“Industry Experts Predict Value Creation for Gujarat PSUs through New Policy-Here is Why”

The recent surge in the stock prices of public sector undertakings (PSUs) in Gujarat has caught the attention of investors and analysts alike.

Last week, shares of these PSUs have seen a rise of up to 30% on the exchange.

Reports suggest that this surge is due to a new policy announced by the Gujarat state government, which requires a minimum level of dividend distribution and bonus shares to shareholders of listed companies and PSUs in the state.

This policy is viewed by investors as a positive move that will benefit both the companies and their shareholders.

While it remains to be seen whether this surge will continue in the coming weeks, the policy announcement has created a lot of optimism among investors.

Let’s understand,

What is the New Policy?

How will it affect these PSUs? and

Why analysts are so bullish on this?

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Image from Business Standard

Image from Business Standard

The Bull move in the Stocks

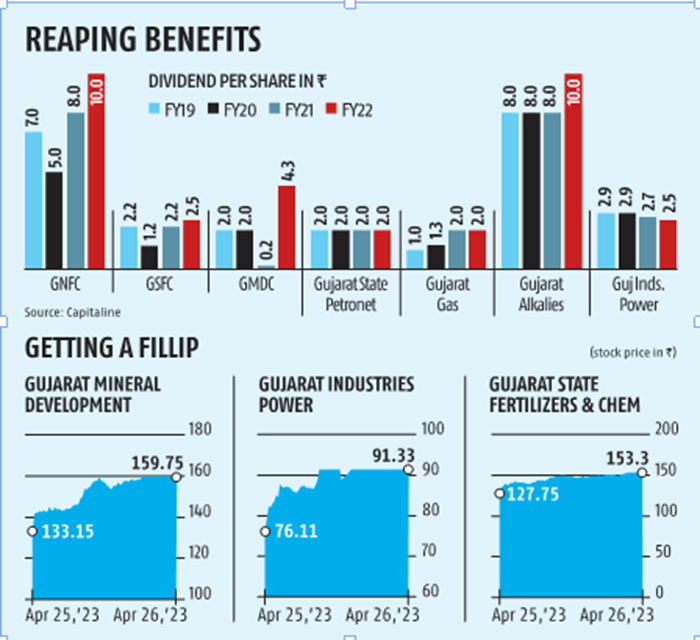

Gujarat State Fertilizers & Chemicals (GSFC) (Rs 159)

-30% Up

Gujarat Industries Power Company (GIPCL) (Rs 93)

– 23% Up

Gujarat Mineral Development Corporation (GMDC) (Rs 159.75)

– 20% Up

Gujarat Narmada Valley Fertilizers & Chemicals (GNFC)(Rs 587)

-12% Up

Gujarat Alkalies & Chemicals (GACL) (Rs 685)

-10% Up

Gujarat State Petronet (GSPL) (Rs 285)

-10% Up

New Policy to Increase Shareholder Value

-The Gujarat state government has announced a new policy that mandates state-run PSUs to issue dividends and bonus shares.

-The policy also sets guidelines for when to go in for stock split and share buybacks.

Minimum Dividend Mandated

-The new policy mandates that a minimum of 30% of profit after tax or 5% of net worth, whichever is higher, be declared as a minimum level of dividend for shareholders.

-However, it also stated that only the minimum level and maximum permissible level of dividend should be declared.

The Impact

Increased Dividend Payout: Gujarat PSUs that have not been paying high dividends in the past may now be required to increase their dividend payout to comply with the minimum dividend requirement.

-This could result in a higher payout for shareholders and potentially attract more investors.

Pressure on Profitability: While the mandate for a minimum dividend payout is aimed at benefiting shareholders, it may put pressure on the profitability of Gujarat PSUs.

-These PSUs may need to prioritize dividend payout over reinvestment in the business or debt reduction, which could impact their long-term growth prospects.

Market Perception: The mandated minimum dividend payout may lead to an improvement in the market perception of Gujarat PSUs, especially if they were previously not known for high dividend payouts.

-This could improve their attractiveness to investors and potentially result in higher stock prices.

Example:

In the financial year 2021-22 (FY22), only GNFC and Gujarat Alkalies paid a dividend of Rs 10 per share. GSFC, Gujarat State Petronet, Gujarat Gas, and Gujarat Industrial Power paid a small dividend of around Rs 2 per share.

However, if the new policy on minimum dividend mandate is implemented, These PSU may need to ensure compliance with the minimum dividend payout requirement. and pay higher dividends.

Overall, the impact of the minimum dividend mandate on Gujarat PSUs will depend on various factors such as the financial health of the PSU, the market conditions, and the regulatory environment.

While the mandate may benefit shareholders in the short term, it may also put pressure on the profitability and long-term growth prospects of the PSU.

Option to Buy Back Shares

PSUs having a net worth of at least Rs 2,000 crore and cash and bank balance of Rs 1,000 crore are mandated to exercise the option to buy back their own shares.

The Impact

Utilization of Surplus Funds: PSUs in Gujarat that meet the criteria for share buyback will be required to utilize their surplus funds to buy back their own shares. This can help them in reducing their cash balances and make better use of their funds.

Improved financial ratios: The buyback of shares can improve the financial ratios of the PSU, such as earnings per share (EPS), return on equity (ROE), and return on assets (ROA), as the buyback reduces the number of outstanding shares, which increases the earnings per share and return on equity.

Increase in Shareholder Value: A buyback of shares by PSUs can result in an increase in the value of the remaining shares held by shareholders. This can lead to an improvement in the overall shareholder value of the PSU.

The rule is aimed at promoting the efficient utilization of funds by PSUs and can potentially result in increased shareholder value.

Stock Split and Bonus Shares

The new policy suggests that PSU would be required to split shares when the market price or book value of the PSU exceeds 50 times its value, provided the existing face value of the PSU is more than Re 1. Meanwhile, state PSUs that declare reserves and surplus in excess of 10 times the paid-up share capital are required to issue bonus shares to their shareholders.

The Impact

Increased Liquidity: The split shares and bonus shares can increase the liquidity of the shares of the PSU as the increased number of shares can be more easily bought and sold in the market.

Improved Accessibility: The lower market price of the shares after the stock split can make them more accessible to small investors who may have previously been unable to buy the shares due to their high price.

Improved Market Perception: The issuance of bonus shares can improve the market perception of the PSU as it indicates that the company is in a strong financial position and is able to reward its shareholders.

Example:

Here are some examples of Gujarat PSUs that may be impacted by the new policy on stock splits and bonus shares:

Gujarat State Fertilizers and Chemicals Limited (GSFC): GSFC is a Gujarat PSU that manufactures fertilizers and chemicals. The market price of GSFC shares has been consistently above Rs 100, which is 50 times its face value of Re 2. Hence, if the policy is implemented, GSFC may be required to split its shares to improve liquidity and accessibility.

Gujarat Gas Limited: Gujarat Gas Limited is a Gujarat PSU that distributes natural gas. The company’s reserves and surplus as of March 2022 were over 12 times its paid-up share capital. Hence, if the policy is implemented, Gujarat Gas may be required to issue bonus shares to its shareholders.

Overall, the impact of the stock split and bonus share requirements on Gujarat PSUs will depend on various factors such as the financial health of the PSU, the market conditions, and the regulatory environment.

While the requirements can improve liquidity and accessibility, and improve the market perception of the PSU, they can also put pressure on the financial position of the company if it is not in a strong position to issue bonus shares or split shares.

Analysts’ Views:

Though the new policy may appear to be milking companies for dividends, analysts believe it will eventually create shareholder value and improve the sentiment of these stocks at the bourses.

Since these companies may not have immediate aggressive capital expenditure plans, the cash in their books can be put to good use, generating wealth for investors, including the government.

Overall, it is a positive step that will keep the interest of investors alive in these companies.

However, analysts believe that this move will go a long way in creating value for all stakeholders.

“Most of these companies produce fertilizers and chemicals, and they may not have any immediate plans to spend money on new projects. This decision will allow these companies to use their saved money to create more wealth for the people who own part of the company, including the government. These companies are fundamentally strong and this decision is beneficial for both the companies and investors. It’s a win-win situation for everyone involved.”

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.