19 Dec “Why is IRCTC on the fast track?”

IRCTC Shares close to Rs 900! What Next?

IRCTC, primarily known for e-ticketing, is expanding into hospitality and catering to broaden its revenue streams.

The Indian Railway Catering and Tourism Corporation (IRCTC), Miniratna PSU, is now set to undergo a substantial expansion in the non-railway catering sector, aiming to broaden its presence across the entire country

The company is in talks with various government bodies, including the Border Security Force and Indian Maritime University, to set up catering units.

IRCTC, established on September 27, 1999, is a subsidiary of Indian Railways, focusing on enhancing passenger services, catering, and tourism activities. Over the years, the company has evolved into a diversified entity, adapting to changing needs and trends.

With shares hitting the Rs 800-mark on Thursday, investors are urged to consider potential investment opportunities.

Let’s explore the company’s performance and evaluate its overall investment appeal.

Also Read: “Why IREDA is up 200% from IPO price?”

Why IRCTC Shares Hit Fresh Highs?

1. IRCTC’s Diversification Move

The achievement of the Rs 800 mark coincided with IRCTC’s announcement of expansion plans on Wednesday evening. The PSU revealed its intent to diversify its business beyond Indian Railways to enhance its brand and overall business presence.

Currently, the company oversees catering services for numerous Ministries, Government Departments, and Autonomous Bodies, including the Judiciary and Universities. It has successfully established hospitality outlets in nine such organizations, including the Department of Telecommunications, Calcutta High Court, and UP Secretariat.”

The strategic move involves signing MoUs and commissioning 15 new catering units across India, showcasing IRCTC’s commitment to diversifying beyond e-ticketing. IRCTC’s catering segment, a key revenue driver, witnessed a remarkable 29% increase in sales, reaching Rs 431.5 crore in the September 2023 quarter.

Also Read: “Ircon International: On Track with Big Plans?”

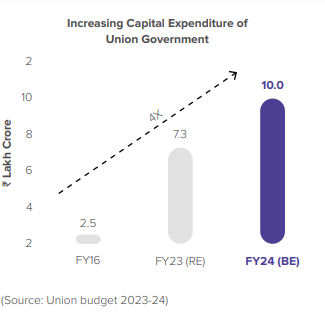

2. Indian Railways’ Ambitious Plan

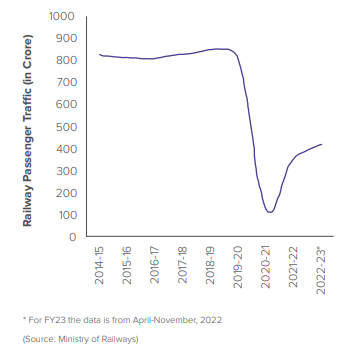

With increasing passenger traffic, Indian Railways plans to invest Rs 1 trillion in acquiring 7,000 to 8,000 new trains. This move aims to boost capacity and improve overall railway services.

The procurement process, set to begin in 4-5 years, presents opportunities for companies like Titagarh Wagon and Texmaco Rail. Notably, IRCTC stands to benefit in the long run due to increased train availability and trips, positively impacting its e-ticketing, catering, and tourism services.

3. IRCTC’s Monopoly Advantage

As the sole entity authorized by Indian Railways for online ticketing, catering, and bottled water services, IRCTC operates in a monopoly. Investors favor this stability, leading to a surge in stock prices when the company makes headlines.

Also Read: “From Crisis to Confidence: YES Bank’s Journey to Stability”

Financial Highlights

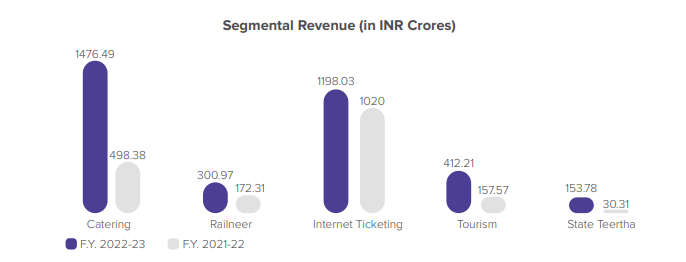

In the September 2023 quarter, IRCTC demonstrated robust financial performance. Its revenue grew by 23% to Rs 9.9 billion, with substantial contributions from the tourism and catering segments.

- Revenue from tourism surged by 39% in Q3 2023.

- Catering segment revenue grew by 29% in the same period.

- A strategic tie-up with Zomato for catering services was announced, with future growth expectations.

- ROCE 59.2 %

- ROE 45.4 %

- Sales growth 34.3 %

- Profit growth 20.5 %

- Profit Var 3Yrs24.3 %

- Sales growth 3Years16.1 %

- OPM 35.0 %

- Debt ₹ 66.8 Cr.

- Debt to equity 0.02

- Free Cash Flow ₹ 743 Cr.

- Int Coverage 84.6

- Cash Equivalent ₹ 2,026

Fundamentals

- Market Cap ₹ 70,568 Cr.

- Current Price ₹ 882

- High / Low₹ 916 / 557

- Book Value ₹ 35.6

- Dividend Yield 0.62 %

- Face Value₹ 2.00

- Stock P/E 65.3

- Industry PE 65.3

- PEG Ratio 1.87

- Return over 1year 30.3 %

Also Read: The Remarkable Turnaround of JLR: From Tata’s “Biggest Mistake” to a “Biggest Victory”

Future Growth Strategies

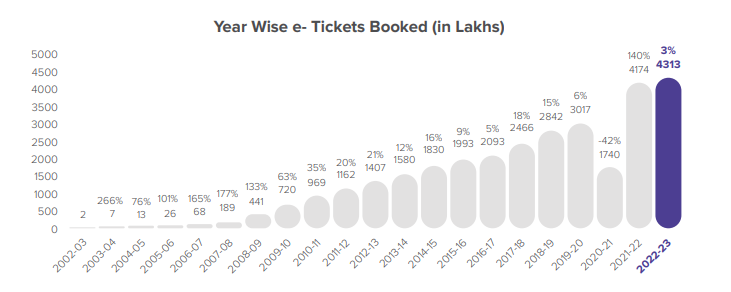

IRCTC anticipates significant growth in online ticketing, aligning with the rise in internet users. The company is adapting to digital trends, with 38% of tickets booked using UPI in the September quarter.

To enhance services, IRCTC plans to create a comprehensive platform for all train-related services. This involves upgrading IT capabilities, utilizing advanced technologies like AI and ML, and transitioning to a flexible public cloud platform within two years.

Also Read: “Suzlon 2.0: What Lies Ahead -Post Turnaround?”

Investing in IRCTC, like any investment, carries certain risks. Here are some particular risks associated with investing in IRCTC:

- Regulatory Risks: IRCTC operates in a heavily regulated industry, with its services subject to government policies and regulations. Changes in regulations or government policies can impact the company’s operations and financial performance.

- Economic Sensitivity: IRCTC’s financial performance is closely tied to the overall economic conditions in India. Economic downturns or fluctuations can affect travel demand, tourism, and discretionary spending on services offered by IRCTC.

- Dependency on Indian Railways: IRCTC’s business is significantly dependent on the Indian Railways. Any adverse developments, disputes, or changes in the relationship with Indian Railways can impact the company’s revenue and profitability.

- Competition: The travel and hospitality industry is competitive, and IRCTC faces competition from other service providers. Increased competition or the entry of new players could affect the company’s market share and pricing power.

- Technological Risks: As an online ticketing platform, IRCTC is vulnerable to technological risks such as system failures, cyber-attacks, and disruptions. Any significant technical issues could impact the company’s ability to provide services and result in financial losses.

- Operational Risks: IRCTC’s operations involve the management of various services, including catering and tourism. Operational challenges, such as supply chain disruptions, quality control issues, or accidents, can impact the company’s reputation and financial performance.

- Dependency on Key Partners: The success of IRCTC is linked to its collaborations and partnerships. Any disruptions or disagreements with key partners, such as Zomato for catering services, could have adverse effects on the company’s operations.

In conclusion, IRCTC’s diversified approach, coupled with its monopoly advantage and strategic growth initiatives, positions it for continued success in the evolving landscape of the Indian railway ecosystem. Investors remain optimistic about the company’s trajectory, considering its strong financial performance and forward-looking strategies.

Investors should conduct thorough research, consider these risks, and assess their risk tolerance before making investment decisions. It’s advisable to consult with financial professionals for personalized investment advice.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments