RBI’s Strict Action on Paytm Payments Bank: All You Need to Know

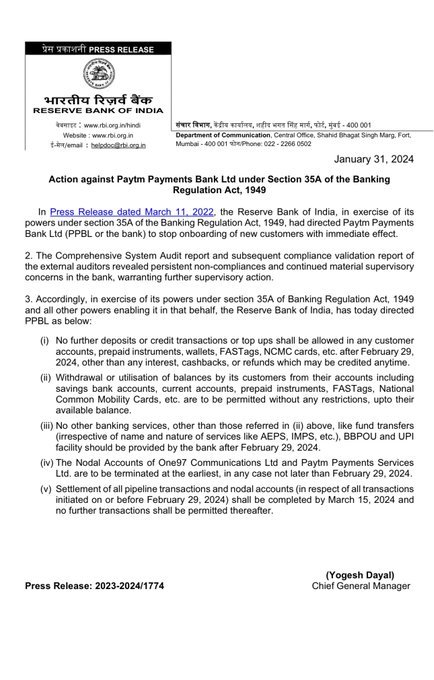

On January 31, 2024, the Reserve Bank of India (RBI) took an unprecedented step by imposing severe restrictions on Paytm Payments Bank (PPBL), effectively halting all its banking activities after February 29.

This move came after a detailed inspection revealed serious regulatory violations, leaving the bank’s future in jeopardy.

What is the issue? How will it affect the User? Can you use Fast tag?

Many questions…

Let’s dive into the details together!

Roots of the Crisis:

- Early Lapses (Strike One): PPBL faced its first regulatory strike within a year of its 2017 inception due to violations, including breaches of day-end balances and non-compliance with KYC guidelines.

- False Information Submission (Strike Two): In October 2021, the RBI found that PPBL submitted false information, resulting in a fine of ₹1 crore.

- Technological and Compliance Lapses (Strike Three): Investigations in 2021 uncovered lapses in technology, cybersecurity, and KYC-AML compliance. RBI imposed supervisory restrictions in March 2022, prompting the bank to stop onboarding new customers and undergo a comprehensive system audit.

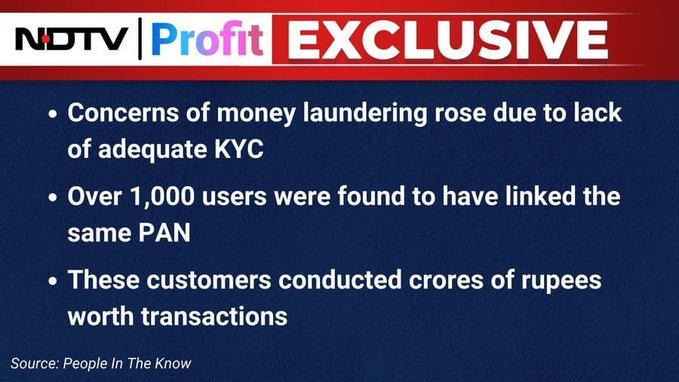

- Continued Non-Compliance (Strike Four): By October 2023, RBI imposed a ₹5.39 crore penalty for persistent non-compliance with KYC norms. Serious KYC-AML violations, digital frauds, and money laundering risks were identified.

Key Concerns:

- KYC Irregularities: Massive irregularities in KYC processes, including the absence of KYC for lakhs of customers and PAN validation failures.

- Inoperative Wallets: Out of 35 crore wallet accounts, 31 crore were found to be inoperative, raising concerns about the bank’s functionality.

- Financial Co-mingling: PPBL’s financial and non-financial businesses were co-mingled with its promoter group companies, violating licensing conditions and prompting concerns about data privacy.

- Transparency Issues: Lack of transparency from the promoters, including false compliance reports and undisclosed financial transactions with the parent entity, One97 Communications Limited.

Paytm’s Response:

In response to the RBI directive, Paytm acknowledged the concerns and emphasized its commitment to address the issues raised. The company urged reliance on official communications for accurate information.

Also Read: PSU Stocks Rally: What’s Fueling the Surge?

Important Information for Paytm Users:

Continuity for Paytm Users:

- UPI Payments: Your UPI payments will continue to work smoothly, ensuring uninterrupted transactions.

- Paytm Wallet: The Paytm Wallet remains fully functional, allowing you to use it for various transactions.

- Fastag Services: If you use Fastag for toll payments, rest assured, it will continue working without any disruption.

- Bookings: All your bookings, whether for travel, events, or any other services, will continue seamlessly.

- Paytm Gadgets: Your Paytm QR, Paytm Soundbox, Paytm Card Machine, and other Paytm gadgets will maintain their functionality.

Concerns Regarding Paytm Payments Bank:

Paytm Payments Bank, a service allowing you to open digital accounts and conduct banking activities, is facing supervisory issues according to the RBI. The regulatory authority has decided to halt the services starting from March 1, with February 29, 2024, being the last operational date.

Action Required for Paytm Payments Bank Users:

If you exclusively deal with Paytm Payments Bank, it is crucial to take action. Move your money and accounts to other banks to ensure the continued safety and accessibility of your funds.

Withdrawal Information:

The RBI has permitted the withdrawal of money from Paytm Payments Bank even after March 1, 2024. Users can access their funds and make necessary arrangements accordingly.

Future Implications:

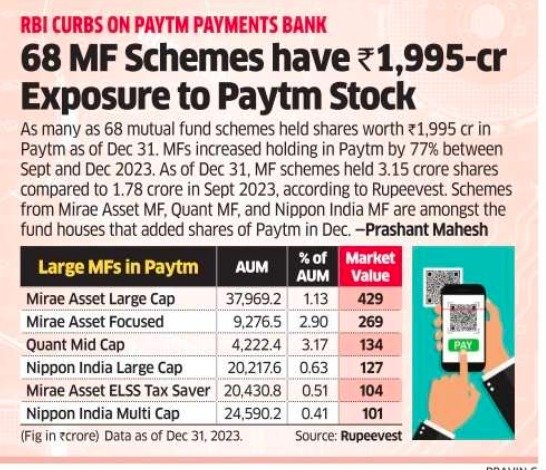

Industry experts suggest that the RBI’s action could lead to the revocation of PPBL’s banking license. Paytm’s other businesses may also face challenges, impacting its relationships with lending partners and potentially affecting its merchant base.

Paytm, once a celebrated player in India’s digital payment space, now faces a critical period. Founder Vijay Shekhar Sharma must navigate these challenges to determine the company’s future and its standing in India’s digital payments landscape. The unfolding events will shape the narrative of Paytm’s resurgence or decline.

While certain services are unaffected, Paytm Payments Bank users need to transition their accounts to alternative banks. Paytm is actively working to resolve this situation and ensure a smooth transition for its users.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————