“Building a Strong Foundation: Invest in Capital Goods Stocks for Steady Growth!”

Thanks to the government’s increasing focus on the manufacturing sector in its policies, analysts are starting to take notice of these companies once again. These businesses play a crucial role in producing the machinery and equipment that factories and other manufacturing facilities rely on.

The question at hand is whether these positive developments in the manufacturing sector will last or wipe out after a few quarters. With the government’s increased focus on manufacturing, as well as the current global supply chain disruptions that are causing companies to rethink their reliance on foreign suppliers, the manufacturing sector is poised for growth.

The reason for the positive outlook on the manufacturing sector in India can be attributed to two main factors.

Firstly, the government’s policy focus is on promoting manufacturing through initiatives like the Production Linked Incentive (PLI) scheme and other incentives.

Secondly, a number of capital goods and engineering companies have diversified their product range and services over the years, expanding beyond their traditional focus on just one industry. This diversification has enabled them to tap into new markets and revenue streams, making them less reliant on any one particular sector.

Here are two fundamentally strong stocks that are looking promising in this sector :

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

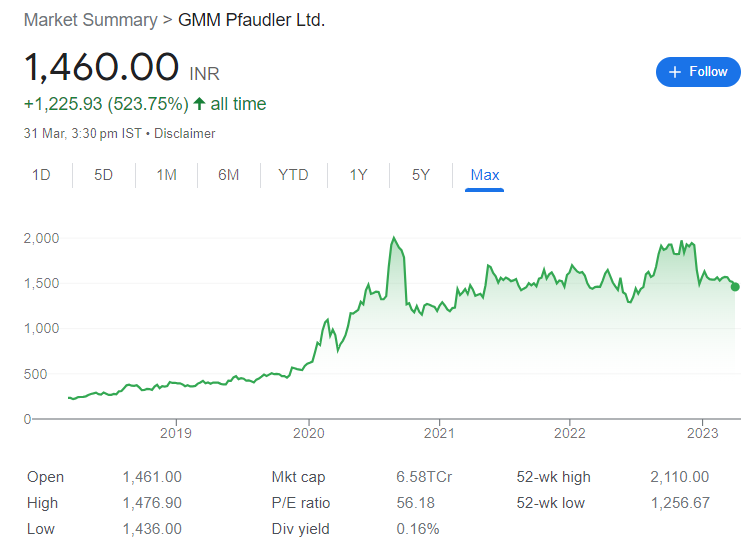

GMM Pfaudler Ltd

GMM Pfaudler Ltd. is an Indian company engaged in the manufacturing and sale of specialized chemical process equipment and engineered systems. The company was formed in 1962 through a joint venture between Pfaudler Werke GmbH of Germany and Gujarat Machinery Manufacturers Ltd. of India and is headquartered in Mumbai, Maharashtra, India.

GMM Pfaudler operates in the

-Chemical

-Pharmaceutical, and

-Food processing industries

The company’s products are used in a wide range of applications, including chemical reactors, distillation columns, and crystallizers.

It has a strong customer base in the Americas, Europe, and Asia, and operates through its subsidiaries in the United States, Germany, Switzerland, and Singapore.

Financial performance:

GMM Pfaudler has shown consistent revenue growth over the years, with a revenue CAGR of 16.3% over the last five years. The company has also maintained healthy EBITDA margins of around 20%. However, the company’s net profit margin has been somewhat volatile, ranging from 6.7% to 11.6% over the last five years.

Management quality:

GMM Pfaudler’s management team has been able to steer the company through various challenges and has demonstrated a track record of strong execution. The company has also maintained a healthy balance sheet, with low debt levels and strong cash reserves.

Investment rationales

Strong Market Position:

GMM Pfaudler has a dominant market position in the Indian market and is also expanding globally. It is the largest player in the glass-lined equipment industry in India, with a market share of around 70%. This provides a strong competitive advantage and creates a barrier to entry for new players.

Growing Industry:

The process equipment industry in which GMM Pfaudler operates is expected to grow at a CAGR of 8-10% over the next 5 years, driven by increasing demand from the pharmaceutical and chemical industries. The company is well-positioned to benefit from this growth, given its strong product portfolio and customer base.

Diversified Product Portfolio:

GMM Pfaudler has a diversified product portfolio, which includes not only glass-lined equipment but also mixing systems, filtration systems, and drying systems. This diversity provides the company with multiple revenue streams and reduces its reliance on any one product.

High Barriers to Entry:

The glass-lined equipment industry requires significant technical expertise and high capital investment, creating high barriers to entry for new players. This makes it difficult for competitors to enter the market, protecting GMM Pfaudler’s market share.

Expansion Plans:

GMM Pfaudler has expansion plans to increase its manufacturing capacity and strengthen its global presence. The company has recently invested in a new manufacturing facility in Gujarat, which is expected to significantly increase its production capacity.

Valuation:

GMM Pfaudler is a midcap company currently trading at a reasonable valuation, with a P/E ratio of around 40, compared to the industry average of around 75. This provides investors with an opportunity to invest in a high-quality company at a reasonable price.

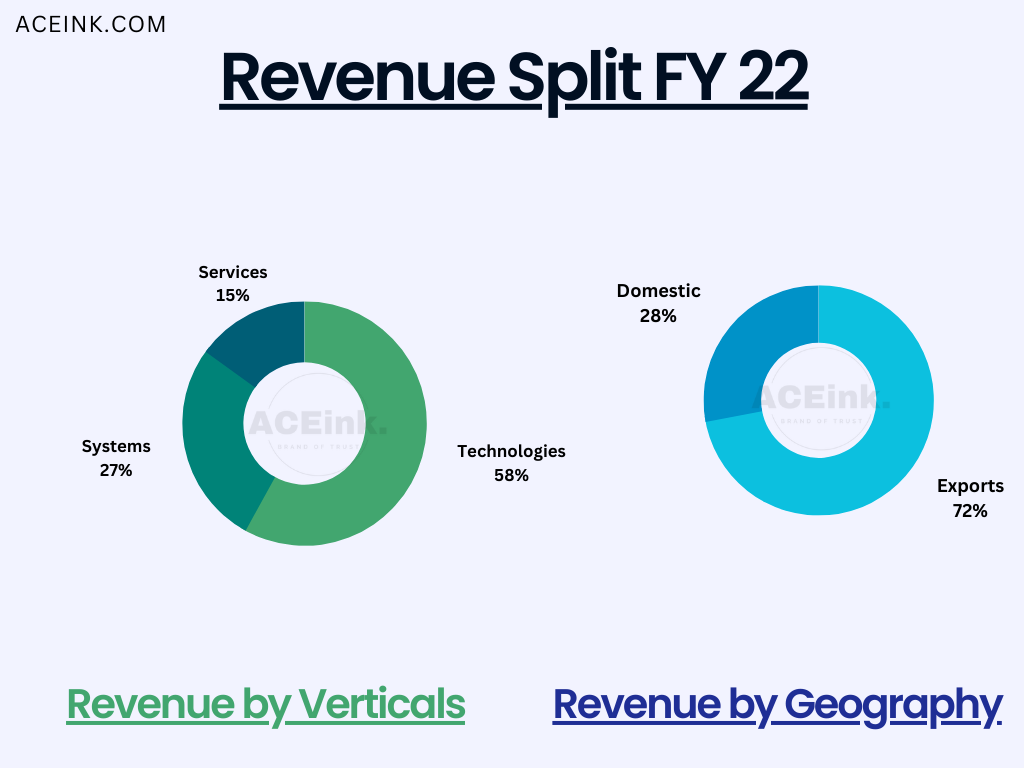

Praj Industries

Praj Industries Ltd. is an Indian company engaged in the design, engineering, and manufacturing of process equipment, plants, and systems for various industries. The company was founded in 1983 by Pramod Chaudhari and is headquartered in Pune, Maharashtra, India.

Praj Ind operates in several industries, including

-Bioenergy,

-Water and wastewater,

-Critical process equipment, and

-Industrial biotech.

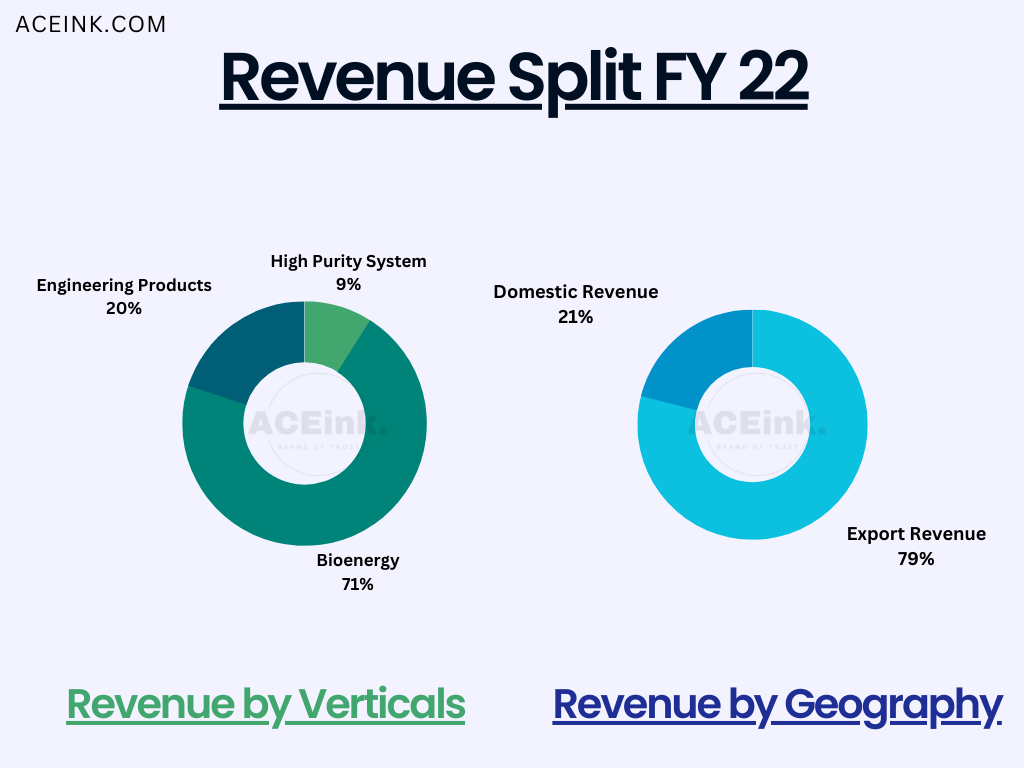

The company’s product portfolio includes technologies for the production of biofuels such as ethanol, biodiesel, and biogas, as well as wastewater treatment systems, critical process equipment, and systems for the production of high-purity water and other process liquids.

Praj Ind has a dedicated R&D center in Pune, which is recognized by the Indian government as a “Research and Development Center” and has been awarded several patents.

Financial Performance: Praj Ind has a consistent track record of revenue growth over the years, with a CAGR of around 11% over the past five years. The company’s profitability has also improved, with a steady increase in its operating margins. Additionally, the company has a healthy balance sheet with low debt levels.

Investment Rationale

Market Opportunity:

Praj Ind operates in the bioenergy, brewery, water and wastewater, critical process equipment, and industrial biotech industries. These industries are expected to grow at a significant rate, driven by the increasing demand for renewable energy and sustainability concerns. Praj Ind is well-positioned to benefit from this trend, given its strong presence in these markets.

Technological Capabilities:

Praj Ind has a strong focus on R&D, with a dedicated team of researchers working on developing new technologies and improving existing ones. The company’s expertise in biofuels, especially second-generation ethanol, is a key differentiator and provides a competitive advantage in the industry.

Market Opportunity:

Praj Ind operates in the bioenergy, brewery, water and wastewater, critical process equipment, and industrial biotech industries. These industries are expected to grow at a significant rate, driven by the increasing demand for renewable energy and sustainability concerns. Praj Ind is well-positioned to benefit from this trend, given its strong presence in these markets.

Technological Capabilities:

Praj Ind has a strong focus on R&D, with a dedicated team of researchers working on developing new technologies and improving existing ones. The company’s expertise in biofuels, especially second-generation ethanol, is a key differentiator and provides a competitive advantage in the industry.

Competitive Landscape:

Praj Ind faces intense competition from both domestic and international players in the process equipment and engineering industry. However, the company’s focus on R&D and its technological capabilities provide a competitive advantage. It has a strong customer base in the Americas, Europe, and Asia, which provides a diversified revenue stream and reduces its reliance on any one market.

Valuation:

Praj Ind is currently trading at a P/E ratio of around 30, which is slightly above the industry average. However, given the company’s growth prospects and strong financial position, the valuation appears reasonable.

Overall, Praj Industries and Pfaudler Ltd. appear to be a well-managed midcap companies with a strong market position, technological capabilities, and a diversified revenue stream. The growth prospects and financial performances make these attractive investment opportunities for long-term investors.

However, investors should closely monitor the competitive landscape and any changes in the regulatory environment that may impact the company’s growth prospects.

——————–

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.