ITC shares at Rs 525? What is the “Demerger Plan” ahead?

The recent success story of ITC on the stock market can be summarized by the quote,

“First they ignore you, then they laugh at you, then they fight you, then you win.”

This quote, often attributed to Mahatma Gandhi, encapsulates the journey of ITC’s stock on Dalal Street.

Initially, investors ignored ITC, It just became a meme stock in 2020. Later on, As the stock prices consolidated around Rs 200, bearish investors attempted to bring the stock down, but their efforts proved unsuccessful.

Despite the bearish calls, ITC shares have experienced a remarkable rally of 133% in the last two years, making it one of the best-performing stocks in the Nifty index.

However, as valuations of ITC shares have increased and dividend yields have fallen to around 3% at current market prices, some investors have started to express concerns.

Nevertheless, the bulls, or optimistic investors, have found another reason to remain confident in ITC.

Multiple reports suggest that the management of ITC, based in Kolkata and known for its diverse portfolio ranging from cigarettes to hotels, is planning to demerge its hotel business. The demerger could potentially be executed through alternate structures such as a real estate investment trust (REIT) or a joint venture (JV).

This development has given the bulls further reason to hold their ground and stay optimistic about ITC’s future prospects in the market. Let’s delve into the key details and correlations between these developments.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

The Demerger

ITC’s Chairman and Managing Director, Sanjiv Puri, has expressed the company’s intention to pursue the demerger of the hotel business. He highlighted the positive trajectory of the industry following the recovery from the Covid-19 pandemic. This demerger process is seen as a strategic step that may be followed by demergers of other businesses in the future.

The roadmap for ITC’s demerger aligns with its long-term vision of enhancing shareholder value and remaining competitive.

Demergers can have significant effects on companies and their share prices, including ITC. Here are some ways in which a demerger can impact ITC and its share price:

- Focused Business Operations: A demerger allows ITC to separate its hotel business from its other operations. This leads to more focused and streamlined business operations for each entity. As a result, the demerged hotel business can have greater autonomy to make strategic decisions specific to its industry, potentially driving growth and profitability.

- Unlocking Shareholder Value: Demergers often aim to unlock shareholder value by creating separate entities with distinct business models and growth prospects. By separating the hotel business, ITC can enhance the valuation of each segment based on its individual merits and market dynamics. This value unlocking potential can positively impact ITC’s share price as investors perceive the increased potential for growth and profitability in the demerged entities.

- Market Perception and Investor Interest: Demergers can attract the attention of investors and analysts, as they provide a clear picture of the separated businesses’ financials and growth prospects. A well-executed demerger strategy can generate excitement and renewed interest from the investment community, potentially leading to increased demand for ITC’s shares and a positive impact on its share price.

- Improved Financial Reporting and Transparency: Demergers often result in improved financial reporting and transparency for the demerged entities. With separate financial statements and disclosures, investors can have better visibility into the performance of each business segment. This increased transparency can enhance investor confidence, which may contribute to a positive perception of ITC and potentially drive its share price higher.

- Strategic Realignment and Flexibility: Demergers provide companies with the opportunity to realign their strategies and adapt to changing market dynamics. For ITC, the demerger of the hotel business allows the company to focus on its core operations and explore growth opportunities in its remaining businesses, such as FMCG and agri-business. This strategic realignment can be viewed positively by investors and reflect in the company’s share price.

It’s important to note that the impact of a demerger on ITC’s share price will depend on various factors, including the successful execution of the demerger process, market conditions, investor sentiment, and the performance of the demerged entities.

Related Read: Will the Nifty Reach 21,000?

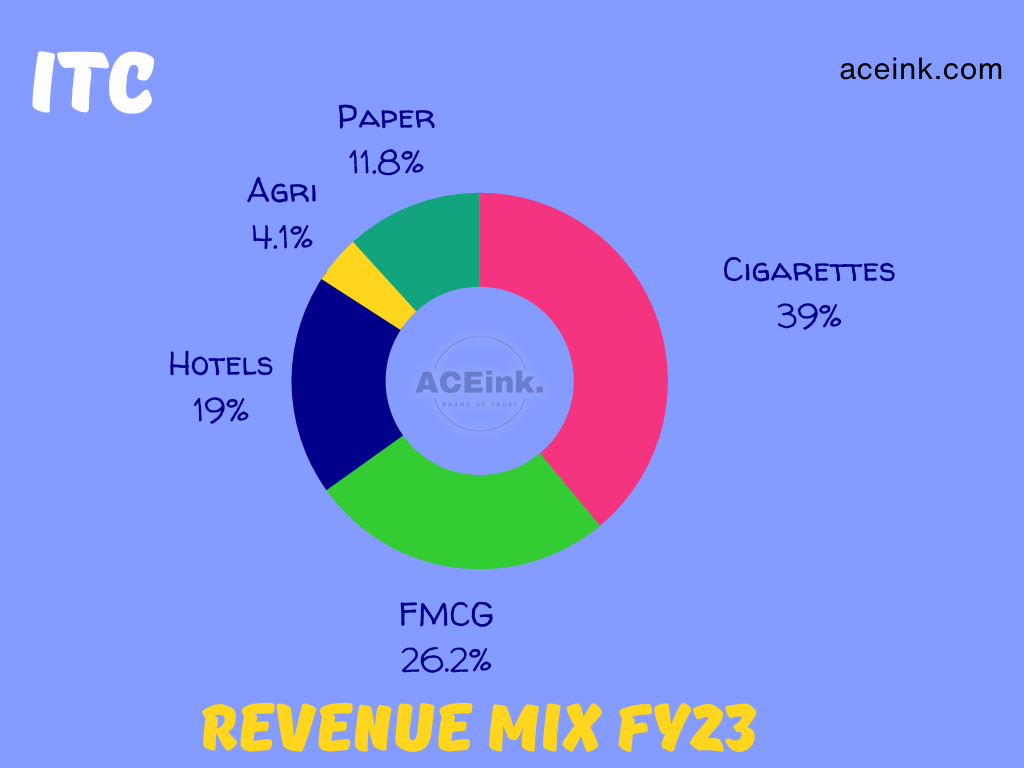

Key Highlights for FY23:

Strong Growth in FMCG – Others Segment:

-The FMCG – Others segment witnessed robust growth, with revenue increasing by 19.6% YoY, reaching approximately 1.5 times the revenue of FY20.

-The segment’s EBITDA (earnings before interest, taxes, depreciation, and amortization) increased by 34.9% YoY,

-The EBITDA margin improved by 115 basis points (bps) YoY despite severe inflationary pressures.

Volume Recovery in Cigarettes:

-The cigarette segment experienced sustained volume recovery due to deterrent actions taken by enforcement agencies against illicit trade and relatively stable tax conditions.

-Segment revenue increased by 20.3% YoY, and segment PBIT (profit before interest and taxes) rose by 20.6% YoY.

Stellar Performance in Hotels:

-The hotel segment delivered an outstanding performance, with segment revenue reaching twice the levels of the previous year and approximately 1.4 times the revenue of FY20.

-Revenue per available room (RevPAR) surpassed pre-pandemic levels.

-The segment’s EBITDA stood at 832 crore, nearly double that of FY20, with an EBITDA margin of 32.2%, marking an increase of 930 bps over FY20.

Robust Growth in Agri-Business:

-The agribusiness segment exhibited robust growth, with segment revenue increasing by 12.2% YoY (19.7% YoY excluding wheat exports).

-The segment’s PBIT grew by 28.8% YoY. Margin expansion was driven by leaf tobacco exports and the value-added agri products portfolio.

-However, restrictions on wheat and rice exports impacted segment revenue.

Strong Performance in Paperboards, Paper & Packaging:

-The paperboards, paper, and packaging segment reported strong performance, with segment revenue increasing by 18.8% YoY and segment PBIT growing by 34.9% YoY.

-The performance was driven by strategic interventions such as in-house pulp manufacturing, proactive capacity expansion in value-added products, digital initiatives, and higher realizations.

Related Read: These Stocks to Give Dividend this Week Upto Rs 180

ITC’s Potential Triggers and Positive Outlook for Stock Growth

Asset Right Model in Hotel Business:

ITC has successfully implemented an asset right model in its hotel business, capitalizing on the return of travel activities to pre-Covid levels.

FMCG Categories Generating Positive Cash Flow:

ITC’s FMCG categories are generating positive free cash flow, reducing the company’s dependence on the cigarette business for growth capital.

Potential Demerger as a Catalyst:

The demerger of ITC’s FMCG, hotel, or IT business is seen as a significant trigger for the stock, potentially driving further growth and value creation.

Revenue Outlook:

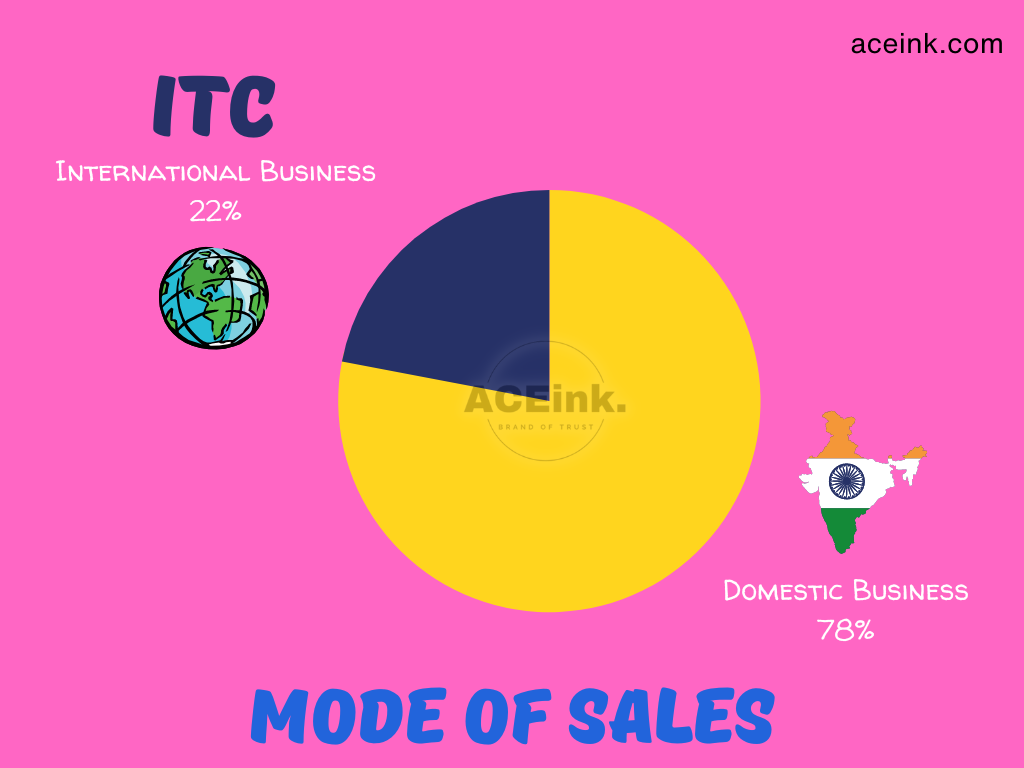

In the June quarter, ITC is expected to report a 6% decline in revenue primarily due to a drop in the agribusiness on a high base.

Growth Expectations: Despite the revenue decline,

-ITC’s cigarette business is anticipated to grow by 9% driven by volume growth,

-while the FMCG and hotels business are expected to report a 15% growth.

-The paper business is likely to see flat revenue due to a high base.

Improved Profitability:

ITC’s overall profitability is expected to improve, driven by a favorable cigarette mix, recovery in the hotels business, and operating leverage in FMCG.

The positive growth outlook for ITC is further reinforced by its ability to adapt to industry dynamics. Rational tax hikes in the cigarette business, innovative formats to connect with the youth, fortified portfolio driving legal volumes, and an improving sales mix are factors expected to contribute to high-single-digit EBIT growth.

Related Read: Can ITC shares reach Rs 1000 Levels?

Analysts Take

-Global brokerage firm Jefferies has a bullish stance on ITC, predicting a potential rally in the stock up to Rs 520.

This valuation is based on various factors, including earnings projections and sales multiples for different businesses.

– Antique Stock Broking estimates a 14% YoY growth in EBITDA and a 16% YoY growth in PAT for ITC, further supporting the positive outlook for the company.

Overall, ITC’s strategic moves, positive cash flow generation, potential demerger, and optimistic projections from brokerage firms indicate a positive outlook for the company’s stock growth in the near future.

-According to Mahesh Prakot of Bonanza Portfolio, the price has been trading just above the high volume zone, which acts as immediate support. However, the Stochastic indicator suggests the stock is overbought, indicating the possibility of profit booking in the near term.

He suggests a buy-on-dip strategy around Rs 460-463 with a target price of Rs 520.

-Gaurav Bissa of InCred Equities highlights that the stock recently witnessed a swing breakout around Rs 460 levels. He suggests that if the stock experiences a retracement, the bounce from the 21-day Exponential Moving Average (EMA) at Rs 450 can be considered a buying opportunity.

The immediate hurdle for the stock is at Rs 480-482.

-Vikas Jain of Reliance Securities has a hold rating on ITC and sets a higher target of Rs 510-520, which aligns with the monthly pivot level.

-Emkay Global sees further upside potential for the FMCG giant even after recently hitting record levels. The domestic brokerage has a target of Rs 525 on the stock as it sees “firm structural prospects”.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this stock has the growth Potential?” In today’s world, the need for sustainable energy solutions has never…..Read More