8% to reach a high of Rs 1,084.80 on the Bombay Stock Exchange (BSE).

Potential Impact on Tata Group Stocks

Investors anticipate a simplification of Tata Group’s holding structure with Tata Sons’ IPO, potentially leading to re-rating of listed holding companies.

Shares of Tata Chemicals are expected to benefit the most from Tata Sons’ listing, with potential value unlocking opportunities.

Overall Market Sentiment

Investors are optimistic about Tata Group stocks, with several companies experiencing significant growth in market capitalisation over the past year.

The combined market capitalisation of all listed Tata stocks recently surpassed Rs30 lakh crore, reflecting investor confidence in the conglomerate.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments