30 Jun Will the Nifty Reach 21,000?

Sensex, Nifty at all-time high – will the bull run continue?

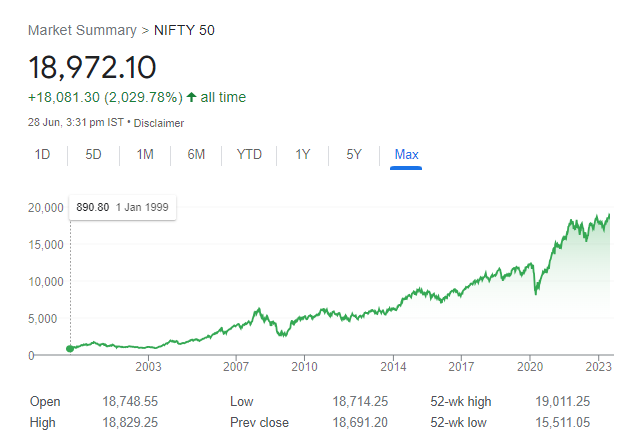

The Nifty50 Index is currently trading at around 19,000, slightly above its previous all-time high level registered in December 2022.

Earlier this year, in March 2023, the index had dipped below 17,000 but has since rallied by approximately 11% driven by positive risk sentiments. Year-to-date, the index is up by around 4%.

The broader markets, as indicated by the BSE500, also have experienced a sharper rally. Since March 2023, the BSE500 has surged by around 13%, led by gains of approximately 20% in the mid and small-cap segments. On a year-to-date basis, the BSE500 is up by around 4.5%.

The Sensex, India’s equity barometer, hit a fresh all-time high after seven months.

What boosted the rally?

Several factors have contributed to the market’s boost.

Stocks of companies such as Reliance Industries, HDFC Twins, Power Grid, TCS, and Larsen & Toubro witnessed gains, which supported the overall market growth.

The market has benefited from positive macroeconomic indicators, including

-Better-than-expected March quarter numbers,

-Increased capital expenditure by the Government of India, and

-Rising manufacturing PMI (Purchasing Managers’ Index).

Foreign portfolio investors (FPIs) have been investing in Indian equities, this sustained foreign capital inflow has boosted market sentiments.

Retail investor optimism: The outperformance of mid and small-cap stocks indicates that retail investors have remained optimistic about the domestic market. The number of registered investors on the BSE (Bombay Stock Exchange) has increased by nearly 24% year-on-year.

The bullish trend in global markets has had a positive impact on the Indian market.

Markets in the US, Euro Zone, Japan, South Korea, and Taiwan have been hovering around 52-week highs. This global rally has corrected the previous year’s wrong discounting of a US recession, leading to overall market optimism.

So, What Next? Will the rally continue?

Let’s find out…

Macroeconomic Factors Driving Strength in Indian Equities:

ET Market

GDP Growth Forecasts Increasing FPI Inflow

Foreign Portfolio Investments (FPI) into Indian equities have turned positive, reflecting a change in the macroeconomic outlook.

After being net sellers of around INR 520 billion (INR 52,000 crore) during the January-February 2023 period, FPI flows have turned into a net positive of around INR 440 billion to date.

Driven first by improving margin as commodity prices, including crude oil, continue to weaken and pick up in revenue as the macro environment improves.

The recent upgrade in FY2024 GDP growth forecasts by Fitch to 6.3% (from 6% earlier) and stability in the Indian Rupee (INR) against the US Dollar (USD) and other major currencies are likely to support further FPI inflows.

Inflation Outlook:

Weakening commodity prices have been influenced by lower-than-expected demand from China, a major global consumer of commodities. The decline in commodity prices has led to the possibility of stable or lower inflation, which could potentially result in a rate cut later in the year.

This outlook for lower inflation supports the positive market sentiments and provides a conducive environment for sustained strength in Indian equities.

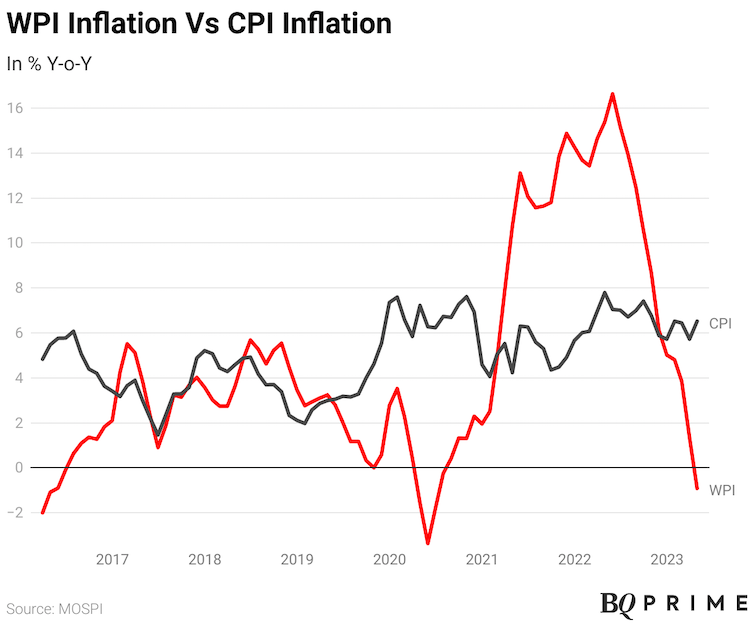

In May 2023, India’s Consumer Price Index (CPI) inflation eased to 4.2% year-on-year (YoY), indicating a more stable pricing environment.

The United States and Eurozone experienced lower CPI inflation rates of 4% and 6% respectively, while core inflation remained sticky at around 5%.

India’s Wholesale Price Index (WPI) inflation stood at (-)3.5%, implying potential deflationary pressures that could translate into lower CPI inflation in the upcoming quarters.

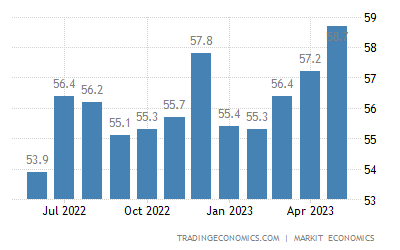

PMI GRAPH

Strong Activity Levels:

The improvement in consumption demand, along with capital investments, is a key factor supporting the strength of the Indian economy.

Although private consumption demand weakened in the latter half of FY2023, it is expected to remain subdued in the near term.

However, historically, intense government investments have led to a revival in consumption demand. Additionally, upcoming state and general elections in 2023 and 2024 could further stimulate consumption, as seen in previous election cycles.

Surveys indicate robust activity levels in India, with manufacturing and services PMI showing expansion and improving consumer sentiment.

The Manufacturing PMI expanded further to 58.7 in May’23 (compared to 57.2 in April’23), while Services PMI continues to stay above 60 for the 2nd straight month.

According to the Centre for Monitoring Indian Economy (CMIE), consumer sentiment currently stands at 94.5, reaching its highest level since the pandemic began. Both urban and rural consumer sentiments have shown improvement, with urban sentiment at 92.7 and rural sentiment at 95.1.

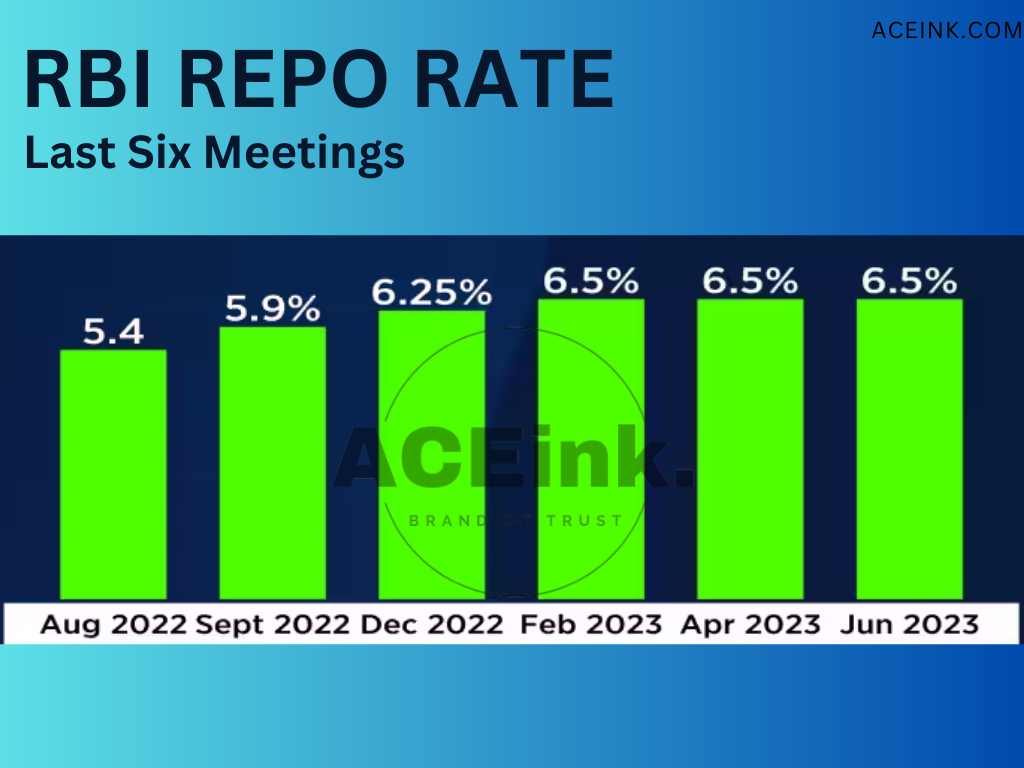

Rate Cut Possibility:

The global macro outlook is improving, with positive high-frequency data in the US pushing recession forecasts further into the economic cycle.

Additionally, the US Federal Reserve is nearing the end of its rate hike cycle, signaling potential stability in interest rates.

Although Europe and the UK continue to face economic weaknesses, we believe their impact on Indian equities will be limited.

The Indian economy has demonstrated resilience, standing strong amidst global challenges. The expectation of stable or lower inflation opens up the possibility of a rate cut by the Reserve Bank of India (RBI) towards the end of 2023.

The rate cut would aim to stimulate economic growth and investment.

Increased Weight of MSCI India:

The weight of MSCI India has increased from around 9% in 2020 to approximately 14% currently.

This rise can be attributed to factors such as the underperformance of China equities and the removal of certain countries from the indices.

The increased weight of MSCI India in major global indices opens the gate for higher passive flows into the country. As more investors allocate funds to passive investment strategies, the inflow of capital into Indian equities is expected to strengthen further.

The Nifty50 Index’s journey towards 21,000 is underpinned by a multitude of factors.

Strong earnings growth, positive macroeconomic conditions, and improving consumer sentiment have contributed to the index’s rally. Technical analysis suggests further upside potential, while the improving global macro backdrop, including positive high-frequency data in the US and stability in interest rates, creates a supportive environment for Indian equities. The increased weight of MSCI India in global indices enhances the potential for higher passive flows into the country.

Overall, the resilience of the Indian economy and positive market sentiments indicate that the Nifty50 Index is well-positioned to reach the 21,000 mark and continue its upward trajectory.

Investors should closely monitor these developments and consider Indian equities as part of their investment portfolios.

PE Re-Rating:

Indian equities are experiencing a PE re-rating supported by global market strength.

The Nifty50 Index has witnessed a remarkable performance, trading at around 19,000, just above its previous all-time high.

This rally can be attributed to positive market sentiments and the strength of Indian equities compared to its Asian peers.

Notably, the Nifty50 has achieved an impressive earnings compound annual growth rate (CAGR) of 9% over the past nine years, outperforming China equities and US equities in terms of earnings growth.

The Nifty index is currently trading at 17.7x based on its FY25E EPS, with projected earnings growth of around 16% on a CAGR basis. This re-rating trend is expected to continue, potentially driving the Nifty index towards 21,000 at approximately 20+ P/E levels.

Technicals:

The technical analysis of the Nifty50 Index reveals a rising trend channel on the monthly time frame.

Historically, the midpoint of this channel has acted as a support level, indicating resilience and potential support for future price movements.

Furthermore, the Fibonacci extension analysis suggests the possibility of the index extending its rise to levels between 20,600 and 21,600, reinforcing the upward trajectory.

Apurva Sheth, Head of Market Perspectives & Research at SAMCO Securities,

suggests that short-term investors can consider booking some profits in the immediate term.

However, medium to long-term investors are encouraged to hold on to their positions and take advantage of any market dips to purchase more stocks.

Gaurav Bissa, VP at InCred Equities,

believes that investors with a horizon of two years or more can expect strong gains in the future.

He identifies sectors like IT, public-sector enterprises, and pharma as ripe for a major reversal and potential wealth creation for long-term investors.

Additionally, he suggests that sectors such as consumer durables, auto, and infrastructure are expected to continue their uptrend with a strong performance in the medium term.

Ultimately, the decision on what to do in the market depends on an individual’s investment goals, risk tolerance, and time horizon. It’s always advisable to consult with a financial advisor or do thorough research before making any investment decisions.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this EV Stock is Having a Great Growth Potential? Imagine you’re driving your dream car, with all…….Read More

Pingback:Buy or Sell: 3 Stocks to Watch This week on 10th July - aceink.com

Posted at 18:21h, 08 July[…] Related Read: Will the Nifty Reach 21,000?r […]

Pingback:5 stocks from sugar sector with upside potential - aceink.com

Posted at 11:59h, 10 July[…] Related Read: Will the Nifty Reach 21,000?r […]

Pingback:Buy or Sell: 3 Stocks to Watch This week 17th July - aceink.com

Posted at 13:32h, 15 July[…] Related Read: Will the Nifty Reach 21,000? […]

Pingback:These stocks to give dividend this week upto Rs.180 - aceink.com

Posted at 02:06h, 16 July[…] Related Read: Will the Nifty Reach 21,000? […]

Pingback:itc - aceink.com

Posted at 00:44h, 18 July[…] Related Read: Will the Nifty Reach 21,000? […]

Pingback:“Public Sector Banks: Share Prices are Still 80% Down from All-Time Highs Despite Recent Rally - aceink.com

Posted at 00:53h, 21 July[…] Related Read: Will the Nifty Reach 21,000? […]

Pingback:Buy or Sell: 3 Stocks to Watch This week 24th July - aceink.com

Posted at 12:10h, 22 July[…] Read: Will the Nifty Reach 21,000? […]

Pingback:These stocks to give dividend this week upto Rs.120 - aceink.com

Posted at 14:18h, 23 July[…] Related Read: Will the Nifty Reach 21,000? […]