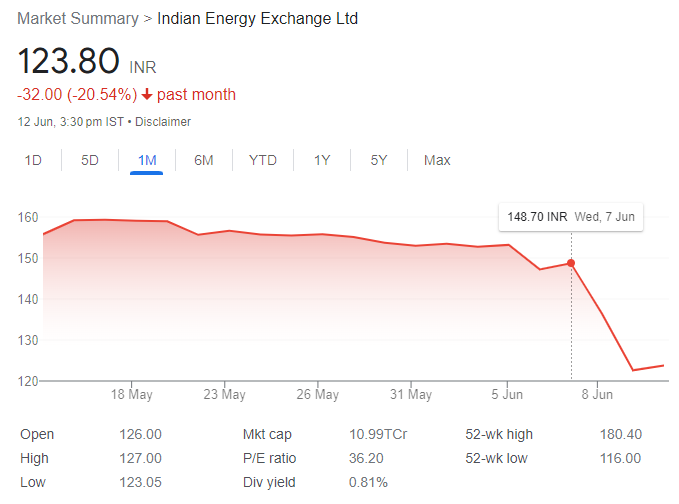

13 Jun IEX – End of Monopoly or New Opportunity?

IEX share rebounds 10% from 52-week lows -UBS sees 58% upside in the stock

The shares of the Indian Energy Exchange (IEX) fell by 15% to a 52-week low of INR 116 on the National Stock Exchange (NSE) following the Ministry of Power’s decision to proceed with market coupling. Market coupling involves an independent third-party collecting buy and sell bids and determining a uniform market price across all exchanges.

The introduction of a market coupler may negate IEX’s ‘moat’.

IEX’s current position as the most trusted platform for electricity spot price determination in India is its business advantage, which could be undermined by the implementation of market coupling. But, still UBS has given ‘buy’ rating on IEX with a target price of Rs 200, implying an upside of 58 % from yesterday’s high.

Also Read:These 27 stocks are giving dividends this week up to Rs 48

Starting in April 2023, the National Load Dispatch Center (NLDC) has taken on the role of the market coupler for a small portion of the market through the newly-launched ancillary market. This is the initial step toward NLDC transitioning into a full-fledged market coupler.

But, It’s important to note that the actual impact of market coupling on IEX’s business and monopoly will depend on various factors, including the specific implementation of market coupling, market dynamics, and how effectively IEX responds to the changing market environment.

That is why some analysts are giving highly negative reviews on the other hand some are still bullish on the stock.

Let’s understand the business of IEX, evaluate all the facts, and try to find out a clear picture with all the possible shades.

More to Read:Buy or Sell: 3 Stocks to Watch on This Week

Company Overview:

-Indian Energy Exchange (IEX) is the first power trading platform in India. It was established in 2008 and is headquartered in New Delhi.

-IEX operates as an automated exchange facilitating the trading of electricity, renewable energy certificates (RECs), and other energy-related products.

-IEX has 7300+ registered participants from 36 States and Union Territories.

-Out of the participants registered to trade electricity contracts include 57 distribution companies, over 620 electricity generators, and over 4645 open-access consumers.

-IEX commands an overall market share of 94.2%, & its market share is 99.9% in DAM & RTM.

Business Overview:

IEX operates as a power trading platform, providing a transparent and efficient marketplace for participants to buy and sell electricity.

It serves as an intermediary between power generators, distribution companies, and industrial consumers.

The company’s primary business activity is the spot market trading of electricity, where electricity is traded for immediate delivery.

Product Overview:

- Electricity Market: IEX offers various trade markets within the electricity segment, including:

- Day-Ahead Market: Participants can trade electricity for delivery on the next day.

- Term-Ahead Market: Allows participants to trade electricity contracts for delivery within a specific future period.

- Real-Time Market: Enables participants to trade electricity for delivery in real-time to meet immediate demand-supply requirements.

- Cross-Border Electricity Trade: Facilitates trading of electricity between India and neighboring countries like Nepal and Bhutan.

- Green Market: IEX operates a separate market segment for trading renewable energy certificates (RECs).

- RECs represent the environmental attributes of electricity generated from renewable sources.

- Market participants can buy and sell RECs to fulfill their renewable purchase obligations (RPOs) and promote clean energy consumption.

- Other Energy Products: In addition to electricity and RECs, IEX also facilitates trading in other energy-related products, including

- Energy Saving Certificates (ESCerts) and

- Renewable Energy Service Company (RESCO) certificates.

- These products promote energy efficiency and renewable energy initiatives in the market.

IEX’s platform provides transparent price discovery mechanisms, efficient trading systems, and robust risk management frameworks.

Participants can access the platform through an online interface or through registered intermediaries like brokers and trading members. The company’s technology infrastructure ensures real-time trading, settlement, and reliable market operations.

IEX’s role as a trusted marketplace for electricity trading contributes to the development of a competitive and liberalized power market in India.

How many exchanges are there other than IEX?

In addition to the Indian Energy Exchange (IEX), there are currently two other power exchanges operating in India. These exchanges are:

Power Exchange India Limited (PXIL):

PXIL is a leading electricity trading platform in India.

It was established in 2008 as a joint venture between the National Stock Exchange of India (NSE) and the National Commodity and Derivatives Exchange Limited (NCDEX).

PXIL provides a platform for trading various electricity products, including day-ahead contracts, term-ahead contracts, and renewable energy certificates.

Hindustan Power Exchange (HPX)

Hindustan Power Exchange (HPX) (formerly known as Pranurja Solutions Limited) is the new age power exchange in Indian Electricity Market. Through continuous innovation and creativity in the services as well as its technology, HPX brings a fresh perspective to the power market.

HPX is promoted by three leading institutions in their respective fields

- PTC India Limited

- BSE Investments Limited

- ICICI Bank Limited

The three conglomerates joining hands represent a unique blend of expertise and skillset. PTC is a pioneer of power trading and played a vital role in the development of the power market in India and South-East Asia. Similarly, BSE has expertise in setting up and running exchanges/trading platforms. It is the oldest and the fastest stock exchange in the world. Parallelly, on the Clearing and Settlement front, ICICI brings in the financial expertise of being the largest and most preferred private bank in India.

These three power exchanges, namely IEX, PXIL, and HPX, offer trading platforms for electricity and related derivatives, facilitating the buying and selling of power among market participants. The implementation of market coupling aims to integrate these exchanges and establish a uniform market clearing price across all platforms.

Benefits of Power Exchanges:

Traditionally in India, state utilities and producers enter long-term power purchase agreements (PPAs) for the trade of power. These bilateral contracts generally run for over two decades and support overall capacity creation. However, when these PPAs are executed in excess of requirements, they prove to be burdensome for distribution companies.

The PPAs do not provide flexibility to the beneficiaries to take advantage of changing market situations.

Power exchanges, on the other hand, allow different avenues to the participants to buy/sell power in the form of multiple market segments.

-Power exchanges offer a fair and transparent trading platform, benefiting both generation companies and buyers.

-They provide timely payments to generation companies and help buyers efficiently manage their power portfolios.

-For example, Generation companies greatly benefit from timely payments. For buyers, power exchanges help in the efficient management of their power portfolios.

-If India has more power exchanges, it will deepen the market and will encourage spot deals for electricity.

-Currently, only 6 percent of the nation’s electricity is traded through spot deals, and with power exchanges, it would be possible to purchase more of India’s electricity through spot deals which can bring ground-breaking results.

As such, the need of the hour for all participants is to maintain a judicious mix between long-term commitment and short-term opportunities.

What Is Market Coupler?

Market coupler refers to a mechanism or system that facilitates the coordination and integration of multiple trading platforms or exchanges within a specific market.

Its primary function is to aggregate buy and sell orders from various exchanges and derive a uniform market clearing price across all platforms. By implementing market coupling, the aim is to enhance market efficiency, increase liquidity, and promote fair competition by aligning prices across exchanges.

It eliminates potential price discrepancies that may arise due to fragmentation across multiple platforms, allowing for a more integrated and unified market.

In summary, market coupling is a mechanism that harmonizes prices and coordinates trading activities across multiple exchanges or platforms within a market, ensuring uniformity and efficiency in price determination.

Evolution of Exchanges in Europe:

-In Europe, initially, each exchange operated as the sole provider of trading platforms in a country or group of countries.

-Pan-European market coupling was later implemented, enabling price discovery at a common platform. This increased market spread and resulted in savings for participants and economies.

-European regulators allowed multiple exchanges to exist in the same geography after the implementation of market coupling.

-In Europe, different countries have multiple exchanges operating alongside each other, such as Nordpool and EEX.

Market Coupling in India:

When we compare this evolution process in Europe with that of the Indian power market, we have three power exchanges and neighboring countries (Nepal and Bhutan) are now part of the common power market.

Discussion for market coupling has already started with suitable enabling provisions in the Power Market Regulations 2021.

As such in time to come, while footprints of the Indian Power Market are expected to increase further in the SAARC countries, the price determination process would be managed by one entity (which would be decided by the CERC) and the power exchange would be competing for market share based on their services.

Thus, in both cases (Europe and India), the power market is moving towards multiple exchange models with common price discovery.

How will it affect IEX business and Monopoly?

In the context of the Indian Energy Exchange (IEX), market coupling involves an independent third-party collecting buy and sell bids from all power exchanges in the electricity market. The third party then matches and aggregates these bids to determine a single, consistent market price that applies to all exchanges. This ensures that participants across different exchanges have access to the same market price for electricity.

The implementation of market coupling can have implications for the business of the Indian Energy Exchange (IEX) and its position in the market. Here are some potential effects:

Increased Competition:

Market coupling allows for increased competition by integrating multiple exchanges.

It creates a more level playing field for all participants, as they have access to the same market-clearing price across exchanges. This can potentially attract more market players and lead to increased competition for IEX.

Impact on Spot Price Determination:

Currently, IEX is the most trusted platform for electricity spot price determination in India.

With market coupling, the uniform market clearing price derived from the aggregated bids across exchanges may impact IEX’s ability to independently determine spot prices. The influence of other exchanges and the third-party market coupler could affect IEX’s position in this regard.

Loss of Monopoly:

Market coupling reduces the potential for any single exchange to maintain a monopoly or significant market power.

As the market becomes more integrated and unified, participants have the flexibility to choose from multiple exchanges based on factors such as pricing, liquidity, and services. This could potentially challenge IEX’s dominant position in the electricity spot price determination market.

Business Adaptation:

IEX may need to adapt its business strategy and offerings to remain competitive in a market with market coupling.

This could involve

-Exploring new revenue streams,

-Diversifying its services, or

-Enhancing its value proposition to attract market participants.

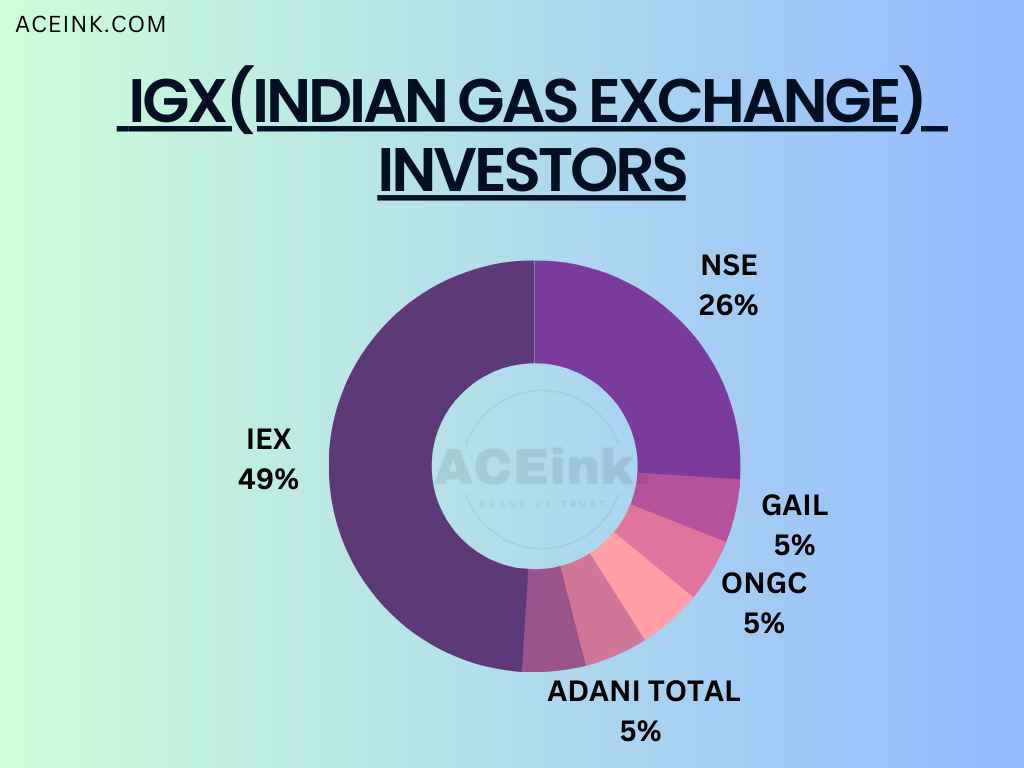

Business Opportunities for IEX:

IEX aims to explore new business opportunities in markets such as

Ancillary services, capacity market, and gross bidding.

-It seeks to support the development of a vibrant gas market and the government’s objective of increasing the share of natural gas in India’s energy mix.

-The company is closely monitoring and complying with regulations, including the implementation of the Grid Code and GNA (Green Market Clearing and Communication). The CERC (Central Electricity Regulatory Commission) has approved transaction fees, ensuring regulatory support for IEX.

-IEX is proposing a CfD (Contracts for Difference) model for renewable energy generation, which can offer price certainty and stability for both generators and buyers. The company anticipates a surplus in the pool through this model, as indicated by a study conducted by Deloitte.

-It highlights the need for the effective implementation of government initiatives such as the PUSH portal and fair allocation of coal.

-IEX expects a shift of volumes from the DAC (Deviation Settlement Mechanism) market back to DAM and foresees increased trading in long-term contracts as coal supply improves and e-auction rates decrease.

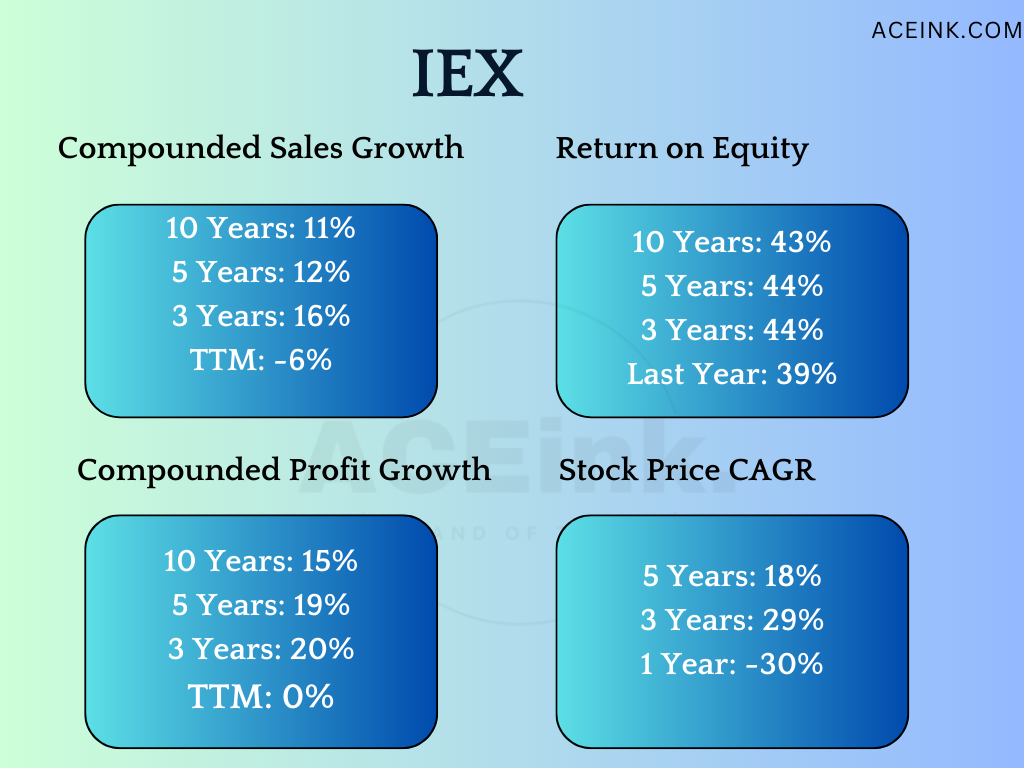

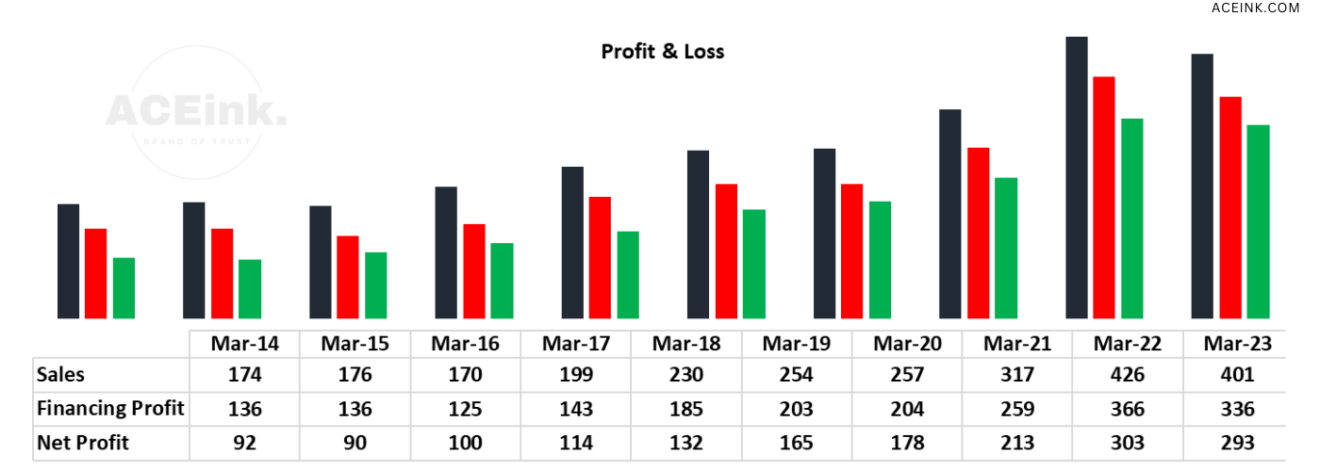

Financials & Fundamentals

Basic

- Market Cap ₹ 11,021 Cr.

- Current Price ₹ 124

- High / Low ₹ 180 / 116

- Stock P/E 37.6

- Industry PE 23.5

- PEG Ratio 1.97

- Return over 1year -30.3 %

Financials

- ROCE 51.8 %

- ROE 39.4 %

- OPM84.0 %

- Debt ₹ 14.1 Cr.

- Debt to equity 0.02

- Qtr Profit Var 2.46 %

- Qtr Sales Var -4.21 %

- Free Cash Flow₹ -31.2 Cr.

Investors

- Promoter holding 0.00 %

- FII holding 17.9 %

- Public holding 60.3 %

- DII holding 21.5 %

- Change in Prom Hold 0.00 %

- Chg in FII Hold 2.39 %

- Chg in DII Hold -0.20 %

-UBS maintained a ‘buy’ rating on IEX with a target price of Rs 200 per share, noting that implementing market coupling in inter-regional transmission or green energy could improve transmission capabilities management.

-Antique Stock Broking downgraded IEX to ‘sell’ with a target price of Rs 105, expressing concerns about potential challenges to IEX’s dominance due to market coupling and competition from other exchanges.

-The brokerage firm Nuvama described this move as a significant negative for IEX and recommended a “reduce” rating on the stock, with a price target of INR 127. Nuvama believes that IEX’s current position as the most trusted platform for electricity spot price determination in India, which is its primary business advantage, could be undermined by the implementation of market coupling.

The Technicals

Mehul Kothari, AVP – Technical Research, Anand Rathi Shares and Stock Brokers.

-The technical indicators, such as MACD and RSI, indicate a negative trend for IEX after its decline from a high of Rs 318 in October 2021. The stock has experienced a breakdown below key levels with heavy volumes, suggesting a bearish sentiment.

-Despite the overall bearish trend, there is a possibility of a short-term pullback in the coming sessions.

-However, analysts believe that any upward movement is likely to be limited and restricted within the range of Rs 135-145.

Resistance and Support Levels: The expected trading range for IEX in the next few weeks is between Rs 145 and Rs 110. These levels can serve as resistance and support, providing guidance for potential entry and exit points.

Remember to conduct thorough research, assess your risk tolerance, and seek advice from a financial advisor before making any trading decisions. Trading in the stock market involves risks, and prices can be volatile, so it’s important to approach trading with caution and make well-informed choices.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments