Unleashing the Potential of PEG Ratio: Why it is better than PE Ratio in Long-Term Investing

When it comes to evaluating the potential of a stock, investors often look at a variety of financial ratios. Two of the most commonly used ratios are the price-to-earnings (P/E) ratio and the price-to-earnings growth (PEG) ratio.

The P/E ratio is a commonly used financial metric due to its simplicity and broad understanding.

However, it’s also one of the most overused and misused ratios, with many using it to justify valuations that don’t necessarily represent true value.

From investor presentations to research reports, the P/E ratio seems to be universal. But is this the best ratio to consider?

Let’s find out!

The P/E ratio is a simple metric that compares a company’s current stock price to its earnings per share (EPS). It can be useful for comparing the valuations of different companies in the same industry or sector.

Let me explain with an example:

Let’s say there are two companies in the same industry, Company A and Company B. Company A has a P/E ratio of 20, and Company B has a P/E ratio of 25. At first glance, it might seem like Company A is the better investment because it has a lower P/E ratio.

However, when you consider the companies’ growth prospects, things might look different. Company A has an expected earnings growth rate of 5% per year, while Company B has an expected earnings growth rate of 10% per year.

This is where the PEG ratio comes in. The PEG ratio is calculated by dividing a company’s P/E ratio by its expected earnings growth rate.

So, in the case of Company A, the PEG ratio would be 20 / 5 = 4

Meanwhile, Company B’s PEG ratio would be 25 / 10 = 2.5

In this scenario, Company B’s PEG ratio of 2.5 suggests that it may be a better investment than Company A, despite having a higher P/E ratio.

This is because Company B’s higher growth prospects make it more attractive to investors.

Which is better PE or PEG Ratio?

The answer is the PEG ratio.

This metric takes into account a company’s earnings growth rate, meaning that it makes more sense to pay a higher price for a stock with faster-growing earnings.

While the PEG ratio is a valuable tool, it’s important to note that it can be challenging to calculate accurately. The quality of earnings forecasts is essential, and changes in the macro environment can impact the accuracy of forecasts. However, despite these challenges, it’s still worth considering the PEG ratio when making long-term investment decisions.

The P/E ratio can also be problematic, as it can lead to selling wealth creators too early or buying them at a high price.

Additionally, by the time the P/E ratio adjusts to the newly announced EPS, it may be too late to make a sound investment decision. In industries such as commodities, the P/E ratio may be the least important factor to consider.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

What is a good PEG ratio?

A good PEG ratio is usually less than 1.0. If the PEG ratio is greater than 1.0, it means the stock may be overpriced, which is not good. However, if the PEG ratio is less than 1.0, it means the stock may be a good value because it is relatively cheaper compared to its earnings growth.

What should I consider in current markets?

Given the current market conditions, it’s crucial to be mindful that corrections may persist for some time. Although some stocks may appear appealing due to their low P/E ratios, it’s important to recognize that this does not automatically make them a worthwhile investment.

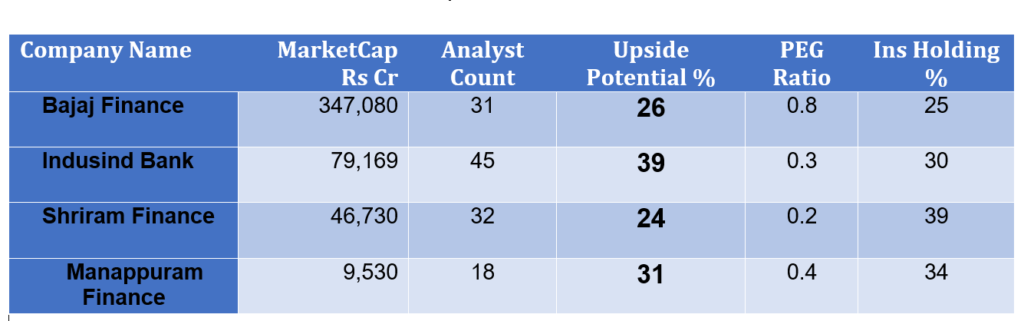

Based on this, ET has gathered the following four stocks from the financial sector from the latest Refinitiv Stock Plus reports.

Of course, it’s important to note that these ratios are just one tool for evaluating stocks, and they don’t provide a complete picture of a company’s financial health. It’s important to look at other factors as well, such as a company’s debt levels, management team, competitive advantages, and overall market conditions. A fundamentally strong stock should have all ticks.

——————–

This electric vehicle EV stock is on the rise to reach all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.