05 Jun These 26 stocks to turn ex-dividend this week

Tata Power to Indian Hotel- These 26 stocks are to give dividends this week including yearly returns upto 230%

Several stocks are scheduled to turn ex-dividend this week.

These stocks include Tata Power, Asian Paints, HDFC AMC, Indian Hotels, and others.

Some of these have given very good returns even up to 230% along with handsome dividend yields while some have given flat to negative returns in the last one year.

Also Read:These 6 banks offering more than 9% FD interest rates for senior citizens

The ex-dividend date is the day when the price of a company’s equity shares is adjusted to account for the dividend payout. It typically occurs one or two working days before the record date.To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here

.

Shareholders whose names appear on the company’s list by the end of the record date will be eligible to receive dividends.

Here are the stocks and their dividend payout details for the upcoming ex-dividend dates:

For 5 June:

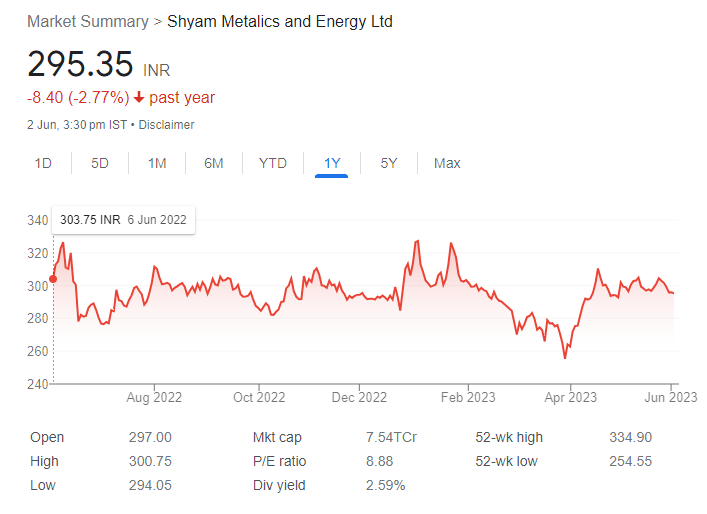

1. Shyam Metalics and Energy Ltd – Dividend of Rs 1.8

Introduction: Shyam Metalics and Energy Ltd is a leading integrated metal-producing company in India.

Business: The company is engaged in the production of iron and steel products, including long steel products, ferroalloys, and pellets.

Products: Their product portfolio includes products like sponge iron, billets, TMT bars, wire rods, ductile iron pipes, and pellets.

Related Read :Buy or Sell: Top 3 Trading Ideas for Next Week by Sumeet Bagadia

2. SKM Egg Products Export (India) Ltd: Dividend of Rs 2

Introduction: SKM Egg Products Export (India) Ltd is a prominent player in the egg and egg products industry.

Business: The company is involved in the production and export of a wide range of egg products, including liquid eggs, egg powder, and specialty egg products.

Products: Their product range includes whole egg powder, egg yolk powder, egg albumen powder, frozen egg products, and customized egg blends.

For 6 June:

3. Nelco Ltd: Dividend of Rs 2

Introduction: Nelco Ltd is a leading provider of innovative technology solutions in the areas of satellite communications, defense, and surveillance.

Business: The company specializes in delivering end-to-end solutions for satellite-based communication networks, integrated security and surveillance systems, and electronic system design and manufacturing.

Products: Their product offerings include VSAT networks, satellite communication terminals, integrated security systems, surveillance solutions, and electronic systems.

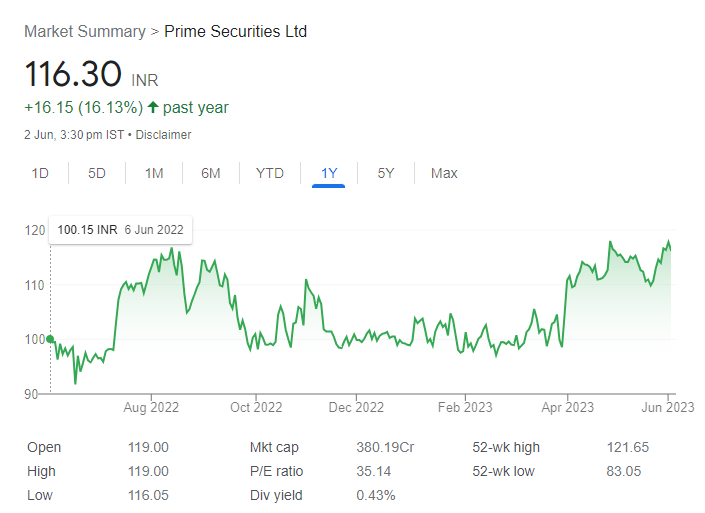

4. Prime Securities: Dividend of Rs 2

Introduction: Prime Securities is a well-established financial services company offering a wide range of investment and advisory services.

Business: The company provides services such as equity broking, portfolio management, investment advisory, wealth management, and financial planning.

Products: Their product offerings include equity trading services, investment advisory services, portfolio management services, mutual funds, and insurance products.

For 7 June:

5. Marksans Pharma: Dividend of Rs 0.50

Introduction: Marksans Pharma is a global pharmaceutical company engaged in the manufacturing and marketing of high-quality generic pharmaceutical formulations.

Business: The company operates in various therapeutic segments, including the cardiovascular, central nervous system, gastrointestinal, anti-infectives, and more.

Products: They offer a wide range of pharmaceutical products such as tablets, capsules, syrups, ointments, injectables, and various other dosage forms.

6. Optiemus Infracom Ltd:Dividend of Rs 1.50

Introduction: Optiemus Infracom Ltd is a leading provider of technology solutions and services in the telecom and enterprise mobility space.

Business: The company offers a comprehensive range of services, including the distribution and retail of smartphones, enterprise mobility solutions, managed services, and integrated technology solutions.

Products: They deal with mobile phones from various leading brands, enterprise mobility solutions, managed mobility services, software solutions, and IT infrastructure services.

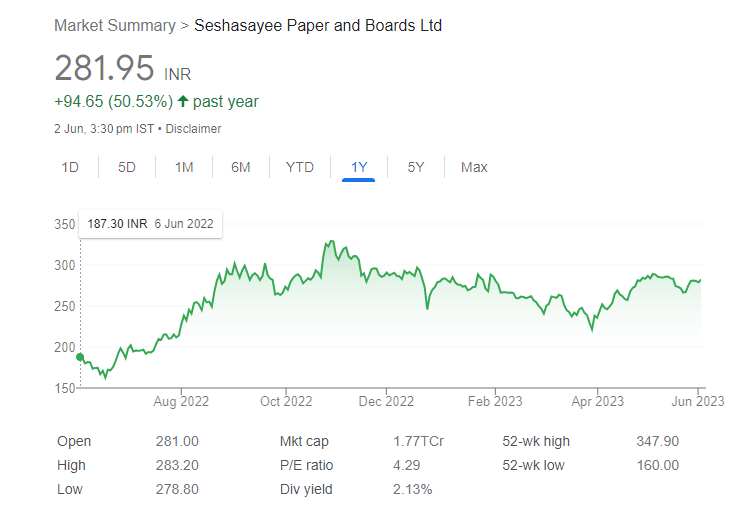

7. Seshasayee Paper & Board Ltd: Dividend of Rs 0.50

Introduction: Seshasayee Paper & Board Ltd is one of India’s oldest and largest manufacturers of paper and paperboard.

Business: The company is engaged in the production of writing and printing paper, industrial paperboard, and packaging paper.

Products: Their product range includes printing and writing paper, coated and uncoated paperboard, packaging boards, and specialty paper products.

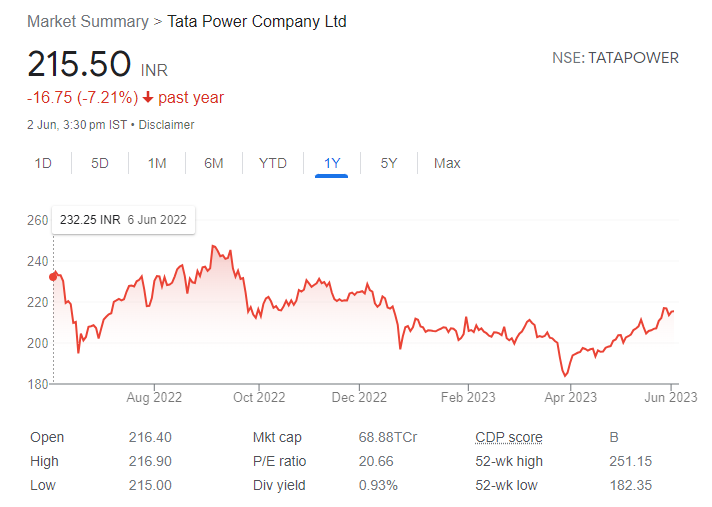

8. Tata Power Ltd – Dividend of Rs 2

Introduction: Tata Power Ltd is India’s largest integrated power company with a significant presence in the generation, transmission, and distribution of electricity.

Business: The company operates in both conventional and renewable energy sectors, providing reliable and sustainable power solutions.

Products: They generate power through various sources such as thermal, hydro, solar, wind, and solar photovoltaic (PV) technologies. Tata Power also offers transmission and distribution services, along with energy trading and power procurement solutions.

9. Uniparts India Ltd: Dividend of Rs 6

Introduction: Uniparts India Ltd is a leading manufacturer and supplier of engineering systems and solutions for the automotive and construction industries.

Business: The company specializes in the production of precision-engineered components, assemblies, and systems for various applications in automobiles, construction equipment, and industrial machinery.

Products: Their product portfolio includes suspension systems, transmission products, chassis components, hydraulic systems, and precision-machined parts.

For 8 June:

10. Bikaji Foods International Ltd: Dividend of Rs 0.75

Introduction: Bikaji Foods International Ltd is a renowned Indian snacks and sweets manufacturer, known for its wide range of traditional and innovative food products.

Business: The company is primarily engaged in the production and distribution of packaged snacks, namkeens, sweets, and confectionery items.

Products: Their product range includes bhujia, namkeens, papad, snacks, sweets, cookies, and other traditional Indian delicacies.

11. Ponni Sugars (Erode) Ltd: Dividend of Rs 6.5

Introduction: Ponni Sugars (Erode) Ltd is an integrated sugar manufacturing company based in India.

Business: The company is involved in sugarcane cultivation, sugar production, co-generation of power, and the manufacturing of industrial alcohol and ethanol.

Products: They produce various sugar products such as crystal sugar, refined sugar, and specialty sugars. They also manufacture industrial alcohol, ethanol, and bio-products.

12. QGO Finance Ltd: Dividend of Rs 0.10

Introduction: QGO Finance Ltd is a financial services company that offers a range of lending and financial solutions to individuals and businesses.

Business: The company provides loans, leasing, and other financial services to support diverse needs such as vehicle financing, personal loans, equipment leasing, and working capital solutions.

Products: Their product offerings include car loans, personal loans, business loans, equipment leasing, and other customized financial solutions.

For 9 June:

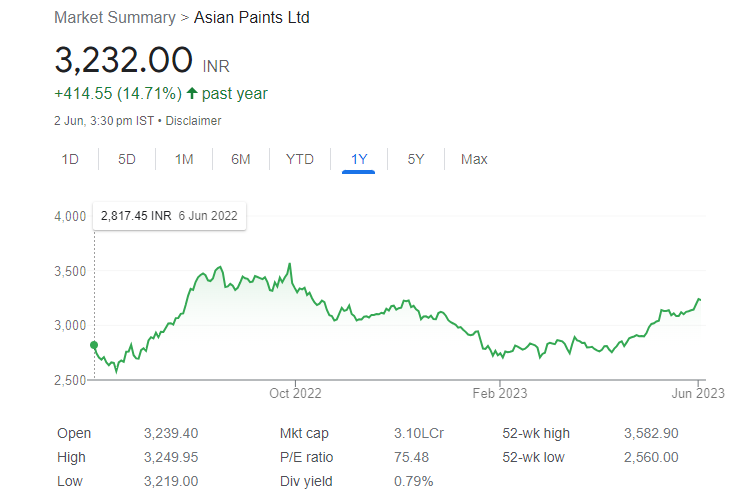

13. Asian Paints: Dividend of Rs 21.25

Introduction: Asian Paints is one of the largest paint and coatings manufacturers in India and operates in over 20 countries globally.

Business: The company is engaged in the manufacturing and distribution of a wide range of decorative and industrial paints, coatings, and related products.

Products: They offer a comprehensive range of paints and coatings for interior and exterior surfaces, including decorative paints, enamels, wood coatings, and waterproofing solutions.

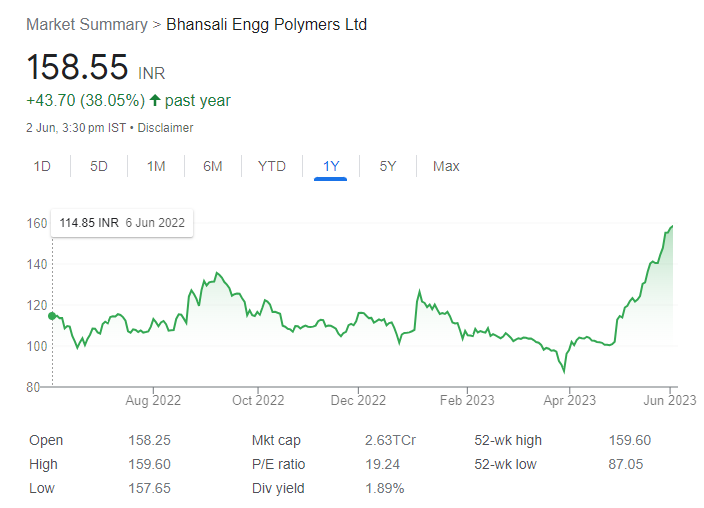

14. Bhansali Engineering Polymers Ltd: (Special Dividend) – Dividend of Rs 14, Dividend of Rs 1

Introduction: Bhansali Engineering Polymers Ltd is a leading manufacturer of engineered polymers and compounds.

Business: The company specializes in the production of high-performance polymers used in various industries such as automotive, electrical, electronics, and consumer goods.

Products: They offer a range of engineered polymers and compounds, including ABS (Acrylonitrile Butadiene Styrene) resins, ASA (Acrylonitrile Styrene Acrylate) resins, and various specialty polymers.

15. Caplin Point Laboratories Ltd: Dividend of Rs 2

Introduction: Caplin Point Laboratories Ltd is a pharmaceutical company focused on the development, manufacturing, and marketing of generic pharmaceutical formulations.

Business: The company primarily focuses on niche therapeutic segments and specializes in injectables, ophthalmics, and oral solids.

Products: They produce a diverse range of pharmaceutical products such as injectable antibiotics, ophthalmic solutions, oral solid dosage forms, and other generic medicines.

16. Cigniti Technologies Ltd: Dividend of Rs 3

Introduction: Cigniti Technologies Ltd is a global leader in independent software testing and quality assurance services.

Business: The company offers comprehensive software testing solutions and quality engineering services to help organizations ensure the reliability, performance, and security of their software applications.

Products: Their services include functional testing, performance testing, test automation, mobile testing, security testing, and specialized testing services for various industries.

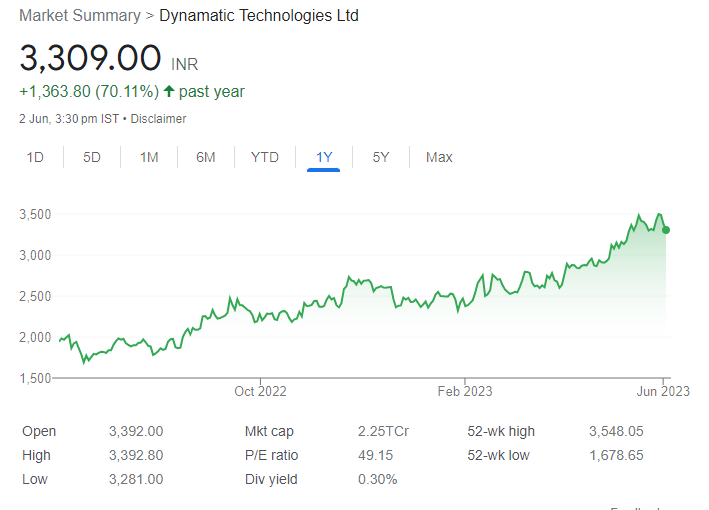

17. Dynamatic Technologies Ltd: Dividend of Rs 7

Introduction: Dynamatic Technologies Ltd is a leading manufacturer of high-precision engineering products and solutions for aerospace, automotive, and hydraulic industries.

Business: The company specializes in the design, development, and production of aerospace components, automotive components, and hydraulic products.

Products: They manufacture aerospace components such as actuation systems, landing gear systems, and precision components. In the automotive sector, they produce components like engine pumps, gears, and assemblies. They also offer hydraulic products and solutions.

18. Elecon Engineering Co Ltd: Dividend of Rs 7

Introduction: Elecon Engineering Co Ltd is a diversified engineering company engaged in the design, manufacture, and supply of material handling equipment, industrial gears, and power transmission products.

Business: The company operates in various sectors, including power, mining, cement, steel, and infrastructure, providing solutions for material handling and power transmission requirements.

Products: Their product range includes gearboxes, couplings, material handling equipment like conveyors and elevators, mining equipment, and power transmission products.

19. Elpro International Ltd: Dividend of Rs 0.23

Introduction: Elpro International Ltd is a leading manufacturer of electronic products and solutions catering to industrial automation, power, and control systems.

Business: The company specializes in the design, development, and production of electronic components, systems, and solutions for various industrial applications.

Products: They offer a wide range of products such as electronic relays, industrial automation systems, power control devices, and custom-engineered solutions for specific industry requirements.

20. HDFC Asset Management Company Ltd: Dividend of Rs 48

Introduction: HDFC Asset Management Company Ltd is one of India’s largest and most respected mutual fund companies, offering a diverse range of investment products and services.

Business: The company manages a wide variety of mutual fund schemes, including equity funds, debt funds, hybrid funds, and exchange-traded funds (ETFs), catering to different investor needs.

Products: They provide a range of mutual fund products, investment plans, and portfolio management services for individuals, institutional investors, and corporate clients.

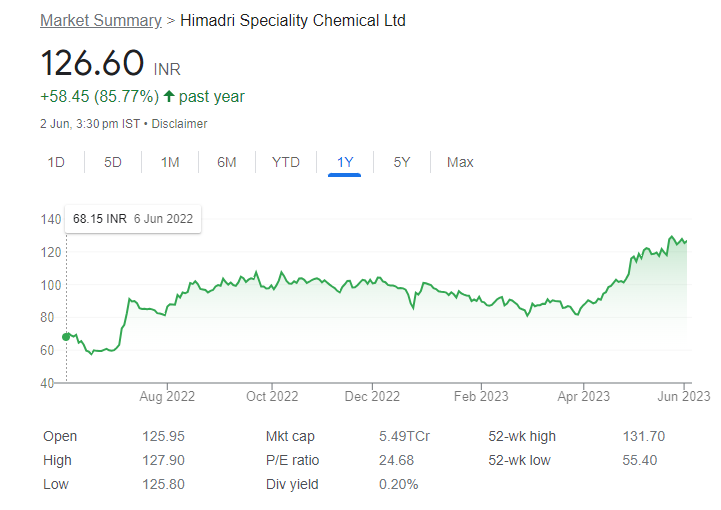

21. Himadri Speciality Chemical Ltd: Dividend of Rs 0.25

Introduction: Himadri Speciality Chemical Ltd is a leading manufacturer of carbon-based chemicals and downstream derivatives, serving diverse industries globally.

Business: The company focuses on the production of specialty carbon materials, coal tar pitch, carbon black, and advanced carbon products for applications in aluminum, graphite, refractory, and other industries.

Products: They offer a wide range of products such as carbon black, coal tar pitch, advanced carbon materials, specialty chemicals, and customized carbon solutions.

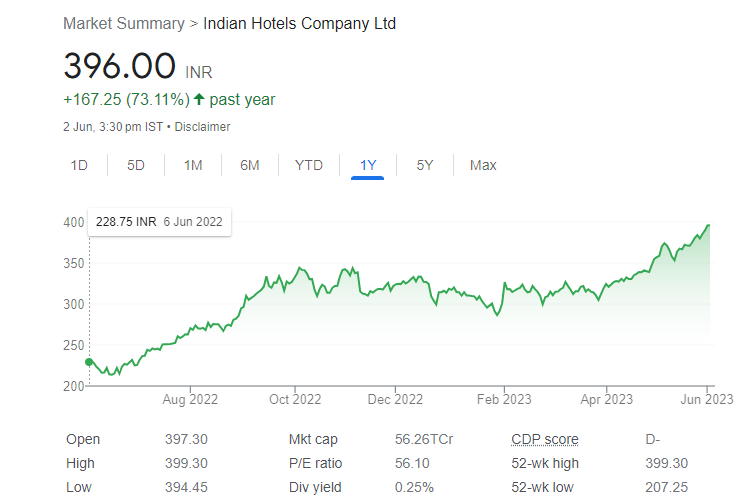

22. Indian Hotel Co. Ltd: Dividend of Rs 1

Introduction: Indian Hotel Co. Ltd, a part of the Tata Group, is a renowned hospitality company operating a chain of luxury hotels and resorts in India and abroad.

Business: The company owns and manages a portfolio of iconic hotels, resorts, and palaces, providing world-class hospitality services to leisure and business travelers.

Products: Their properties include luxury hotels and resorts under various renowned brands, offering premium accommodations, dining, spa, and event facilities.

23. National Fertilizers (NFL): Dividend of Rs 1.53

Introduction: National Fertilizers Limited (NFL) is a leading fertilizer manufacturing and marketing company in India.

Business: The company is primarily engaged in the production and marketing of urea, industrial chemicals, and bio-fertilizers.

Products: National Fertilizers produces a wide range of fertilizers, including urea, ammonia, diammonium phosphate (DAP), nitrogenous fertilizers, and bio-fertilizers. They also offer various industrial chemicals such as sulphuric acid, nitric acid, and sodium nitrate

24. NRB Bearings Ltd: Dividend of Rs 4.1

Introduction: NRB Bearings Ltd is an Indian company that specializes in the design, manufacture, and supply of precision bearings for various industrial applications.

Business & Products: NRB Bearings produces a wide range of bearings, including ball bearings, roller bearings, and customized bearing solutions for diverse industries such as automotive, railways, and industrial machinery.

25. Solar Industries India Ltd: Dividend of Rs 8

Introduction: Solar Industries India Ltd is an Indian company that specializes in the manufacturing and distribution of explosives and explosive-related products.

Business: Solar Industries India is primarily engaged in the production of industrial explosives used in mining, quarrying, and infrastructure development.

Products: The company also offers a wide range of explosive-related products and services, including detonators, cartridges, explosive storage and transport solutions, and blasting services.

Solar Industries India focuses on ensuring safety, efficiency, and sustainability in the use of explosives for various industries.

26. Voltas Ltd: Dividend of Rs 4.25

Introduction: Voltas Ltd is a leading engineering and air conditioning company in India that provides solutions in the areas of cooling, ventilation, refrigeration, and electro-mechanical projects.

Business: The company operates in various segments, including Electro-Mechanical Projects and Services, Engineering Products and Services, and Unitary Cooling Products.

Products: Voltas offers a wide range of products, including air conditioners, air coolers, commercial refrigeration products, water coolers, deep freezers, HVAC systems, textile machinery, and mining and construction equipment.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments