27 Jun ideaForge Technology IPO vs Cyient DLM IPO

All you need to know : GMP, subscription status, price, review, valuations- Which IPO should you apply?

The stock market is buzzing with activity as many companies are going public and offering their shares to investors.

This week, there are a total of seven companies going public, with three of them listed on the mainboard and four in the SME segment.

One notable IPO is that of ideaForge Technology, a drone manufacturer, which opened on Monday and quickly attracted enough interest from investors to fully subscribe to its offering within just a few hours.

Meanwhile, Cyient DLM, a subsidiary of the listed IT major Cyient Ltd, opened its IPO for subscription on Tuesday.

The company operates as an integrated Electronic Manufacturing Services (EMS) and solutions provider, offering a wide range of services throughout the value chain and product life cycle. With its expertise and capabilities, Cyient DLM caters to various industries and provides end-to-end solutions in the electronic manufacturing sector.

So, which IPO should you invest in – ideaForge IPO or Cyient DLM IPO?

Both companies are fast-growing and have the potential to deliver significant listing gains.

However, analysts believe investors should carefully consider their risk tolerance before investing in either company.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

Experts’ View

The view presented by the analyst highlights the potential preferences of short-term and long-term investors regarding the IPOs of IdeaForge Technologies and Cyient DLM.

IdeaForge Technologies:

According to the analyst, IdeaForge Technologies’ IPO may be attractive to short-term investors seeking listing gains.

However, they advise caution for long-term investors due to a visible slowdown in the order book and a high concentration of revenues from the Indian defense forces.

This indicates that while the company may offer short to medium-term potential, a longer-term investment approach requires monitoring the company’s performance and diversification of revenue sources.

Cyient DLM:

The analyst believes that Cyient DLM is better positioned for long-term investment perspectives.

The company is noted to have competitive advantages and capabilities such as sectoral expertise, manufacturing complex products, providing end-to-end solutions, and enjoying the trust of its customers.

These factors are seen as providing Cyient DLM with a strong edge in the marketplace.

The implication is that the company’s potential for sustained growth and market positioning makes it appealing for long-term investors.

Also Read: MFs bought 1 crore Infosys shares in May- Should you buy now?

Anubhuti Mishra, Equity Research Analyst at Swastika Investmart Ltd, provides an alternative perspective on the IPOs of Cyient DLM and IdeaForge Technologies. Here are the key points highlighted by Mishra:

IdeaForge Technologies:

-Mishra acknowledges the growth potential of IdeaForge Technologies, particularly in the growing demand for drones in India.

-However, she points out that the company faces challenges such as competition from international players and regulatory uncertainty.

-These factors introduce inherent risk for long-term investors, suggesting that only aggressive investors should consider holding IdeaForge Technologies for the long term.

Cyient DLM:

-Mishra believes that Cyient DLM is benefiting from the increasing adoption of digital technologies by businesses.

-The company has a strong track record of growth and is well-positioned for future growth.

-This suggests that the company has the potential to deliver both short-term and long-term gains for investors.

IdeaForge Technology IPO and Cyient DLM -IPO Details

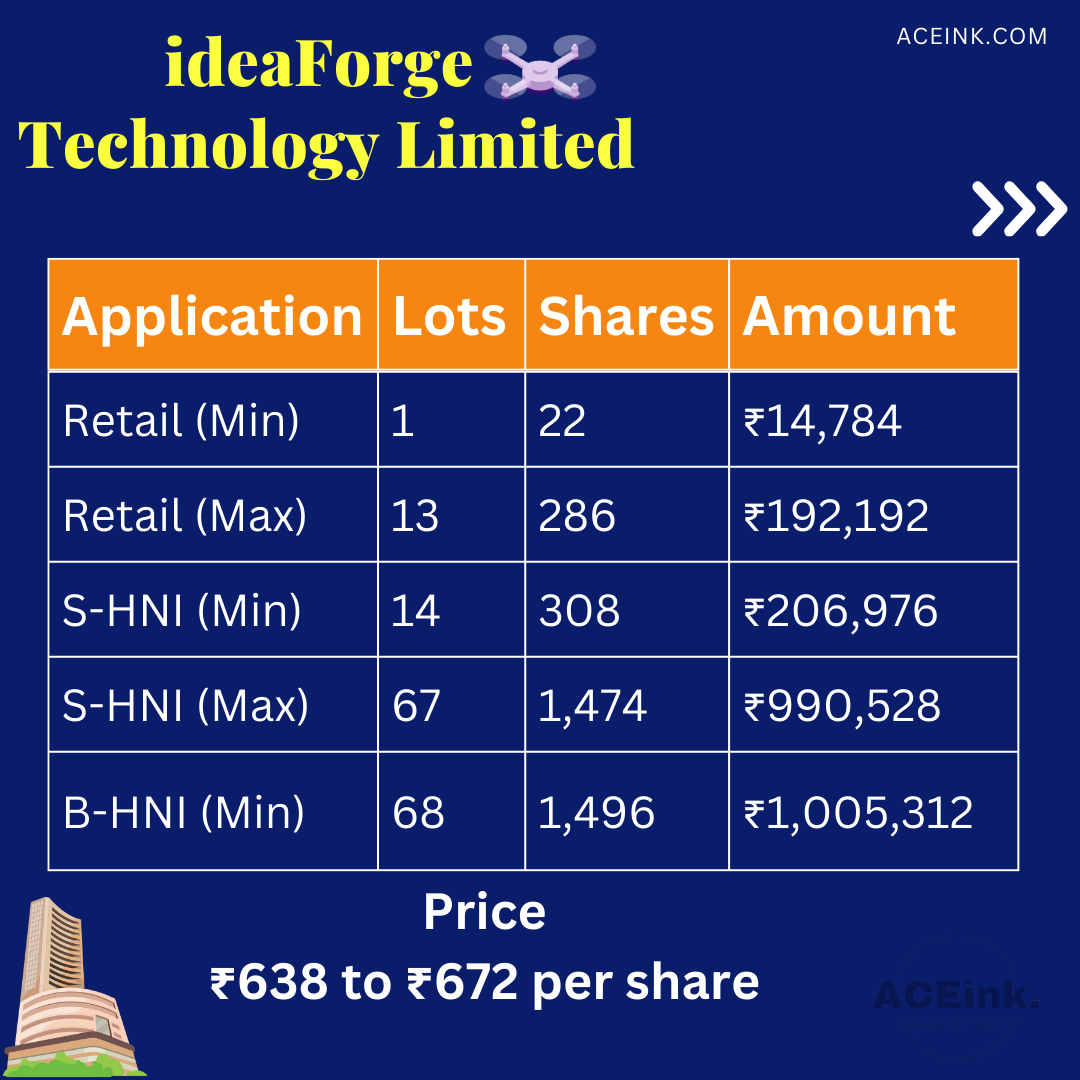

IdeaForge Technology IPO:

Opening Date: June 26, 2023

Closing Date: June 29, 2023

IPO Size: Rs 567 crore

Price Band: Rs 638 to Rs 672 per equity share

Components: Fresh issue of shares worth Rs 240 crore and an offer for sale (OFS) of 48.69 lakh shares

-The IPO of IdeaForge Technology Ltd received a strong response on its first day of subscription.

-It was subscribed 3.69 times, indicating significant investor interest.

-The retail investors’ portion was subscribed 12.48 times, and the employee portion was subscribed 8.47 times.

-The IPO will remain open for subscription until Thursday, June 29.

-The company aims to raise Rs. 567 crores through a combination of fresh issue and offer for sale.

-IdeaForge Technology holds a significant market share in the Indian unmanned aircraft systems (UAS) market, which positions it as a pioneer and market leader in its industry. This may provide a competitive advantage and potential growth opportunities.

Cyient DLM IPO:

Opening Date: June 27, 2023

Closing Date: June 30, 2023

IPO Size: Rs 592 crore

Price Band: Rs 250 to Rs 265 per equity share

Components: Fresh issue of 2.23 crore equity shares

-Cyient DLM, a subsidiary of Cyient Ltd (a listed IT major), launched its IPO for subscription on Tuesday.

-The company is an integrated Electronic Manufacturing Services (EMS) and solutions provider, offering services across the value chain and product life cycle.

-The IPO intends to raise Rs 567 crore, with a fresh issue of shares worth Rs 240 crore and an offer for sale (OFS) of 48.69 lakh equity shares worth Rs 327 crore by promoters and investors.

-It’s worth noting that the ideaForge Technologies IPO has already garnered significant interest from retail investors, suggesting strong demand for the offering. The high interest from retail investors indicates the potential for an active and competitive subscription process.

-For the Cyient DLM IPO, it will be interesting to observe investor response and subscription levels over the course of its subscription period.

-Cyient DLM operates in the sunshine EMS sector, which is expected to benefit from government support and has sustained business performance potential.

Financial Performance:

ideaForge Technology:

FY23 Net Profit: Rs 31.99 crore (27.3% decrease from FY22)

FY23 Revenue: Rs 186 crore (16.66% increase from FY22)

FY22 Net Profit: Rs 44.01 crore

FY21 Net Loss: Rs 14.63 crore

FY21 Revenue: Rs 36.34 crore

Outstanding Order Book (as of March 2023): Rs 192.27 crore (decreased from Rs 310.87 crore in FY22)

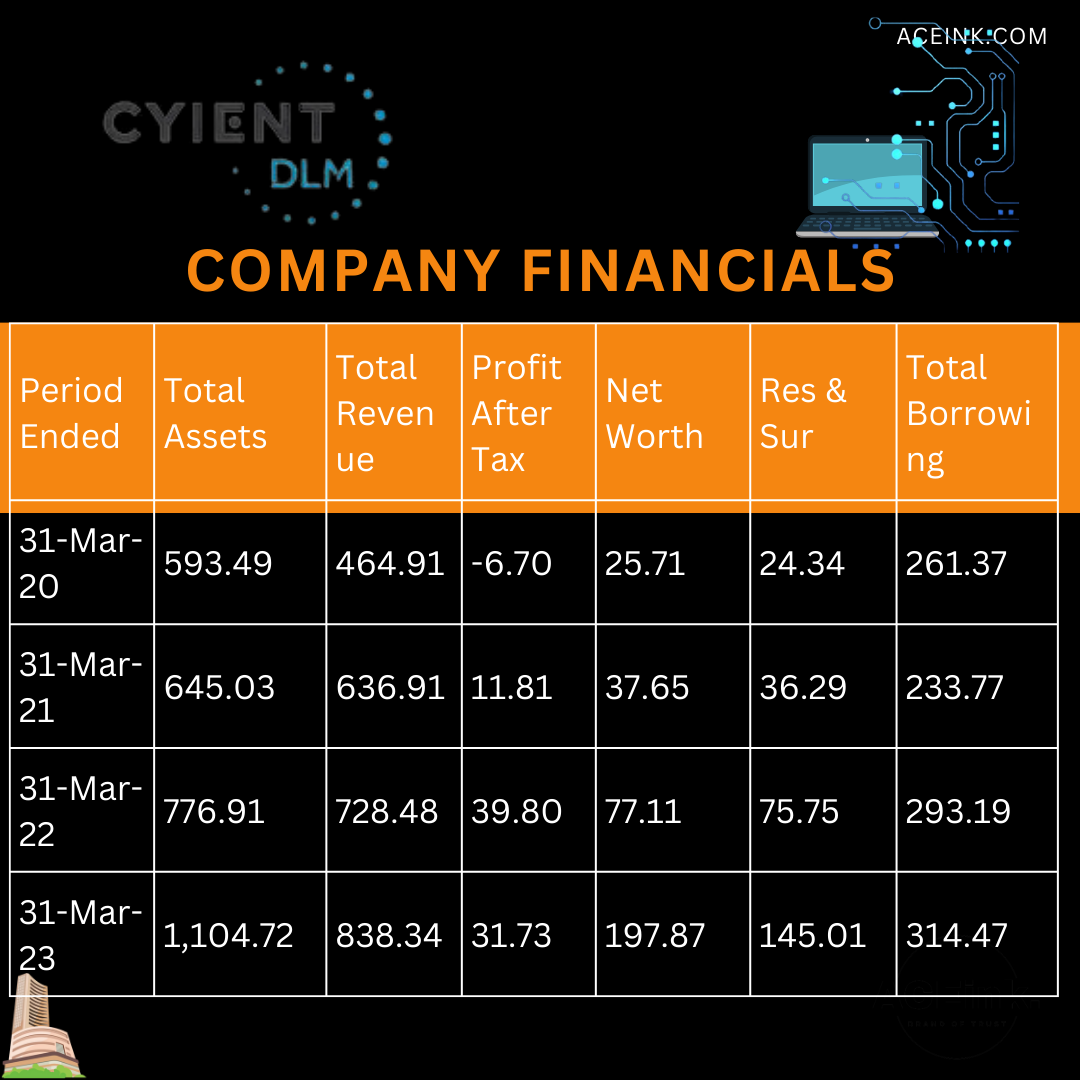

Cyient DLM:

FY23 Net Profit: Rs 31.73 crore (4% increase from the previous year)

FY23 Revenue: Rs 832 crore (15.4% increase from the previous year)

FY22 Net Profit: Rs 39.80 crore

FY22 Revenue: Rs 720.53 crore

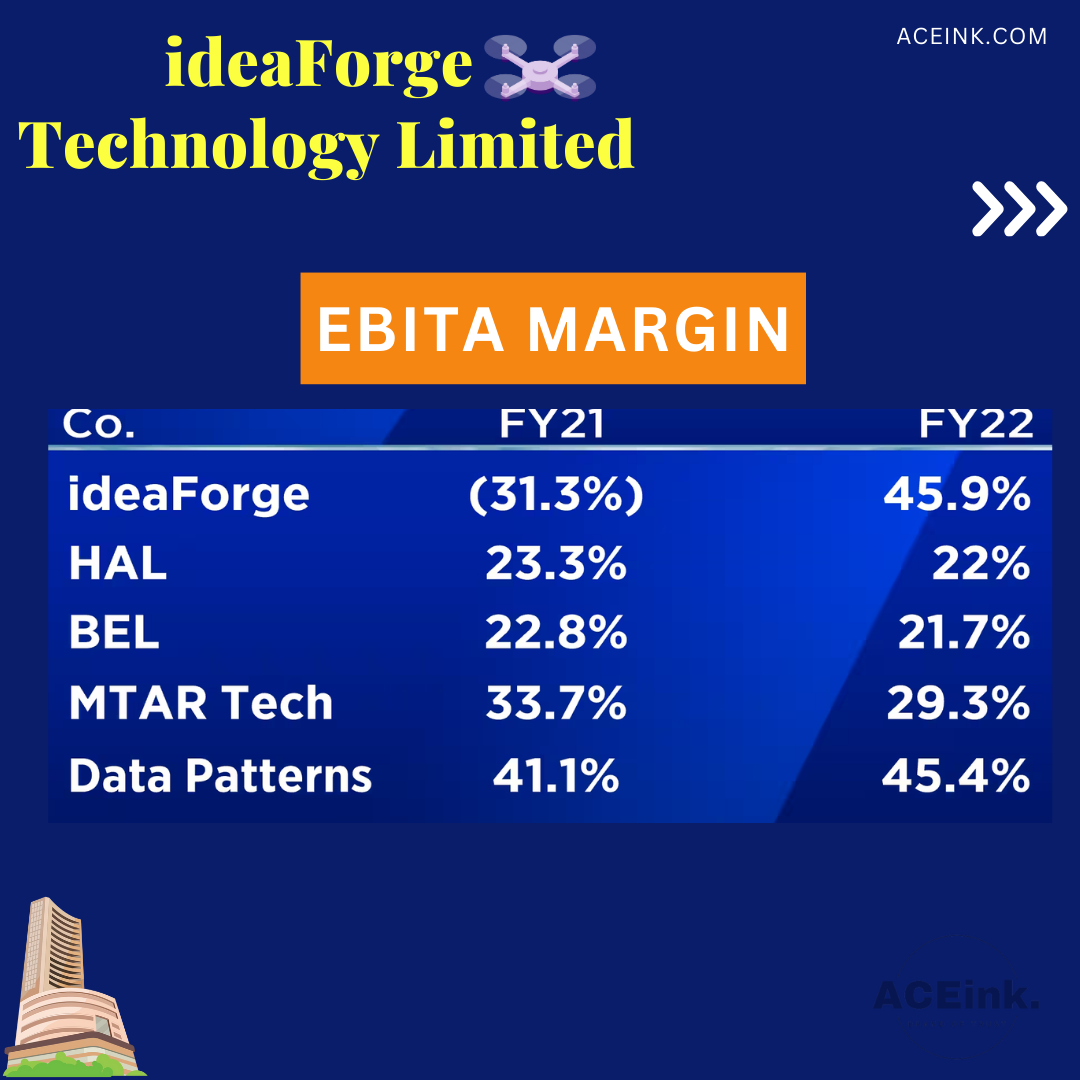

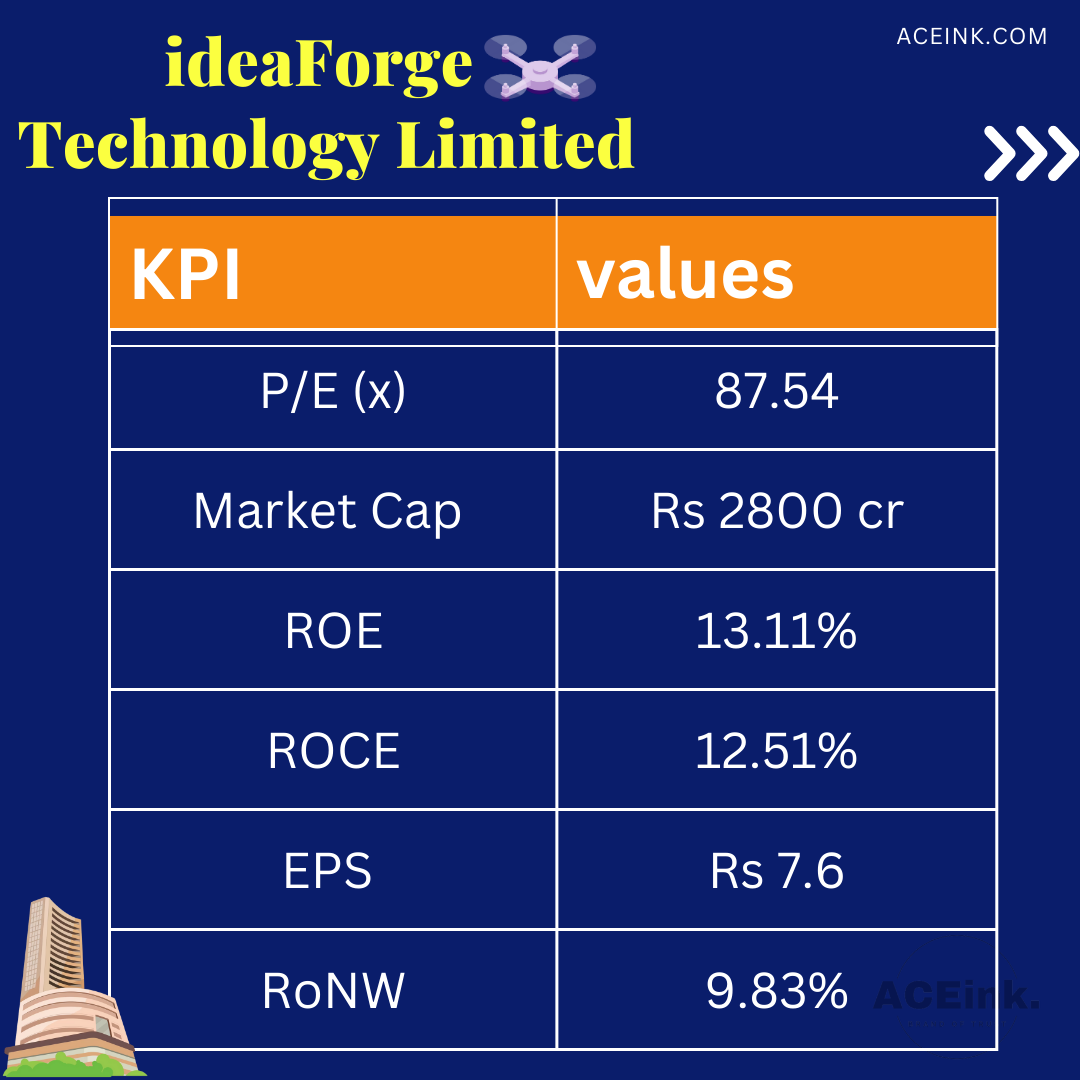

Valuation

ideaForge Technology is demanding a price-to-earnings (P/E) multiple of 87.5x based on its FY23 earnings. This valuation is considered to be at a significant premium compared to the prevailing valuations of its peers.

Analysts believe that the high valuation is reflective of the positive factors associated with ideaForge, such as its dominant market position and medium-term growth outlook.

It suggests that these positive aspects of the company are already being factored into the demanded valuation.

On the other hand,

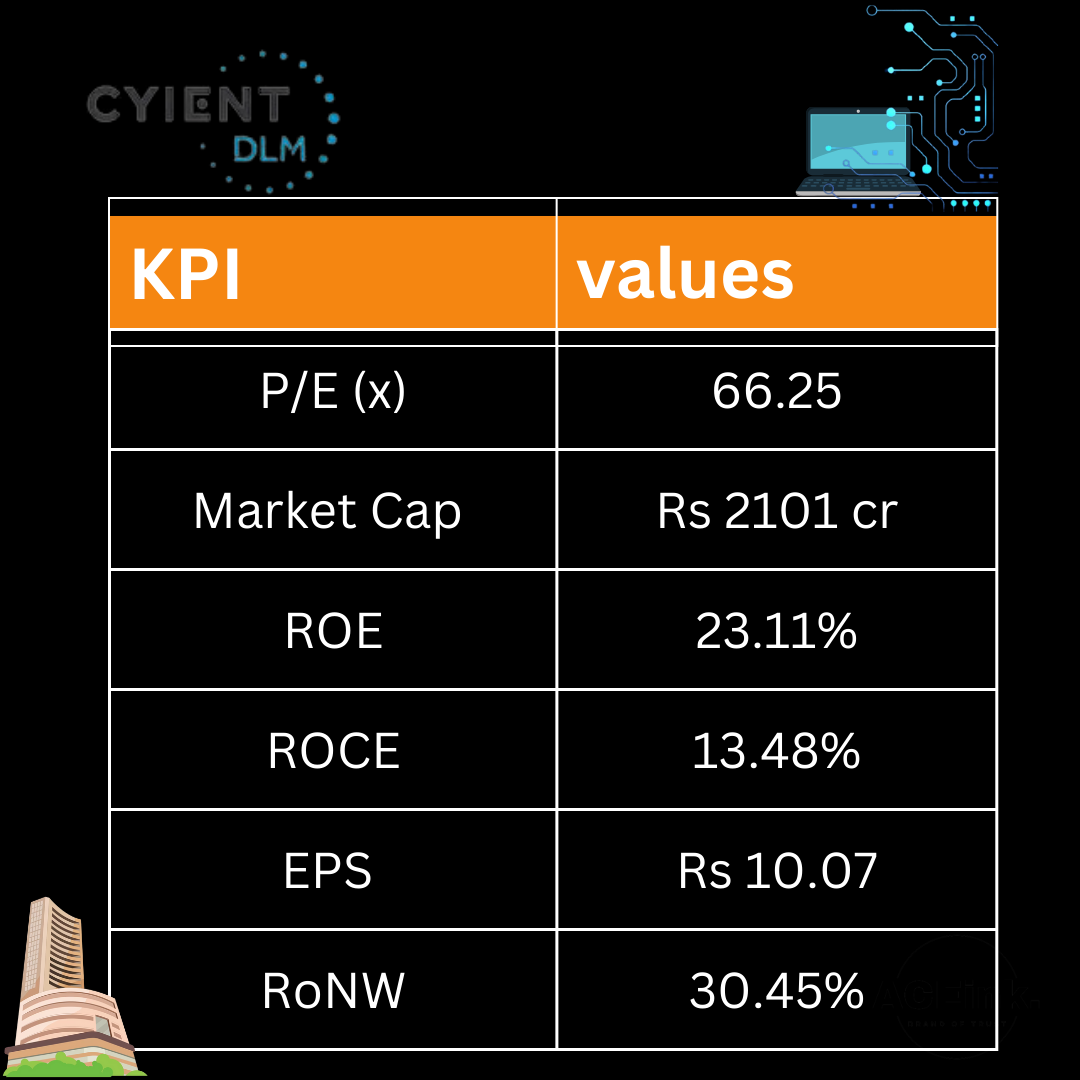

Cyient DLM is available at a P/E multiple of 66.2x based on its FY23 earnings at the upper price band of Rs 265.

This valuation is said to align with the valuations of industry peers. Analysts are optimistic about Cyient DLM’s future prospects, citing factors such as a robust order book, reduced debt post-IPO, and strong promoter backing.

These factors are seen as positive indicators of the company’s future performance.

When assessing valuations, it’s important to consider multiple factors, including the company’s financial performance, growth prospects, industry comparisons, and market conditions. Valuations should be evaluated in the context of the company’s fundamentals and the broader market landscape.

GMP

The information you provided states that the grey market premium (GMP) for the ideaForge Technology IPO is Rs 490 per share as of June 27. This suggests that the shares of ideaForge may potentially list at a premium of around 73% to the issue price.

Similarly, for Cyient DLM, the grey market is indicating a premium of Rs 100 per share, indicating a listing at a premium of over 37% to the issue price.

Grey market premium is an unofficial market where shares are traded before their official listing on the stock exchange. The premium or discount in the grey market indicates market sentiment and investors’ expectations regarding the listing price of the shares.

It’s important to note that grey market premiums can be volatile and may not always accurately reflect the actual listing price or performance of the shares once they are listed.

Investors interested in participating in these IPOs should carefully review the IPO prospectus, and understand the company’s business model, growth prospects, and associated risks.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“These Stocks to Give Dividends This Week up to Rs 140 ” These 19 stocks are to turn ex-dividend this week ….Read More

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More

——————-

No Comments