09 Apr “Simplifying Bank Analysis: Why Analysts are Bullish on this Bank Stock’s Fundamentals

“Investing in Banking Stocks: Risks, Rewards, and Everything in Between”

Investing in stocks can be a great way to grow your wealth over time. However, it’s important to choose the right stocks to invest in, which requires careful research and analysis.

One sector that has always been popular among investors is the banking industry. Banking stocks can offer excellent returns, especially in a growing economy like India.

One bank that has recently been gaining the attention of analysts is CSB Bank. With many analysts giving buy calls on the bank, investors are starting to take notice.

In this blog, we will explore the basics of banking stock investing, including how to evaluate a bank’s financials, what to look for in a strong banking stock, and the reasons why many analysts are bullish on CSB Bank.

Whether you’re a seasoned investor or just starting, read on to discover everything you need to know about investing in banking stocks, including the potential rewards and risks involved.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Company Info:

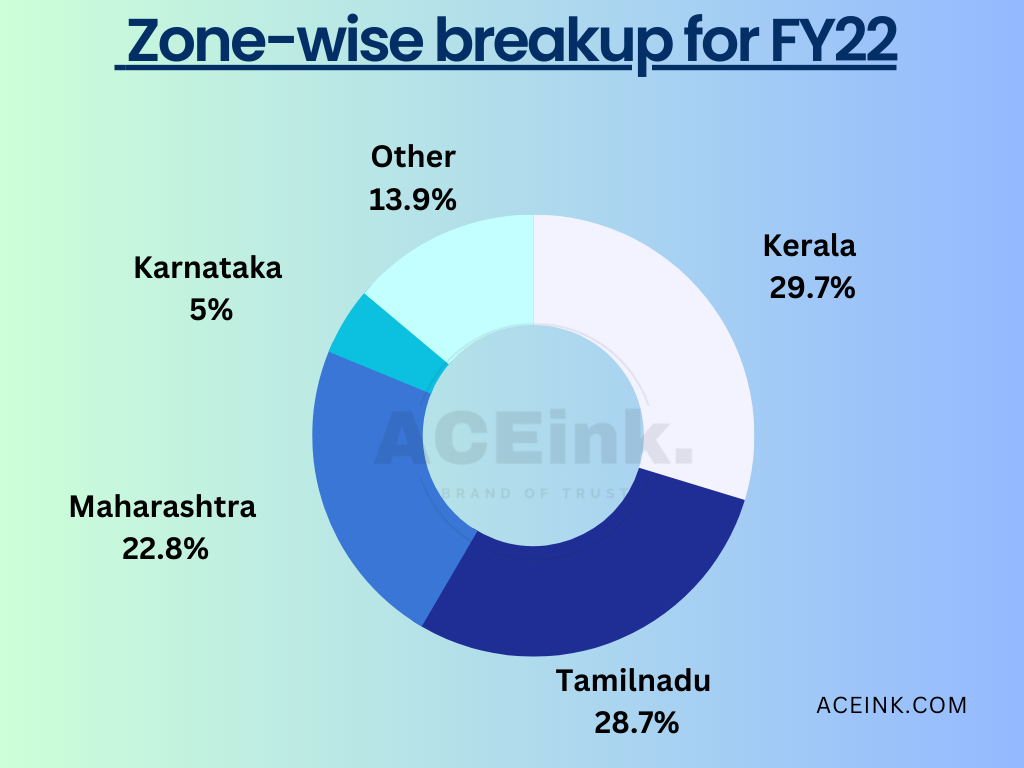

CSB Bank Ltd is a private sector bank in India that was formerly known as Catholic Syrian Bank. The bank was founded in 1920 and has its headquarters in Thrissur, Kerala, India.

CSB Bank is known for its customer-centric approach and innovative banking solutions. It has won several awards and recognitions for its banking services and has been rated as one of the top banks in India in terms of customer satisfaction. It is one of the oldest private-sector banks in the country and has a

-Strong presence in South India, with over 400 branches and more than 250 ATMs across the region.

-Offers a range of financial products and services, including savings accounts, current accounts, fixed deposits, loans, credit cards, and insurance.

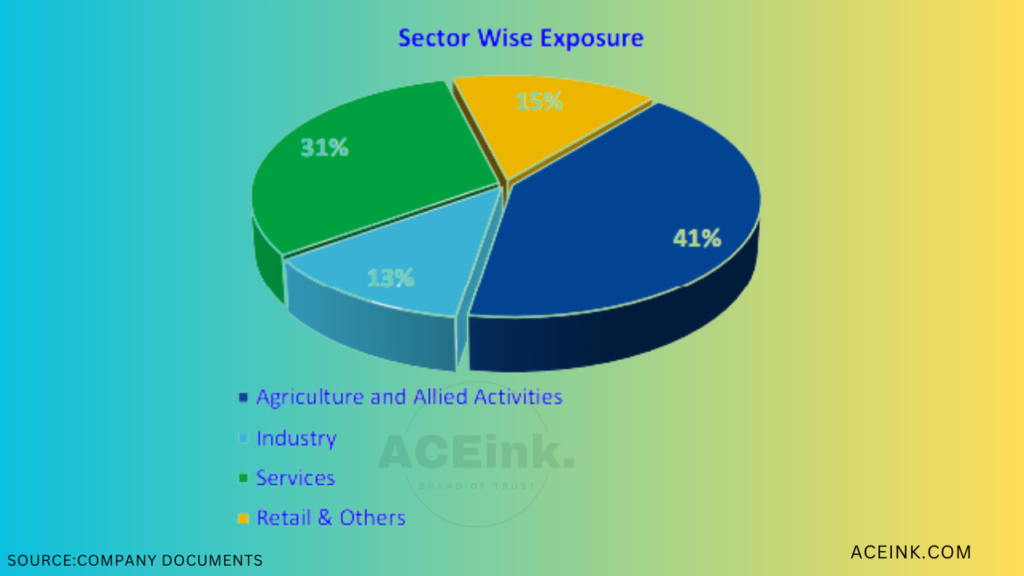

-Focuses on SME and MSME lending and has a strong customer-centric approach.

-Strong network of business correspondents and digital kiosks, which enables it to reach customers in remote and underserved areas.

Focus on Niche Segments:

CSB Bank has a focus on niche segments of the market, such as small and medium-sized enterprises (SME) and retail customers. By catering to these niche segments, the bank has been able to differentiate itself from larger competitors and build a loyal customer base. The bank has been leveraging its customer-centric approach and technology investments to offer tailored solutions to its niche segments, which has helped it stay competitive in the market.

Asset Quality:

The quality of a bank’s assets is an important indicator of its financial stability. Investors should analyze the bank’s gross non-performing assets (GNPAs), net non-performing assets (NNPAs), and provision coverage ratio (PCR) to assess its asset quality. CSB Bank has been maintaining a healthy asset quality with a GNPAs ratio of 1.45%, an NNPAs ratio of 0.42%, and a PCR of 91.93% as of now.

The asset quality of the bank has improved significantly over the last 1 year and it is expected the trend of strong recoveries and upgrades to continue.

Capital Adequacy:

Capital adequacy is an important metric that indicates a bank’s ability to absorb losses and maintain solvency. Investors should analyze the bank’s capital adequacy ratio (CAR) to assess its capital position. CSB Bank has been maintaining a healthy CAR of 25.78% as of Dec 2022, well above the regulatory requirement of 11.5%.

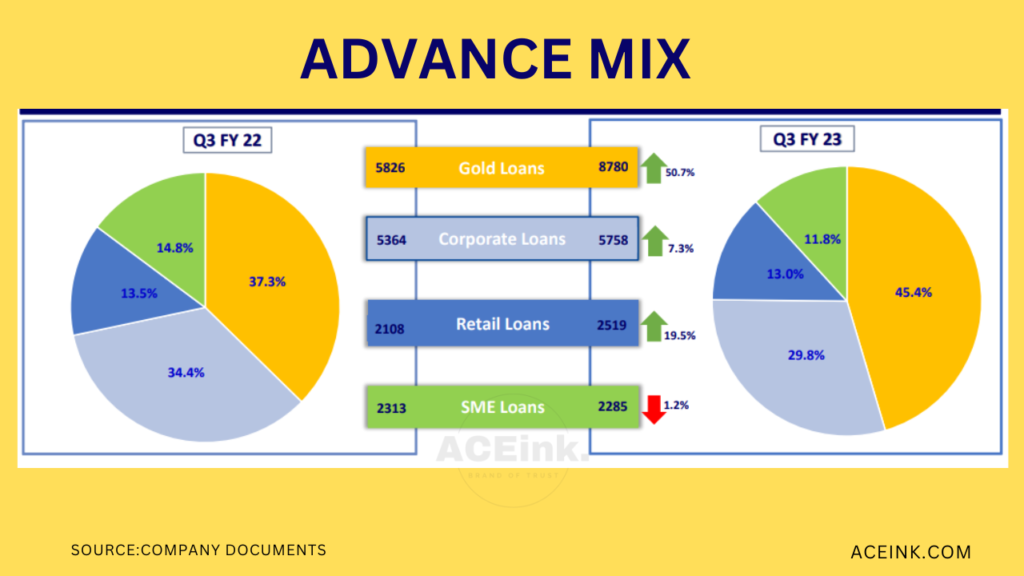

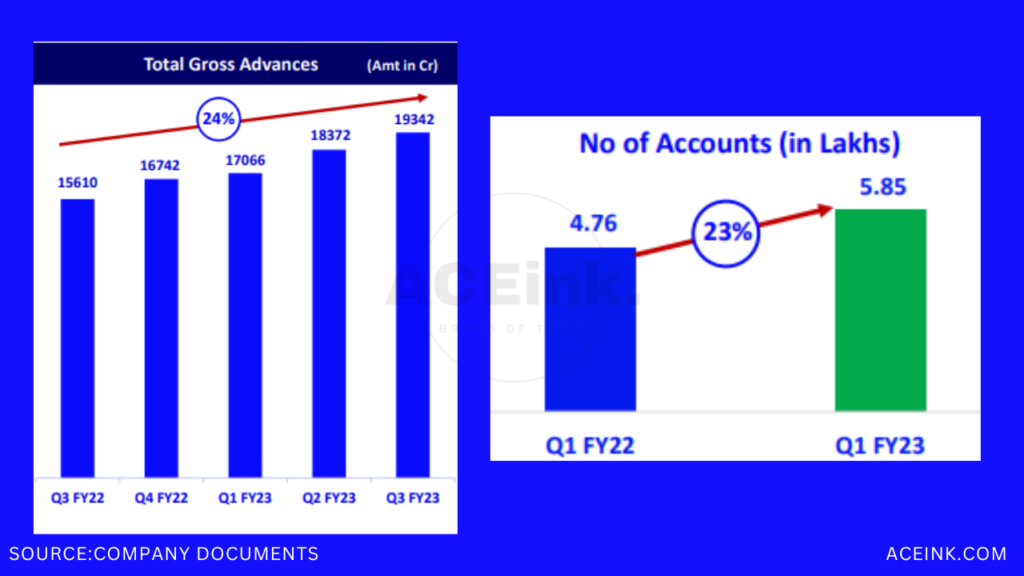

Loan Growth:

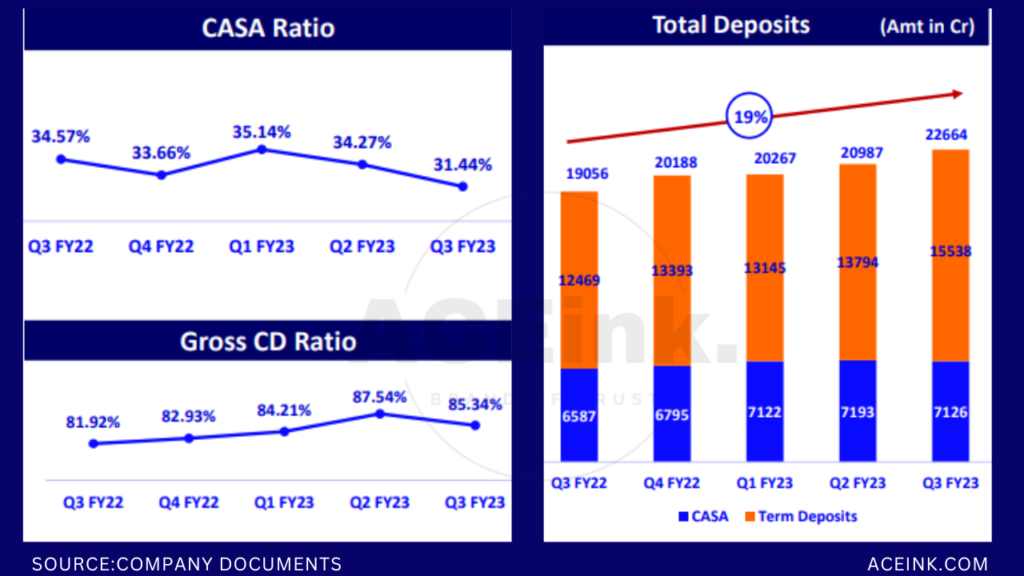

Loan growth is an important metric to analyze a bank’s revenue growth potential. Investors should analyze the bank’s loan growth rate and loan-to-asset ratio to assess its loan growth potential. CSB Bank has been reporting steady loan growth, with a loan growth rate of 24% (YOY) and a CD ratio of 85.34% as of Dec 2022.

Liquidity:

Liquidity is essential for a bank to meet its obligations and maintain its operations. Investors should analyze the bank’s liquidity ratio, loan-to-deposit ratio (LDR), and deposit growth rate to assess its liquidity position. CSB Bank has been maintaining a healthy liquidity position with a liquidity coverage ratio of 124% and a deposit growth rate of 19%.

Deposit Growth:

Deposit growth is an important metric to assess a bank’s ability to fund its operations and lends to customers. Investors should analyze the bank’s deposit growth rate and deposit-to-asset ratio to assess its deposit growth potential. CSB Bank has been reporting healthy deposit growth, with a deposit growth rate of 19%(YOY) and a deposit-to-asset ratio of 73.42%.

Profitability:

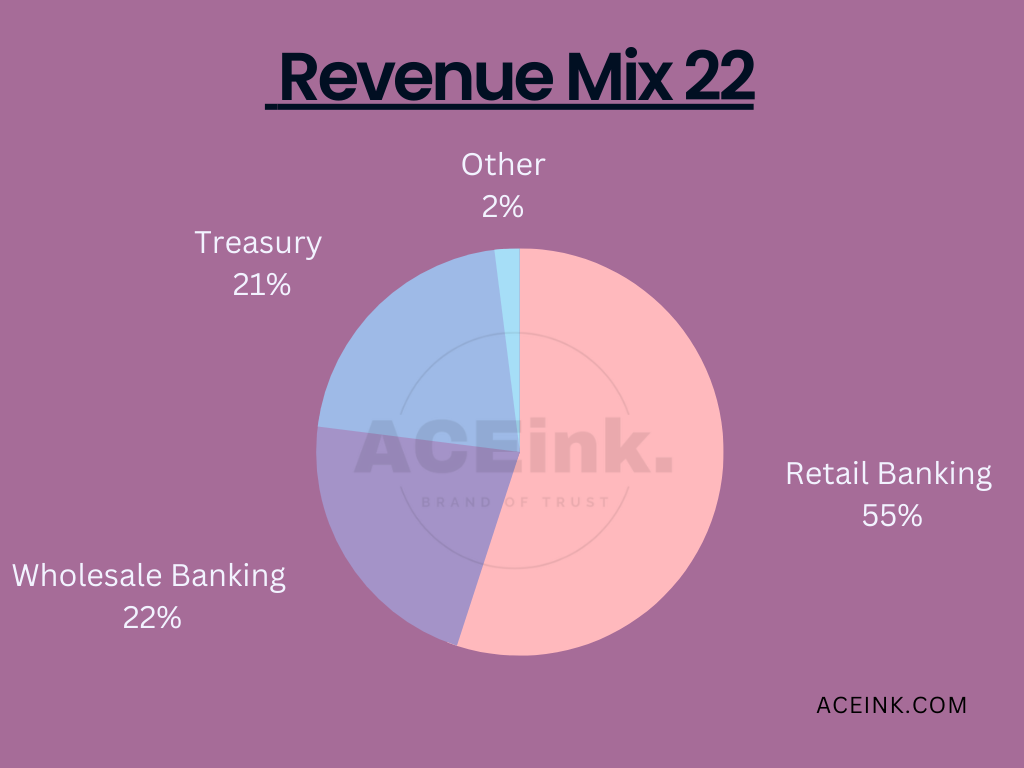

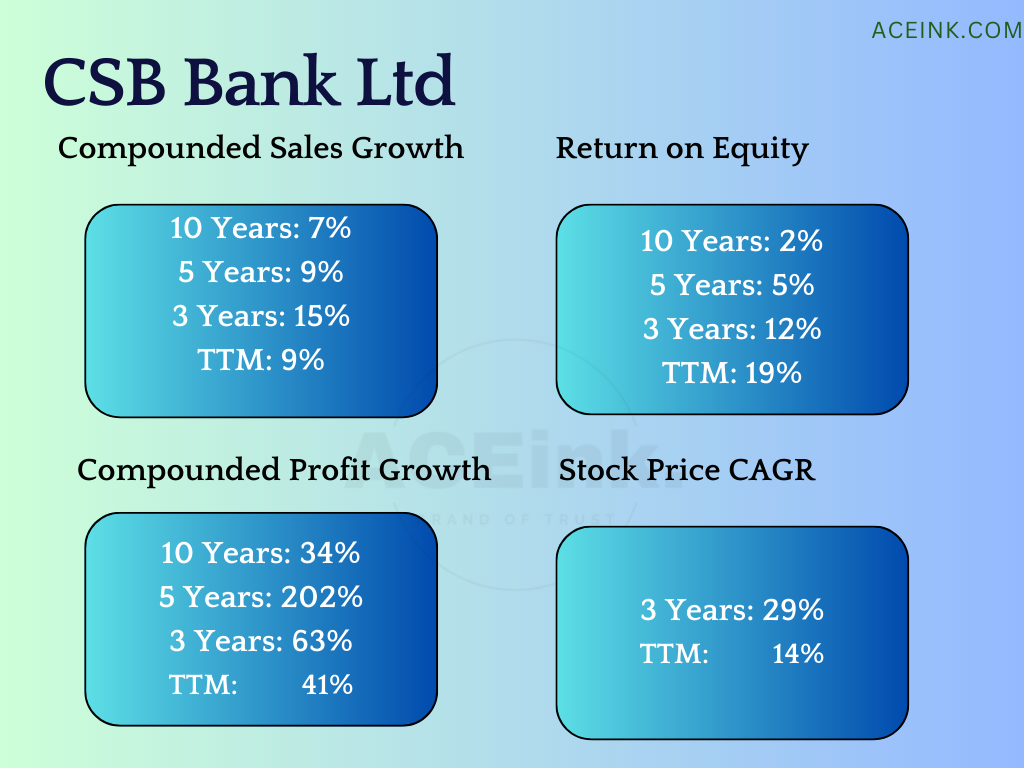

Profitability is a key indicator of a bank’s financial health. Investors should analyze the bank’s net interest margin (NIM), return on assets (ROA), and return on equity (ROE) to assess its profitability. CSB Bank has been reporting strong profitability ratios in recent years, with a NIM of 5.80%, ROA of 2.37%, and ROE of 19%.

For the quarter ended 31-12-2022, the company has reported a Standalone Total Income of Rs 681.95 Cr, up 13.64 % from last quarter’s (QOQ) Total Income of Rs 600.12 Cr and up 17.62 % from last year’s same quarter’s (YOY) Total Income of Rs 579.81 Crore. The bank reported a net profit after tax of Rs 155.95 Crore in the current quarter.

Cost Efficiency:

Cost efficiency is an important metric to assess a bank’s ability to manage expenses and maintain profitability. Investors should analyze the bank’s cost-to-income ratio (CIR) and operating expenses to assess its cost efficiency. CSB Bank has been focusing on improving its cost efficiency, with a CIR of 56% as of Dec 2022, which is lower than the industry average.

Growth Potential:

The Bank reported healthy growth numbers in the provisional release for FY2023. Expected Deposits grew 21.4% for the year (8% increase QoQ) out of which CASA deposits grew 16.1% (11% increase QoQ). Gross advances up 30.3% YoY (12% increase QoQ) out of which advances against Gold and Gold Jewellery rose 47.7% YoY (up 10% QoQ). Non-gold loans have started growing well. Also, The bank has a strong provision coverage ratio of 91.9%.

CSB Bank has been focusing on expanding its reach in existing markets as well as entering new markets, such as the North-Eastern region of India, which presents significant growth opportunities.

Experienced Management Team:

CSB Bank has a highly experienced management team comprising professionals with extensive experience in the banking and financial services industry. The bank’s CEO and MD, Mr. C.VR. Rajendran, has over 40 years of experience in the banking sector and has been instrumental in driving the bank’s growth and profitability.

Technology Adoption:

Technology adoption is critical for a bank’s future growth and competitiveness. Investors should analyze the bank’s investments in technology, digital offerings, and innovation to assess its ability to stay ahead of the curve. CSB Bank has been investing in technology and digital offerings, to enhance customer experience and expand its reach.

Innovative products and services that CSB Bank offers to its customers:

CSB UPI

CSB Mobile Banking

CSB Digital Account Opening

CSB Smart Pay -Prepaid card

CSB digital loan processing and disbursal

Valuation:

Valuation is an important aspect to consider before investing in a bank. Investors should analyze the bank’s price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to assess its valuation. As of April 2023, CSB Bank had a P/E ratio of 8.45, P/B ratio of 1.69, but no dividend yield.

Macro Environment:

The macro-environment, including the economic and political conditions in the country, can significantly impact a bank’s financial health. Investors should analyze the macro environment and its potential impact on the bank’s operations and earnings potential. CSB Bank operates in a stable macro environment in India, with the economy projected to grow in the coming years.

Like any investment, investing in CSB Bank comes with certain risks like Market Risk, Operational Risk, Regulatory Risk, etc. Here are some key risks that investors should be aware of in the case of banking stocks:

Interest Rate Risk:

CSB Bank’s profitability is sensitive to changes in interest rates, particularly since the bank has a significant portion of its loan portfolio in floating-rate loans. Any adverse movement in interest rates can impact the bank’s net interest margin and earnings potential.

Concentration Risk:

CSB Bank’s loan portfolio is concentrated in certain sectors such as retail, SMEs, and agriculture. Any adverse developments in these sectors can impact the bank’s loan quality and profitability. The bank is taking measures to diversify its loan portfolio, but concentration risk remains a concern.

Credit Risk:

As a bank, CSB Bank is exposed to credit risk, which is the risk of default on loans or other debt securities. The bank’s loan portfolio is subject to various factors such as economic conditions, borrower creditworthiness, and industry-specific risks. Defaults or non-performing assets (NPAs) can impact the bank’s profitability and earnings potential.

Liquidity Risk:

Liquidity risk is the risk of the bank not being able to meet its financial obligations when they become due. CSB Bank manages liquidity risk through various measures such as maintaining sufficient liquidity buffers and monitoring cash flows, but there is still a possibility of liquidity pressures in the event of unforeseen events.

It is important to note that fundamental analysis involves a comprehensive evaluation of a company’s financial performance and health, and investors should conduct their own research and analysis before making any investment decisions.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments