04 Mar Tata Motors’ Demerger: All You Need to Know

Unlocking Value: Tata Motors’ Demerger Strategy

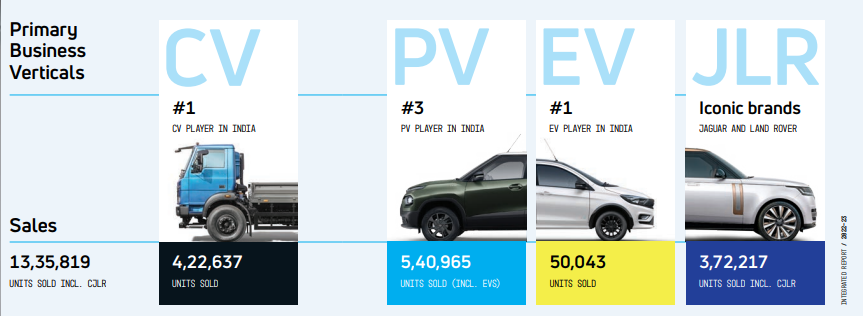

In a significant strategic move, Tata Motors Ltd (TML) has announced its decision to demerge its operations into two distinct listed entities: commercial vehicles (CV) and passenger vehicles (PV).

This recent announcement may not come as a shock to industry observers. This move is the culmination of earlier strategic maneuvers, including the establishment of a distinct vertical for electric vehicles (EVs) in 2018 and the segregation of its domestic PV business into a separate subsidiary in March 2020 amidst the onset of the COVID-19 pandemic.

Adding to the mix is the inclusion of the Jaguar Land Rover (JLR) business under the PV umbrella, providing a comprehensive offering for investors interested in domestic economic growth prospects.

Also Read: “How does the market trend move in a pre-election month?”

Tata Motors made this decision at a time when its domestic PV, CV, EV, and JLR segments were performing exceptionally well, reflecting positively on the company’s overall performance. Consequently, the stock experienced significant upward momentum, more than doubling in value over the past year.

While the market may have anticipated such a move to some extent, the true valuation of each entity will only be revealed upon their eventual listing, likely a year or more from now.

While conventional wisdom may suggest that CVs could be assigned a lower valuation compared to PVs, the actual market dynamics may paint a different picture. This uncertainty underscores the need for cautious optimism, especially considering the potential maturity of the domestic auto cycle by the time of listing.

Let’s delve into the details to understand the implications and potential outcomes of this demerger in simpler terms.

Also Read: Why IHCL is the Best Play for Industry Upcycle

Understanding the Demerger:

Imagine Tata Motors as a big cake. With this demerger, they’re slicing it into two smaller cakes: one for commercial vehicles like trucks and buses, and another for passenger vehicles like cars and SUVs. Despite this division, shareholders will still own a piece of both cakes.

Demerger Overview:

- TML’s demerger plan segregates its commercial vehicles and passenger vehicles businesses into separate entities.

- One entity will house the commercial vehicles business and its associated investments, while the other will encompass the passenger vehicles businesses, including EVs, JLR, and related investments.

- Shareholders will retain identical holdings in both listed entities, ensuring continuity in ownership structure.

- Regulatory approvals are anticipated to be obtained within a timeframe of 12-15 months, marking the completion of the demerger process.

- Despite the division, manufacturing operations for commercial and passenger vehicles will remain unaffected, as both segments boast separate manufacturing facilities.

Also Read: Why Jefferies is Bullish on These 26 Companies: A Comprehensive Analysis

Financial Snapshot:

Let’s look at the numbers.

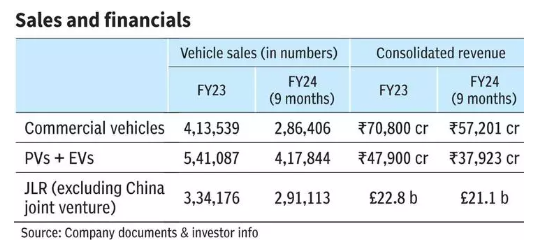

- TML’s commercial vehicle business recorded robust revenue of Rs. 57.2 thousand crore YTDFY24, underscoring its strong market presence and revenue generation capabilities.

- Conversely, the passenger vehicle business witnessed revenue of Rs. 37.9 thousand crore YTD FY24, showcasing its significant contribution to the company’s overall financial performance.

- Market share statistics further highlight the commercial vehicle segment’s dominance, with a commanding 37% share in overall CV sales.

- In the passenger vehicle domain, TML has made substantial strides, securing a 12-13% market share in internal combustion engine (ICE) vehicles, fueled by successful launches such as the Nexon and Punch.

Why It Matters:

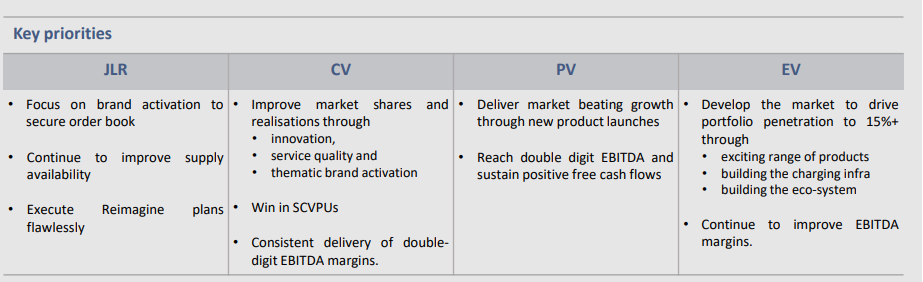

The demerger underscores Tata Motors’ commitment to strategic alignment and focused execution. By streamlining its operations into specialized entities, the company seeks to amplify its competitive advantage within each market segment.

This targeted approach facilitates more nuanced decision-making processes, enabling Tata Motors to capitalize on emerging opportunities and navigate evolving industry dynamics with precision. By focusing on specific areas like CVs or PVs, Tata Motors can better tailor its strategies and grab opportunities in each market segment.

This could mean more growth and better profits, which is good news for shareholders.

What Experts Say:

Experts see this move as a smart play. By splitting into two, Tata Motors can focus more on what they’re good at.

For the PV business, this means capitalizing on electric vehicles and the success of models like Nexon and Punch. On the CV side, they’re dominating with a 37% market share and eyeing growth in e-buses.

Investor Outlook:

- Analysts view the demerger as a strategic maneuver aimed at unlocking shareholder value and enhancing operational efficiencies.

- The passenger vehicle business, bolstered by successful product launches and a burgeoning electric vehicle (EV) portfolio, stands poised for sustained growth.

- Jaguar Land Rover (JLR), a key component of the passenger vehicle entity, contributes significantly to profitability, with robust margins and positive cash flow projections.

- Conversely, the commercial vehicle segment, buoyed by its dominant market position and foray into the burgeoning e-bus sector, presents compelling growth prospects.

In the world of investing, change is constant. Tata Motors’ demerger is a bold move that could unlock hidden value for shareholders. By focusing on specific areas of their business, they’re aiming for more growth and better returns. For investors, it’s a reminder that sometimes, breaking things apart can lead to greater success in the long run.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments