06 Jul Biggest Positive Development in Tata Power

“Big Reasons Why Tata Power Should be on Your Watchlist”

Tata Power, one of India’s leading power companies, experienced a significant boost in its share price, rising by 3.63% to reach Rs 229.74.

This jump is followed by the company’s recent order worth Rs 1,744 crore to implement a smart metering project for Chhattisgarh State Power Distribution Company. The project is expected to be completed over a span of 10 years.

In a world where sustainable energy sources are becoming increasingly vital, Tata Power has embarked on an exciting transformation. With a rich history dating back over a century, The company has set its sights on a future driven by renewable energy.

Investors have shown great enthusiasm for Tata Power, as reflected by its stock performance. Over the last two years, the company’s stock has witnessed an 80% increase, and in the last five years, it has skyrocketed by over 220%.

But, The real reason for their excitement is the major development that awaits Tata Power, which has the potential to completely change the company’s fate for the better.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

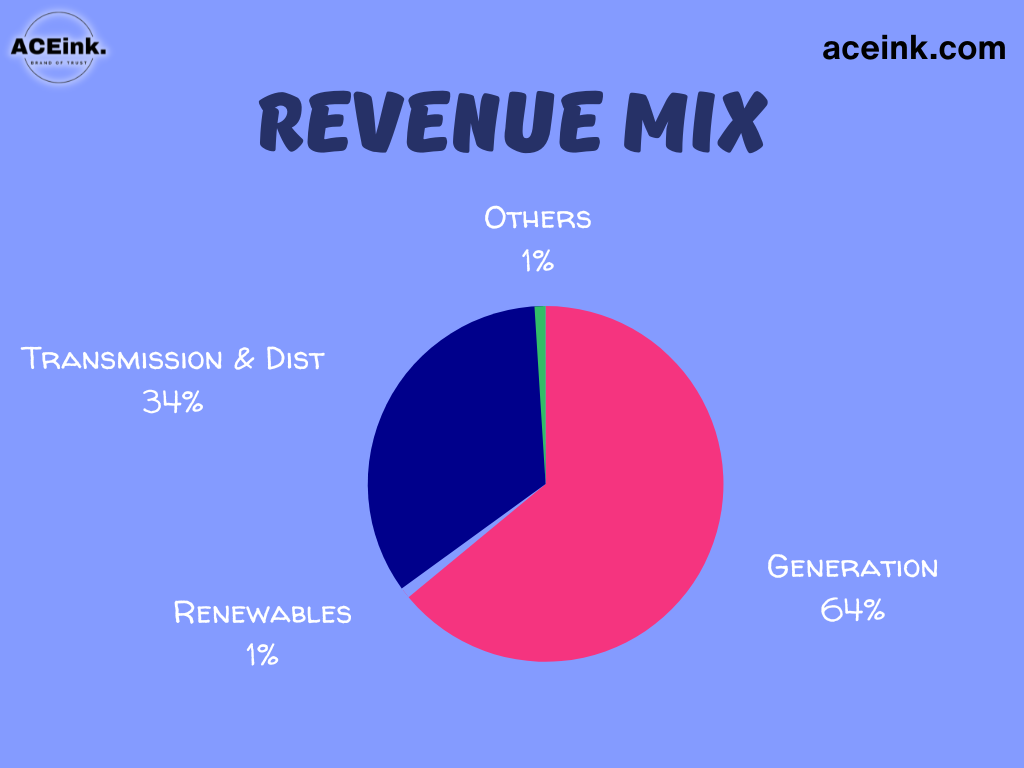

Power Portfolio

It is one of the leading integrated power companies in India, engaged in the generation, transmission, and distribution of electricity, as well as the development of renewable energy projects.

Presently, the company has a total capacity of around 13,985MW from its various

-Thermal, hydro, Renewable, WHR power projects across India.

Out of the total capacity,

-Thermal accounts for 57%

-Solar (25%)

-Wind (8%)

-Hydro (7%) and

-Waste-heat recovery (3%)

Related Read:Tata Power – Buy, sell, Hold- What Experts are saying

Mundra Plant turning profitable – Biggest Positive Development

Tata Power, won the bid for the Mundra Ultra Mega Power Plant (UMPP) in 2007, with high expectations for its success. The initial plan was to fuel the UMPP with coal imported from Tata’s mines in Indonesia.

However, trouble began to emerge a few years later when the Indonesian government mandated that coal exports could only be done at prices linked to international rates. This came as a shock to Tata Power, which then sought higher tariffs for power in India but had its plea rejected by the Supreme Court.

The challenges for the UMPP intensified around a decade later, in 2021 when international coal prices surged from USD 100 per tonne to over USD 400 per tonne.

Tata Power was unable to make changes to the power supply agreements (PSAs) and increase tariffs accordingly.

Consequently, the company was forced to completely halt operations at the Mundra UMPP due to the unviable power purchase agreements (PPAs) with five states.

In 2017, the company offered to sell a 51% stake in the project to overcome financial difficulties. The plant had accumulated significant loans, and further financial support was hindered by the project’s unviability.

Tata Power operates six thermal power plants in India, located in

-Trombay (Mumbai),

-Jojobera and Maithon (Jharkhand),

-Belgaum (Karnataka), and

-Mundra (Gujarat).

The Mundra power plant, the largest among Tata Power’s portfolio, is currently operating four out of its five units, with the fifth unit undergoing maintenance.

However, there is a glimmer of hope for the power plant as the Central Electricity Regulatory Commission CERC has decided to compensate imported coal-based power plants for supplying electricity at a higher cost under exceptional circumstances under sec 11.

The Section 11 regime, implemented on March 16, 2023, allows power companies like Tata Power to pass on the full cost of power generation to consumers under the Electricity Act.

This regime has been enforced by the Union power ministry in response to the significant increase in electricity demand. Tata Power, among other companies, benefits from this provision, allowing them to pass on costs such as coal expenses and fixed costs to consumers.

This could potentially change the fortunes of the Mundra UMPP.

To ensure a steady supply of coal, Tata Power has secured back-to-back tie-ups for importing coal from Indonesia for the Mundra plant throughout the year. This will help support the plant’s operations and address previous challenges related to coal supply.

During the three months when the plant was not operational from January to March of the current year, Tata Power incurred losses and made a provision of INR 200 crore due to an onerous contract. With the implementation of Section 11 and all plants running, Tata Power expects to resume shipments and potentially reverse some of the provisions.

The revival of the Mundra power plant aligns with the growing power demand in India.

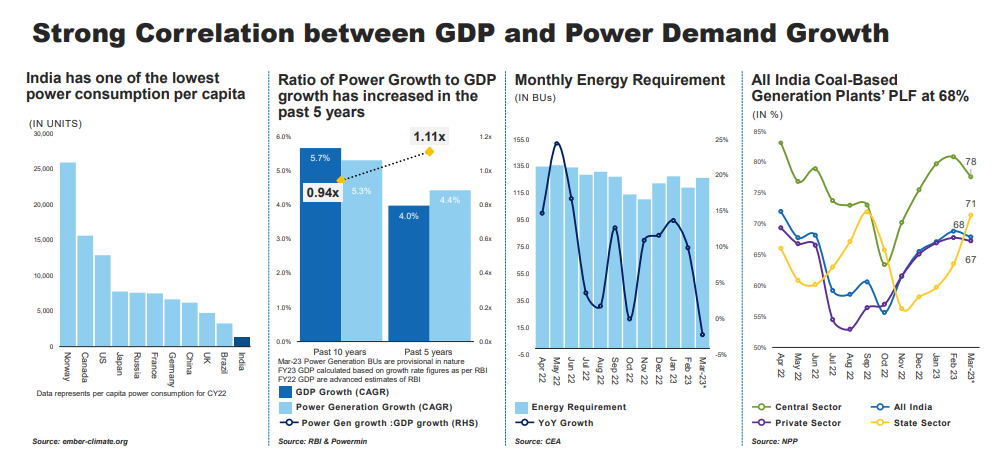

Increasing Power Demand

India experienced a significant increase in power demand, with a 7% increase in the last quarter and a 9% increase for the full year. This indicates a growing need for electricity in the country.

The ratio of power generation growth to GDP growth has increased from 0.94 in the last decade to 1.11 in the last five years.

Coal-based power generation accounted for more than 74% of the total power generated in FY23.

Decreasing Coal Price

Additionally, there have been other positive developments for Tata Power.

In the last six months, international thermal coal prices have dropped by more than 50%.

This reduction is attributed to increased supplies from South Africa and Colombia, which have eased the demand crunch in European countries caused by reduced coal imports from Russia.

Furthermore, a warmer winter compared to previous years has contributed to the decline in international coal prices.

While coal prices have fallen globally, including Indonesian coal, companies were still subject to paying a royalty based on a certain fixed slab in accordance with Indonesian regulations. However, the Indonesian government has recently made changes to this royalty pay slab, raising hopes for improvements in the coming months.

Government Policies:

The government plans to auction around 50 GW of renewable capacity this year and in the following years.

Tata Power is prepared to bid for round-the-clock projects and offers strong solutions for solar, wind, and storage.

Financials

Tata Power has been making significant progress in improving its financial position.

-In the March quarter, the company reported a 48% year-on-year increase in net profit.

-Tata Power demonstrated strong financial performance, with a profit after tax (PAT) of INR 939 crores and a revenue growth of 32% compared to the previous year.

-This positive performance has been accompanied by a gradual reduction in debt since FY16 when the gross debt exceeded INR 49,000 crore. The company has been working towards reducing its gross debt to less than INR 25,000 crore by the end of the financial year, and the current net debt stands at INR 35,328 crore.

-The company reduced its debt by approximately INR 2,800 crores in the March quarter and intends to invest about INR 12,000 crores in FY 2024 using internal accruals and operating profits.

-TPSSL’s profitability has increased due to selective project execution and the completion of high-profit margin projects.

Investments:

Tata Power is also looking toward future growth and investments.

The company plans to invest nearly INR 12,000 crores in FY 2024 from internal accruals and operating profits, indicating its confidence in the market and its ability to generate funds for expansion.

Furthermore, Tata Power has successfully divested assets, receiving INR 900 crores from the sale of the Arutmin mines.

Additionally, INR 500 crores of shareholders’ loan line has been converted to dividends, providing further financial stability.

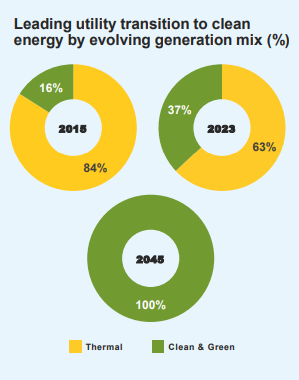

Renewable Projects:

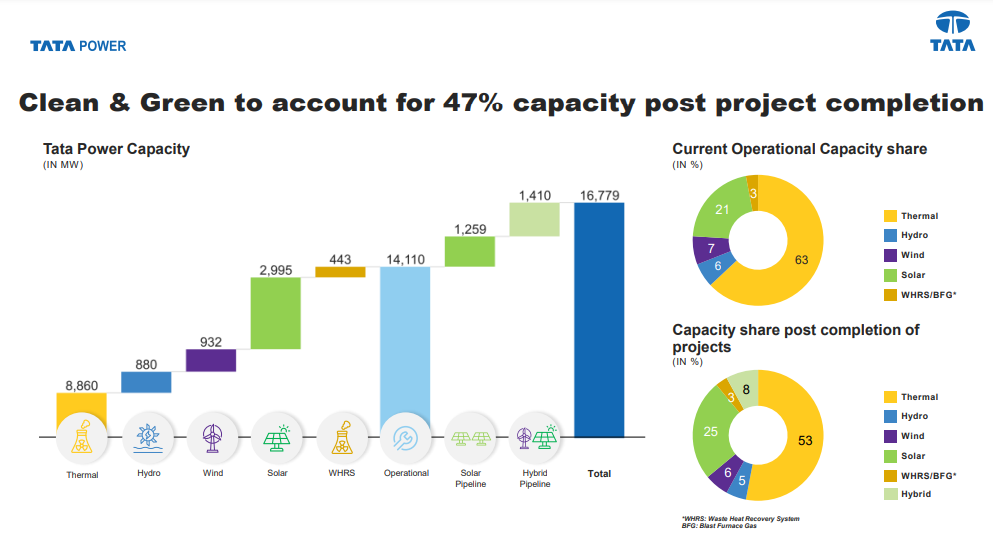

Tata Power has set ambitious targets to increase the share of renewable energy in its portfolio.

The company aims for renewable energy to account for 60% of its portfolio by 2025, a significant jump from the current level of 30%.

Furthermore, Tata Power envisions clean energy to make up 80% of its generation capacity by 2030, as it strives to achieve net carbon zero status by 2045.

To achieve these targets, Tata Power has shifted its focus towards solar and wind energy while reducing its reliance on coal-fired electricity generation, which is more polluting. However, due to the rising power demand in the country, the company may need to continue meeting some of this demand through fossil fuel-based generation in the short term.

-Currently, Tata Power has nearly 6,600 MW of renewable projects in its portfolio, reflecting its commitment to expanding renewable energy capacity.

-The company’s rooftop business experienced significant growth, installing a total of 718 MW during the year, with an order backlog of 468 MW.

-The renewable pipeline includes 2.6 GW, and the order book stands at INR 17,000 crore, indicating higher capex for FY’24.

-To expand its presence in the renewable energy sector, Tata Power is planning to set up a 4 GW cell and module manufacturing plant in Tamil Nadu, indicating its focus on sustainable energy solutions.

-The capital expenditure (capex) for renewables amounts to approximately INR 2,500 crore out of a total consolidated capex of INR 6,500 crore.

In addition to its financial achievements, Tata Power has received accolades for its performance. The company’s credit rating has been upgraded, and it was honored with India’s Best Annual Report Award for 2021, highlighting its commitment to transparency and excellence in reporting.

Risks In Investment

Investing in Tata Power carries certain risks that potential investors should be aware of.

First, regulatory and policy changes in the energy sector could impact the company’s operations and profitability.

Additionally, fluctuations in commodity prices, especially coal and renewable energy equipment, may affect Tata Power’s costs and revenue.

The company’s reliance on external sources for fuel, such as imported coal, exposes it to geopolitical and supply chain risks.

Moreover, the competitive landscape in the energy industry and the potential for increased competition from renewable energy players could pose challenges for Tata Power. Lastly, macroeconomic factors and shifts in consumer demand for energy could impact the company’s financial performance.

It is crucial for investors to carefully evaluate these risks before making investment decisions.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“ Rs 782 to Rs 3,552 in three years: Can multi-bagger FMEG stock hit the Rs 4,000 mark?…Read More

With EPS Growth And More: Why This Share Makes An Interesting Case

——————-

“Why the Thriving entertainment Industry Should Be on Your Investment Radar” Visualize the glistening waters of Goa, India’s…Read More

“Discovering Hidden Gems: The Investment Potential of the Gaming Stock”

Related Posts

Post A Comment

You must be logged in to post a comment.

No Comments