“The Risks and Rewards of Investing in Dividend Stocks: What You Need to Know”

Are you looking for a way to generate passive income while building long-term wealth?

Have you considered investing in dividend-paying stocks?

Dividend stocks are a unique investment opportunity that allows investors to earn a steady stream of income while potentially benefiting from long-term capital appreciation, but there is also some risk involved.

Dividends are an important concept for anyone who invests in stocks, but they can often be confusing or intimidating. In this article, we’ll break down what dividends are, why companies pay them, what investors should consider when evaluating dividend-paying stocks, what the risks involved are, and many more. So let’s dive in and explore the world of dividends and dividend-paying stocks!

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

What are dividends?

A dividend is a payment made by a company to its shareholders, usually in the form of cash, but sometimes in the form of additional shares of stock or other assets. Dividends are typically paid out on a regular basis, such as quarterly or annually, and are usually based on the company’s earnings.

Why do companies pay dividends?

Companies pay dividends for several reasons.

First, it’s a way for them to distribute their earnings to shareholders. Instead of keeping all of their profits, they can share some of the wealth with the people who own the company (i.e., the shareholders). This can be especially important for companies that have matured and are no longer experiencing high levels of growth. By paying dividends, they can still provide a return to their shareholders even if their stock price isn’t increasing at a rapid rate.

Another reason companies pay dividends is to attract investors. Some investors, particularly those who are retired or looking for a steady stream of income, may be more interested in stocks that pay dividends than those that don’t.

Finally, paying dividends can also be a way for companies to signal to the market that they are financially stable and profitable. When a company pays a dividend, it’s a sign that they have enough cash on hand to cover its expenses and still have money left over to share with its shareholders.

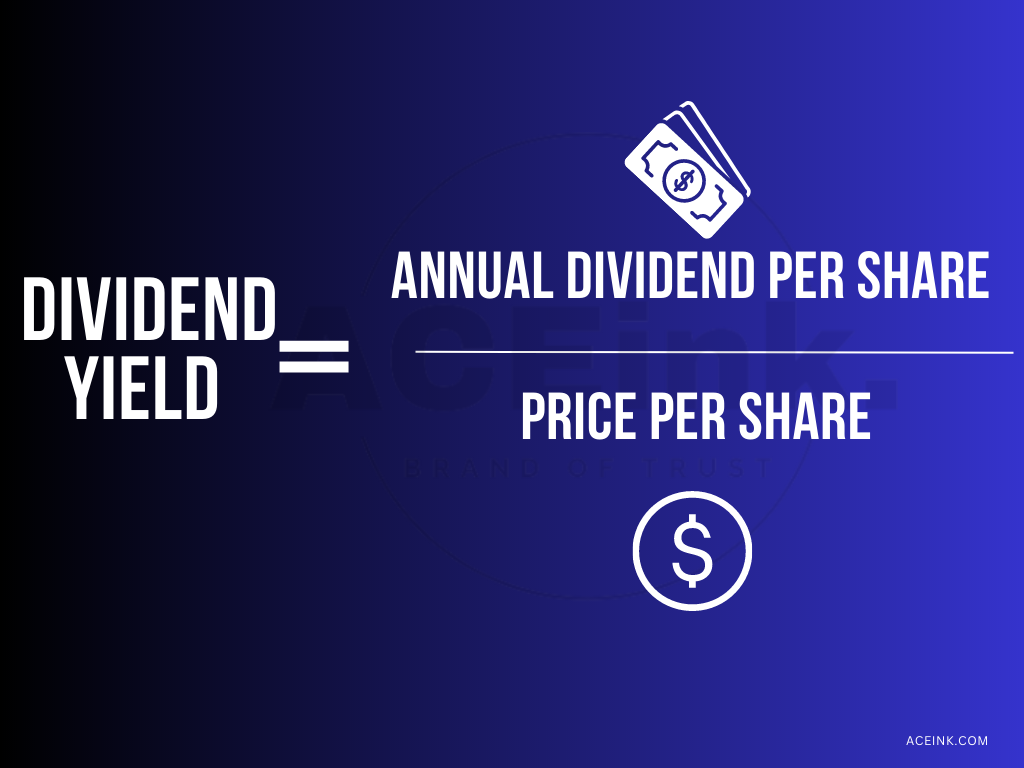

What is dividend yield?

The dividend yield is a financial ratio that represents the annual dividend payment of a stock relative to its current stock price. In other words, it measures the percentage of a company’s stock price that is returned to shareholders in the form of dividends.

For example, if a company pays an annual dividend of Rs15 per share and

its stock is currently trading at Rs450 per share,

the dividend yield would be 3%

(15/450 = 0.03 or 3%)

How much dividend yield is good?

The “good” dividend yield depends on your investment goals and risk tolerance.

In general, a dividend yield that is higher than the average yield for the market or industry may be considered attractive. However, a very high dividend yield may indicate that the market is skeptical about the company’s future earnings or that the company is paying out more in dividends than it can sustainably afford.

A high dividend yield may be attractive to investors seeking a reliable stream of passive income, but it’s important to consider a company’s overall financial health and dividend history before making any investment decisions based solely on dividend yield.

In short, there is no hard and fast rule for what constitutes a “good” dividend yield. It’s important to consider a company’s overall financial health and dividend history, as well as your own investment goals and risk tolerance, before making any investment decisions.

What should investors consider when evaluating dividend-paying stocks?

-Look for companies with a long history of dividend payments:

First, look at the company’s dividend history. Have they consistently paid a dividend over the past several years?

Have they increased the dividend over time?

Companies that have a long history of paying and increasing their dividends are often considered more stable and financially sound.

For example, companies like TCS, and IOC have been paying dividends for over many consecutive years, which can be a strong indicator of their financial health and commitment to returning value to shareholders.

– Consider the payout ratio:

The payout ratio is the percentage of a company’s earnings that are paid out in dividends. A higher payout ratio can be an indication that a company is committed to returning value to shareholders, but it can also be a sign that the company is not reinvesting enough earnings back into the business. It’s important to evaluate a company’s payout ratio in the context of its overall financial health.

-Dividend yield:

Next, consider the company’s dividend yield. A higher dividend yield may be more attractive to some investors, but it’s important to remember that a high yield can also be a sign of a company that is struggling financially and may not be able to maintain the dividend in the long term.

-Company’s overall financial health:

Finally, look at the company’s overall financial health. A company that is paying dividends but also has a high level of debt or isn’t generating consistent profits may not be a good investment. It’s important to consider the company’s financials as a whole before making any investment decisions.

What are the benefits of dividend-paying stocks?

-Dividend-paying stocks can provide a steady source of income:

Investors looking for a reliable stream of passive income can benefit from investing in dividend-paying stocks. Companies that pay consistent and growing dividends can provide a reliable source of income for investors, which can be especially important for those who are retired or looking for a steady stream of income.

– Dividend-paying stocks can provide stability in volatile markets:

In times of market volatility, dividend-paying stocks can provide stability for investors. Companies that pay consistent dividends are often more established and financially stable, which can help protect investors during times of market turbulence.

-Diversify your portfolio:

As with any investment strategy, it’s important to diversify your portfolio when investing in dividend-paying stocks. This can help mitigate risk and provide exposure to a range of companies and industries. By diversifying your portfolio, you can also benefit from the potential for capital appreciation, as well as income generated from dividends.

What is the risk in investing in dividend-paying stock?

While investing in dividend-paying stocks can offer many benefits, there are also risks to consider. Here are some of the key risks to keep in mind when investing in dividend stocks:

Market risk:

Like all stocks, dividend-paying stocks are subject to market risk. The value of these stocks can fluctuate based on a variety of factors, including changes in the overall economy, shifts in industry trends, and company-specific news.

Dividend cuts or suspensions:

While dividend-paying stocks can offer a steady stream of income, there is always the risk that a company may reduce or suspend its dividend payments. This can happen if a company’s earnings decrease or if it needs to conserve cash for other purposes, such as investing in growth opportunities.

Interest rate risk:

When interest rates rise, dividend stocks may become less attractive to investors, as they may choose to move their money into fixed-income investments that offer higher yields. This can lead to a decrease in the price of dividend-paying stocks.

It’s important to keep these risks in mind when investing in dividend-paying stocks. While these stocks can offer a reliable stream of income and potential long-term capital appreciation, they are not risk-free investments. Diversifying your portfolio and carefully evaluating the financial health and growth potential of each company can help mitigate these risks and potentially enhance your investment returns over the long term.

——————–

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.