12 Jun These 27 stocks are giving dividends this week up to Rs 48

These 27 stocks are to turn ex-dividend this week including TCS & Tata Investment

The ex-dividend date is the date on or after which a security, such as a stock, trades without its dividend.

When a company declares a dividend, it sets a record date, which is the date by which an investor must be on the company’s books as a shareholder to receive the dividend payment. The ex-dividend date is typically set 1 or 2 business days before the record date.

Also Read:NPS withdrawal rule set to change Soon- All you need to know about NPS

On the ex-dividend date, the stock price is adjusted downward by the amount of the dividend to account for the fact that new buyers of the stock will not be eligible to receive the upcoming dividend payment.

In other words, if you purchase a stock on or after the ex-dividend date, you will not receive the next dividend payment.

The ex-dividend date is important for investors because it determines whether or not they will receive the upcoming dividend. Investors who want to receive the dividend payment must purchase the stock before the ex-dividend date, so their names appear on the company’s list by the record date. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

For 12 June:

1. Tata Investment Corporation:

The company has declared a final dividend of Rs 48.

Tata Investment Corporation is a financial services company based in India.

It is a subsidiary of Tata Sons and operates as an investment company.

The company’s primary business is to make investments in various financial instruments such as

-equity shares,

-debentures, and

-mutual funds.

Tata Investment Corporation provides long-term capital appreciation to its shareholders through investments in the Indian capital market.

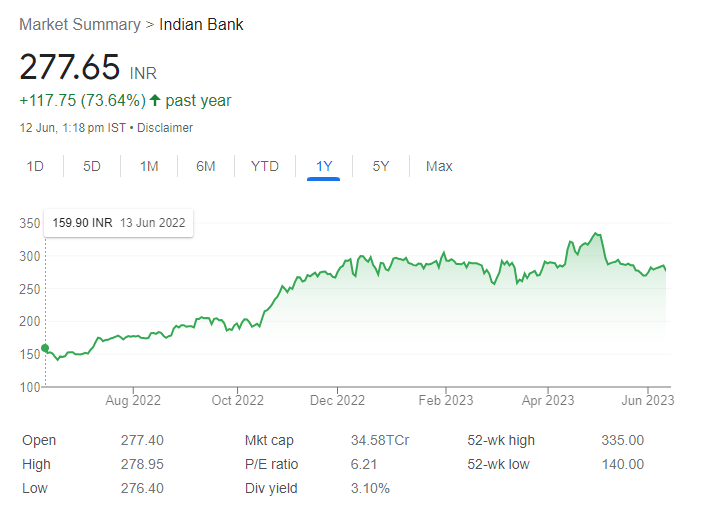

2. Indian Bank:

The company has declared a final dividend of Rs 8.6.

Indian Bank is a leading public sector bank in India.

It offers a wide range of banking products and services to individuals, businesses, and corporates.

The bank provides various services, including savings accounts, current accounts, loans, credit cards, and investment options.

Indian Bank focuses on promoting financial inclusion and supporting economic growth by providing accessible and affordable banking services to its customers.

3. ICICI Lombard General Insurance Co:

The company has declared a final dividend of Rs 5.5.

ICICI Lombard General Insurance Co is one of the leading general insurance companies in India.

The company offers a comprehensive range of insurance products, including

-motor insurance,

-health insurance,

-travel insurance,

-home insurance, and more.

ICICI Lombard is known for its customer-centric approach and innovative insurance solutions.

The company strives to provide financial protection and peace of mind to individuals and businesses through its wide array of insurance offerings.

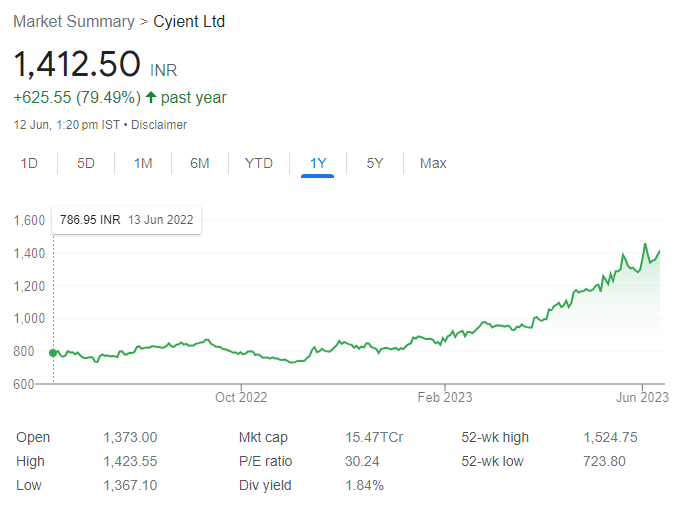

4. Cyient Ltd:

The company has declared a final dividend of Rs 16.

Cyient Ltd is a global engineering and technology solutions company.

It provides services and solutions in various industries, including

-aerospace,

-defense,

-telecommunications,

-utilities, and

-transportation.

Cyient offers engineering, manufacturing, data analytics, and digital solutions to help its clients enhance their operational efficiency and drive innovation.

The company has a global presence and serves customers across the world.

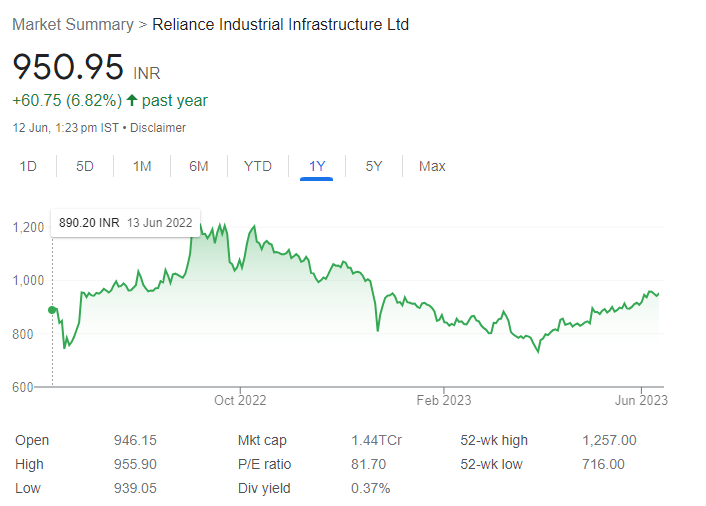

5. Reliance Industrial Infrastructure Ltd:

The company has declared a dividend of Rs 3.5.

Reliance Industrial Infrastructure Ltd is a subsidiary of Reliance Industries Limited, one of India’s largest conglomerates.

The company is involved in the business of setting up and operating industrial infrastructure facilities.

It provides infrastructure support services to industries, including

-transportation of petroleum products,

-storage and handling of oil and gas, and

-construction and maintenance of industrial plants.

Reliance Industrial Infrastructure Ltd plays a crucial role in supporting the growth and development of various industries in India.

6. Apcotex Industries Ltd:

The company has declared a final dividend of Rs 3.5.

Apcotex Industries Ltd is a leading manufacturer of synthetic latex products in India.

The company specializes in producing emulsion polymers, synthetic rubber, and other latex-based products.

Apcotex caters to diverse industries such as

-textiles,

-paper,

-adhesives,

-construction, and

-coatings.

The company is known for its high-quality products and commitment to customer satisfaction. Apcotex Industries Ltd contributes to the growth of several sectors by providing innovative and sustainable solutions.

For 13 June:

7. Diamines & Chemicals Ltd:

The company has declared a final dividend of Rs 3.

Diamines & Chemicals Ltd is a chemical manufacturing company based in India.

It specializes in the production of various chemicals, including diamines, phenols, anilines, and specialty chemicals.

The company caters to industries such as textiles, pharmaceuticals, agrochemicals, and dyes.

Diamines & Chemicals Ltd is known for its high-quality products and commitment to sustainable manufacturing practices.

8. Jindal Saw Ltd:

The company has declared a final dividend of Rs 3.

Jindal Saw Ltd is a leading manufacturer of steel pipes and tubes.

The company offers a wide range of products, including seamless pipes, submerged arc welded pipes, and ductile iron pipes.

Jindal Saw serves various industries, including

-oil and gas,

-water,

-energy, and

-infrastructure.

The company is known for its technological expertise, product quality, and customer-centric approach.

9. LKP Finance Ltd:

The company has declared a final dividend of Rs 1.

LKP Finance Ltd is a non-banking financial company (NBFC) based in India.

The company provides a range of financial services, including

-asset financing,

-investment banking,

-wealth management, and

-advisory services.

LKP Finance caters to individuals, corporates, and institutional clients.

The company focuses on delivering customized financial solutions and building long-term relationships with its customers.

10. LKP Securities Limited:

The company has declared a final dividend of Rs 0.1.

LKP Securities Limited is a leading brokerage and financial services provider in India.

The company offers a wide range of services, including equity and derivatives trading, portfolio management, investment advisory, and research.

LKP Securities aims to provide transparent and efficient trading platforms and value-added services to its clients.

For 14 June:

11. Tata Chemicals Ltd:

The company has declared a final dividend of Rs 17.5.

Tata Chemicals Ltd is a global chemical company with a diverse portfolio of products.

It operates in various sectors, including chemicals, fertilizers, and consumer products.

The company manufactures and markets chemicals such as

-soda ash,

-salt,

-specialty chemicals, and

-agricultural inputs.

Tata Chemicals is committed to sustainable and responsible business practices and strives to contribute to the well-being of society.

12. Canara Bank:

The company has declared a final dividend of Rs 12.

Canara Bank is one of the largest public sector banks in India.

It offers a wide range of banking products and services, including retail and corporate banking, loans, insurance, and investment options.

Canara Bank focuses on providing financial inclusion and serving the banking needs of diverse customer segments.

The bank is known for its customer-centric approach and robust banking solutions.

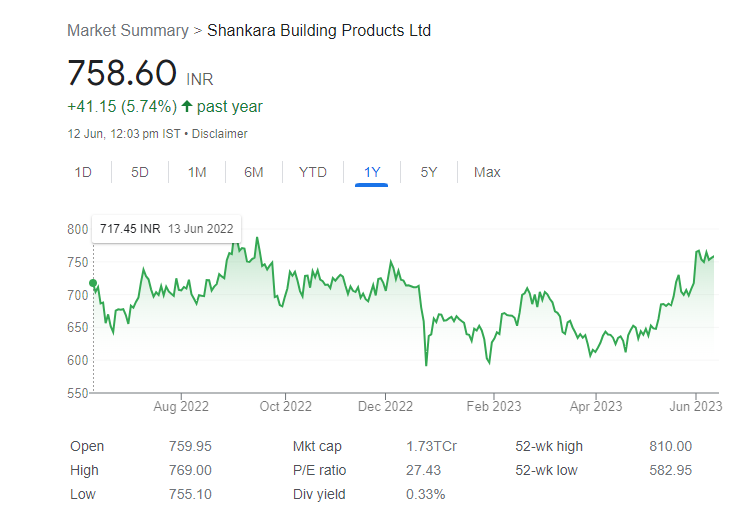

13. Shankara Building Products Ltd:

The company has declared a final dividend of Rs 2.5.

Shankara Building Products Ltd is a leading retailer and distributor of building materials in India.

The company offers a comprehensive range of products, including cement, steel, tiles, roofing solutions, plumbing, and electrical fittings.

Shankara Building Products serves both individual customers and contractors, providing them with quality products and efficient services for their construction and renovation needs.

For 15 June:

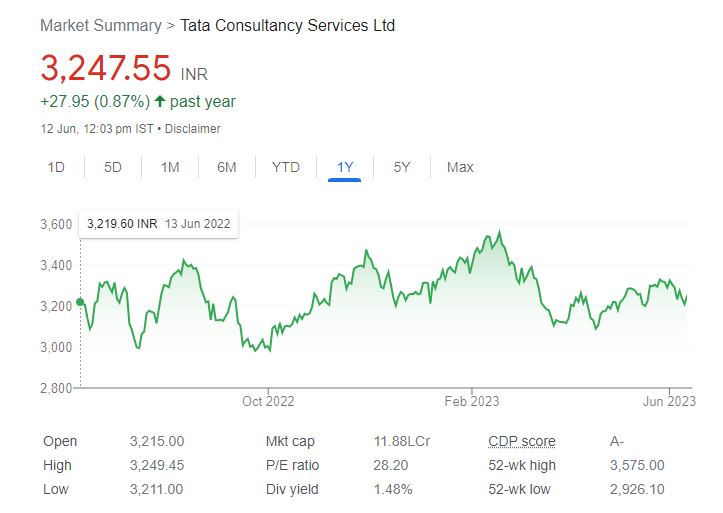

14. Tata Consultancy Services (TCS):

The company has declared a final dividend of Rs 24.

Tata Consultancy Services (TCS) is one of the largest IT services and consulting companies globally.

It provides a wide range of services, including

-software development,

-IT consulting,

-business process outsourcing, and

-digital solutions.

TCS serves clients across various industries, helping them transform their businesses through technology and innovation.

The company is known for its expertise in areas such as cloud computing, artificial intelligence, cybersecurity, and data analytics.

Tata Consultancy Services is committed to delivering value to its clients and driving digital transformation across industries.

15. DCB Bank:

The company has declared a final dividend of Rs 1.25.

DCB Bank is a private-sector bank in India.

It offers a range of banking products and services to individuals, small businesses, and corporates.

The bank provides services such as savings accounts, current accounts, loans, credit cards, and wealth management solutions.

DCB Bank focuses on customer-centricity, technological innovation, and responsible banking practices to meet the financial needs of its customers.

Visaka Industries Ltd:

The company has declared a final dividend of Rs 0.6.

Visaka Industries Ltd is a leading manufacturer of building materials and textiles.

The company’s building products division offers solutions such as roofing sheets, fiber cement boards, and panels for construction applications.

Visaka Industries’ textiles division specializes in the production of yarn and fabrics.

The company is known for its quality products, sustainable manufacturing practices, and commitment to environmental stewardship.

DJ Mediaprint & Logistics Ltd:

The company has declared a final dividend of Rs 0.15.

DJ Mediaprint & Logistics Ltd is a logistics and media distribution company.

It provides end-to-end solutions for the print media industry, including printing, packaging, and distribution services.

The company’s logistics division offers services such as warehousing, transportation, and supply chain management. DJ Mediaprint & Logistics aims to provide efficient and reliable services to its clients in the media and publishing sectors.

For 16 June:

18. Angel One Ltd:

The company has declared a final dividend of Rs 4.

Angel One Ltd is a leading financial services company in India.

It provides a range of services, including

-online trading,

-investment advisory,

-wealth management, and

-portfolio management.

Angel One aims to empower individual investors by offering user-friendly platforms, research tools, and personalized investment advice.

The company is known for its customer-centric approach and commitment to providing innovative financial solutions.

19. Avantel Ltd:

The company has declared a final dividend of Rs 1.

Avantel Ltd is a telecommunications company based in India. It offers a wide range of services, including voice, data, and video communication solutions.

Avantel serves both individual and enterprise customers, providing them with reliable and efficient communication services.

The company focuses on leveraging technology to deliver high-quality connectivity and enhance the overall communication experience.

20. Eimco Elecon (India) Ltd:

The company has declared a final dividend of Rs 5.

Eimco Elecon (India) Ltd is an engineering company that specializes in providing material handling equipment and solutions.

The company offers a wide range of products, including

-conveyors, cranes,

-loaders, and

-specialized equipment for various industries such as mining, construction, and power generation.

Eimco Elecon focuses on delivering innovative and customized solutions to meet the unique material handling needs of its clients.

21. HDFC Life Insurance Company Ltd:

The company has declared a final dividend of Rs 1.9.

HDFC Life Insurance Company Ltd is one of the leading life insurance companies in India.

It offers a comprehensive range of life insurance products, including term insurance, savings plans, investment-linked plans, and retirement solutions.

HDFC Life focuses on providing financial protection and long-term wealth creation options to individuals and families.

The company is known for its customer-centric approach, strong financial performance, and wide distribution network.

22. High Energy Batteries (India) Ltd:

The company has declared a final dividend of Rs 3.5.

High Energy Batteries (India) Ltd is a leading manufacturer of batteries and energy storage solutions.

The company specializes in the production of automotive batteries, industrial batteries, and renewable energy storage systems.

High Energy Batteries focuses on delivering high-performance, reliable, and environmentally-friendly battery solutions to various sectors such as automotive, telecom, power, and renewable energy.

23. Piramal Enterprises Ltd:

The company has declared a final dividend of Rs 31.

Piramal Enterprises Ltd is a diversified conglomerate with business interests in

-pharmaceuticals,

-financial services, and

-healthcare.

The company operates in areas such as drug discovery, contract manufacturing, and distribution of pharmaceutical products.

Piramal Enterprises also provides financial services, including lending, investment, and insurance solutions.

The company is committed to innovation, quality, and making a positive impact on society through its businesses.

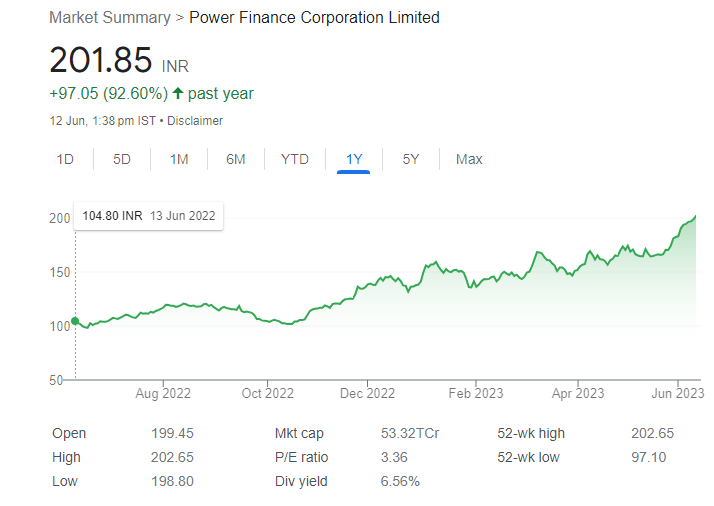

24. Power Finance Corporation Ltd:

The company has declared a final dividend of Rs 4.5.

Power Finance Corporation Ltd (PFC) is a leading financial institution in the power sector in India.

It provides financial assistance for the development of power projects, including thermal, hydro, and renewable energy projects.

PFC offers a range of financial products and services, including

-project financing,

-debt restructuring, and

-advisory services.

The company plays a crucial role in supporting the growth and development of the power sector in the country.

25. Shriram Finance Ltd:

The company has declared a final dividend of Rs 20.

Shriram Finance Ltd is a non-banking financial company (NBFC) that specializes in providing various financial products and services.

The company offers loans for automobiles, commercial vehicles, construction equipment, and small businesses.

Shriram Finance focuses on serving the under-served and under-banked segments of society, providing them with convenient and accessible financial solutions.

The company has a strong presence in rural and semi-urban areas and is committed to inclusive growth and financial inclusion.

26. SMC Global Securities Ltd:

The company has declared a final dividend of Rs 1.2.

SMC Global Securities Ltd is a leading financial services provider in India.

The company offers a wide range of services, including

-equity and commodity broking,

-investment banking,

-wealth management, and

-research advisory.

SMC Global Securities caters to retail and institutional clients, providing them with innovative investment solutions and personalized services. The company is known for its expertise, transparency, and commitment to delivering value to its clients.

27. Torrent Power Ltd:

The company has declared a final dividend of Rs 4.

Torrent Power Ltd is an integrated power utility company in India.

It is engaged in the generation, transmission, and distribution of electricity.

The company operates thermal and renewable power plants, supplying electricity to customers in various states.

Torrent Power also provides distribution services, including

-metering,

-billing, and

-customer support.

The company focuses on delivering reliable and affordable power solutions, contributing to the growth and development of the energy sector.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

Pingback:IEX – End of Monopoly or New Opportunity? - aceink.com

Posted at 18:35h, 10 September[…] Also Read:These 27 stocks are giving dividends this week up to Rs 48 […]