17 Feb Fundamentally Strong Electric Vehicle EV Stock

Fundamentally Strong Electric Vehicle EV Stock

According to the forecasts made by DIGITIMES Research analyst Jessie Lin, EV uses will increase to 17% by 2023, 24% by 2024, and nearly 33% by 2025, globally. The sales volume of EVs is likely to reach 140 lakh units in 2023 and 285 lakh units in 2025.

As the EV revolution is picking up pace, SONACOM has increased its focus on electric vehicles (EV), the company is among the few companies that can design high-power density EV systems resulting in higher orders from customers.

According to ICICI Securities, the company has the potential to outperform for the following reasons

– Strong Clientele base

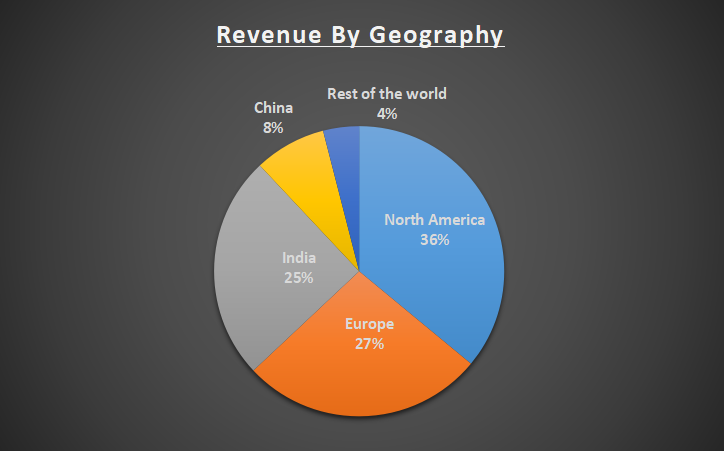

– Focusing on diversification across geographies and vehicle segments

– Increasing focus on the EV segment

Going forward, increasing market share across various components along with a strong order book will help Sona BLW drive its growth.

ICICI Securities has given to following target on Sona BLW Ltd

Target price: Rs574| Potential Upside: 27%

About Sona BLW

– Engaged in the business of designing, manufacturing, and supplying automotive systems and their components

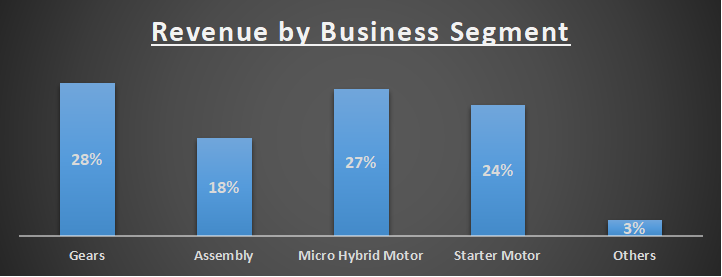

– Having products like electric vehicle (EV) traction motors, differential assemblies, gears, motors and belt starter generator (BSG) systems

– Serving leading automobiles like Volvo Eicher, Daimler, M&M, Escorts, Mahinda Electric, Renault Nissan, Maruti Suzuki, Ashok Leyland etc.

– 79% of its revenue comes from its top 10 customers

Global Leadership:

– The Largest manufacturer of differential gears for Passenger vehicles, commercial vehicles & Tractors in India

– One of the Top 10 Global Differential Bevel Gear Suppliers with a 5% market share

– Among the Top 10 Global Starter Motor Suppliers with a 3% market share

– Having an 8.7% market share in Battery Electric Vehicle (BEV) Differential Assembles globally

World-class research and development (R&D) facility:

– Continuously innovating new products

– Introduced a new EV product recently

Focusing on diversification

– Planning to increase the company’s market share across all segments

– Introducing new products to widen its current product portfolio

– Penetrating new geographies

Focus on the EV sector:

– Received 41 EV orders from 25 customers by the end of Dec 2022

– Currently, its EV share in revenue is 29%,

– Planning to increase it to 50% in the next 2 years

Key risks:

– Global car electrification Slowdown

– Inability to get desired PLI benefits

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments