03 Jan Why EV Battery Makers Promise Growth in 2024

“Budget 2024: Good News for Electric Vehicles?”

In a move signaling strong support for electric mobility, the government is considering extending the second phase of the Faster Adoption and Manufacturing Electric Vehicles (FAME II) scheme into the next fiscal year.

The potential extension, likely to be addressed in the interim budget, underscores the government’s commitment to sustaining the momentum of electric vehicle adoption.

FAME II, initiated in 2019 with a budget of Rs 10,000 crore, has played a pivotal role in subsidizing EV purchases, and an extension would further contribute to the growth of the electric vehicle sector.

The demand for electric vehicles (EVs) in India is on the rise, creating a lucrative opportunity for investors.

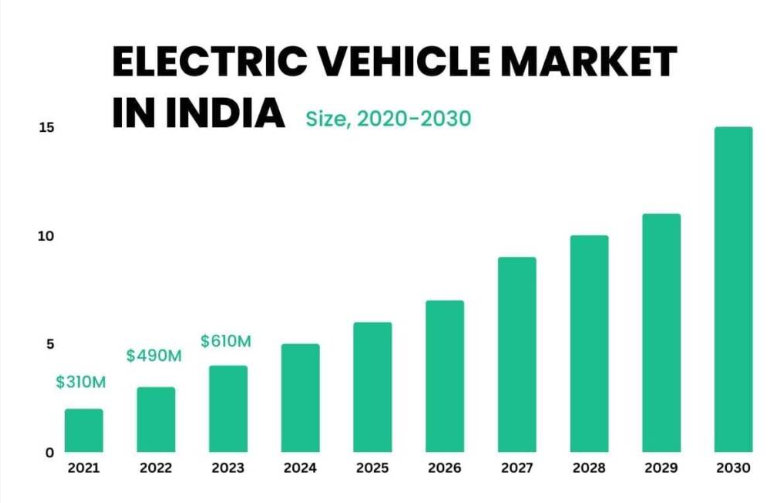

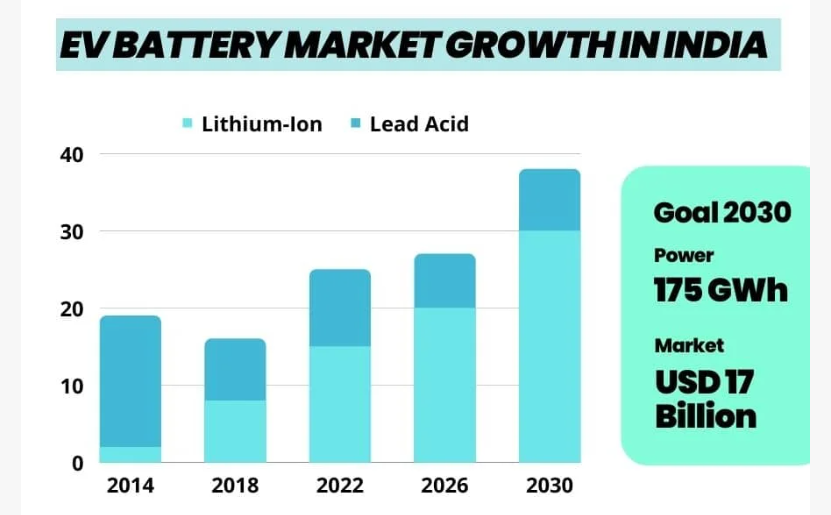

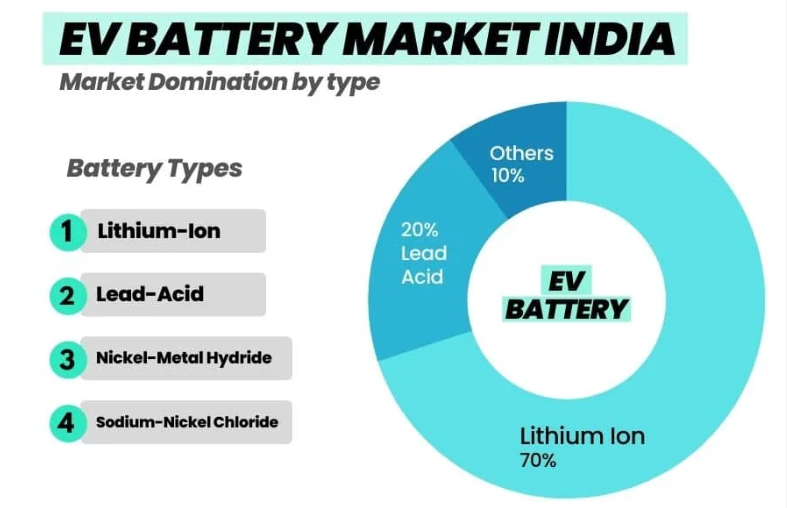

The Indian electric vehicle (EV) battery market is poised for substantial growth, driven by the visionary goal of having 30% EVs on Indian roads by 2030.

2024 holds the promise of increased EV adoption, innovative models, and affordable pricing.

-The EV market in India is projected to reach US$ 37.7 billion by 2028, with a remarkable CAGR of 46.4% from 2023 to 2028, according to Mordor Intelligence.

-According to a report by GameChanger Law Advisors and Speciale Invest, the market is expected to soar from $16.77 billion in 2023 to $27.70 billion by 2028, with a Compound Annual Growth Rate (CAGR) of 10.56% during this period.

Also Read: The Remarkable Turnaround of JLR: From Tata’s “Biggest Mistake” to a “Biggest Victory”

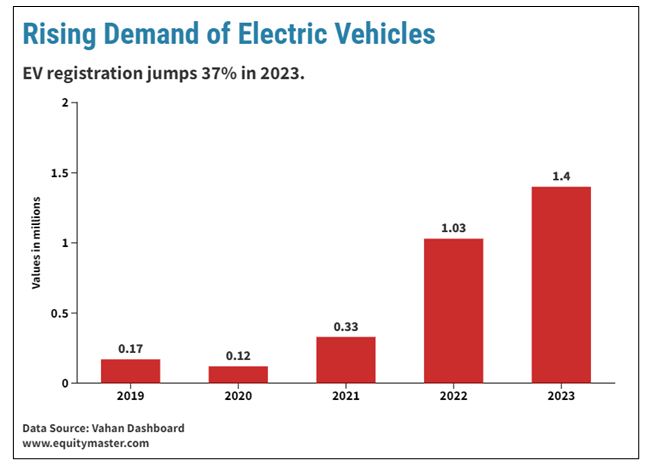

Surge in EV Registrations

In 2023, EV registrations reached 1.4 million year-to-date, marking a substantial 37% increase compared to the previous year, as reported by the Vahan Dashboard.

Electric Vehicle Finance: A Driving Force

Analysts predict a shift from the Internal Combustion Engine (ICE) era to EVs, driven by the financial route. Despite challenges, the government, financial institutions, and automakers are collaborating to make EVs more affordable, with initiatives like FAME under the National Electric Mobility Mission Plan (NEMMP).

Also Read: “Ircon International: On Track with Big Plans?”

Global Trends and Innovations

The global landscape also impacts the Indian EV battery segment. Girish Linganna, Defence and Aerospace analyst, anticipates a breakthrough in battery technology in the United States in early 2024.

Nanotech Energy’s new manufacturing facility, Chico 2, focusing on graphene-based battery cells, holds the potential to enhance battery performance

Global Commitment to Renewable Energy

Recent actions at the G20 Summit highlight a global commitment to triple renewable energy capacity by 2030, emphasizing the fight against climate change. This sets the stage for robust growth in the EV market.

Also Read:IRCTC Shares close to Rs 900! What Next?”

Government Initiatives and Green Push

-In India, initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme and tax benefits for hybrid and electric vehicles are propelling EV adoption.

-The government’s commitment to achieving net zero carbon emissions by 2070 is a driving force behind the surge in EV demand.

Parliamentary Committee Urges Three-Year Extension of FAME-II Scheme for Electric Vehicles

In a significant development, the Parliamentary Standing Committee on Industry has recommended extending the Faster Adoption and Manufacturing of Electric Vehicles (FAME-II) India Scheme by three years. The committee’s report highlights a series of measures aimed at boosting electric vehicle (EV) adoption in the country.

The FAME-II scheme, initiated in 2019 with a budget of Rs 10,000 crore, was originally planned for a three-year duration. It targeted supporting various EV segments, including e-buses, e-3 wheelers, e-passenger cars, and e-two wheelers. As of December 21, 2023, the scheme has subsidized a total of 12,16,380 vehicles, with an expenditure of Rs 5,422 crore.

Currently, FAME-II subsidies apply to electric four-wheelers for fleet operators. The committee’s report suggests seeking additional funds for FAME-II in a vote on account, emphasizing that the extension would streamline the process without requiring multiple approvals. The final budget, set to be presented in June-July after the upcoming general elections, is expected to play a crucial role in determining the fate of the FAME-II extension.

The report underscores the need to broaden the scheme’s scope by including private four-wheelers and quadricycles. It also emphasizes mandating EVs in public transport, logistics, and delivery sectors. The committee aims to facilitate a smoother transition to electric mobility and advocates setting a mandatory deadline to decarbonize the country’s transport sector. Stay tuned for further updates on this evolving scenario.

- The Indian government envisions the electric vehicle (EV) market capturing 30% of total vehicle sales in the country by the year 2030.

- The FAME-II scheme, dedicated to EVs, aims to generate 175 Gigawatts of power from renewable energy by 2022, reflecting a commitment to sustainable practices.

Consumer Preference for EVs in India:

- McKinsey & Company reports that 70% of Indian car consumers in tier-one cities express a preference for electric cars as their next vehicle.

- This surpasses the global average of 52%, indicating a substantial and growing inclination towards electric vehicles in the Indian automotive market.

Following companies are amongst the top EV Battery makers in India

- Amara Raja Energy & Mobility

- One of the largest manufacturers of lead-acid batteries in India.

- MOU with the Government of Telangana for a lithium-ion Battery Gigafactory.

- Planned investment of around Rs 95 billion over the next 10 years.

- Exide Industries

- Leading manufacturer of lead-acid batteries and storage solutions.

- Commitment to invest Rs 60 billion in a 12 GWh Li-Ion cell plant.

- Tata Chemicals Ltd

- Amara Raja Energy & Mobility

- Inked an MOU with ISRO to acquire Lithium-ion cell technology.

- To commence Lithium-ion battery production at its manufacturing plant in Dholera, Gujarat.

- Demonstrating a commitment to environmental responsibility, Tata Chemicals has initiated a program focused on recycling Lithium-ion batteries.

- Neogen Chemicals Ltd

- Leading manufacturer of Bromine and lithium-based specialty chemicals.

- Strong relationship with leading lithium miners and processors.

- Planning to expand electrolyte and lithium salt capacity units.

- HBL Power Systems Ltd

- Established in 1983, specializes in batteries and e-mobility products.

- Robust growth with a stock price CAGR of 83% in the last 5 years.

- Investment in in-house development of technology parts for EVs.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments