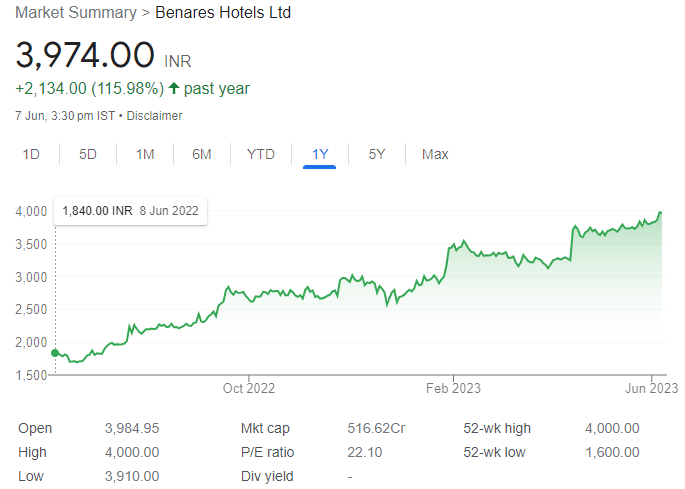

07 Jun This small-cap Tata group stock surged over 100% in one year

Hotel stocks of the Tata group company have outperformed cash cows of the group like TCS, Titan

Among the 28 Tata group stocks, the hotel stocks, including Indian Hotels Company (IHC) and Oriental Hotels, have performed exceptionally well, delivering stellar returns to their shareholders in the last year.

However, the true standout in the Tata Group’s hospitality sector is a small-cap stock with a market capitalization slightly above Rs 500 crore. This stock is none other than Benares Hotels Ltd.

Also Read:IKIO Lighting IPO Details – GMP, Date, Price, Reviews & More

In the past year, the share price of Benares Hotels has experienced significant appreciation, climbing from approximately Rs 1,918 to Rs 3,890 per share. This remarkable growth has generated a return of over 100% for its shareholders, surpassing the returns achieved by major Tata group stocks such as Tata Consultancy Services (TCS), Tata Motors (TaMo), Titan Company, Tata Steel, Tata Communications, and Tejas Networks.

The impressive performance of Benares Hotels demonstrates its ability to generate alpha returns, outperforming well-established Tata group stocks.To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

In comparison to other Tata group stocks, Benares Hotels has consistently outperformed, offering higher returns to its shareholders. For instance:

Tata Motors share price increased by a little over 25% in the last year.

TCS share price remained unchanged during this period.

Tata Steel share price remained almost unchanged.

Indian Hotels share price rose by around 70%.

Oriental Hotels share price increased by over 50%.

Titan share price rose by around 30%.

Tata Power share price declined by over 6%.

Company Overview: Benares Hotels

Benares Hotels is a renowned hospitality company that operates a collection of luxury hotels and resorts, catering to discerning travelers from around the world. With a commitment to excellence in service, attention to detail, and a deep respect for cultural heritage, Benares Hotels has established itself as a prominent player in the global hospitality industry.

Founded in 1985 by Mr. Rajiv Verma, Benares Hotels started with a single property in Varanasi, India, which quickly gained recognition for its exceptional hospitality and distinctive charm. Over the years, the company has expanded its portfolio to include several other iconic properties in India and beyond.

Establishment and Management:

2009: Nadesar Palace, managed by Taj (Indian Hotels), becomes operational.

2011: Benares Hotels Limited becomes a subsidiary of Indian Hotels (Taj).

The Holding Company:

-The Indian Hotels Co. Limited (IHCL) is the ultimate holding company, with a 49% shareholding in Benares Hotels Limited.

-Tata Sons Private Limited has a significant interest in IHCL.

-IHCL has a global portfolio of 235 hotels in 12 countries across 4 continents.

Expansion and New Hotel Ventures:

2011: Benares Hotels starts setting up a hotel in Gondia, Maharashtra.

2015: The Gateway Hotel, Balaghat Road in Gondia, Maharashtra, with 34 rooms, becomes operational.

2018: Commissioning of a new banquet hall and renovation of 55 rooms at The Gateway Hotel, Varanasi.

2019: Rebranding of The Gateway Hotel Ganges as Taj Ganges, Varanasi, with extensive renovations and the largest banquet in the 5-star category in Varanasi.

2020: Renovation of all 130 rooms at Taj Ganges, the addition of 3 new suites, and expansion at Nadesar Palace.

2021: The COVID-19 pandemic impacts the operations of Benares Hotels.

Services:

Future Growth Plan:

-To meet the increasing demand and high occupancies, Taj Ganges is expanding its offerings.

-A new 100-room tower with larger rooms will be added, increasing the total room inventory to 230.

-Additionally, Gateway Hotel, Gondia has transitioned to become a Ginger hotel and joined IHCL’s Lean Luxe portfolio.

-Ginger is an important growth vehicle for the company, and this rebranding is expected to benefit the hotel.

Property Portfolio:

-Currently operates a portfolio of 8 luxury hotels and resorts.

-Properties located in India and other international destinations.

-Including Taj Ganges and Taj Nadesar Palace in Varanasi, with 144 rooms and suits.

-As well as Ginger, Gondia in Maharashtra with 34 rooms

Industry Recognition:

-Multiple awards and accolades for excellence in hospitality.

-Consistent inclusion in “Best Hotels” and “Top Luxury Resorts” lists.

-The iconic Taj brand, owned by IHCL and represented by two of BHL’s hotels, was recognized as the World’s Strongest Hotel Brand and India’s Strongest Brand across all sectors by Brand Finance 2022.

Key Fundamentals

- Market Cap ₹ 517 Cr.

- Current Price ₹ 3,974

- High / Low ₹ 4,000 / 1,600

- Stock P/E 22.1

- Industry PE 33.1

- PEG Ratio 0.74

- Book Value ₹ 767

- Dividend Yield 0.25 %

- Promoter holding 62.6 %

- Public holding 37.4 %

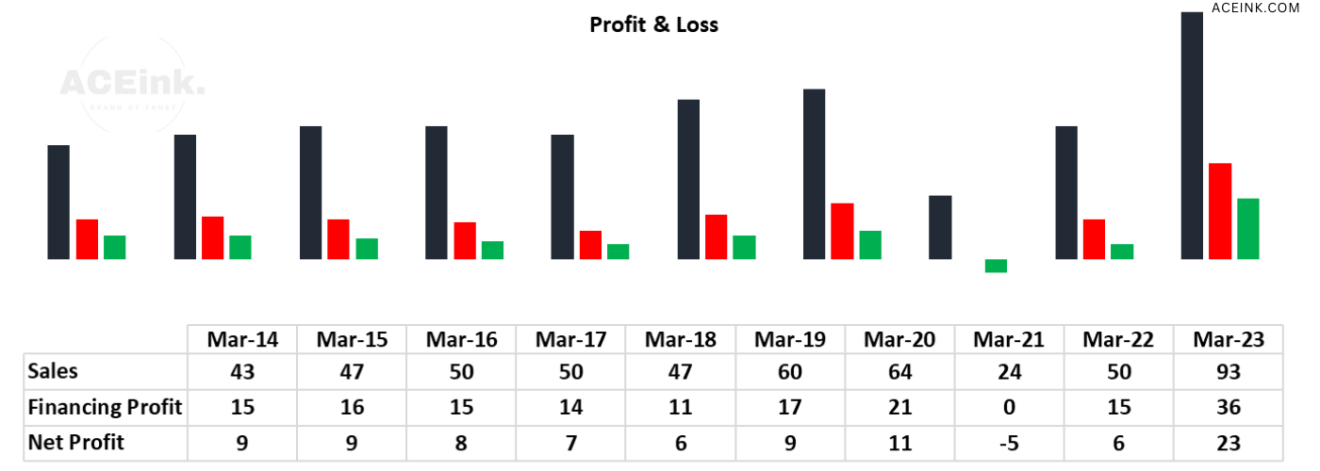

Financials

- ROCE 34.2 %

- ROE 26.3 %

- OPM 38.7 %

- Qtr Profit Var 150 %

- Qtr Sales Var 70.6 %

- Debt ₹ 3.71 Cr.

- Debt to equity 0.04

- Free Cash Flow ₹ 26.3 Cr.

-Achieved the highest-ever EBITDA in the fiscal year, leading to robust revenue growth and profitability.

-Recorded a 49% revenue increase and a 2.21 times increase in PAT compared to pre-Covid levels.

-Declared a dividend of 200%.

Investment Risks in Benares Hotels Limited:

Industry-specific Risks:

Volatility in the Hospitality Industry: The hotel industry is susceptible to fluctuations in business cycles, economic conditions, and travel patterns. Changes in consumer preferences, global events, and geopolitical factors can impact the demand for hotel services and affect Benares Hotels’ financial performance.

Market Risks:

Competition: Benares Hotels operates in a highly competitive market, facing competition from both domestic and international hotel chains, as well as local independent hotels. Intense competition may lead to pricing pressures, reduced market share, and potential impact on profitability.

Market Demand: The demand for hotel services is influenced by factors such as tourism trends, economic conditions, and political stability. Any downturn in the travel and tourism industry or a decline in the local or global economy can affect the occupancy rates and revenue generation for Benares Hotels.

Operational Risks:

Execution and Expansion Risks: Benares Hotels’ ability to successfully execute its expansion plans, including the development and management of new hotels, can impact its financial performance. Delays, cost overruns, and operational challenges in new ventures can pose risks to profitability.

Operating Expenses: The hotel industry is subject to various operating expenses, including labor costs, utility expenses, maintenance costs, and supply chain risks. Fluctuations in these costs can impact the profitability of Benares Hotels.

Regulatory and Legal Risks:

Compliance and Licensing: Benares Hotels must comply with various regulatory requirements, including obtaining and maintaining licenses, permits, and certifications. Non-compliance with applicable laws and regulations can result in penalties, fines, or disruptions in operations.

Legal and Litigation Risks: The hotel industry is exposed to legal and litigation risks, including disputes with customers, employees, suppliers, or other third parties. Any adverse legal judgments or settlements can have a financial impact on Benares Hotels.

Economic Risks:

Inflation and Currency Fluctuations: Benares Hotels’ financial performance can be affected by inflationary pressures and currency fluctuations. Rising inflation can increase operating costs, while currency fluctuations can impact revenue from international guests and currency translation for multinational operations.

Force Majeure Events:

Natural Disasters and Pandemics: Benares Hotels is exposed to risks associated with natural disasters, epidemics, and pandemics, as demonstrated by the impact of the COVID-19 pandemic. Such events can disrupt operations, reduce demand, and lead to financial losses.

It is important for potential investors to conduct thorough research, assess the risks mentioned above, and consider their risk tolerance before making any investment decisions related to Benares Hotels Limited.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments