12 Aug Buy or Sell: 3 Stocks For This Week 14th Aug

The market next week: Sumeet Bagadia’s 3 Stock Recommendations

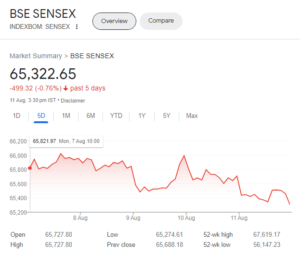

In the backdrop of weak global market sentiments driven by renewed concerns about a potential US Fed rate hike, the Indian stock market witnessed a decline.

The NSE Nifty shed 114 points to close at 19,428 levels, the BSE Sensex corrected by 365 points, ending at 65,322, and the Bank Nifty index decreased by 342 points, concluding at 44,199 levels. While broad market indices experienced a lesser decline than the Nifty, the advance-decline ratio dropped to 0.65:1.

RBI’s Hawkish Pause and Global Equities:

On August 10, the RBI maintained a ‘hawkish pause,’ holding the repo rate steady at 6.5%. This rate has remained unchanged since February. RBI Governor Shaktikanta Das emphasized the short-lived nature of the recent CPI inflation spike. He highlighted India’s resilience and stability amid global volatility.

Also Read: Why Analysts are Bullish on This Midcap Stock?

Next Week’s Stock Market Strategy:

Sumeet Bagadia, the Executive Director at Choice Broking, outlines a strategic approach for the upcoming week.

He indicates that the Nifty has a support level established at 19,250 to 19,300 levels, and a decisive breach of this support could indicate a further downside trend. In terms of resistance, Bagadia identifies the index’s hurdle at 19,650 levels, with a stronger resistance zone at 19,800 levels.

Notably, for Nifty to achieve a new high or reach the 20,000 mark, it must consistently sustain itself above 19,800 on a closing basis.

Business in the Week Ahead (August 14-18, 2023)

IPO News:

Pyramid Technoplast and Balaji Speciality subscriptions open on August 18 and close on August 22. Pyramid Technoplast’s shares are priced at Rs 151-166.

Monday (August 14):

- India Inflation Rate: July’s figure is awaited after June’s annual consumer inflation rate rose to 4.81% from an upwardly revised 4.31% in May.

- WPI Manufacturing YoY: July’s figures to be announced following a 2.71% drop in wholesale manufacturing prices in June from a year earlier.

- India WPI Food Index YoY: July’s data is anticipated after June saw a 1.24% year-on-year decrease in wholesale food prices.

- Earnings: Balkrishna Paper Mills Ltd, Coffee Day Enterprises, Concord, Divi’s Lab, GMR Airports Infrastructure, Hindustan Copper, ITC, PC Jewellers, Vodafone Idea Ltd, Wockhardt Ltd.

Tuesday (August 15):

- UK Unemployment Rate: June data is awaited after the UK’s unemployment rate for the quarter between March to May rose to 4.0% with an increase of 77,000 unemployed.

- China Industrial Production: July’s data is expected after China’s June industrial production rose by 4.4% year-on-year.

- India Balance of Trade: July’s data is anticipated following June’s narrowing merchandise trade deficit of $20.13 billion.

- India Exports/Imports Data: July’s figures are awaited after Indian exports decreased by 22.0% in June, and imports declined by 17.5%.

Wednesday (August 16):

- UK Inflation Rate: July numbers are expected following June’s consumer price inflation drop to 7.9%, the lowest since March 2022.

- US Manufacturing Production: July data is anticipated after US manufacturing production decreased by 0.3% year-on-year in June.

Thursday (August 17):

- US Initial Jobless Claims: Data for the week ending August 12 is to be released, following a jump of 21,000 to 248,000 in Americans filing for unemployment benefits.

- Earnings: Yatharth

Friday (August 18):

- India Foreign Exchange Reserves: Data for the week ending August 4 is awaited, after India’s foreign exchange reserves decreased to $603.870 billion by July 28 from $607.04 billion.

These events and data releases will play a crucial role in shaping market sentiment and trends throughout the week. Stay informed to make well-informed decisions amidst this dynamic landscape.

Recommended Stocks for the Next Week:

Looking at potential investment opportunities, Sumeet Bagadia suggests three stocks for consideration in the upcoming week:

Also Read: “Volatile Markets? These 5 Stocks Offer 40% Upside Potential as Suggested by the Analysts”

1. Bharti Airtel:

- Buy at around Rs 870,

- Target: Rs 900,

- Stop loss: Rs 865.

The Technicals:

- Notably supported by a robust foundation,

- Positioned at a commendable support level of ₹865,

- This support level coincides with the 100-day Exponential Moving Average (EMA),

- Represents a broader consolidation range of ₹865 to ₹900,

- Resilience within this price band makes it an interesting consideration for accumulation opportunities.

Company Information: Bharti Airtel is a leading telecommunications company based in India. Established in 1995, it is headquartered in New Delhi. The company operates in multiple countries and is known for its extensive mobile network and broadband services.

Business Overview: Bharti Airtel offers a range of telecommunication services, including mobile services, broadband, and digital TV. It is one of the largest mobile network operators in India and has a significant presence in Africa as well.

Product Overview: Bharti Airtel provides a variety of mobile plans, prepaid and postpaid connections, broadband services, and digital entertainment offerings like Airtel Xstream. The company has also expanded into digital payments with Airtel Payments Bank.

2. Coal India:

- Buy at around Rs 234.90,

- Target: Rs 248,

- Stop loss: Rs 227.

The Technicals:

- Shares have formed strong support near ₹230 levels

- Close to the 50-day Exponential Moving Average (EMA)

- Trading around ₹234.90, above the 20-day, 50-day, and 200-day EMAs

- A small hurdle near ₹237

- Overcoming this resistance could drive the stock towards ₹248

- Momentum indicator RSI at 54, indicating strength

Company Information: Coal India Limited is a state-owned coal mining company based in Kolkata. It was established in 1975 and is one of the largest coal producers in the world.

Business Overview: Coal India is responsible for coal production, exploration, and distribution. It operates numerous coal mines across India, supplying coal to various sectors including power, steel, cement, and more.

Product Overview: As a mining company, Coal India’s primary product is coal, which is essential for energy production and various industrial processes.

3. Grasim Industries:

- Buy at around Rs 1805-1810,

- Target: Rs 1890,

- Stop loss: Rs 1765.

The Technicals:

- In the daily time frame, Grasim Industries’ share price exhibits a Higher High – Higher Low formation,

- Suggesting a bullish trend likely to continue

- The gradual rise in volume confirms bullishness

- Supported by the 50-day and 20-day Simple Moving Averages

- Indicators like RSI and MACD confirm the positive trend

- Closing above 1835 will lead to 1890-1910 levels, However it is safer to enter at 1805-1810 levels

Company Information: Grasim Industries is a part of the Aditya Birla Group and is headquartered in Mumbai, India. It was founded in 1947.

Business Overview: Grasim operates in various sectors including viscose staple fiber, cement, chemicals, and more. It’s known for its diverse portfolio and sustainable practices.

Product Overview: Grasim’s products range from textiles and fibers to cement and chemicals. The company is a prominent player in the Indian market across several industries.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments