28 Jun SEBI approves Tata Technologies IPO

Tata Technologies IPO – Unlisted Share Price, Company, Business, Rally in Tata Motors: All You Need to Know

After almost two decades, the renowned Tata Group is making a highly anticipated comeback to the stock market with the upcoming initial public offering (IPO) of Tata Technologies.

The last time the Tata Group went public was in July 2004 with Tata Consultancy Services (TCS), which has since become one of the biggest wealth creators on Dalal Street, commanding a market capitalization of approximately Rs 11.7 lakh crore.

The Securities and Exchange Board of India (SEBI), the regulatory authority, has given its approval for the Tata Technologies IPO, marking a significant milestone for the Tata Group.

Related Read: ideaForge Technology IPO vs Cyient DLM IPO- Which IPO should you apply?

This IPO holds great importance for both the conglomerate and eager investors, as it represents a fresh chapter in the Tata Group’s journey.

The IPO will follow the offer for sale (OFS) route, where existing shareholders will sell up to 9.57 crore units, which is around 23.60% of the company’s paid-up share capital. Market insiders estimate that the IPO could be worth at least Rs 4,000 crore, indicating the high level of interest and anticipation surrounding the offering.

As we await further details about the Tata Technologies IPO, including the price range to be determined by the book-running lead managers, the market buzz continues to grow.

The Tata Group’s esteemed reputation, coupled with Tata Technologies’ strong position in the engineering services sector, sets the stage for an exciting IPO that holds the promise of growth and value creation for investors.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

Company Details:

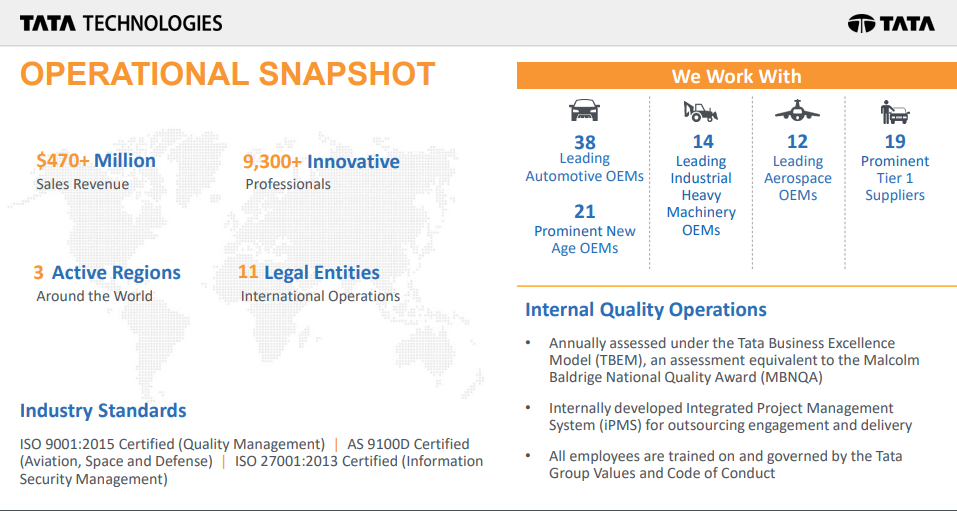

Tata Technologies Limited (TTL) is a global product engineering and digital services company founded in 1989.

A subsidiary of Tata Motors, that specializes in engineering services.

They provide innovative product development and digital engineering solutions, with a particular focus on manufacturing industries. Their expertise and technological advancements have earned them a strong reputation in the field.

Initially a business unit of Tata Motors, it became an independent entity headquartered in Singapore in 1994 and expanded operations in India in 1996.

It helps global OEMs and partners in

-Automotive,

-Industrial machinery,

-Aerospace, and

-Related industries to engineer and manufacture better products and improve business efficiencies.

The company has over 7,900 employees and major offices in 17 countries, serving more than 5,000 clients worldwide.

Additionally, Tata Technologies is ranked as the 15th-largest IT company in the Fortune India Infotech Industry ranking.

Business Overview

Tata Technologies specializes in product engineering and manufacturing engineering within the mechanical domain, with a particular focus on areas such as body engineering.

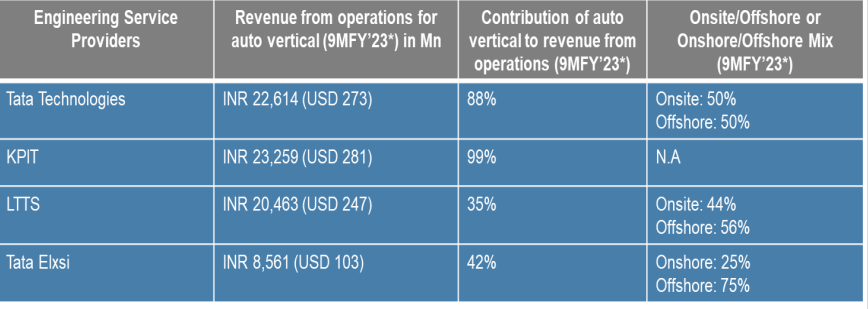

Additionally, the company is expanding its capabilities in software and embedded engineering, aligning itself with the expertise of peers like KPIT Tech, Tata Elxsi, and L&T Tech Services.

By enhancing its offerings in these segments, Tata Technologies aims to stay competitive and cater to the growing demand for software-driven solutions in the engineering services industry.

This strategic focus allows the company to tap into diverse markets and leverage its expertise across multiple domains, positioning itself as a comprehensive engineering solutions provider.

Related Read: MFs bought 1 crore Infosys shares in May- Should you buy now?

IPO Issue Details:

-The IPO is an offer for sale (OFS) with no fresh issuance of shares by the company.

-The offer includes up to 9.57 crore equity shares, representing 23.60% of its paid-up share capital.

-The exact size of the IPO has not been disclosed, but experts estimate it to be around Rs 3,800 crore based on the recent buyback

valuation.

-Tata Technologies’ recent buyback valued the company at Rs 16,080 crore.

Objectives of the OFS:

-The company will not receive any proceeds from the OFS; it will go to the selling shareholders.

-After deducting offer-related expenses and taxes, each selling shareholder will receive their respective proportion of the proceeds.

Selling Shareholders:

-Tata Motors, the parent company of Tata Technologies, will offload 8.11 crore shares, representing a 20% stake.

-Alpha TC Holdings Pte plans to sell up to 97.16 lakh shares (2.40%).

-Tata Capital Growth Fund Inc. would offload up to 48.58 lakh equity shares (1.20%).

Offer Structure:

-50% of the IPO shares are reserved for qualified institutional buyers (QIBs).

-35% of the shares are reserved for retail investors.

-15% of the shares are reserved for non-institutional investors.

Company’s Financials: ( As per DRHP )

Revenue Growth:

For the nine months ended December 2022, the company reported revenue from operations of Rs 3,011.79 crore, compared to Rs 2,607.30 crore for the nine months ended December 2021. This represents a growth of 15.5% in revenue.

Net Profit:

The net profit for the 9MFY23 period stood at Rs 407.47 crore, while it was Rs 331.36 crore for the 9MFY22 period. This indicates an increase in net profit.

Adjusted EBITDA Margins:

The company’s Adjusted EBITDA margins have shown consistent growth over the years. In FY20, the margin was 16.50%, and it increased to 19.20% in the 9MFY23 period.

Why Tata Motors share is surging?

Tata Motors shares have experienced a significant increase of more than 35% since Tata Technologies filed a Draft Red Herring Prospectus (DRHP) for its initial public offering (IPO).

The surge in share price can be attributed to market expectations that the IPO will strengthen Tata Motors’ balance sheet and bring substantial benefits to the company.

According to market experts mentioned in the Bloomberg article, the uptrend in Tata Motors shares is likely to continue following the launch of the Tata Technologies IPO.

Tata Technologies IPO contains shareholding of Tata Motors and the auto major is offering its shares for sale in this public issue, which is a 100 percent offer for sale (OFS). This means the net proceeds of Tata Technologies IPO will strengthen the balance sheet of Tata Motors instead of Tata Technologies.

According to the report, Tata Motors will improve its financial position and reduce debt by selling its equity stake in Tata Technologies. Tata Motors has invested a total of Rs 224.1 crore in Tata Technologies.

Under the IPO, Tata Motors intends to sell 81,133,706 shares of its subsidiary.

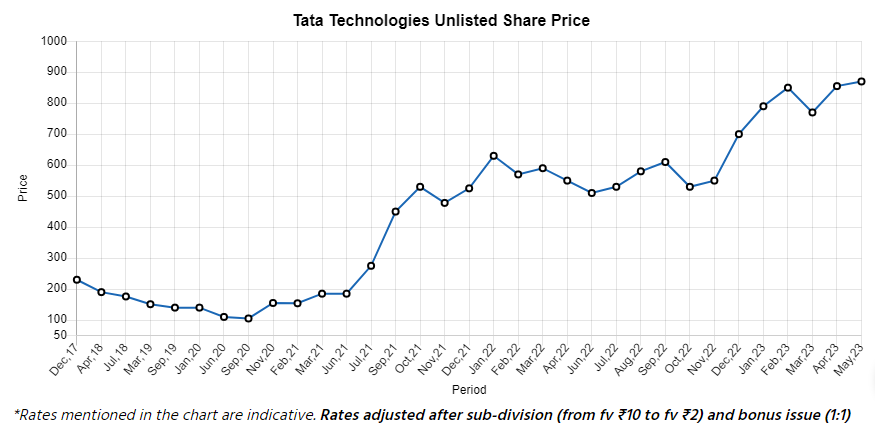

Tata Motors had acquired Tata Technologies shares at a price of Rs 7.40 apiece (as mentioned in the DRHP), whereas Tata Technologies’ share price is quoting around Rs 850 per share in the unlisted stock market.

So, the market is expecting huge monetary benefits for Tata Motors from this upcoming IPO of Tata Technologies.

Both the primary and secondary markets are optimistic about the Tata Technologies IPO due to the strong brand image associated with the Tata group. This positive sentiment is expected to translate into a successful public offering. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Key Parameters of Tata Motors

- Market Cap ₹ 2,05,889 Cr.

- Current Price ₹ 573

- High / Low ₹ 586 / 375

- Book Value ₹ 136

- Price to book value 4.20

- Face Value₹ 2.00

- Stock P/E 81.5

- Industry PE 96.9

- PEG Ratio -4.07

- Return over 1year 38.3 %

- Dividend Yield 0.35 %

Financial Ratios

- ROCE 6.14 %

- ROE 5.62 %

- OPM 9.20 %

- Debt ₹ 1,34,113 Cr.

- Debt to equity 2.96

- Int Coverage1.11

- Qtr Profit Var 563 %

- Qtr Sales Var 35.0 %

- Free Cash Flow ₹ 16,443 Cr.

Shareholding Pattern

- Promoter holding 46.4 %

- Change in Prom Hold 0.00 %

- FII holding 15.3 %

- Chg in FII Hold 1.45 %

- Public holding 20.4 %

- DII holding 17.7 %

- Chg in DII Hold 2.48 %

Technical Analysis and Targets of Tata Motors

Ganesh Dongre, Senior Manager — Technical Research at Anand Rathi, further

-Supports the bullish outlook for Tata Motors shares.

-Tata Motors’ share price witnessed a decisive rally after a channel breakout at Rs 470 to Rs 480 levels.

-Investors are advised to maintain a trailing stop loss at Rs 510 and hold the stock for the next targets of Rs 600 and Rs 615.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Fundamentally Strong Midcap IT Stock ” A Leader in Cloud Communication and Blockchain Solutions, If you are looking for a company that is in…….Read More

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More

——————-

Related Posts

1 Comment

Post A Comment

You must be logged in to post a comment.

Pingback:Will the Nifty Reach 21,000? - aceink.com

Posted at 22:21h, 30 June[…] Also Read: Tata Technologies IPO – Unlisted Share Price, Company, Business, Rally in Tata Motors: All You Ne… […]