01 May GSFC can be the biggest beneficiary of new policy on dividend, share buyback . Here’s why

“How the New Policy on Dividend and Share Buyback is Boosting GSFC “

The Gujarat government’s announcement of a new capital restructuring plan has sparked a rally in the stock prices of seven Gujarat-based public sector units (PSUs).

The plan is expected to result in increased dividend payouts and bonuses by these state-run companies, leading to a positive market sentiment among investors.

And many experts believe that GSFC can be the biggest beneficiary of this move.

In the previous blog, we took a closer look at the recent policy change and its potential impact on PSUs’ and stock performance, Read here

In this blog post, We will explore the reasons why GSFC is expected to be the biggest beneficiary of the policy change. Additionally, we will discuss some potential risks and challenges that investors should consider before investing in GSFC.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

-GSFC, or Gujarat State Fertilizers & Chemicals Limited, is a public sector undertaking (PSU) located in Gujarat, India.

-Established in 1967

-One of the leading producers of fertilizers and industrial chemicals in India.

The company’s product portfolio includes

various grades of urea,

ammonia, ammonium nitrate,

ammonium sulfate,

diammonium phosphate,

nitrophosphate, and more.

-It also produces industrial chemicals like

methanol,

acetic acid,

anhydrous

ammonia, and others.

-Apart from its core business of fertilizers and chemicals, GSFC has diversified into other areas like information technology, power generation, and textiles.

-It has also expanded its operations globally and has established international subsidiaries and joint ventures.

Business model:

Core Business:

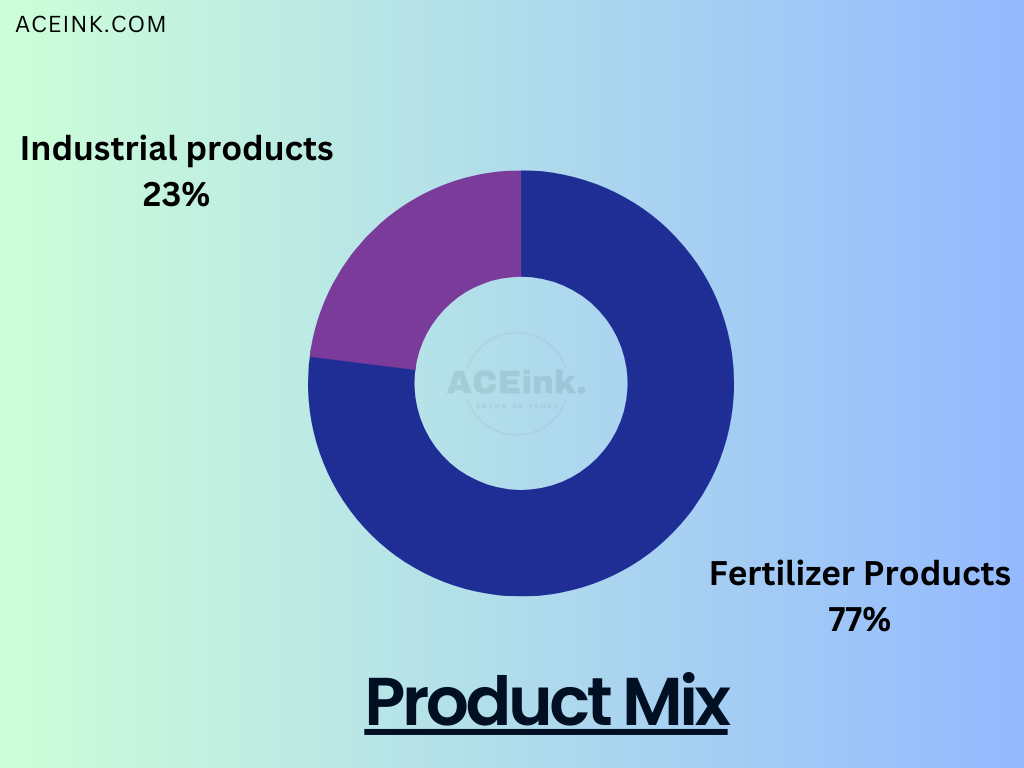

GSFC’s core business is the production and sale of fertilizers and industrial chemicals.

The company has a diversified product portfolio, and it produces various grades of fertilizers and chemicals to cater to the needs of different sectors.

Vertical Integration:

The company follows a vertical integration strategy, where it produces all the key raw materials required for its core products in-house.

This includes the production of ammonia, urea, phosphoric acid, and sulphuric acid.

By having control over its raw materials, GSFC can ensure quality control and cost optimization.

Diversification:

While the company’s core business is fertilizers and chemicals, GSFC has diversified into other areas like

information technology,

power generation, and

textiles.

This strategy has allowed the company to mitigate risks associated with a single business and expand its revenue streams.

Global Presence:

GSFC has established international subsidiaries and joint ventures to expand its global footprint. The company has a presence in several countries, including the USA, UAE, Egypt, and China.

Research and Development:

GSFC has a dedicated research and development team that focuses on developing new products and improving existing ones. The company has several patents to its credit and invests a significant amount in R&D every year.

Investment in various Gujarat-based (PSUs)

GSFC has a significant investment in various Gujarat-based Public Sector Undertakings (PSUs) as part of its strategy to diversify its portfolio and create value for its stakeholders.:

Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC):

-holds a 2.75% stake in GNFC

-which is another Gujarat-based PSU involved in the production of fertilizers, chemicals, and petrochemicals. GNFC and GSFC have a joint venture for the production of acetic acid.

Gujarat Alkalies and Chemicals Ltd (GACL):

-holds a 3.9% stake in GACL,

-which is a leading producer of caustic soda, chlorine, and other industrial chemicals in India. GACL and GSFC have a joint venture for the production of caustic soda and allied chemicals.

Gujarat State Petronet Ltd (GSPL):

-holds a 2.1% stake in GSPL,

-which is a state-owned natural gas transmission company. GSPL is involved in the transportation of natural gas from various sources to customers in Gujarat and other states in India.

Gujarat Industries Power Company Ltd (GIPCL):

-holds a 1.96% stake in GIPCL,

-which is a power generation company based in Gujarat. GIPCL operates several thermal and renewable power plants in Gujarat and other states.

Gujarat Mineral Development Corporation (GMDC):

-holds a 1.6% stake in GMDC,

-which is a state-owned mining company involved in the exploration, extraction, and processing of various minerals. GMDC has operations in Gujarat and other states in India.

By investing in these Gujarat-based PSUs, GSFC has been able to create strategic alliances, share resources and expertise, and unlock synergies.

Why GSFC can be the biggest beneficiary:

The new policy introduced by the Gujarat government aims to unlock value from the state-owned PSUs by providing them with greater autonomy and encouraging them to pay higher dividends and buybacks.

GSFC’s investments in Gujarat-based PSUs:

-GSFC has invested Rs 4,200 crore in various Gujarat-based PSUs, including GNFC, GACL, GSPL, GIPCL, and GMDC

-Due to the new policy, all the dividends and buyback benefits from the state-owned PSUs are likely to come to GSFC eventually.

-These investments could potentially benefit from the new policy, which aims to unlock value from state-owned PSUs.

Cash reserves of GSFC:

-GSFC has a cash reserve of Rs 2,360 crore, which includes subsidies receivable from the government.

-This cash reserve is significant, representing 40% of GSFC’s current market cap.

It’s important to note that this is an opinion, and it’s important to conduct your research and analysis before making any investment decisions. The impact of the new policy on the performance of GSFC and other Gujarat-based PSUs will depend on various factors, such as the implementation of the policy, market conditions, and other macroeconomic factors.

Fundamentals:

- Market Cap ₹ 6,334 Cr.

- Current Price ₹ 159

- High / Low ₹ 180 / 115

- Stock P/E 4.71

- Industry PE 10.7

- Book Value ₹ 293

- Dividend Yield 1.57 %

- Face Value₹ 2.00

- Return over 1year– 7.37 %

- Price to book value 0.54

- Promoter holding 37.8 %

- FII holding 21.4 %

- Public holding 33.0 %

- DII holding 2.14 %

Fundamentals:

- ROCE 12.6 %

- ROE 8.54 %

- OPM 15.5 %

- Qtr Profit Var 73.6 %

- Qtr Sales Var 33.3 %

Here are some potential risks to consider when investing in GSFC:

Dependence on the fertilizer industry:

-GSFC primarily operates in the fertilizer industry, which is cyclical and highly dependent on commodity prices.

-Fluctuations in raw material prices, demand, and supply can impact the performance of the industry and the company.

Competition:

-The fertilizer industry is highly competitive, with several players operating in the market.

-GSFC competes with both domestic and international players, which could impact its market share and profitability.

Regulatory risks:

-As a fertilizer manufacturer, GSFC is subject to various regulations and policies governing the industry.

-Changes in regulations, government policies, and subsidy schemes could impact the company’s performance and financials.

Political risks:

-Any changes in the political landscape, policies, or leadership could impact the company’s operations and financials.

Operational risks:

-As a manufacturing company, GSFC is exposed to various operational risks such as plant shutdowns, equipment failures, and supply chain disruptions.

-These risks could impact the company’s production, sales, and financials.

It’s important to note that these are potential risks and may not necessarily impact the company’s performance.

It’s important to conduct thorough research and analysis before making any investment decisions and consider the company’s financials, management, industry trends, and other relevant factors.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments