21 Apr Why many brokers are giving ‘BUY’ call on L&T ?

Why Over 30 Analysts Are Recommending This Top Large-Cap Stock

Investing in stocks can be a daunting task, especially in these uncertain times. However, for those with a one-year investment horizon, the construction infrastructure space offers promising opportunities.

With a focus on the domestic market, companies in this sector are poised to benefit from the Government of India’s capital expenditure plan announced in the budget.

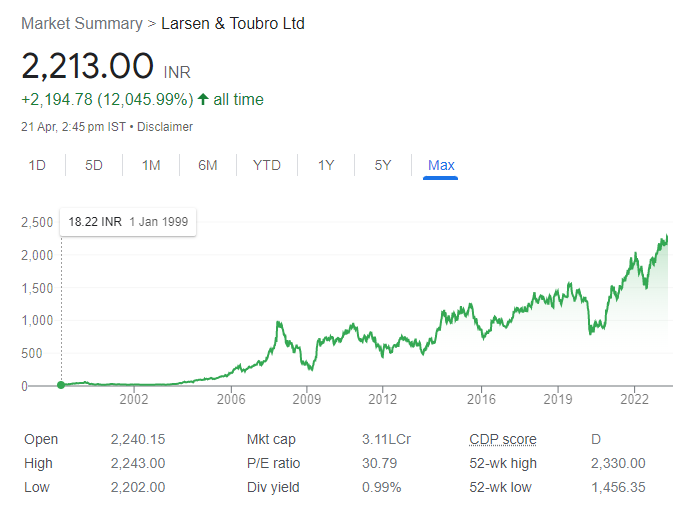

Leading the pack is Larsen & Toubro, whose recent efforts to streamline operations and improve return ratios make it an attractive investment option.

Despite recent corrections in the market, the company’s future looks bright. With execution improving, experts anticipate the stock to trade at significantly higher levels. So, for investors willing to take a chance, buying L&T shares at current levels could yield profitable returns in the next year.

-The company has taken significant steps to improve its performance by divesting unrelated diversifications and focusing on mainstream assets, while also managing its working capital more effectively.

-As a result, its return ratios have seen a notable improvement.

-With its execution capabilities improving, analysts anticipate the stock to trade at substantially higher levels.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Jefferies India maintains ‘Buy’ call on L&T: Current Price₹ 2,215

Target Price of Rs 2,650

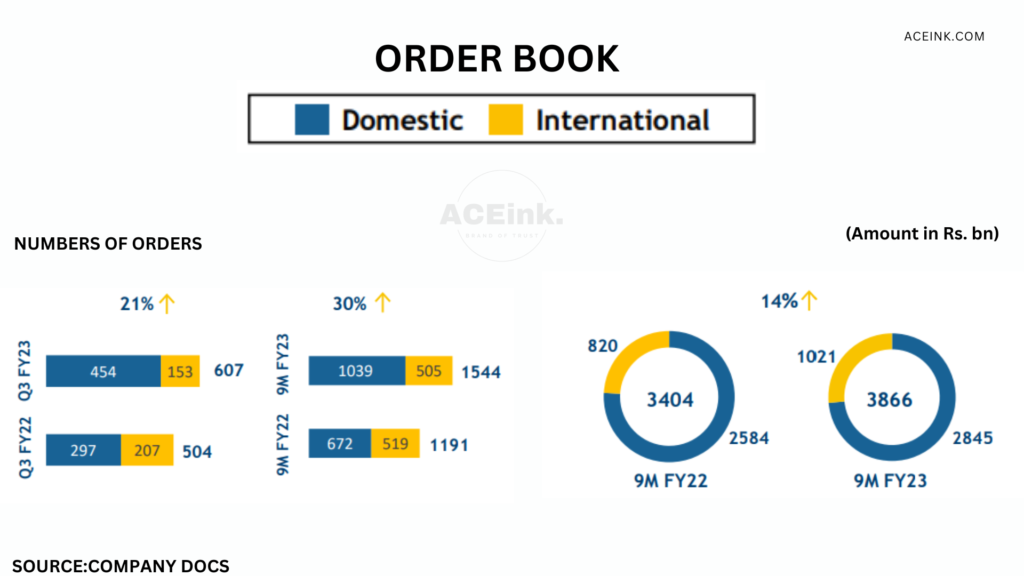

-Jefferies notes that despite concerns over the pre-election impact on L&T’s order flow and share price, historical data shows otherwise.

-In the last three pre-election-year periods, L&T’s order inflow has grown by double digits, despite the embargo on the center’s ordering activity six months before the elections.

-During these years, domestic orders accounted for the majority of the total orders, while overseas orders saw an increase in two out of the three periods.

Macquarie maintains an ‘Outperform’ rating on L&T:

Target Price of Rs 2,540

– The firm is bullish on L&T’s defense orders, with the recent selection of L&T to build the Zorawar Light Tank for the Indian Army.

-Additionally, Macquarie notes that L&T’s order inflow is expected to be driven by defense, domestic infrastructure, and international hydrocarbon projects.

-However, the brokerage house acknowledges that the weak performance of L&T’s IT subsidiaries in the near term could weigh on the company’s share price performance.

Sharekhan has also recommended buying shares of L&T:

Target Price Rs 2,600

According to Sharekhan, L&T, the engineering conglomerate,

-by virtue of its leadership and commendable execution track record in the engineering, procurement, and construction (EPC) domain will benefit from capital expenditure upcycle in both public and private sectors.

The Company – Larson and Toubro (L&T)

Introduction

Larson and Toubro (L&T) is a multinational conglomerate based in Mumbai, India.

The company was founded in 1938 and has a significant presence in India and globally.

Operations

L&T operates in various sectors such as engineering, construction, technology, manufacturing, and financial services.

The company has operations in over 30 countries and is considered as one of the largest engineering and construction companies in India.

L&T has been involved in the construction of several iconic infrastructure projects such as airports, highways, bridges, and power plants.

Diversified Business:

Engineering & Construction (E&C): This segment comprises L&T’s core business and contributes the majority of the company’s revenue.

It includes engineering, procurement, and construction (EPC) of infrastructure projects, such as

-buildings,

-airports,

-metro rail systems,

-power plants, and

-oil and gas projects.

Electrical & Automation (E&A): This segment provides solutions for the electrical, automation, and control requirements of various industries, including

-power generation,

-transmission, and distribution, as well as

-manufacturing,

-construction, and

-mining.

Heavy Engineering (HE): This segment focuses on manufacturing and supplying critical equipment and components for various industries, such as

-defense,

-aerospace,

-nuclear power, and

-the refinery.

Information Technology and Technology Services (IT & TS): This segment provides software development, maintenance, and support services to various clients across industries, such as

-banking and financial services,

-retail, and

-manufacturing.

Financial Services (FS): This segment includes L&T Finance Holdings Limited, which offers a range of financial products and services, such as

-retail and corporate lending,

-wealth management, and

-insurance.

Developmental Projects (DP): This segment focuses on developing infrastructure projects through public-private partnerships (PPP), such as

-airports,

-ports, and

-industrial parks

The Fundamentals – Larson and Toubro (L&T) :

- Market Cap₹ 3,11,279 Cr.

- Stock P/E 30

- Industry PE 22

- PEG Ratio 4.66

- ROCE 11.0 %

- ROE 10.2 %

- OPM 13.2 %

- Debt ₹ 1,29,071 Cr.

- Debt to equity 1.58

- Qtr Profit Var 20.9 %

- Qtr Sales Var 1 7.3 %

- Promoter holding 0.00 %

- DII holding 38.6 %

- FII holding 24.5 %

- Public holding 36.6 %

The Big Fat Order:

The recent Rs 3,100-crore contract signed between L&T and the Ministry of Defence for the procurement of three cadet training ships is likely to have a positive impact on the company’s sentiments and business prospects. Here are some possible reasons:

New Business Opportunities: The contract provides L&T with an opportunity to expand its presence in the defense sector and tap into the growing demand for naval vessels. This could lead to additional contracts and business opportunities in the future.

Diversification: The contract also allows L&T to diversify its business portfolio by adding a new product line, which could contribute to the company’s revenue and profitability.

Increased Visibility: The contract reinforces L&T’s position as a trusted partner for the Indian Navy and could lead to more opportunities in the defense sector. This could also improve the company’s visibility and reputation among potential clients and investors.

Positive Sentiments: The news of the contract signing could create positive sentiments among investors and analysts, leading to a potential increase in the company’s stock price.

Overall, the contract signing between L&T and the Ministry of Defence is likely to have a positive impact on the company’s sentiments and business prospects, providing opportunities for growth and diversification in the defense sector

Like any investment, investing in Larsen & Toubro Limited (L&T) carries certain risks. Here are some potential risks to consider before investing in L&T:

Economic risk: L&T’s business is heavily dependent on economic conditions in India and other countries where it operates. Any downturn in the economy or a slowdown in infrastructure spending could negatively impact the company’s revenue and profitability.

Project execution risk: L&T’s E&C segment involves executing large-scale projects that can be subject to delays and cost overruns. These risks can impact the company’s financial performance and lead to a decline in investor confidence.

Regulatory risk: L&T operates in a highly regulated industry, and any changes in regulations or government policies could impact the company’s operations and financial performance.

Competitive risk: L&T faces competition from domestic and international players in various segments, and any loss of market share could impact the company’s financial performance.

Foreign exchange risk: L&T generates a significant portion of its revenue from international operations, which exposes it to fluctuations in foreign exchange rates. Any adverse movements in foreign exchange rates could impact the company’s financial performance.

For example, in 2020, L&T’s revenue was impacted due to the COVID-19 pandemic, which led to project delays and disruption in the supply chain. Additionally, the company faced challenges in the power sector, which impacted the E&A segment’s revenue. These factors led to a decline in the company’s stock price, which highlights the potential risks of investing in L&T.

However, the company has a strong track record of navigating through challenging times and has taken steps to diversify its business portfolio to mitigate these risks.

Overall, L&T has a strong presence in India and overseas markets, and its diverse business portfolio provides a stable revenue stream. The company has a strong focus on innovation and technology, which has helped it stay ahead of the competition. However, the company operates in a highly competitive market, and its performance is closely linked to the overall economic conditions in India and other countries where it operates.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments