Tata Motors shares in focus -Here is Why?

The Indian automobile industry has been witnessing a surge in demand in recent times, with various manufacturers reporting strong sales numbers. One such player that has been making headlines is Tata Motors, a leading automobile manufacturer in India.

Tata Motors has been on an upward trajectory, with the stock price rising significantly over the past year.

Yesterday the stock witnessed a significant rise in line with the broader market rally, hitting a fresh 52-week high.

The company is expected to announce its Q4FY23 results soon, and investors are eagerly anticipating a strong performance with significant revenue growth and profitability.

In this blog post, we will delve deeper into Tata Motors’ recent performance, the factors driving its growth, and what investors can expect from the company in the near future with the Experts’ opinions technical as well as fundamental, and try to find the answer…

Can it breach the Rs 700 mark?

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

The Share Price History:

-Reached a 52-week high of Rs 494 on August 17, 2022

-but was unable to sustain its upward momentum.

-Made a 52-week low of Rs 366.05 on May 12, 2022.

-In 2023, the stock rebounded and found support above the Rs 400 level.

-Tata Motors stock rises 21.54% in a year and 28% in 2023

-The stock hits 52-week high amidst a broader market rally

-Stock gains 5.74% to reach Rs 502.30

-Total 18.14 lakh shares traded, turnover of Rs 89.40 crore

The Fundamentals:

History

-Tata Motors was founded in 1945 as a manufacturer of locomotives and

-later expanded into commercial vehicles.

-In 2008, Tata Motors made a landmark acquisition by buying British car brands Jaguar and Land Rover.

Business Model

Tata Motors’ business model can be described as

– a vertically integrated approach,

-where the company controls various stages of the production process,

-from design and engineering to manufacturing and distribution.

Here are some key elements of the company’s business model:

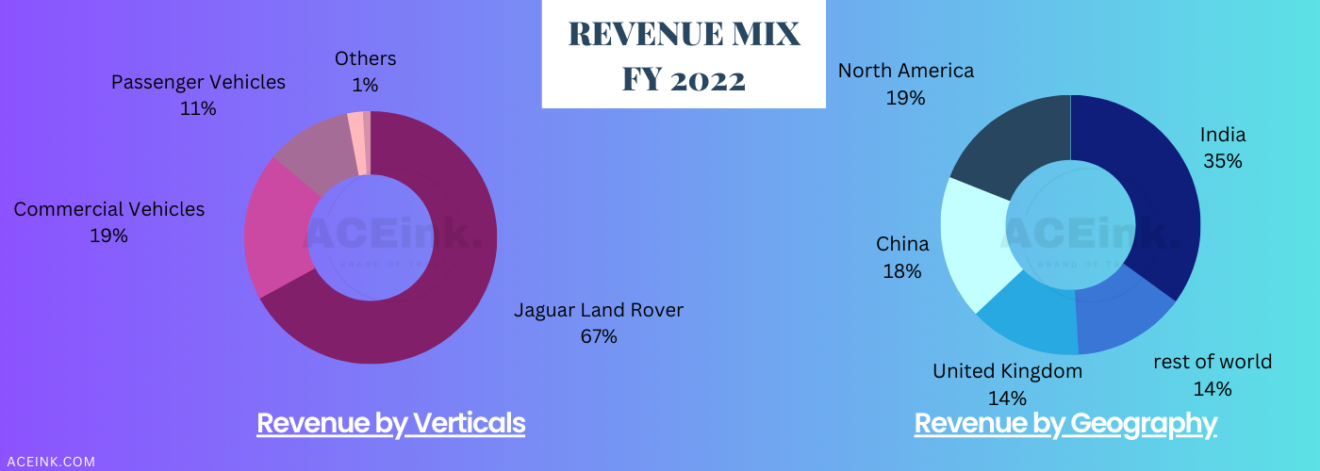

Diversified Product Portfolio:

-Tata Motors produces a diverse range of vehicles, including passenger cars, commercial vehicles, and electric vehicles.

-This allows the company to cater to different segments of the market and reduces its dependence on any particular product category.

Focus on R&D:

The company has established several R&D centers around the world, including in

-India,

-UK

-South Korea

Manufacturing and Distribution:

Tata Motors has a strong manufacturing presence in

-India,

-South Africa,

-Thailand

-UK

The company also has a network of dealerships and service centers in over 175 countries, enabling it to reach a wide customer base.

Sustainability:

-Tata Motors has a strong focus on sustainability and has made significant investments in developing electric and hybrid vehicles.

-The company is also committed to reducing its carbon footprint through sustainable manufacturing practices and has set a goal to become a net-zero carbon company by 2050.

Partnerships:

-Tata Motors has entered into several partnerships to expand its capabilities and reach new markets.

-For example, the company has partnered with Coimbatore-based Jayem Automotives to launch performance versions of its models.

Acquisition:

-In 2008, Tata Motors acquired luxury car brand Jaguar Land Rover (JLR) from Ford Motor Company.

-The acquisition has allowed Tata Motors to enter the premium segment of the automotive market and to expand its global footprint.

Joint Ventures:

-Tata Motors has also entered into several joint ventures to expand its capabilities and reach new markets.

-For example, the company has a joint venture with Marcopolo, a Brazilian bus and coach manufacturer, to manufacture and market buses and coaches in India.

Technology Partnerships:

-Tata Motors has also entered into several technology partnerships to develop new products and technologies.

-For example, the company has partnered with German engineering firm Robert Bosch to develop diesel engine technology.

Strategic Alliances:

-Tata Motors has formed strategic alliances with other companies to expand its presence in new markets and to gain access to new technologies.

-For example, the company has a strategic alliance with Fiat Chrysler Automobiles to share engines and platforms.

Jaguar Land Rover (JLR) Performance:

Strong MLA Unit Deliveries:

-JLR has seen a significant improvement in deliveries of MLA units such as the Range Rover and Range Rover Sport.

-This has contributed to strong performance in the luxury car segment.

Slight Retail Volume Decline:

-While retail volumes saw a slight decline, deliveries on the Defender improved, and the Range Rover held up well.

-JLR has been able to maintain its position in the market with a diversified product portfolio.

Steady Wholesale Volume Improvement:

-Wholesale volumes have been steadily improving, and JLR expects this trend to continue in the coming quarters.

-Tata Motors is investing in securing chip supplies and ramping up production of the Range Rover and Range Rover Sport to meet demand.

Tata Motors’ Electric Vehicle Plans

Significant Growth in EV Sales:

-Tata Motors has achieved significant growth in the electric vehicle segment,

-with sales of over 50,000 EVs and strong profitability.

-The company has recently launched the Tiago EV and

-has a strong order book for other electric vehicles.

New EV Products Planned:

-Tata Motors plans to launch three new electric vehicle products in 2025, with the Tiago already launched.

-The company aims to increase the proportion of EVs in its fuel mix to 25-30%,

-with CNG accounting for a similar proportion and

-gasoline making up the rest with a high mix of flex-fuel.

-Diesel is expected to decrease below 5%.

Tata Motors’ Investment Plans

Investment in Battery Plants:

-Tata Motors is investing in battery plants for its EVs in India and Europe, with JLR and

-Tata Motors as anchor customers.

-This investment will help to ensure a reliable supply of batteries and

-support the growth of the EV segment.

Investment Spending:

-Tata Motors plans to spend around Rs. 6,000 crores on investments for the full year, with strong cash flows funding capex.

-The company is investing in new technologies and FMEs, which is translating into higher employee costs.

Focus on RDE Transition:

-Tata Motors is preparing for the RDE transition in April 2023 and plans to come up with value enhancements for customers.

-The company is committed to ensuring that its products meet all regulatory requirements and that its customers are satisfied with their purchases.

What is RDE Transition?

-RDE stands for Real Driving Emissions.

-The RDE regulation is a European Union (EU) initiative aimed at reducing vehicle emissions and improving air quality.

-The RDE test measures the actual emissions from vehicles while they are being driven on the road, as opposed to laboratory-based testing, which has been criticized for not providing an accurate reflection of real-world emissions.

Why is it important?

-Starting in April 2023, all new vehicles sold in the EU will be required to meet the RDE regulations.

-This means that car manufacturers, including Tata Motors and its subsidiary Jaguar Land Rover, will need to ensure that their vehicles meet the required emissions standards under real-world driving conditions.

-This is a significant challenge for the industry, but it is also an opportunity for companies like Tata Motors to demonstrate their commitment to sustainability and to offer customers more environmentally friendly vehicles.

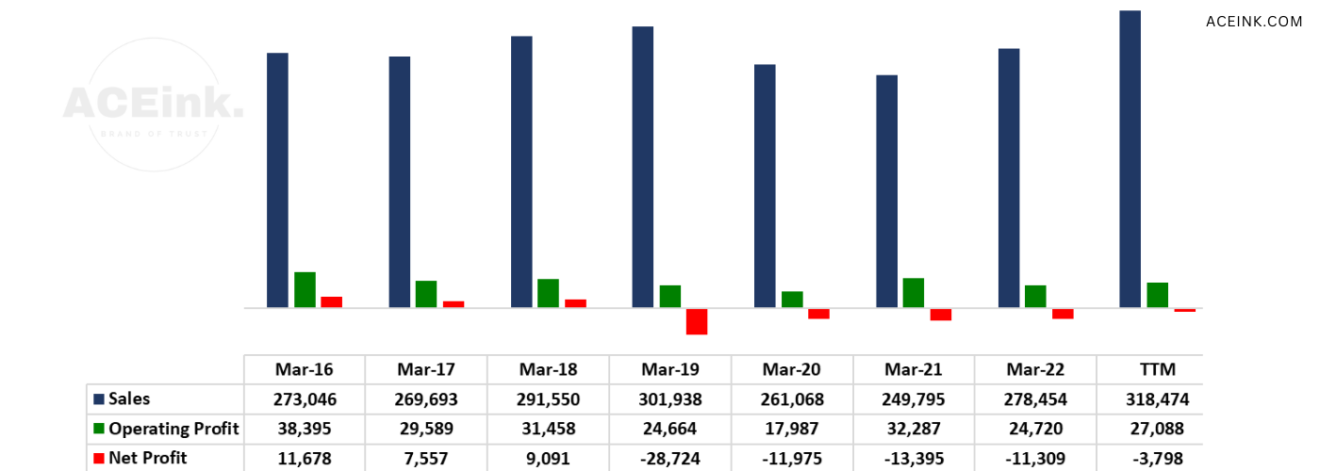

Industry Growth:

-The industry grew by around 16% over Q3 FY22 and Tata Motors is focused on maintaining its position in the market.

-The company is committed to meeting the needs of its customers and delivering high-quality products and services.

Specific risks that Tata Motors may face

Fluctuations in Demand:

Tata Motors may face fluctuations in demand for its vehicles due to changes in consumer preferences, economic conditions, and other factors. This could lead to overproduction, inventory buildup, and pricing pressures.

Competition:

Tata Motors faces intense competition from both domestic and international manufacturers in the automotive market. The company may struggle to compete on price, quality, and innovation.

Technological Disruptions:

The automotive industry is rapidly evolving, and Tata Motors may struggle to keep pace with technological advancements. This could lead to obsolescence of existing products, increased costs, and reduced competitiveness.

Supply Chain Disruptions:

Tata Motors relies on a complex supply chain to manufacture its vehicles. Any disruptions in the supply chain, such as natural disasters, political instability, or raw material shortages, could affect production and profitability.

Regulatory and Compliance Risks:

The automotive industry is subject to various regulations and compliance requirements related to safety, emissions, and other factors. Non-compliance with these regulations could result in fines, legal liabilities, and damage to the company’s reputation.

Currency and Exchange Rate Risks:

Tata Motors operates in multiple countries and is exposed to currency and exchange rate fluctuations. These fluctuations could impact the company’s profitability, cash flows, and financial performance.

Brand and Reputation Risks:

negative publicity or quality issues related to Tata Motors’ products could damage the company’s brand and reputation, leading to reduced demand and market share.

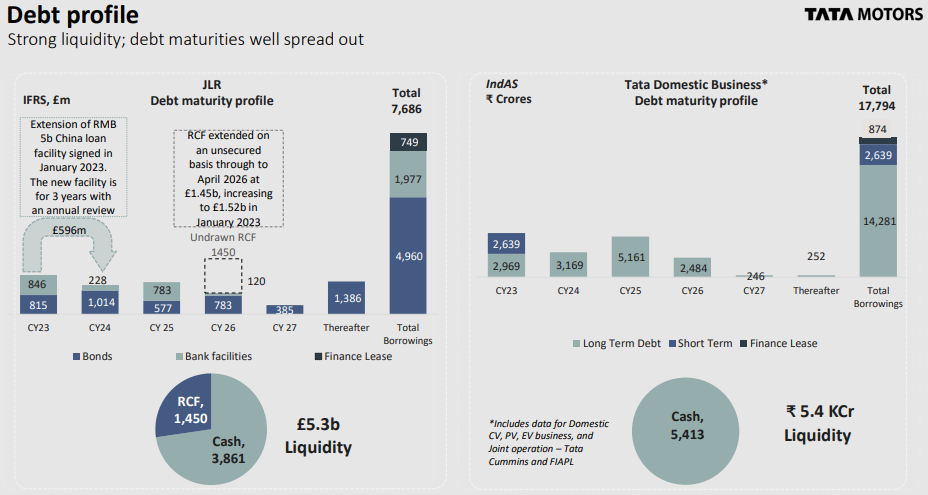

The Debt Profile:

Tata Motors’ debt profile remains a concern, given its high level of debt relative to equity, which indicates a high level of financial leverage. The company’s debt-to-equity ratio of 5.52 suggests that the company has a significant amount of debt that it will need to service, and this can lead to increased financial risk, particularly in times of economic downturns.

However, the positive net cash flow of ₹6,459 crore is encouraging as it indicates that the company is generating more cash than it’s spending on its operations and investments. This could help the company in meeting its financial obligations, including debt repayment.

Additionally, the significant cash flow from operating activities of ₹14,281 crore is also positive, as it indicates that the company’s core operations are generating significant cash flow. This can be a good sign as it shows that the company is able to generate cash flow from its primary business activities, which could help in reducing its reliance on external funding sources.

It’s worth noting that while positive cash flows are positive indicators, the company’s debt profile should also be assessed in the context of the industry and economic environment. Furthermore, the company’s ability to generate cash flow and service its debt obligations will depend on various factors such as management quality, competitive landscape, and future growth prospects.

Overall, while the positive cash flows from operating activities and net cash flow are encouraging, the high level of debt is still a concern, and investors should conduct thorough research and analysis before making any investment decisions.

Those interested in learning more about – How to analyze the Debt impact on the company and other financial topics may want to consider enrolling in one of the best Fundamental Analysis and Learning Courses.

Source Company Presentation

The Charts and The Technicals :

-The relative Strength Index (RSI) stands at 62.2, indicating neutral trading levels.

-The one-year beta of 1.3 signifies high volatility during the period.

-Stock trading above all major moving averages – 5 days, 20 days, 50 days, 100 days, and 200 days.

Inverse Head and Shoulder Pattern Indicates Potential for Tata Motors Stock

-Daily Chart Shows Tata Motors Trading Below Short-Term Averages, Above Long-Term Averages

Having Potential Target of Rs 500-600 in Next 2 Months.

-RSI Readings Point to Potential Rise of Tata Motors Stock to Rs 584 if Maintained Above Rs 535

Analyst Outlook:

Expected Rise in Revenue and EBITDA Margin by Experts

Tata Motors is likely to clock a 37 % rise in consolidated revenue led by

-a strong growth across JLR (+53%),

-CVs (+18 %) and

-PVs (+7 %),

-The company is also expected to see consolidated Earnings before interest, taxes, depreciation, and amortization (EBITDA) margin expand by 140 bps,

-led by higher production in JLR, and supported by a strong margin performance in CVs.

Vaishali Parekh, Vice President – Technical Research, Prabhudas Lilladher

-notes a breakout above Rs 450 with a symmetrical triangle breakout on the daily chart and small resistance near 515 levels.

-A closing above Rs 515 will take the stock to Rs 550-600 levels, with strong support at Rs 450 for the longer term.

Osho Krishan, Sr. Analyst – Technical & Derivative Research, Angel One

-observes a massive spurt in price volume and a breach of the previous swing high, indicating a bullish sentiment. However, the stock has entered an overbought region, suggesting a possibility of some cool-off.

-Immediate support lies around Rs 480, followed by sacrosanct support of the Rs 465 zone.

-The next leg of the rally could be triggered only by sustenance above the Rs 500-510 zone.

Vinit Bolinjkar, Head of Research, Ventura Securities

-expects Tata Motors to announce strong Q4FY23 results on May 12, 2023, with significant revenue growth and profitability

-due to better-than-expected sales volume growth in JLR, CV, and PV segments, along with price hikes implemented in Q3FY23 and a decline in input costs.

-The market has already factored in these positive developments, leading to a significant rally in the stock price.

-He also anticipates that the company’s GBP 15 bn capex plan for EVs will generate great excitement among investors during the Q4FY23 result conference call.

-has an FY26 price target of Rs 715 per share, which represents an upside potential of 43.3% from the current market price.

Board of Directors Meeting Scheduled

The board of directors of Tata Motors is scheduled to meet on May 12, 2023, to consider and approve audited financial results of the company (Standalone and Consolidated), for the quarter and fiscal year ended March 31, 2023.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.