30 Jul “Stocks with dividends up to Rs. 150”

“Dividend calendar this week”- These stocks are to turn ex-dividend this week including Crisil, Coforge & UPL”

Dividends are like extra rewards you get for being a part-owner of a company. When you buy shares of a company’s stock, you become a shareholder, which means you own a small piece of that company. If the company makes a profit, it may decide to share some of that profit with its shareholders as dividends.

One important factor to consider is the dividend yield of the stock. The dividend yield is a way to measure how much money a company pays in dividends compared to the price of its stock. It’s expressed as a percentage and helps investors understand the return, they may receive from dividend payments by holding that stock.

For example, If the stock price is Rs 1000 and the company is giving a dividend of Rs 25, then the dividend yield of the stock will be 2.5%.

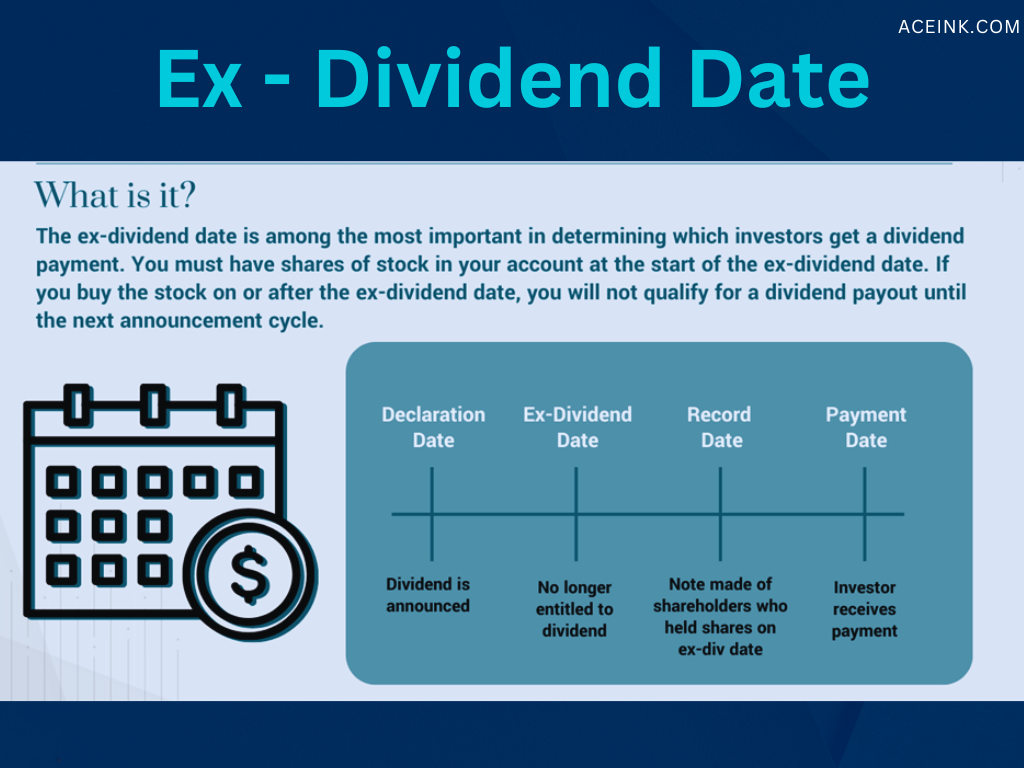

If you want to receive the dividend payment from a company, you need to buy the stock before a certain date called the ex-dividend date. This is important because it ensures that your name is on the company’s list of shareholders by the record date.

To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

For example

To receive dividends on the 1 August 2023 (Tuesday) Ex-Dividend date stocks mentioned here, you need to buy them on or before 31st July 2023 (Monday) to ensure that you receive the dividend payment.

Here is the Dividend calendar this week of stocks with a dividend yield of more than 1 :

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

Ex-dividend date – 1 August 2023 (Tuesday)

D B Corp Ltd – Dividend Per Share: Rs 3

Company Info: D B Corp Ltd is a media conglomerate operating in India.

Business: D B Corp Ltd focuses on publishing newspapers and running digital media platforms.

Products: Newspapers and digital content.

Rupa & Company Ltd – Dividend Per Share: Rs 3

Company Info: Rupa & Company Ltd is a well-established textile manufacturer and distributor.

Business: They specialize in producing high-quality undergarments and hosiery products for men, women, and children.

Products: Stylish Innerwear and Socks.

Sharda Cropchem Ltd – Dividend Per Share: Rs 3

Company Info: Sharda Cropchem Ltd is a leading agricultural solutions provider.

Business: They specialize in the distribution of crop protection products and agrochemicals.

Products: Pesticides, Herbicides, and Fungicides.

Ex-dividend date – 2 August 2023 (Wednesday)

CRISIL Ltd – Dividend Per Share: Rs 8

Company Info: CRISIL Ltd is a leading global analytical company providing ratings, research, and risk and policy advisory services.

Business: CRISIL’s expertise spans diverse industries, including finance, insurance, infrastructure, healthcare, and energy.

Products: Credit ratings, Market Intelligence, and Risk assessment solutions.

Lakshmi Automatic Loom Works Ltd – Dividend Per Share: Rs 10

Company Info: Lakshmi Automatic Loom Works Ltd is a reputable manufacturing company.

Business: They specialize in producing high-quality textile machinery and equipment.

Products: Automatic looms and other advanced textile manufacturing solutions.

Hawkins Cookers Ltd – Dividend Per Share: Rs 100

Company Info: Hawkins Cookers Ltd is a renowned Indian kitchenware manufacturer established in 1959.

Business: The company specializes in producing high-quality pressure cookers and cookware for domestic and international markets.

Products: Pressure cookers, Non-Stick Cookware, Stainless Steel Cookware, Sauce Pans and Fry Pans.

Ador Welding Ltd – Dividend Per Share: Rs 17.50

Company Info: Ador Welding Ltd is a leading welding solutions provider.

Business: They specialize in manufacturing and distributing welding equipment and consumables.

Products: Welding machines, Electrodes, Wires, and other welding accessories.

Styrenix Performance Materials Ltd – Dividend Per Share: Rs 24

Company Info: Styrenix Performance Materials Ltd – A leading chemical manufacturer specializing in high-performance materials.

Business Info: We develop and produce innovative solutions for various industries, including automotive, electronics, and construction.

Products: Engineering plastics, Elastomers, and Specialty chemicals.

ABM Knowledgeware Ltd – Dividend Per Share: Rs 1.25

Company Info: ABM Knowledgeware Ltd is a technology company specializing in software solutions and services.

Business: It provides e-governance, municipal software, and IT solutions to various government and private organizations.

Products: Software products for tax management, Enterprise resource planning, and Citizen service delivery.

BDH Industries Ltd – Dividend Per Share: Rs 4

Company Info: BDH Industries Ltd – A leading multinational conglomerate with diverse business interests.

Business: BDH Industries Ltd has diverse business interests in pharmaceuticals, chemicals, textiles, consumer goods, and real estate sectors.

Products: Medicines, Specialty chemicals, Fabrics, Household products, and Premium properties.

Also Read: “These banking stocks may give up to 30% returns

Ex-dividend date – 3 August 2023 (Thursday)

Shreyans Industries Ltd – Dividend Per Share: Rs 2.50

Shreyans Industries Ltd – Dividend Per Share: Rs 2.50

Company Info: Shreyans Industries Ltd is a leading manufacturing company.

Business: Specializes in producing high-quality paper and packaging solutions.

Products: Eco-friendly paper products and Innovative packaging materials.

Albert David Ltd – Dividend Per Share: Rs 9

Company Info: Albert David Ltd is a pharmaceutical company.

Business: It specializes in manufacturing and distributing pharmaceutical products.

Products: Medications and Healthcare solutions.

Esab India Ltd – Dividend Per Share: Rs 20

Company Info: ESAB India Ltd is a leading welding and cutting solutions provider.

Business: They offer a wide range of welding equipment, consumables, and automation solutions.

Products: Welding machines, Electrodes, Wire feeders, Plasma cutters, and Welding automation systems.

Alembic Ltd – Dividend Per Share: Rs 2.20

Company Info: Alembic Ltd is a multinational pharmaceutical company.

Business: They specialize in the research, development, and manufacturing of pharmaceutical products.

Products: Pharmaceuticals, including generic drugs and active pharmaceutical ingredients (APIs).

S H Kelkar & Company Ltd – Dividend Per Share: Rs 2

Company Info: S H Kelkar & Company Ltd is a leading fragrance and flavors company based in India.

Business: They specialize in creating and supplying a wide range of fragrances and flavors for various industries.

Products: Perfumes, Essential oils, Aroma chemicals, and Food flavors.

UPL Ltd – Dividend Per Share: Rs 10

Company Info: UPL Ltd is a global agrochemical and agricultural solutions company.

Business: UPL Ltd specializes in crop protection products, seeds, and agricultural technologies.

Products: Herbicides, Insecticides, Fungicides, Seeds, and Biopesticides.

Avanti Feeds Ltd – Dividend Per Share: Rs 6.25

Company Info: Avanti Feeds Ltd is a leading aquaculture company based in India.

Business: Avanti Feeds specializes in the production and export of high-quality shrimp feed and processed shrimp products.

Products: Shrimp feed and processed shrimp products.

Coforge Ltd – Dividend Per Share: Rs 19

Company Info: Coforge Ltd is a global IT solutions company providing innovative services to clients worldwide.

Business: Coforge specializes in IT consulting, software development, and business process outsourcing.

Products: Digital transformation, Data analytics, Cloud services, and Enterprise mobility.

Ex-dividend date – 4 August, 2023 (Friday)

Golkunda Diamonds & Jewellery Ltd – Dividend Per Share: Rs 1.50

Company Info: Golkunda Diamonds & Jewellery Ltd. is a leading jewellery manufacturer and retailer known for exquisite craftsmanship.

Business: Golkunda specializes in crafting high-quality diamond and gold jewellery, catering to a diverse global clientele.

Products: Diamond rings, Earrings, Necklaces, Bracelets, and Bespoke jewellery pieces.

Chennai Petroleum Corporation Ltd – Dividend Per Share: Rs 27

Company Info: Chennai Petroleum Corporation Ltd is a public sector undertaking, headquartered in Chennai, India, operating in the oil and gas sector.

Business: CPCL is primarily engaged in refining crude oil and marketing petroleum products.

Products: Petroleum derivatives such as Gasoline, Diesel, Liquefied petroleum gas (LPG), Jet fuel, and Petrochemicals.

Apar Industries Ltd – Dividend Per Share: Rs 40

Company Info: Apar Industries Ltd is a leading Indian company specializing in the manufacturing and distribution of electrical and telecom cables, transformer oils, and petrochemicals.

Business: Apar Industries focuses on delivering high-quality solutions for the power, telecom, and oil & gas industries, operating with a commitment to innovation and sustainability.

Products: Electrical cables, Telecom cables, Transformer oils, and a wide range of Petrochemical products.

Cheviot Company Ltd – Dividend Per Share: Rs 27

Company Info: Cheviot Company Ltd is a leading multinational corporation specializing in manufacturing and distribution.

Business: Cheviot Company Ltd focuses on providing high-quality consumer goods and industrial products worldwide.

Products: Electronics, Home Appliances, Automotive parts, and Personal care items.

VST Industries Ltd – Dividend Per Share: Rs 150

Company Info: VST Industries Ltd is a prominent tobacco manufacturing company.

Business: It operates in the tobacco industry with a focus on cigarettes and related products.

Products: Tobacco products, including Cigarettes and other smoking accessories.

Sudarshan Chemical Industries Ltd – Dividend Per Share: Rs 1.50

Company Info: Sudarshan Chemical Industries Ltd is a leading chemical manufacturing company.

Business: They specialize in producing and supplying a wide range of pigments and agrochemicals.

Products: Pigments, Agrochemicals.

Munjal Showa Ltd – Dividend Per Share: Rs 4.50

Company Info: Munjal Showa Ltd is a leading manufacturer of automotive components.

Business: Munjal Showa specializes in producing high-quality suspension systems and other precision parts for the automotive industry.

Products: Suspension systems, Precision automotive components.

EPL Ltd – Dividend Per Share: Rs 2.15

Company Info: EPL Ltd is a global manufacturing company.

Business: They specialize in electronics and electrical products.

Products: Consumer electronics, Electrical appliances, and Industrial equipment.

Bayer CropScience Ltd – Dividend Per Share: Rs 30

Company Info: Bayer CropScience Ltd is a global agricultural company.

Business: They focus on developing and selling crop protection products and seeds.

Products: Herbicides, Insecticides, Fungicides, and Genetically modified seeds.

Aditya Birla Sun Life AMC Ltd – Dividend Per Share: Rs 5.25

Company Info: Aditya Birla Sun Life AMC Ltd – A leading asset management company in India.

Business: Offering a range of mutual funds and investment solutions for individuals and institutions.

Products: Equity funds, Debt funds, Balanced funds, and Other investment options.

Kirloskar Oil Engines Ltd – Dividend Per Share: Rs 2.50

Company Info: Kirloskar Oil Engines Ltd is a renowned Indian engineering company.

Business: It specializes in manufacturing engines, power-generating sets, and related products.

Products: Diesel engines, Gas engines, and Power generating sets for various industrial applications.

Andhra Paper Ltd – Dividend Per Share: Rs 12.50

Company Info: Andhra Paper Ltd is a leading paper manufacturing company based in India.

Business: They specialize in producing a wide range of paper products for various industries.

Products: Writing paper, Printing paper, Packaging paper, and Specialty papers.

Ador Fontech Ltd – Dividend Per Share: Rs 5

Company Info: Ador Fontech Ltd is a multinational welding and metal engineering solutions provider.

Business: They offer cutting-edge welding products, repair, and maintenance services for diverse industries.

Products: Welding consumables, Equipment, Maintenance solutions, and Metal repair technologies.

Wim Plast Ltd – Dividend Per Share: Rs 8.50

Company Info: Wim Plast Ltd is a leading manufacturer and distributor of plastic products.

Business: They specialize in producing high-quality plastic furniture and household items.

Products: Chairs, Tables, Storage containers, and Other plastic home essentials.

Also Read: ITC DEMERGER- Why ITC Stock is Falling?

Ex-dividend date – 7 August 2023 (Next Monday)

Lumax Industries Ltd – Dividend Per Share: Rs 27

Company Info: Lumax Industries Ltd is a leading automotive lighting solutions provider.

Business: Lumax Industries specializes in manufacturing and supplying lighting products for the automotive industry.

Products: Headlights, Tail lamps, Fog lamps, and other automotive lighting components.

Karur Vysya Bank Ltd – Dividend Per Share: Rs 2

Company info: Karur Vysya Bank Ltd is a leading Indian banking institution founded in 1916.

Business: KVB offers a wide range of banking and financial services to individuals and businesses.

Products: Savings accounts, Loans, Insurance, Investment options, and Digital banking solutions.

Navneet Education Ltd – Dividend Per Share: Rs 2.60

Company info: Navneet Education Ltd is an Indian educational publisher.

Business: Navneet focuses on publishing educational materials and stationery products.

Products: Textbooks, Workbooks, E-learning solutions, and Stationery items.

Gabriel India Ltd – Dividend Per Share: Rs 1.65

Company info: Gabriel India Ltd is a leading automotive manufacturing company.

Business: They specialize in producing suspension systems and ride control products.

Products: Shock absorbers, Struts, and other suspension components.

Lumax Auto Technologies Ltd – Dividend Per Share: Rs 4.50

Company info: Lumax Auto Technologies Ltd is a leading automotive component manufacturer.

Business: Lumax Auto Technologies Ltd specializes in producing high-quality automotive components.

Products: Lighting, Gear shifters, Exhaust systems, and chassis components.

National Fittings Ltd – Dividend Per Share: Rs 1.50

Company info: National Fittings Ltd – Leading manufacturer of industrial pipe fittings.

Business: Specializes in producing and supplying high-quality fittings for various industries.

Products: Pipe fittings, Valves, Flanges, and Related fluid control solutions.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

Defense stock rally up to 64% on strong growth prospects but here is a twist! In recent times,…Read More

No Comments