19 Aug Buy or Sell: 3 Stocks For This Week 19th Aug

The market next week: Sumeet Bagadia’s 3 Stock Recommendations

Domestic equity indices closed in the negative territory for the fourth consecutive session on Friday, influenced by unfavorable global cues and additional foreign fund outflows.

Analysts predict further profit-taking due to a combination of factors, including the weakening Indian rupee, rising domestic inflation, decreased foreign investment, China’s economic slowdown, and apprehensions about US interest rates.

The 30-share BSE Sensex concluded at 64,948.66, down by 202.36 points (0.31%), while the Nifty ended at 19,310.15, experiencing a decline of 55.10 points (0.28%).

Stock Market Tips for Next Week:

- According to Sameet Chavan, Chief Analyst – Technical and Derivatives at Angel One, the recent Nifty performance has witnessed negative closures for the past four weeks. Despite this, the market’s correction hasn’t been too severe.

- Global headwinds and concerns stemming from RBI policy decisions are contributing to market pressure, while other sectors are demonstrating inherent strength, offering some support at lower levels.

- Investors will have their eyes on the listing of Jio Financial Services, the BRICS Summit, and key economic data releases.

- Despite concerns over inflation, the RBI’s analysis suggests that stagflation risks are expected to remain contained. Additionally, the deficit in August rains could exert pressure on vegetable prices.

- Market structure remains intact, anticipating potential buying at lower levels if global conditions remain stable.

- Nifty’s sustained move above 19370 – 19400 could signal a revival towards 19550 – 19650; caution advised as breaking 19250 might trigger a sharper correction to 19100 – 19000 support.

Also Read: Contra Bets: 5 Software Stocks with 29% Upside Opportunity”

Key Events to Watch:

Monday (August 21):

- Jio Financial Listing: Jio Financial Services, which recently spun off from Reliance Industries, is slated for listing on August 21. This move comes ahead of FTSE Russell’s plan to remove it from its indices. The current trading price after price discovery is Rs 261.85.

Tuesday (August 22):

- Aeroflex Industries IPO: The IPO of Aeroflex Industries, supported by notable investor Ashish Kacholia, commences on August 22 with a price band of Rs 102 to Rs 108 per share. The IPO aims to raise Rs 351 crore for debt repayment and other corporate purposes.

- BRICS Summit: Prime Minister Narendra Modi will participate in the BRICS Summit in Johannesburg from August 22 to 24.

Wednesday (August 23):

- Japan Manufacturing PMI Flash: The au Jibun Bank Japan Manufacturing PMI flash reading for August will be released. This index, with a dividing line at 50, reflects factory activity’s expansion or contraction.

Thursday (August 24):

- US Initial Jobless Claims: The data for the week ending August 19 will indicate the number of Americans filing for unemployment benefits, reflecting trends in the US labor market.

Friday (August 25):

- Jackson Hole Symposium: Federal Reserve Chair Jerome Powell is set to deliver a speech on the economic outlook at the Jackson Hole Symposium.

Recommended Stocks for the Next Week:

Looking at potential investment opportunities, Sumeet Bagadia suggests three stocks for consideration in the upcoming week:

Also Read: Top Picks for the Current Market

Ambuja Cements Ltd:

Buy at Rs 453.05

Target: Rs 480

Stop loss: Rs 445

Also Read: “Technical Analysis: All You Need to Know for Smarter Investments”

The Technical:

Ambuja Cements Ltd trading around 453.05 levels, above crucial moving averages.

Expected bounce from 435 levels near 200-day EMA levels.

Strong breakout on charts supported by robust trading volumes.

Buying opportunity is seen around 445 levels; stock is expected to move towards 480 levels and beyond.

Company Information: Ambuja Cements Ltd is a prominent name in the cement manufacturing industry in India.

It is a part of the global conglomerate LafargeHolcim and is headquartered in Mumbai, Maharashtra.

Business Overview: Ambuja Cements is engaged in the production and distribution of cement and related products. The company operates cement plants across India and serves both domestic and international markets.

It is known for its commitment to sustainable practices and quality construction materials.

Product Overview:

Ambuja Cements offers a range of cement products, including

-Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), and other specialized variants.

The company’s products are widely used in various construction projects, including residential, commercial, and infrastructure developments.

Also Read: Why Analysts are Bullish on This Midcap Stock?

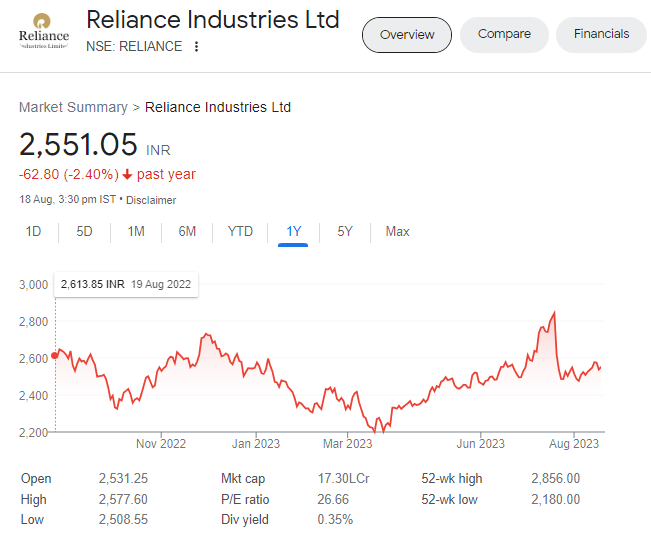

Reliance Industries Ltd:

Buy at Rs 2556.80

Target: Rs 2630

Stop loss: Rs 2520

The Technical:

Reliance Industries Ltd trading at 2556.80 levels; strong support at 2520 levels below 20-day EMA.

Minor resistance around 2585 levels; crossing could lead to 2630 levels (near all-time high).

Trading above important moving averages; RSI indicator suggests potential upward movement

Company Information:

Reliance Industries Ltd is a diversified conglomerate based in Mumbai, India.

It has a significant presence in various sectors, including petrochemicals, refining, telecommunications, and retail.

Business Overview:

Reliance Industries operates across multiple sectors, contributing significantly to India’s economic growth. The company’s operations span refining and petrochemicals, organized retail, digital services, and more.

It is known for its innovative approach and large-scale industrial projects.

Product Overview:

Reliance Industries’ products range from petrochemicals and refined products to consumer goods and digital services.

Its telecom venture, Jio, has revolutionized the Indian telecommunications industry, offering a wide range of services to consumers across the country.

The company’s diversified portfolio contributes to its status as a major player in India’s business landscape.

Britannia Industries Ltd:

Buy at Rs 4535

Target: Rs 4745

Stop loss: Rs 4400

The Technical:

Britannia Industries is trading at 4535, down 12% from its recent peak.

Established support around 4400 with increased trading volume; RSI suggests oversold condition.

Bullish stance justified; entry at 4535 with favorable risk-to-reward ratio.

Company Information:

Britannia Industries Ltd is a well-established player in the food industry, known for its diverse range of products including biscuits, bread, and dairy products.

Headquartered in Bangalore, India, the company has a strong presence in both domestic and international markets.

Business Overview:

Britannia Industries operates in the fast-moving consumer goods (FMCG) sector, focusing on the production and distribution of various food products.

The company’s offerings are highly recognized and preferred by consumers, making it a significant player in the FMCG market.

Product Overview:

Britannia offers a wide variety of products, including

Biscuits, cakes, bread, dairy products, and other snack items.

The company’s products are known for their quality, taste, and widespread availability. Britannia’s diverse product portfolio caters to the preferences and demands of a wide range of customers.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments